Related Categories

Related Articles

Articles

Credit Cards versus Cash

(CC vs. C)

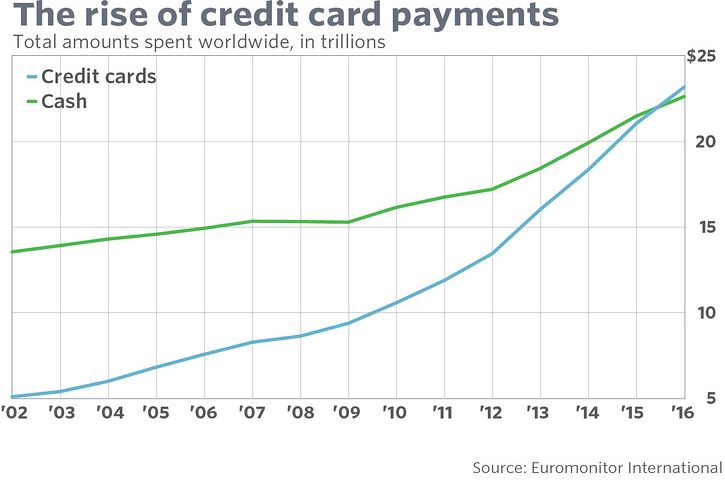

Beginning of the end for cash? As consumers have increasingly used credit and debit cards and made purchases online and on apps, they've used less and less cash; in 2016, consumers will spend a greater amount on cards than they do with cash...

...for the first time, according to the market-research firm Euromonitor International, which has been tracking consumer payments over the last several decades.

In 2016, consumers worldwide will spend about USD 23.2 trillion in card payment transactions and USD 22.6 trillion in cash. This is a milestone for cards and electronic payments, it's just a "nominal" one, said Kendrick Sands, a senior consumer finance analyst for Euromonitor. The shift has happened gradually over the last 20 years, "dramatically skewing in favor of card and electronic payments," he said.

Technology has made it easier for people across the world to have access to financial services, Sands said; plus, several countries’ governments have even given their citizens incentives to use card and mobile payments instead of cash, in an effort to reduce “shadow economy” activities and illegal transactions.

South Korea's government, for example, started to promote credit cards around 1997 in an effort to boost consumption in the country and cut down on cash payments, which are harder to track for tax purposes, according to The Economist.

The biggest share of card growth from 2015 to 2016 happened in the Asia Pacific region, accounting for USD 1.7 trillion in transactions, followed by North America, with an increase of USD 187 billion, according to Euromonitor.

The rise of debit cards is another reason why cash has declined in recent years; Debit card use worldwide grew about 8% in terms of cards in circulation from 2015 and 2016; by that same measure, credit card use grew about 5% worldwide. Two of the most famous credit-card companies may be VISA and Mastercard (please see the performance of their respective stock-price in the last years; as fundamental underlying I also showed the EPS/Earnings per Share of Mastercard in the box below the Price-charts of VISA/V and MasterCard/MA).

There has already been pushback in some countries, including in Europe, from citizens who want to continue using cash in countries where governments have put limits on cash transactions. Plus, there are security concerns. Hackers have repeatedly broken into retailers’ payment systems, as well as into central banks in Bangladesh and Ecuador.

And cash is still useful to people who don’t have access to the internet or who don’t feel comfortable using a digital banking system. Using credit cards and online payments can make spending easier, which can lead to budgeting problems for some consumers, and can send them into financial trouble.

In terms of frequency, cash is still used for about 85% of transactions worldwide, but that can mostly be attributed to the popularity of using cash for small transactions, according to research from MasterCard/MA and management consulting firm McKinsey.

"There's always going to be a portion of the population that will even pay more to use cash," Sands said.

Disclaimer: Ralph Gollner hereby discloses that he directly ownes some of the securities mentioned above (as per 26th September 2016): MA (MasterCard)

Original article: www.marketwatch.com/story/this-year-will-be-a-turning-point