Related Categories

Related Articles

Articles

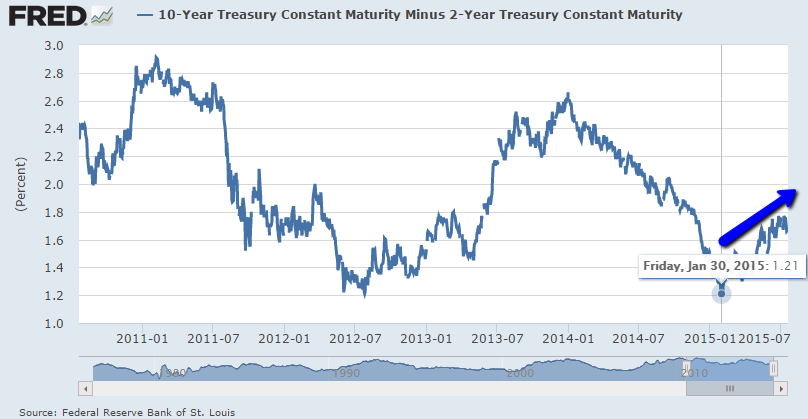

Banks (could) profit from Steepening Yield Curve

While short-term interest rates are set by the Federal Reserve, longer-term rates are determined by the market. A rise in longer-term yields is generally an indication of an improving economy.

Lower economic growth expectations generally result in a flattened yield curve structure. Longer-term yields are also affected by long-term inflation expectations and central bank activities.

A steeper yield curve is good for banks

Banks typically borrow short term and lend longer term, which results in maturity transformation. The longer-term loans are funded in large part by shorter-term deposits. So banks gain from a steeper yield curve. A steep curve allows banks to lend on higher long-term rates and borrow on lower short-term rates. This boosts the banks’ margins.

chart retrieved as per 21st July 2015 via: https://research.stlouisfed.org

Regarding individual banking-names: At a price-to-book value ratio (or PBV) of 1.74x, WFC is carrying a higher multiple compared with peers like JPMorgan Chase & Co. (JPM), Citigroup (C), and Bank of America (BAC), which trade at a PBV of 1.16x, 0.82x, and 0.77x, respectively, (data) as of July 10, 2015. On an average, banks in the XLF ETF trade at a price-to-book value ratio of 1.28x.

Following a chart of the ETF on Financials (XLF), updated on a monthly basis:

Text / sources: http://finance.yahoo.com