Related Categories

Articles

Warren Buffet

Million % Plus...

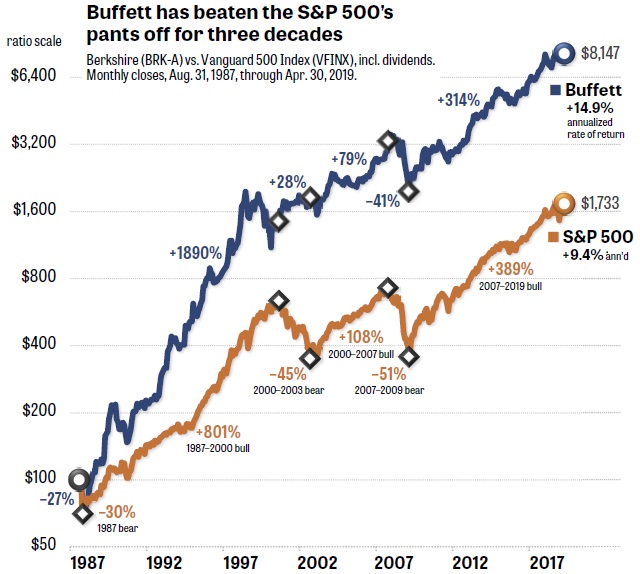

What happens if you compound +20.5% (each year) over 54 years? well, you will achieve an overall gain of 2.472 Million percent. ( + 2,472,627%). By the end of 2018, Berkshire Hathaway stock had risen...

...by 2,472,627% (that's not a typo) in the 54 years since Buffett took control of the company.

Because of this phenomenal performance, it's often assumed that Buffett must have taken some big risks that paid off well but, surprisingly, this isn't the case. Every investment Buffett makes is done because the value makes sense, there's a low probability of ...

PayPal

(Update vom April 2018)

Im Posting #1040 habe ich PayPal bereits charttechnisch beobachtet. Damals, am 28. April 2018, deutete sich bereits ein mögliches Zuspitzen auf ca. USD 100 per Q1-2019 an, sofern die Aktie ihr Kurslevel ÜBER USD 70 bis zum...

...Jahresende 2018 halten könnte.

Knapp aber doch wurden bis in den Dezember hinein dann Kursregionen von USD 70 bis USD 75 erfolgreich gehalten. Circa ein Jahr später notiert der Aktienkurs somit nicht mehr bei USD 74, sondern bereits bei USD 107. Ein schöner Anstieg!

Disclaimer/Disclosure: Ralph Gollner hereby discloses that he ...

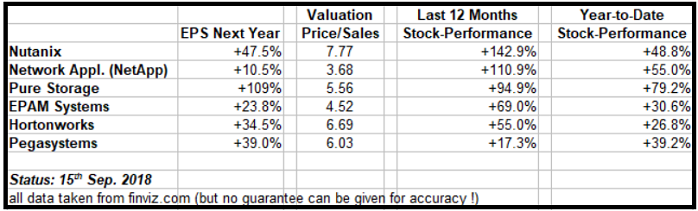

The new FANGS are in town?

Well, I don't know. But maybe those guys are not new in town...

At least NetApp is an old Player, which was a very hot company in the years 1999 and 2000!

I will watch these guys very closely within the upcoming 18 months.

cheers Ralph

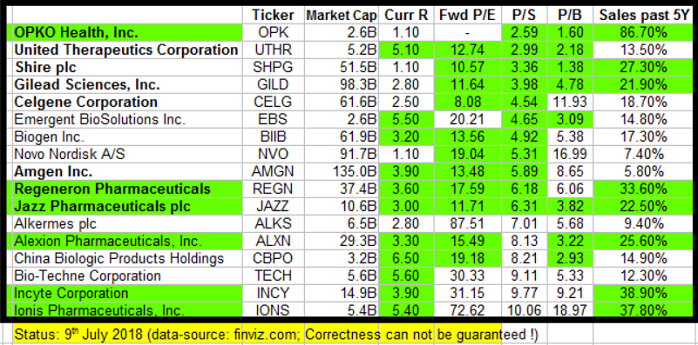

Biotech (9th July 2018)

When investors think of biotech stocks, visions of Amgen (AMGN) and Gilead (GILD) tend to dance in their heads. These companies aren't just among the biggest in the business - they're also a couple of the most successful in terms of revenue and...

...profits. However, as the old adage goes, the best things often come in small packages. Smaller biotechnology companies can and often do offer better growth prospects. In the table above I added some other Biotech-companies to the two Goliaths (AMGN, GILD) including some interesting metrics.

But always be aware: ...

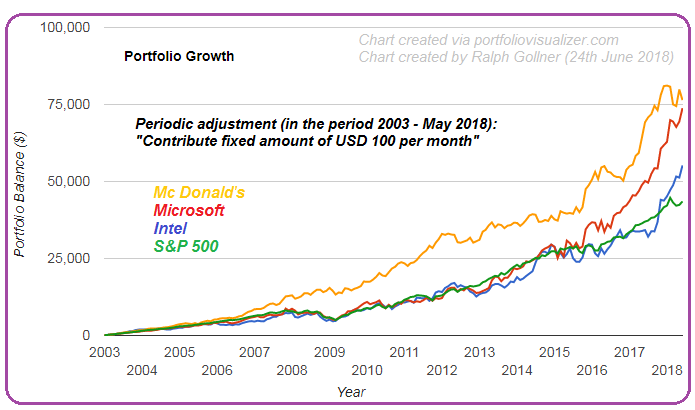

Examples: INTC, MCD, MSFT, S&P 500

If one has a long-term investment horizon, well, then there are several possibilities how to take the first steps...

In the chart above -also the tough period in the years 2008 until 2011- has been covered. Via "Cost-Average" one can "easily" bridge such tough years; Keyword: Long-Term Investment Horizon!

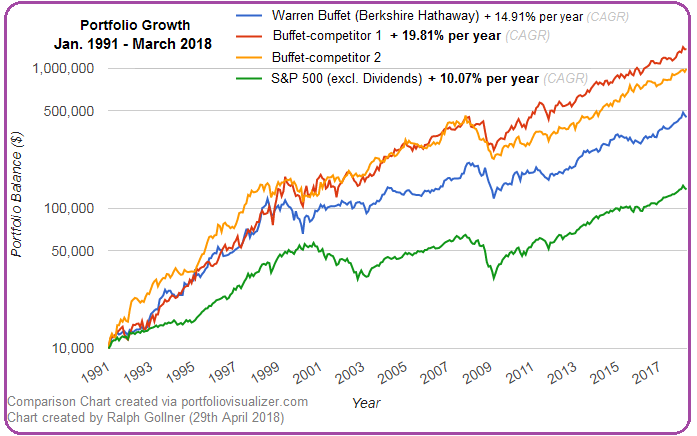

WTF = WBF

One of the "real" competitors of Warren Buffet's Investment vehicle "Berkshire Hathaway" delivers astonishing performance-results (Buffet-competitor 2). In the year 1986 you were able to buy 120 stocks (of the Buffet-competitor 2) for a total of 1,000...

...US-Dollar. If you were able to follow a Buy&Hold-Strategy, these 120 stocks would be pretty valuable by now: ca. 123,000 US-Dollar. That sums up to a total-plus of > 12,000% and outperforms the broad US-Stock Market (S&P-500) by far - and even Berkshire Hathaway (Buffety Soleti).

Data: Thomson Reuters Datastream

...

These 3 (NOT FANG)

Maybe these 3 stocks just "need a short rest." I (Ralph Gollner) am still invested in these three names, but there is some hot wind blowing out there. And I guess it's not just a hot summer-breeze (being still cold in NYC and here in Austria)...

The three names mentioned (see performance-curves of each company-stock in chart above):

FB = Facebook

GOOGL = Alphabet (formerly known as Google)

MSFT = Microsoft

FACC

Eine mit Winglets ausgerüstete Boeing 737NG kann zwischen 360.000 und 490.000 Liter Kraftstoff pro Jahr je nach geflogenen Strecken, gegenüber einem Standardmodell einsparen. Der oberösterreichische Luftfahrtzulieferer FACC hat aktuell volle Auftragsbücher (nicht nur...

...Winglets-Bestellungen). Bis zum Jahr 2024 hat das Unternehmen Order in Höhe von EURO 5,2 Mrd. in der Pipeline (Status Q1-2018). "Wir müssen daher massiv den Betrieb erweitern", zitiert das österreichische Wochenmagazin "News" Vorstandschef Robert Machtlinger.

In naher Zukunft brauche FACC 500 bis 700 neue ...

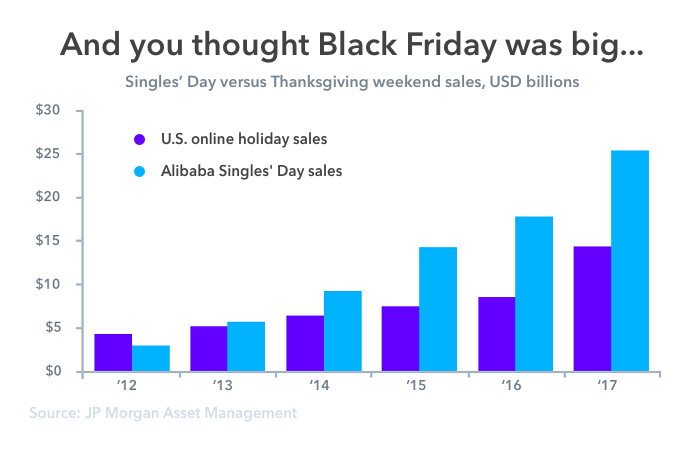

What's Behind Alibaba's USD 25 Billion in Sales on Singles' Day?

Since the early 2010s, China's e-commerce giant Alibaba Group has single-handedly turned Singles' Day into the biggest shopping event by launching large-scale shopping promotions centered around 11th November. Gradually,...

... other e-commerce companies also joined the event and Singles' Day no longer belonged to single people only, but to all e-consumers across the nation, just like Black Friday in the United States.

... other e-commerce companies also joined the event and Singles' Day no longer belonged to single people only, but to all e-consumers across the nation, just like Black Friday in the United States.

On 12th November 2017, Alibaba announced that it generated a record 168.2 billion yuan (USD 25.3 ...

Alphabet hat sich im 1. Halbjahr (wieder) stark entwickelt

Der Technologiekonzern scheint kaum noch zu stoppen und nimmt vor allem im Suchmaschinengeschäft eine Monopolstellung ein. Das Werbegeschäft brummt. Der strukturelle Wandel ist in vollem Gange. Während die klassische...

...TV- und Plakatwerbung immer unwichtiger wird, führen innovative Geschäftsmodelle im Internet den Markt an. Alphabet ist hier klarer Innovationsführer und macht so ordentlich Kasse. Mit intelligenten Werbeanzeigen, Suchplatzierungen und Rubrikenanzeigen lässt Alphabet seine Konkurrenz hinter sich.

Trotz der ...

China & its platforms

(transformation into the year 2017)

Chinese companies transformed from the year 2000 (the year, when I bought stocks for the first time) up to the year 2017 their "normal" business-models into a wide platform strategy, covering different ecosystems. How it all started:

So, companies like Amazon and China's Tencent are tough to categorize as the former engages in e-commerce, cloud-computing, logistics, and consumer electronics, while the latter provides services ranging from social media to gaming to finance and beyond.

Consider how customer expectations are ...

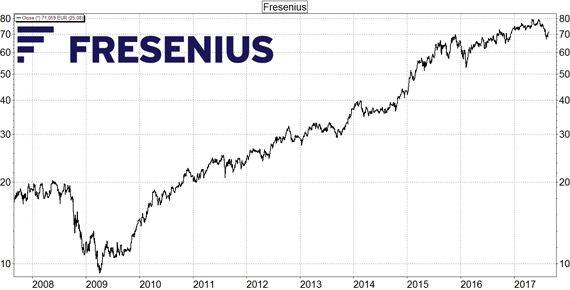

Fresenius SE & Co. KGaA

Die Fresenius SE & Co. KGaA ist ein international tätiges Medizintechnik- und Gesundheitsunternehmen. Der Hauptsitz liegt in Bad Homburg vor der Höhe. Gegründet wurde das Unternehmen 1912. Die Veränderung der Bevölkerungsstruktur sorgt bei Fresenius nach wie vor...

... für Rückenwind. Reminder: Auch im 1. Quartal 2017 konnte der Konzern Umsatz und Gewinn steigern. In den ersten drei Monaten des Jahres stieg der Umsatz um 19 Prozent auf 8,4 Mrd. Euro (Analystenprognose 8,11 Mrd. Euro), während der Gewinn um 28 Prozent auf 457 Mio. Euro angesprungen ist. Dabei ...

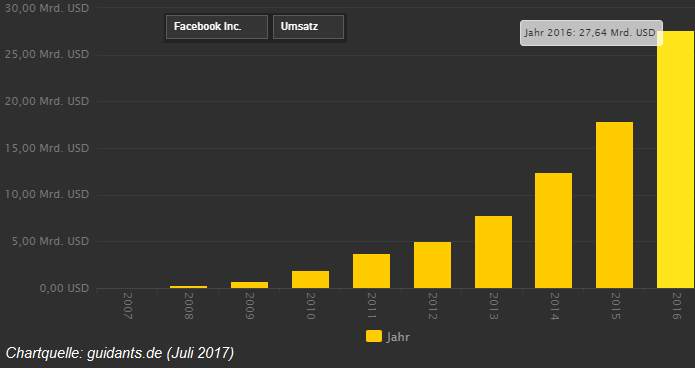

Facebook (earnings review)

quick n dirty

Let's check the latest metrics in the wake of Facebook’s robust Q2-2017 results on 26th July 2017. Its revenue increased to over USD 9 billion, up 45% versus a year ago - that is enormous growth for such a large company. But one concern is...

...that Facebook is basically already selling all the advertising space on your News Feed that it can, and so that growth may be difficult to sustain. However, it is far from fully monetizing Instagram, WhatsApp or Messenger - so there may still be plenty of low hanging fruit left.

Further metrics from ...

Get used to higher Risk/Return-products...

Original Article as per 19th June 2017

Investors are expecting aggressive, unrealistic returns and higher income than may be available from the retail products they are currently invested in. That is a key conclusion from the annual Global Investment Survey (GIS) conducted by Legg Mason.

According to the survey, income investors seek an overall average rate of return of 8.64 percent. Respondents that are employed seek an even greater 9.27 percent - compared to only 6.22% among the "fully-retired". Yet their portfolios are not delivering at these ...

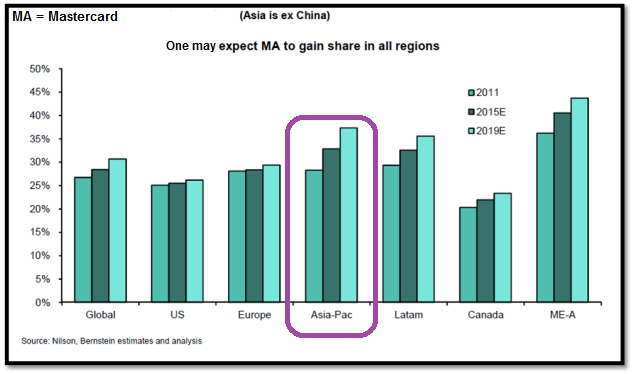

Mastercard (Ticker: MA)

Driven by global economic growth and a secular shift to electronic payments, one can believe Mastercard (ticker: MA) can grow net revenue by low double digits over the next several years. This, coupled with modest margin expansion and aggressive share buyback...

...may result in earnings-per-share growth in the mid-to-high-teens. Still, this favorable outlook is reflected in Mastercard's valuation and therefore shares could only perform as per market averages.

The recent development in the last years obviously underlines the tailwind-forces, which are driving ...

OMV und Preis-Buchwert-Verhältnis

OMV: Mit dem Energiekonzern kam 1987 der erste Staatsbetrieb an die Börse. Für den Konzern war das der Auftakt für die internationale Expansion. Für das Unternehmen selbst wirkte der Gang an den Kapitalmarkt wie ein Entwicklungsturbo.

Unter dem steigenden Druck der internationalen Anleger wurden viele angeschlossene Betriebe, die nichts mit dem Kerngeschäft zu tun hatten (etwa Busunternehmen), veräußert. In zwei weiteren Schritten 1989 und 1996 kamen neuerlich 25 Prozent des Unternehmens an die Börse. In der Zwischenzeit - nämlich 1994 fand die OMV ...

How to Find Wide Investment Moats the 'Easy' Way

Finding a wide investment moat is critical to investing, especially for the long term; Warren Buffett's simple-is-better philosophy extends to his ability as a teacher to take complex subject matter and turn it into something we can...

...all understand.

As a rule, Warren Buffett invests only in castle and moat businesses. These businesses, as Buffett himself has described, are wonderful businesses with durable competitive advantages. The extension of this metaphor might be that castle and moat businesses are strong businesses built ...

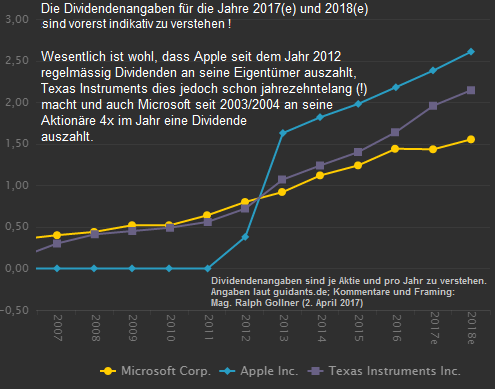

Big Players, Aktionäre und Dividenden

No-Brainer? Keine Ahnung, ABER: Der Aktionär ist Miteigentümer am Unternehmen und hat Anspruch auf einen Anteil des Gewinns, der in Form einer Dividende ausgeschüttet wird. Die Dividende ist von der Ertragslage des Unternehmens abhängig...

...und deshalb veränderlich. Außerdem kann sich der Aktionär auch einmal jährlich in der ordentlichen Hauptversammlung durch sein Stimmrecht an wichtigen Entscheidungen der Aktiengesellschaft beteiligen, wie z.B. Gewinnverwendung, Entlastung des Vorstands und des Aufsichtsrats. Er kann das Stimmrecht aber auch ...

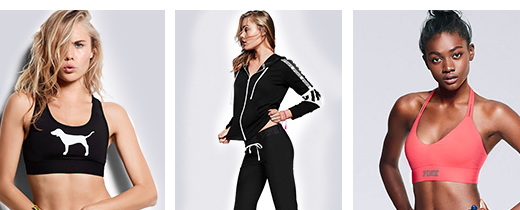

Victoria's Secret & Co. (L Brands)

At the right price, L Brands offers investors the opportunity to own a leading company in remarkably uncrowded categories, and one with a strong record of delivering shareholder returns...

L Brands Inc formerly known as Limited Brands, Inc., operates as a specialty retailer of women's intimate and other apparel, beauty & personal care products and accessories under various trade names.

L Brands, through Victoria's Secret, PINK, Bath & Body Works, La Senza and Henri Bendel, is an international company that recorded sales of USD 12.2 billion in 2015 ...

2015’s map of the largest company (U.S.A.)

2016's map of the largest company in each state by market cap from Broadview Networks looks much like the 2015 edition (see map here!). Apple Inc. is still the big cheese in California and ExxonMobil Corp. is king in Texas, while...

...J.P. Morgan Chase & Co. JPM, reigns supreme in New York. There are a few notable changes though. In the meantime Ford Motor Co. relinquished its title to Dow Chemical Co. in Michigan, and Kraft Heinz Co. booted McDonald’s Corp. from its perch in Illinois. There were also changes of the guard in Alabama, ...

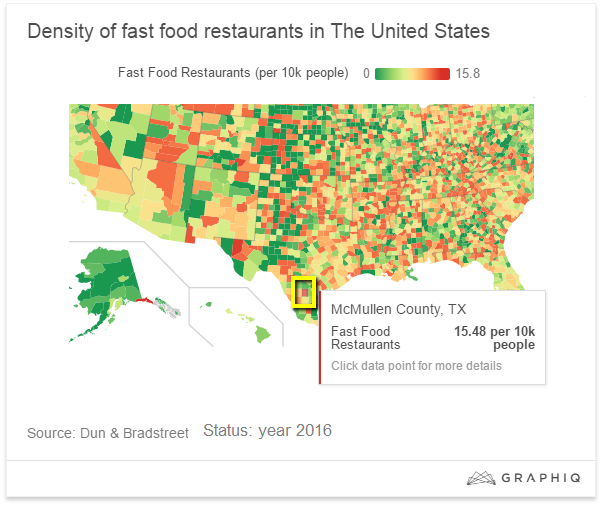

Fast Casual (Fast Food)

"There's pressure on the fast-food industry to try and match the strides made by the fast-casual better burger providers," said Steven Buckley, chief operating officer of BurgerFi International, a burger chain launched in 2011 in an interview with 'marketwatch'.

BurgerFi has used technology not only to drive sales, but for labor efficiency purposes, helping to speed up the guest experience and allow workers to spend more time with customers.

"You have technology, which people think is impersonal, but it allows you to focus more on guest interaction," said ...

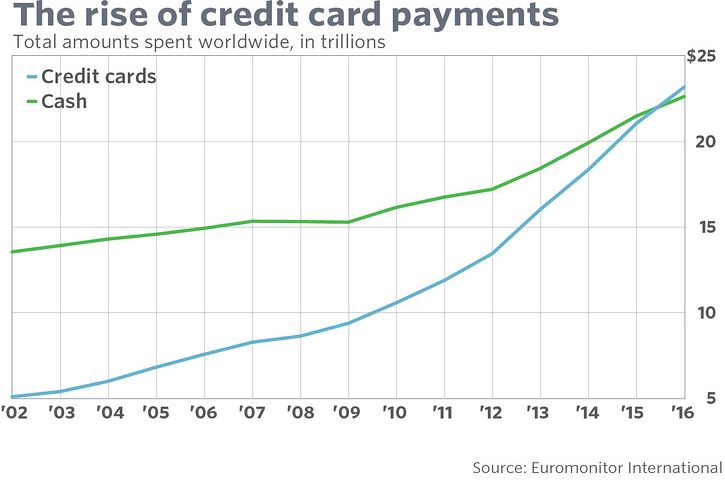

Credit Cards versus Cash

(CC vs. C)

Beginning of the end for cash? As consumers have increasingly used credit and debit cards and made purchases online and on apps, they've used less and less cash; in 2016, consumers will spend a greater amount on cards than they do with cash...

...for the first time, according to the market-research firm Euromonitor International, which has been tracking consumer payments over the last several decades.

In 2016, consumers worldwide will spend about USD 23.2 trillion in card payment transactions and USD 22.6 trillion in cash. This is a milestone for ...

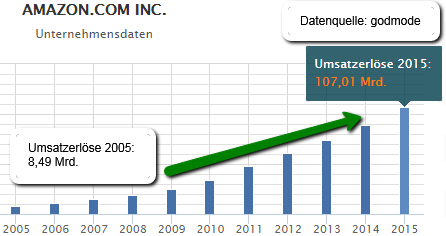

Amazon (2006 - 2016)

Text: Tobias Krieg; Grafiken: Mag. Ralph Gollner

Amazon wurde 1994 von Jeff Bezos gegründet, er entwickelte die Idee des elektronischen Buchhandels gemeinsam mit David E. Shaw, als Bezos in dessen Hedgefonds D.E. Shaw Group arbeitete.

Jeff Bezos verließ das Investment-Unternehmen um seine Pläne in die Wirklichkeit umzusetzen. Bereits in den ersten Monaten explodierten die Umsätze, die Verkaufszahlen übertrafen alle Erwartungen. Es folgte eine bis heute andauernde Erfolgsgeschichte die seines Gleichen sucht, auch im vergangenen Jahr konnte der Umsatz um 20 % auf ...

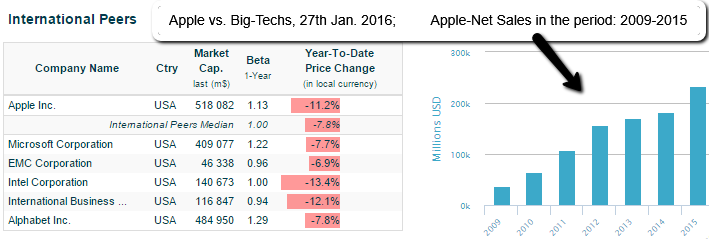

APPLE (Snapshot January 2016)

source: http://www.infinancials.com

source: http://www.infinancials.com

Apple-Stock-Valuation @ price per stock of 93.42 USD (27th Jan. 2016)

Market Cap: USD 517.97B*

Apple - Enterprise Value/EBITDA (ttm): 6.56*

Comparison/Group Computer Hardware - Enterprise Value/EBITDA (EV/EBITDA): 6.62*

S&P 500 - Median over 35 years! (historical calculation) EV/EBITDA: 8.2**

Apple - Price/Sales (ttm): 2.39*

S&P 500 - Price/Sales: 1.8*

Apple - Forward Annual Dividend Yield: 2.09% (Data provided by Morningstar, Inc.)

Apple - Dividend-Payout Ratio (payout/earnings): 21.48% (Data provided by Morningstar, ...

selected Oil stocks (US), 22nd Jan. 2016 (Chartshow - automat. updated / daily)

Phillips 66 (PSX), Occidental Petr. (OXY), National Oilwell Varco (NOV), Pioneer Natural Resources (PXD), Hess Corp. (HES), Helmerich & Payne (HP), Baker Hughes (BHI), Marathon Oil Corp. (MRO)

It will be important, that most of these Oil-stocks will be holding their support level, which they established at a Oil-Price-level of ca. 28 USD in January 2016 or their own respective January 2016-LOW-Levels within the next months. Otherwise further down-pressure could be expected!

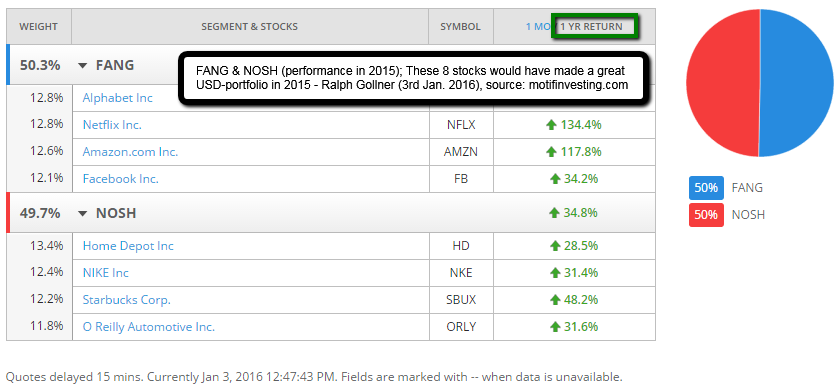

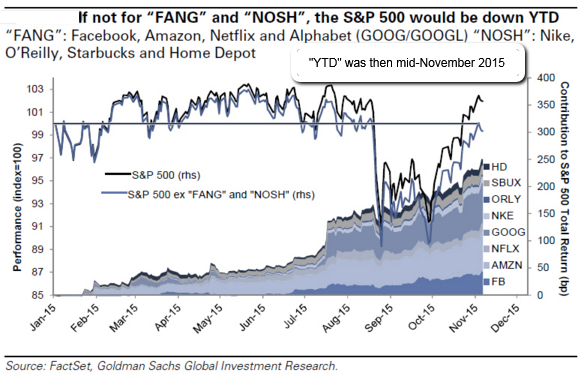

FANG, NOSH or SLAM ("the" 2015 stocks)

Ever heard of the famous "herd-stocks": FANG >> FB, AMZN, NFLX, Alphabet(Google), or

NOSH >> NIKE, O'Reilly, Starbucks, Home Depot? All delivered a great outperformance versus S&P 500 in the year 2015:

Following comparison betweeen the FANG & the NOSH Group outlays the 2,5%-performance, which these 8 stocks cumulatively added to the S&P 500-index in the period Jan. 2015 - Nov. 2015:

Thinking about NOSH I came up with my other selection of stocks, which were nice to be held in the wobbly 2015:

>> my own word/group-creation "SLAM": Skechers, ...

Online-Retail (2015ff)

US versus other countries (please see graph below the graph below ;-)

“With e-commerce penetration at a mere 7% of U.S. retail sales (as per Q3-2015), the channel has significant room to expand,” said Edward Yruma, Jessica Schmidt, Noah Zatzkin and other Pacific Crest analysts in a report (Status as per Q3-2015). “[They] believe that e-commerce can be at least 30% of total retail sales in the next five years.”

The GLOBAL B2C-Internet revolution is not over, the revolution may be starting just right NOW ? !!

article-source: http://www.marketwatch.com

...

Auswahl an Aktien mit dem Siegel "Nachhaltigkeit" / "Gutes Gewissen"

Gratis-ökom-Research: http://www.oekom-research.com

Gratis-finance-ethics-Einzelaktien-Research: www.mountain-view.com/de/analysierte-unternehmen

Überblick über die 50 Global-Challenges-Index-Mitglieder: http://gcindex.boersenag.de/de/index/indexstruktur

Im September 2007 wurde der Global-Challenges-Index (GCX) der Börse Hannover lanciert, der 50 internationale Aktien von besonders nachhaltig agierenden Unternehmen enthält. Folgend die Entwicklung des GCX-Index 2011 bis 2015.

Folgende subjektive Auswahl einiger Aktien, ...

Uwe Lang / "Börsenpfarrer" - Indikatoren (Timinghilfe), 27. Okt. 2015

Anleger müssen nur auf die Signale achten. „Börsenpfarrer“ Uwe Lang beschäftigt sich seit 45 Jahren mit den Märkten. Er hat ein System entwickelt, das Kauf- und Verkaufsignale gibt. Es geht darum, Wendepunkte an den Märkten zu ermitteln.

Was sind nun die einzelnen Signale? => Beginnend mit den einfachsten Indikatoren:

1) Aktienindizes als Frühindikatoren:

Hierfür werden drei Indizes herangezogen, die sich als Frühindikatoren bewährt haben:

Nasdaq Composite, Dow Jones Utility und DAX.

1 a) Der DAX gibt ein Kaufsignal, ...

Berkshire Hathaway (Price-Book-Value)

Let us take a quick look at Warren Buffet's empire, more specific at Berkshire Hathaway’s share price and its book value, especially in these current weeks/months since the PB-relation seems interesting relative to its history.

As per 7th Sep. 2015 Berkshire's current price/book value of 1.31 is 17% below its 30-year average of 1.58.

Price A-Share: 196,501 USD (as per 4th Sep. 2015)

Price B-Share: ca. 132.5 USD (as per 4th Sep. 2015)

As written in the good "Seeking-Alpha-article": In Warren Buffett's 2014 Letter to Shareholders released on 27th Feb. ...

"how to ride a trend" - Skechers (SKX) im Jahr 2015

Vorab: Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Die Aktie, die in diesem Blogeintrag/Artikel behandelt/genannt wird, befindet sich aktuell (seit mehreren Monaten) im "Echt-Depot" von Mag. Ralph Gollner.

Die Linie "wöchentlicher Durchschnitt 28 Wochen" kann als mögliche STOP-LOSS-Linie dienen. Per Status Aug. 2015 befindet sich dieser Level (SMA28-weekly) bei ca. 100 USD. Es lassen sich aber aus dem Chart heraus auch mögliche Supportlinien bereits bei 120 USD und bei 105 USD ...

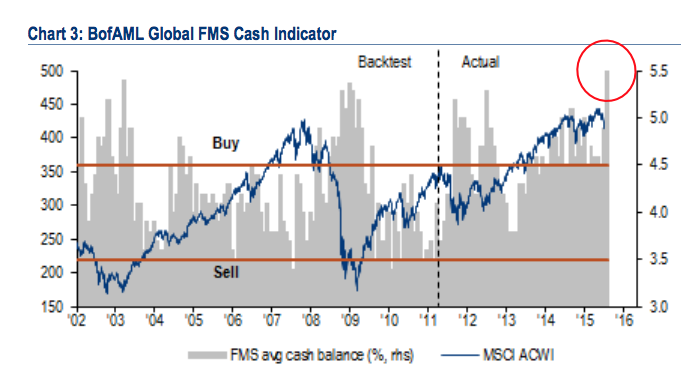

Fund Managers Holding Highest Cash Percentage Since Lehman

Posted July 14, 2015 by Joshua M Brown (a New York City-based financial advisor at Ritholtz Wealth Management)

as written by Joshua: Michael Hartnett is out with his latest Fund Manager Survey for Bank of America Merrill Lynch and it’s, well, something else. According to the survey, conducted among 149 participants with $399 billion in AUM from July 2nd through July 9th, cash levels in fund manager survey (FMS) portfolios have hit 5.5%.

Here’s Hartnett & Co:

FMS cash levels jump to highest level since Lehman = trading buy ...

Related Articles

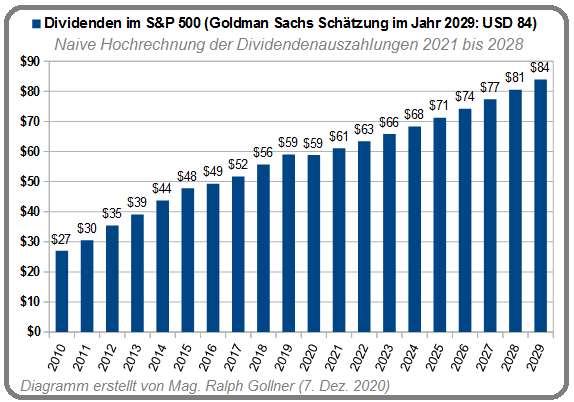

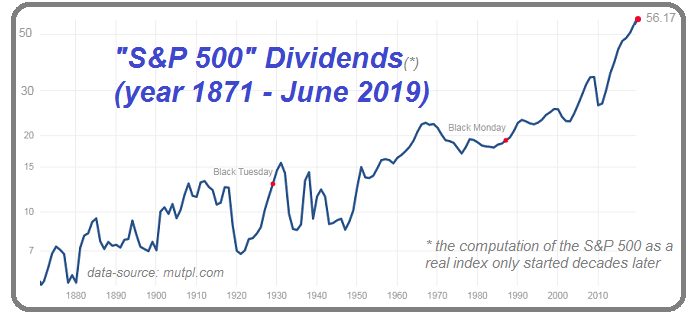

Dividenden im S&P 500 (2010 bis 2029)

Naiver linearer Anstieg der Dividenden bis in das Jahr 2029(!), folgend der Prognose von Goldman Sachs führt zu folgendem Diagramm im S&P 500. Die aktuelle Dividendenrendite im S&P 500-index bewegt sich bei circa 1,60%.

Lassen wir uns überraschen, ob ...

Goldminer-Purchase

I just had this idea of "repurchasing" a former Goldminer-Stock Holding (Gold Royalties-stock to be more precise) of mine. Following a podcast, where I listended to Stephanie Kelton. Keyword: Modern Monetary Theory (aka MMT)...

...Circa one hour ago I purchased some ...

JUST companies award

Nonprofit

Stakeholder capitalism will only thrive if more of us investors make a commitment to consider all stakeholders in our decisions on how we run our companies, where we work, where we invest, and what we buy.

The selection of 3 Industry Leaders above features the ...

The selection of 3 Industry Leaders above features the ...

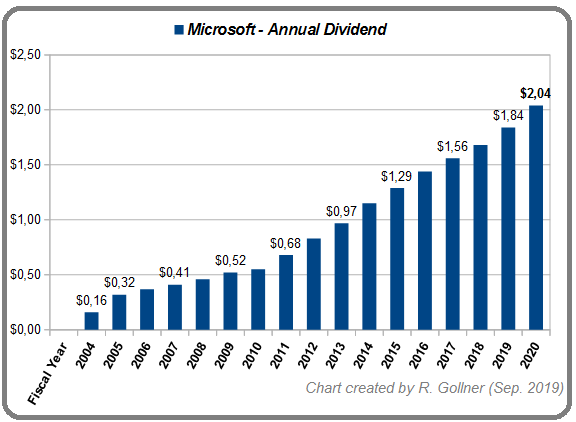

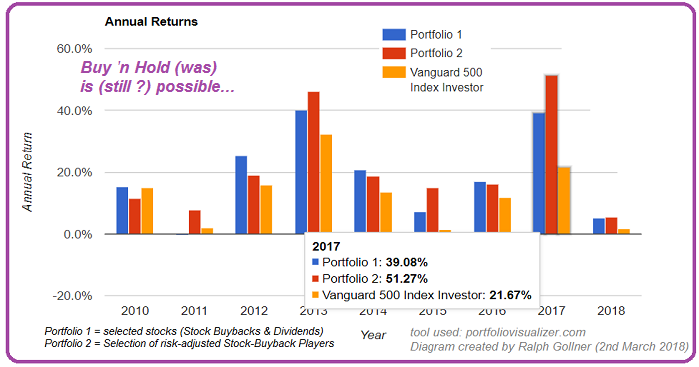

Shareholder Yield

(Microsoft)

Dividends are the most common method that a company can use to return capital to shareholders. Dividend growth investors often place significant emphasis on dividend yields and dividend growth as a result. However, there are additional ways...

...for companies ...

Advantages of Using Yield on Cost

Upfront info: In the long run (> 10 years) there are many forces driving a Portfolio-Performance.

Here just one of the most logic ones: The yield on cost can be useful in assessing how productive an existing investment has been at providing income...

...in ...

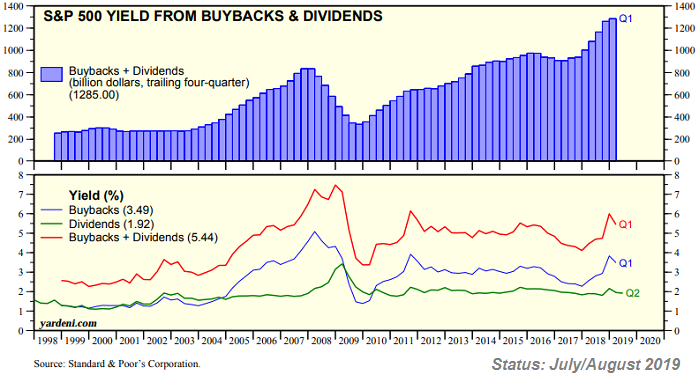

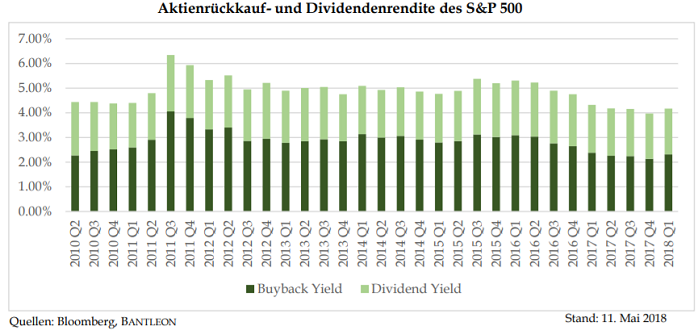

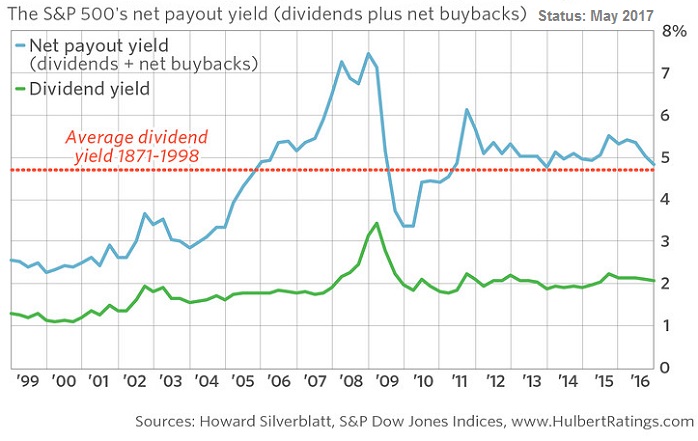

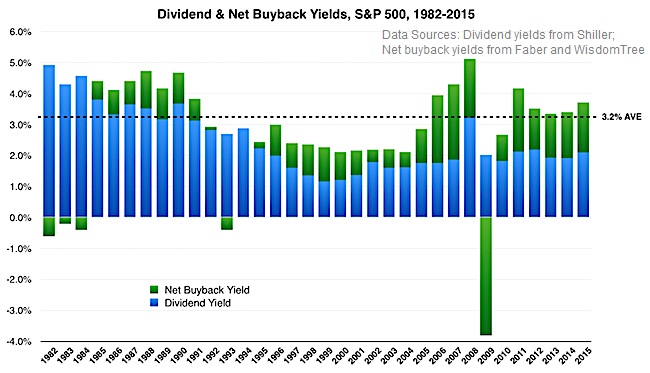

Buyback yield + Dividend yield

Recheck the total amount that companies are returning to shareholders - a total that includes both dividends and share repurchases (or buybacks). Up until several decades ago, dividends were the predominant way in which companies returned cash to...

...

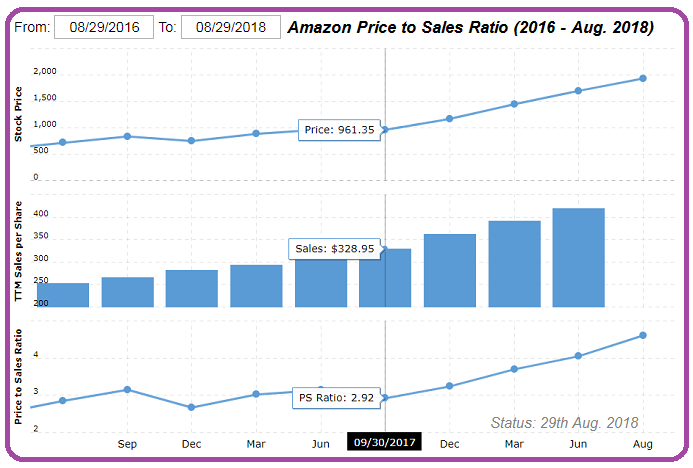

Amazon (AMZN)

Price/Sales-Valuation (PS-Ratio)

In the following chart you can see a neat overview of the last two years: It's about the Amazon-Stock Price, Amazon Sales from quarter to quarter and the corresponding valuation, more precise: the...

...Price-To-Sales Ratio/Valuation. Until Sep. ...

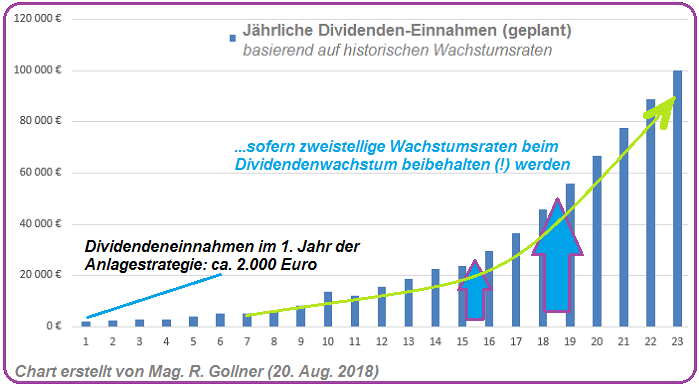

Dividendenzahlung ist (ein) passives Einkommen!

Wichtiger als die blosse Dividendenrendite ist (wohl) das jährliche Dividendenwachstum. Nach 23 Jahren hätte man im Beispiel anbei eine "persönliche" Dividendenrendite von...

...100% (sofern wir von einem Startkapital von EUR 100.000,-- ...

Shareholder Yield

(Buyback yield + Dividend yield)

Der Rückkauf eigener Anteile durch die ausgebende Gesellschaft wird je nach Quelle als "Buy Back", "Repurchase" oder "Aktienrückkauf" bezeichnet. Anfang der 1980er Jahre wurden Buy Backs in der US-amerikanischen...

...Wirtschaft erstmals in ...

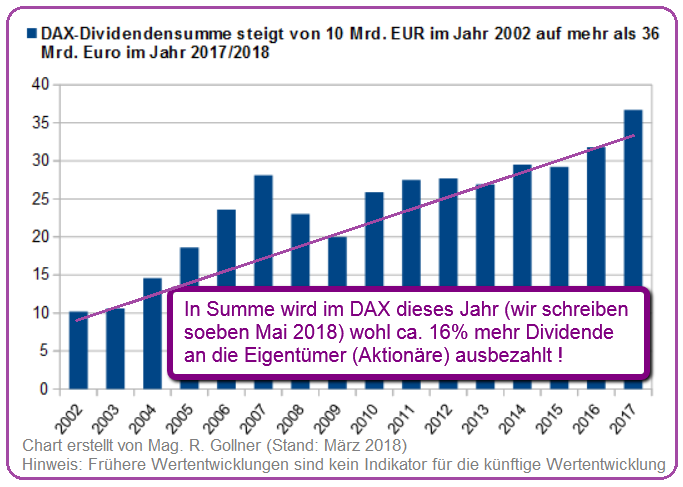

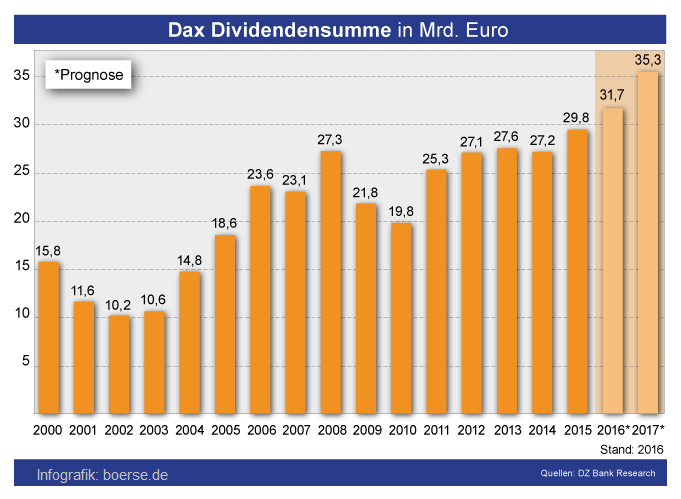

DAX-Dividendensumme

(für das Geschäftsjahr 2017)

Für das Geschäftsjahr 2017 haben ca. 25 Unternehmen Dividendenerhöhungen angekündigt, bzw. bereits die gegenüber dem Vorjahr erhöhte Dividende an ihre Aktionäre ausbezahlt. Somit hat...

...sich die ausbezahlte DAX-Dividendensumme final um mehr ...

The New Game in town:

3month Yield vs. S&P 500 dividend yield

The United States 3 Month Bill Yield is now sitting at ca. 1.92%. This is a tiny difference to the current S&P 500 dividend yield, which is also hovering around 1.9%. Therefore you could sail the potential tricky summer period...

...

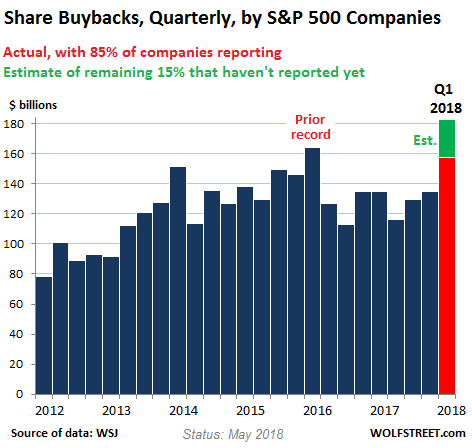

Buyback yield

(Aktienrückkäufe / Marktkapitalisierung)

Ca. USD 22,5 Trillionen schwer ist die Marktkapitalisierung des US-Aktienindex S&P 500. Aktienrückkäufe im S&P 500 im Jahr 2018 sollten einen neuen Rekordwert von ca. USD 700 Mrd. bis USD 720 Mrd. erreichen können. Zusammen mit einer...

...

PayPal (Wal-Bauch, Auffangbecken)

Der Bezahldienst Paypal hat dank boomender Ausgaben im Internet zu Jahresbeginn (2018) gute Geschäfte gemacht. Im ersten Quartal kletterte der Gewinn verglichen mit dem Vorjahreswert um ein Drittel auf unter dem Strich 511 Millionen...

...Dollar (420 ...

US-Stock Buybacks

(record expected in the year 2018)

S&P 500 companies may buy back a record USD 800 billion of their own shares in 2018, funded by savings on tax, strong earnings and the repatriation of cash held overseas. That will far exceed the USD 530 billion in share buybacks that...

...

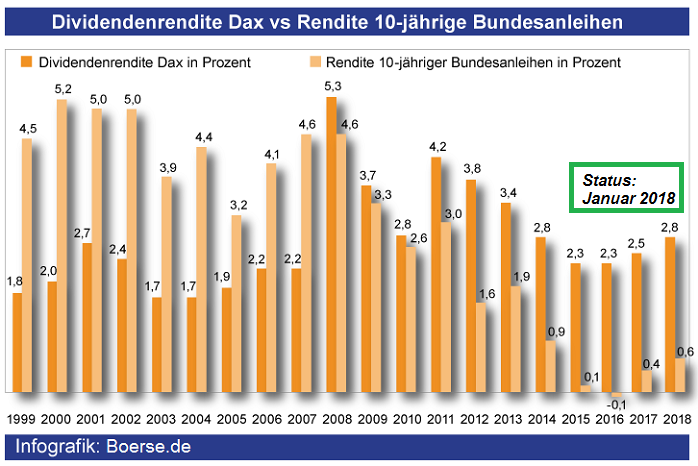

DAX-Dividendendenrendite

versus

10-jährige Deutsche Bundesanleihen

Die Korrektur an den Aktienmärkten hat dazu geführt, dass die Dividendenrenditen wieder etwas gestiegen sind. So bietet der DAX eine Dividendenrendite von etwa 3,2% (aktuell). Als Gegenspieler zu den DAX-Dividenden...

...lässt ...

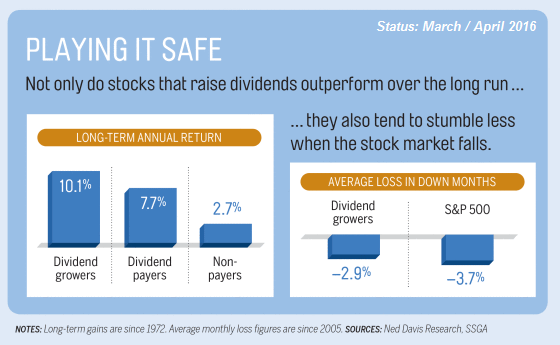

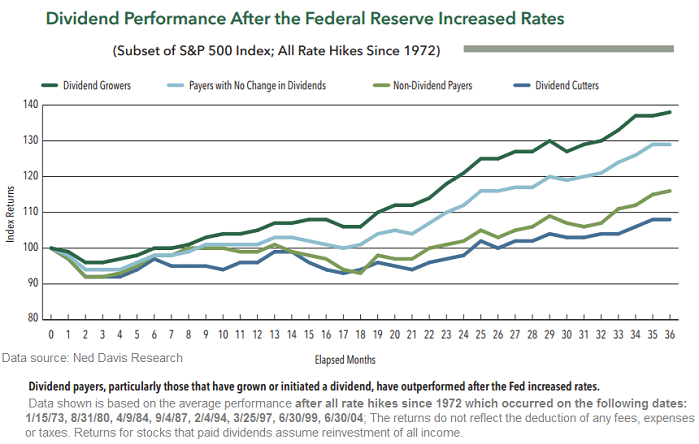

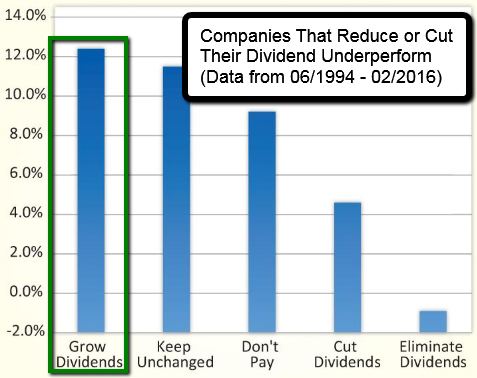

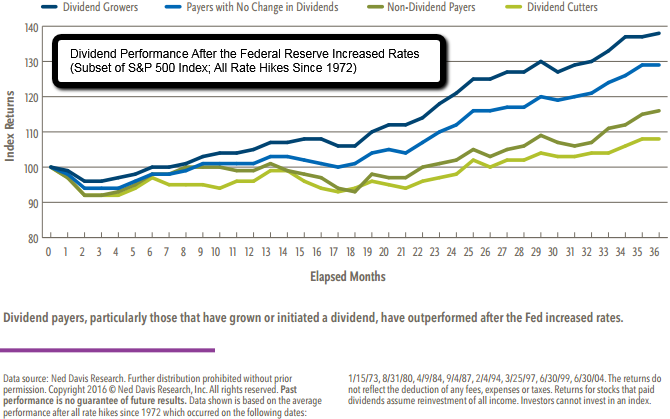

Stocks with Rising Dividends

(Long-Term Returns)

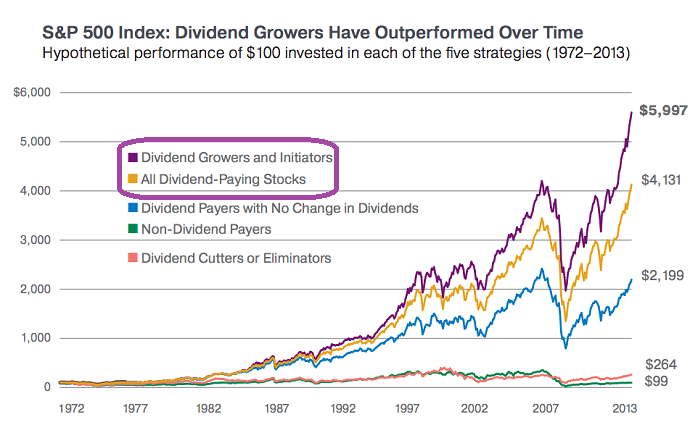

Here's a simple fact that many people don't know: Over the past four decades, stocks with rising dividends outperformed every other type of stock. This 44-year study from Ned Davis Research and Oppenheimer Funds tells a clear story:

In the ...

NVIDIA ( > EMA 38 weekly)

Nvidia (Ticker: NVDA) is active in pure growth-sectors: And the growth in revenues is very likely to continue, as the company is involved in such attractive fields as gaming,...

...cryptocurrency, autonomous driving, and machine learning (Artificial Intelligence / ...

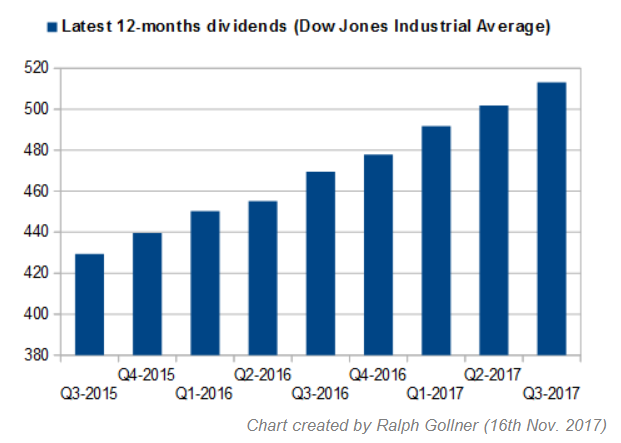

Dow Jones Industrial Average Dividends (2015 - 2017)

quarter over quarter (12-months dividends)

The table shows the the total dividends paid out by the Dow Jones Industrial Average-stocks in the timeframe: Q3-2015 until the most recent quarter Q3-2017 (calculated in Index-points).

The total ...

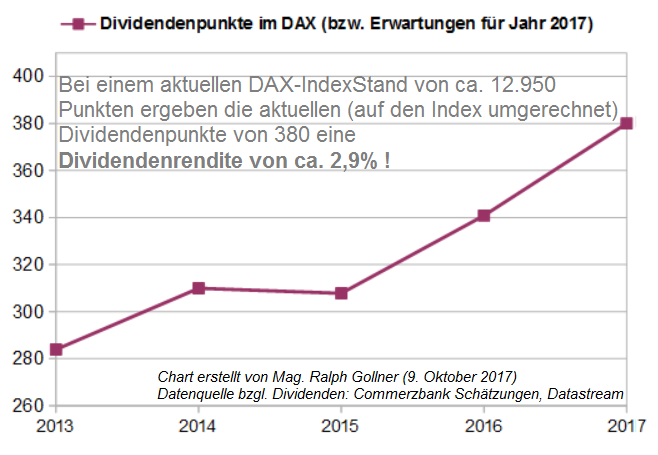

DAX-Dividenden (in Punkten 2013 - 2017)

Als einer der wenigen großen Indizes weltweit wird der DAX, wie ihn die Allgemeinheit kennt, als Performanceindex berechnet. Das heißt, bei dieser Berechnung fließen die Dividenden mit ein. Sie werden als Reinvestment berücksichtigt. Im...

...

Dividend growth investing

Dividend growth investing stands the test of time. There is plenty of academic evidence to show that stocks with consistently rising dividend payments tend to outperform the broader stock market. Identifying stocks with strong dividend growth...

...prospects, ...

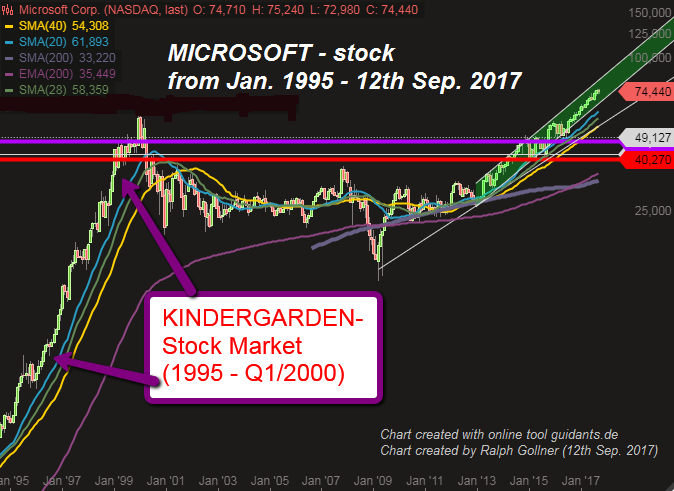

Microsoft (1995 - Sep. 2017)

Microsoft hat jüngst einen neuen Meilenstein erreicht. Zum ersten Mal in der Firmengeschichte erzielte der Windows-Erfinder mit seiner Cloud-Softwaresuite Office 365 mehr Umsatz als mit seinem klassischen Office-Softwarepaket, das auf dem Computer...

...der ...

Inherent in this certain Investment-approach is that 1st: the selected companies are large or mega cap companies and 2nd there is an implied assumption that they will continue to operate as going concerns. So because this strategy is focused on Large Caps, an investor can be comfortable in ...

Inherent in this certain Investment-approach is that 1st: the selected companies are large or mega cap companies and 2nd there is an implied assumption that they will continue to operate as going concerns. So because this strategy is focused on Large Caps, an investor can be comfortable in ...

Nasdaq-100

Mögliche Support-levels

Spätestens bei ca. 5.450 Punkten wird es interessant, ob bei einem eventuellen Sturz auf diesen Kursbereich die 100 Dickschiffe im US-Technologie-Index die Kurve nach oben wieder einlegen können. Vorerst steht ein 2,8% Rutsch zur "Diskussion":

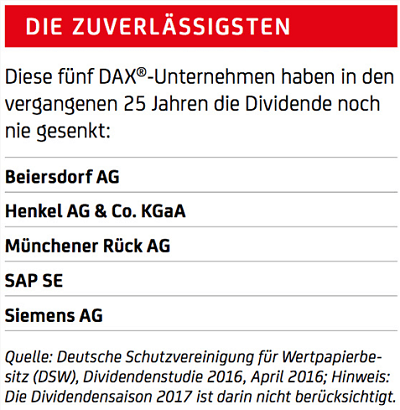

DAX

(Auswahl zuverlässiger Dividendenwerte)

Dividendenwerte sind folgend langfristiger Studien grundsätzlich stabilere Aktien als Aktien von jenen Unternehmen, welche keine Dividenden an ihre Eigentümer auszahlen.

Disclaimer: Ralph Gollner hereby discloses that he directly owns securities of ...

Dividend GROWERS ! (not only payers)

Some ideas: Quality & Dividends (Dividend Growers); Follow Buffett's lead (maybe?). Look for companies with competitive advantages in their industries - what Warren Buffett calls "wide moats" - that keep rivals at bay. Then you may look for...

...

Buyback yield + Dividend yield

Recheck the total amount that companies are returning to shareholders - a total that includes both dividends and share repurchases (or buybacks). Up until several decades ago, dividends were the predominant way in which companies returned cash to...

...

Dividends & Share Buybacks

Equities continue to have a strong cash return story, even with interest rates having moved higher since bottoming last year. The S&P 500 Index sports a current Dividend yield of ca. 2.0%, a level that has been fairly consistent in recent years.

Dividend increases ...

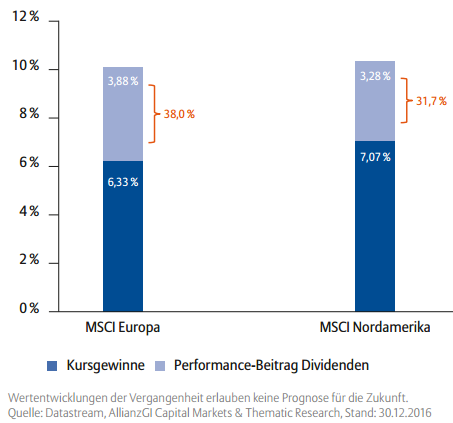

Dividendenhistorie (1971 - 2016)

Dividendenpapiere können Stabilität für's Depot bringen. Im folgenden Schaubild erkennt man den Anteil an der p. a. Gesamtperformance der Dividenden und Kursgewinne 1971 bis Ende 2016 im internationalen Vergleich (annualisiert):

Über den gesamten Zeitraum ...

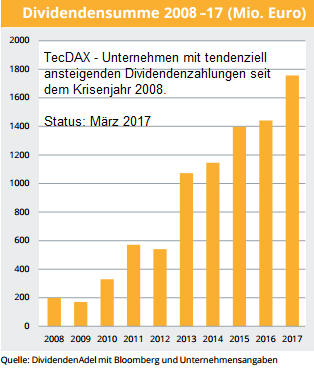

TecDAX und

DIVIDENDEN

Der Anteil der ausschüttenden TecDAX-Unternehmen liegt nun bei 73% (22 von 30) - doppelt so viele Zahler wie im Jahr 2009 und deutlich mehr als im NASDAQ 100 Index, wo die Quote unter 50% liegt!

Why stock market investors should not fear

Fed rate hikes

In theory, rising interest rates are supposed to hurt the stock market because it makes interest-rate instruments relatively more attractive and reduces liquidity in the marketplace. But in reality, interest rates and the stock...

...

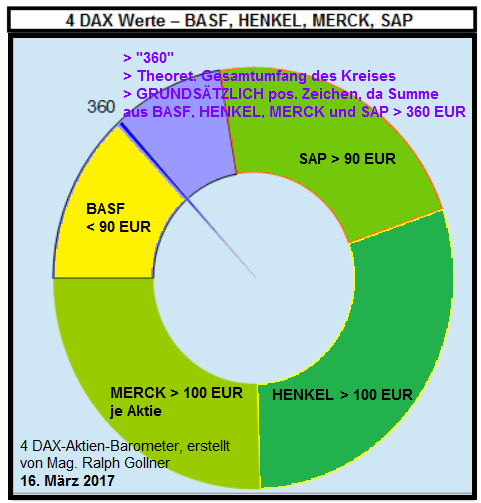

4-DAX-Aktien Barometer (BASF, Henkel, Merck, SAP)

Für einen raschen Überblick und Status des DAX sehe ich mir manchmal nur 4 (!) Aktien aus dem DAX-Universum (Aktienkorb, 30 Aktien) an. BASF (Chemie & Co.), Henkel (Putzmittel, Klebstoff & Co.), Merck (Gesundheit) und SAP (Technologie):

...

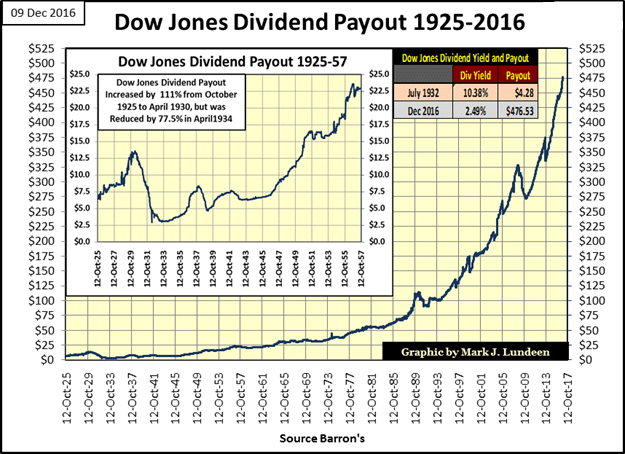

Dow Jones - Dividend Yield

(History)

With the current low yield 10year-Treasuries @ 2.365%, it is not easy to justify putting one's hard earned money (only) into the U.S. Treasury. For investors looking for yield and inflation protection, the current "Dow"-dividend yield...

(see Dow table ...

DAX-Dividendensaison 2017

& Historie

Die Redaktion von finanzen.net erwartet folgende Dividendenbewegungen in 2017. Bei acht DAX-Unternehmen wird es 2017 wahrscheinlich (!) keine Dividendenerhöhung geben, doch glücklicherweise auch keine Kürzungen...

DAX-Schwergewichte wie BASF und Bayer ...

DAX-Schwergewichte wie BASF und Bayer ...

DAX-Dividendenrendite (1998-2016)

In der Regel erhalten Aktien-Investoren einmal im Jahr eine Dividende. Allerdings schwanken die Kurse von Aktien, sodass die tatsächliche Rendite nur schwer prognostizierbar ist. Per Sep. 2016 rentiert das deutsche Leitbarometer mit ca. 2,95 Prozent.

...

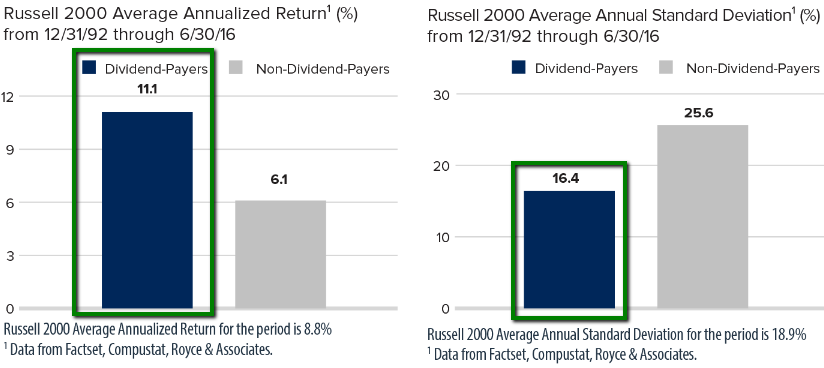

Dividend-Paying Small-Caps (Russell 2000-components) outperformed...

Non-Dividend-Paying Small Caps WITH LOWER VOLATILITY! Standard deviation is a statistical measure within which total returns have varied over time. The greater the standard deviation, the greater a stock's volatility.

If ...

Dividend Growers outperform "the rest"

There is the existence of a return penalty for seeking out too high of a dividend-yield. Why would this be the case? Yield can be a proxy for risk. Stocks with the highest yields are those most likely to be perceived as risky by investors...

Source: ...

Source: ...

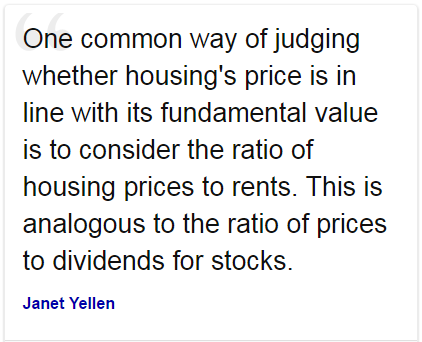

Nice Reminder Janet Y.

I found this quote from the current Federal Reserve Chair Janet Yellen; So why not check out the dividend-ratios of well-run companies/stocks and re-check, if these may really "deserve" such a high dividend-ratio...implying(?)...

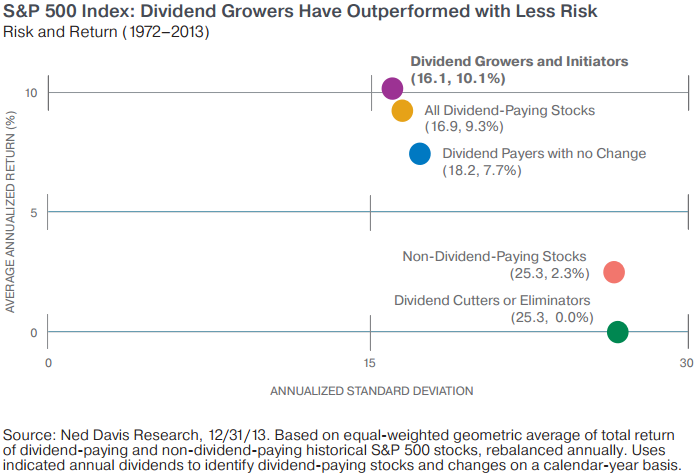

History 1923 - 2013

(Ned Davis Research)

This research-outcome helped me in surviving the stormy markets in the year 2015 and in the first 5 months of 2016. Dividends have been the lifeblood of long-term investors - helping them achieving high returns! year-over-year:

The performance shown ...

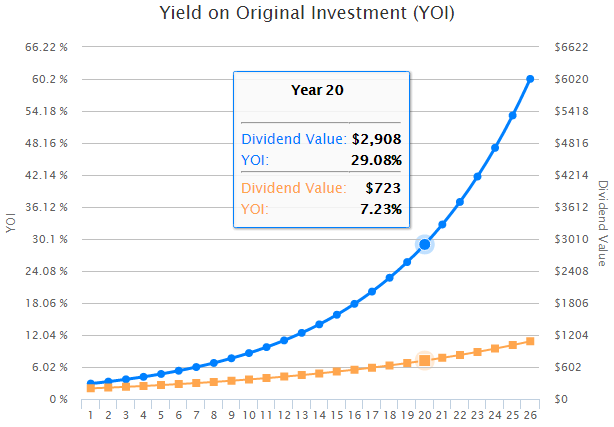

YOI or YOC

The Power of Compounded Growth and Reinvested Dividends! Buying a 2.9%-Dividend-Yield stock, which is raising its dividend payments 10% year-over-year leads to following YOI or YOC (yield on cost) after 20 years (check the blue line):

YOI stands for "yield on original investment ...

Yield on Cost (20 years/holding period)

You want to know how your yield on cost and income will grow if you bought 10 shares of a $100 stock for a total investment cost of USD 1,000?! Example: Your stock started with a 3% yield (ca.) and has an annual dividend growth rate of 12%...

| ... |

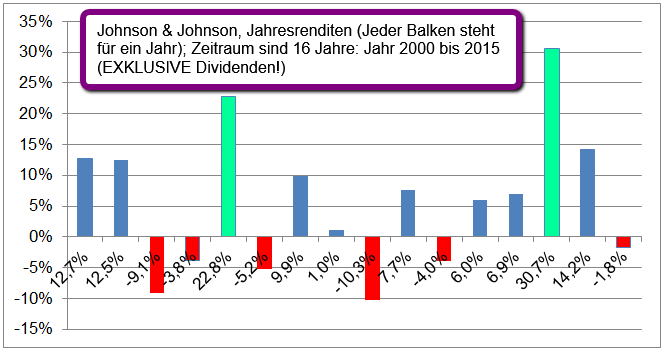

Wer nichts weiß, muss alles glauben

(Dividenden - "steady income stream")

Dividende ist der Betrag je Aktie, den eine AG an ihre Aktionäre jährlich ausschüttet. Folgend werden vorab die jährlichen Aktienrenditen von 3 Unternehmen angeführt (2000 bis 2015, ABER OHNE Dividenden!):

Die meisten ...

Search for Dividends! (March 2016)

Dividend payers, particularly those that have grown or initiated a dividend, have outperformed after the Fed increased rates; Historical recap:

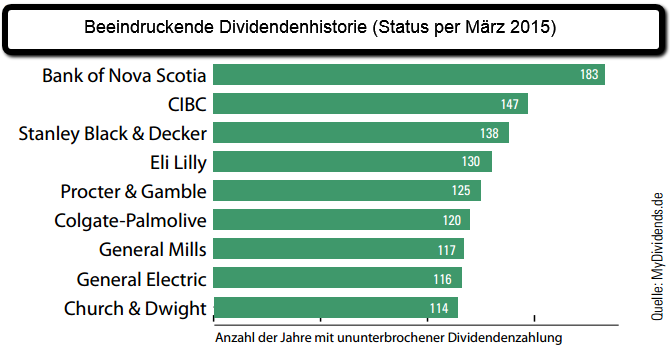

Dividendenzahler - Methusalems

Es gibt tatsächlich einige Unternehmen, die bereits im 19. Jahrhundert mit der Zahlung einer Dividende begonnen und diese tatsächlich bis heute niemals unterbrochen haben!

Achtung an sogenannte "leichtgläubige Blindflieger": Natürlich ist dies keine Garantie, ...

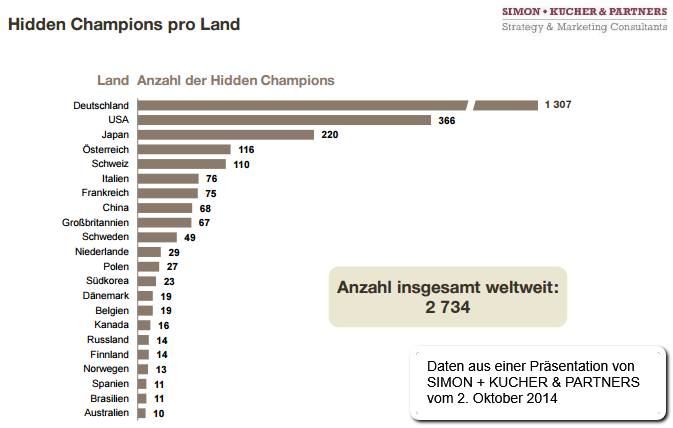

Hidden Champions

Was ist ein Hidden Champion?

♦ Top 3 in der Welt oder Nr. 1 auf seinem Kontinent

♦ Mittelständisches Unternehmen

♦ Geringer Bekanntheitsgrad im Publikum*

*Red Bull ist (somit) kein Hidden Champion

Aktuelle (per Aug. 2017 nachgereicht) Quelle zum Selber-Nachlesen:

Dividend stocks for bear markets/if you really wanna stay invested(?)

Dividend-paying stocks often come out ahead during a market sell-off. The majority of following stocks remained stable during the last sell-off periods (names given in text below, SPX stands for US-Benchmark S&P 500):

In ...

Walt Disney (Dec. 2015), Lucasfilm payoff !

Over the past two decades, total U.S. box office gross sales have ticked steadily higher, growing from USD 4.8 billion in 1991 to USD 10.92 billion in 2013:

The second top grossing movie distributor of the past two decades, The Walt Disney Company ...

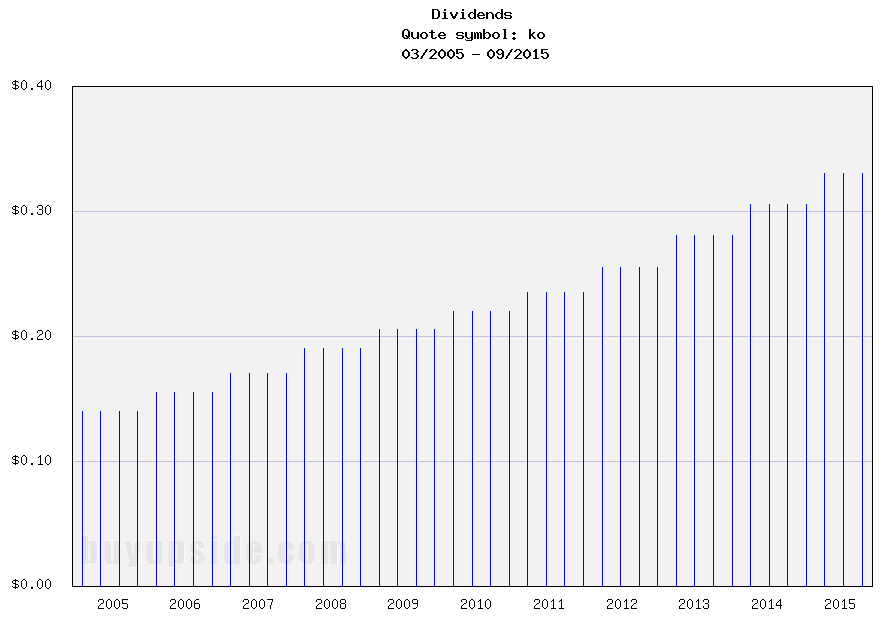

Definition of 'Yield On Cost - YOC' (example: Coca Cola/ticker: KO)

"YOC" ist the annual dividend rate of a security divided by the average cost basis of the investments. It shows the dividend yield of the original investment. Here a chart of the div. payments (cash-out) to Coke-Investors: ...

...

Dividend Investing for Newbies (5 min. - Video)

Dogs of the Dow (Foolish four?)

Dividend investors employ a variety of popular approaches to pick stocks including dividend growth, relative dividend yield and the Dogs of the Dow.

This article (source: http://www.ndir.com) is focusing on the Dogs of the Dow which is wildly popular in ...

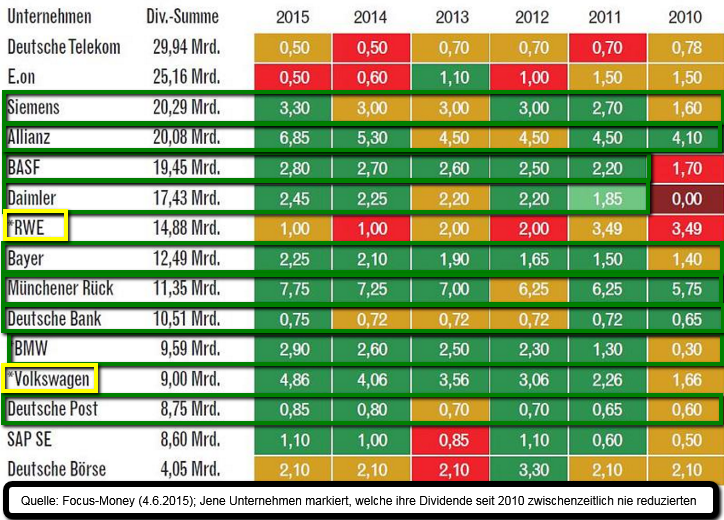

DAX-Dividenden-Goliaths

bezogen auf die absolute Dividendenhöhe (per Stand Juni 2015, Datenquelle: http://www.focus.de):

*RWE (Atomthema) und Volkswagen-Spezialfall "Dieselgate": Dividendenentwicklung ungewiss, ebenso E.on

Mehrere DAX-Unternehmen haben in den letzten Jahren regelmäßig ...

DIVCON 5 (the place to be ;-)

Reality Shares’ so-called DIVCON Indexes predict companies’ ability to raise dividends!

(see also this marketwatch-article from 5th Oct. 2015: http://www.marketwatch.com)

San Diego-based investment manager Reality Shares has a new way of selecting winners by ...

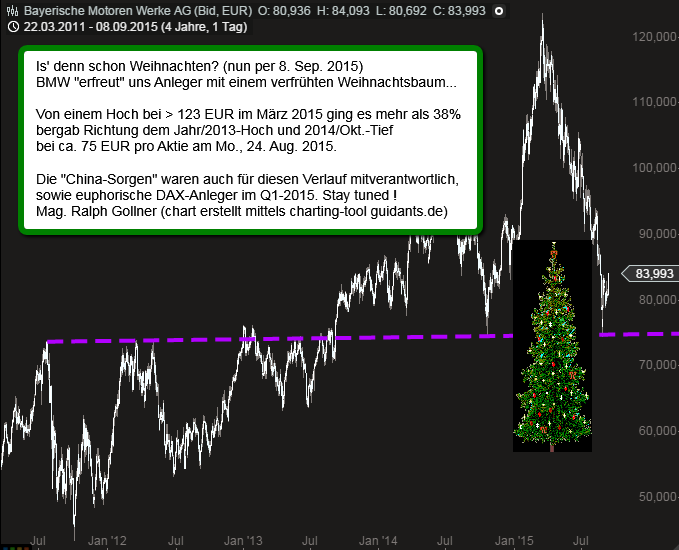

BMW-Aktie (im Zeitraum 2011 bis inkl. 8. Sep. 2015)

zur weiteren Info: der DAX (Performance-Index) notiert per 8. Sep. 2015 bei ca. 10.320 Punkten (CET-13:35). Wichtig zu wissen ist weiters, dass BMW sich mit den deutschen Automobilherstellern Daimler und Volkswagen im DAX "duelliert". China ...

crazy moves on high volume (weekly candles as per 28th Aug. 2015), updated weekly

...there is an easy way to set a stop-loss after last weeks' move (hint: just around the low of the week ending 28th Aug. 2015 ;-)

There are many other crazy charts to be looked at, a tiny selection of those you ...

AT&S ("Wie reite ich einen Trend" / Erklärung KISS - keep it short & simple! )

Vorab: Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Die Aktie, die in diesem Blogeintrag/Artikel behandelt/genannt wird, befindet sich aktuell (seit mehreren Monaten) im "Echt-Depot" von Mag. ...

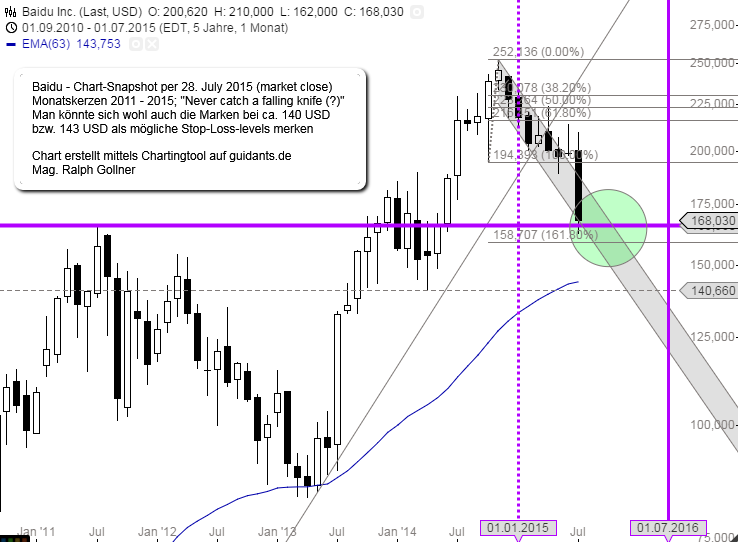

Baidu (BIDU), die chinesische Google (Juli 2015)

Revenue 2010 - 2014 (FYE):

2010: 7,9 CNY mn

2011: 14,5 CNY mn

2012: 22,3 CNY mn

2013: 31,9 CNY mn

2014: 49,1 CNY mn

Growth-Year over Year:

EPS past 5Y: 48.30%

Sales past 5Y: 61.60%

BEIJING (IT-Times), Meldung per 2. Juli 2015 - E-Commerce-Sektor ...

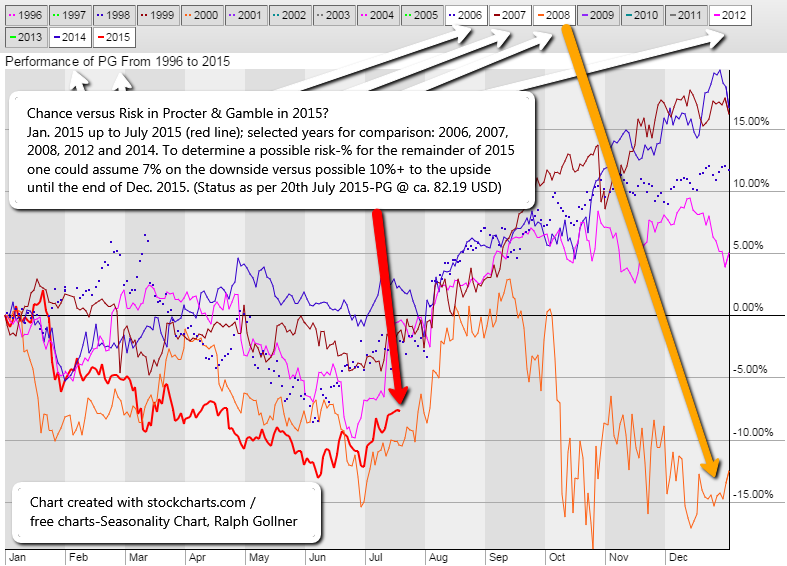

Procter & Gamble @ ca. 81 USD (20th July 2015)

Rechecking the strong diverse seasonality in PG HY-1 versus the 2nd Half-year following pattern can be found:

Deutsche Boerse (Chart per 13. Juli 2015, Kurs per 17. Juli 2015: 87,27 EUR)

Im Oktober 2014 testete die Aktie der Deutschen Börse nochmals den langjährigen Aufwärtstrend, der sich ab dem Tiefpunkt des Jahres 2003 bildete. Ab dann ging es steil bergauf, innerhalb eines halben Jahres gewann die ...

Procter & Gamble ( Snapshot @ 81.91 USD, 14th July 2015 intraday)

The Procter & Gamble Co. (PG) operates in 180 countries and territories, and it’s expanding its presence in the e-commerce market. One might think as a private person one has nothing to do with Procter & Gamble, but chances are ...

Lanxess / DAX-Turnaroundwert (Chemie) @ ca. 54 EUR (1. Juli 2015)

Der deutsche Spezialchemiekonzern Lanxess setzt seine Neuausrichtung mit dem Umbau der weltweiten Kautschukproduktion fort. In dem für den Konzern besonders wichtigen Kautschukgeschäft könnte sich die Nachfrage 2015 leicht ...

Wells Fargo ( Snapshot @ 56.1 USD, 4th June 2015 intraday)

Wells Fargo & Company (NYSE:WFC) has recovered well from the financial crisis, and maintained positive earnings throughout the period. This fact alone may intrigue many potential investors, as many believe in investing in great ...

Artikel von Armin Brack

Chefredakteur Geldanlage-Report

Bei Neuengagements könnte man nun Qualitäts-Wachstumsaktien kaufen, die aus Konsolidierungen auf neue Hochs ausbrechen. Armin Brank (Chefredakteur Geldanlage-Report) orientiete sich dabei gerne an der erfolgserprobten CANSLIM-Strategie ...

Es gibt Unternehmen, welche seit mehr als 100 Jahren (Stichtag ist im Mai 2015) ihre Dividende ohne Unterbrechung zahlen. In manchen Perioden musste diese gekürzt werden, dennoch wurde immer eine Zahlung durchgeführt.

Einige Unternehmen, welche durchgehend über diesen langen Zeitraum ihre ...

Selection of CANSLIM stocks (as per 29th May 2015), fin. metrics as per www.finviz.com

| Ticker | Company | Sector | Industry | Market Cap (USD) | PEG | P/S | P/B | Fwd P/E | EPS past 5Y | Price (USD) |

|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | Avago Technologies Limited | Technology | Semiconductor - Broad Line | 37.99B | 3,1 | 7,3 | 10,4 | 16,24 | 50.80% | ... |

It could be that some of the listed semiconductor names are approaching levels for a possible outbreak to the upside (May ME 2015). A selection of some companies, filtered via the screening tool of www.finviz.com, you can find in the list(s) below:

selected semiconductor names

| Ticker | ... |

selected consumer goods - stocks (USA), prices & valuation metrics as per 22nd May 2015 (market close)

| Ticker | Company | Industry | Market Cap | P/E | Price in USD | Fwd P/E | PEG | P/S | P/B | EPS past 5Y | EPS next 5Y | Sales past 5Y |

|

Tyson Foods, Inc. | Meat Products | ... |

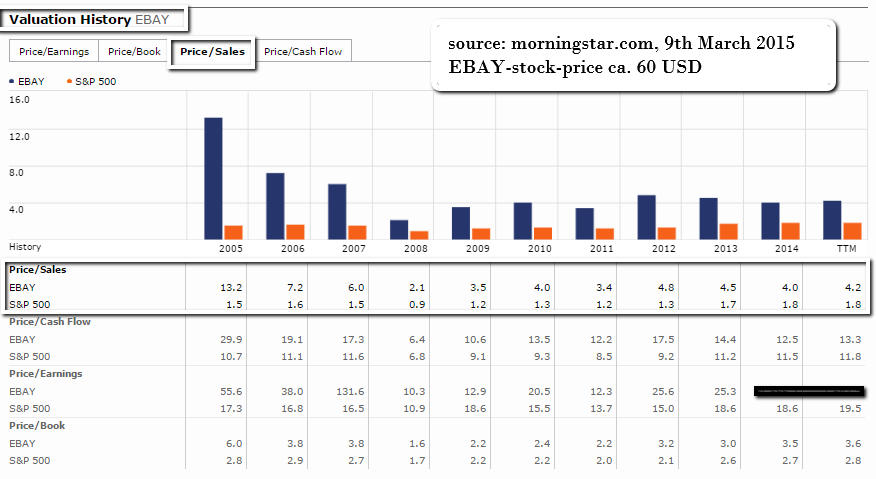

Info upfront: Carl Icahn (famous investor) is invested in EBAY (as per March 2015).

PE-ratio shall be below 20 and the stock is starting to rise in the short-term-past (current price ca. 60.5 USD)