Related Categories

Articles

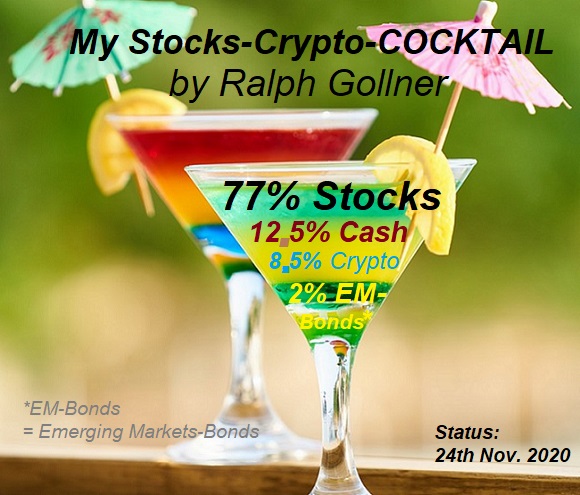

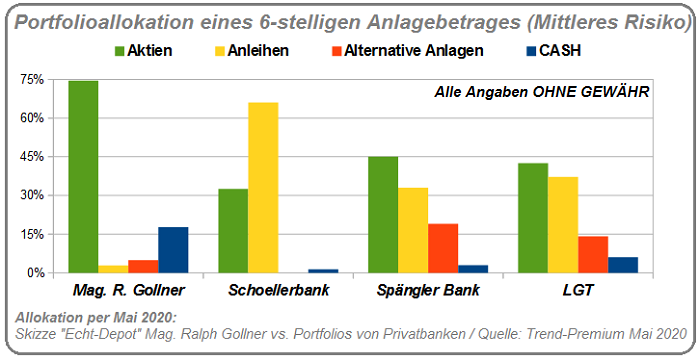

My current Asset Allocation looks like a

sweet Crypto-Cocktail (8.5% Crypto Inside ;-)

The Investment-portfolio as per End-November 2020 is split into Stocks, Crypto, EmergingMarkets-Bonds and Cash:

Let's see what the final weeks of this crazy year 2020 will bring in the Financial Markets.

Cheers

Ralph

LIRP-environment & Cash-yields

We appear to be entering a period of prolonged low interest rates across most major developed markets. US investors are wrestling with how to adapt to this "new normal" - and how their asset allocation decisions should shift in a zero-rate environment.

Japanese investors, however, have dealt with these conditions for over 20 years since the initiation of the Zero Interest Rate Policy (ZIRP). Japan dropped rates to zero in February of 1999, and Japanese government bonds have been at around a 1% yield ever since. Zero rates are just normal in Japan.

Japan ...

The uncrowned King

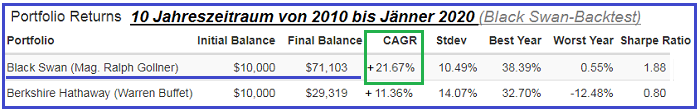

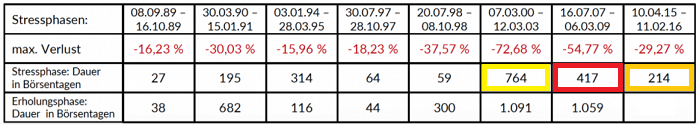

BLACK SWAN-BACKTEST

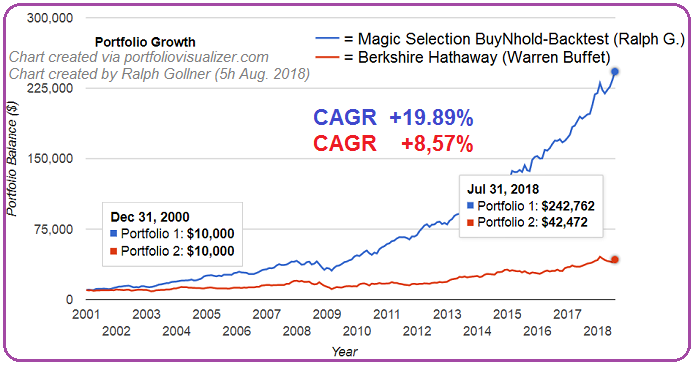

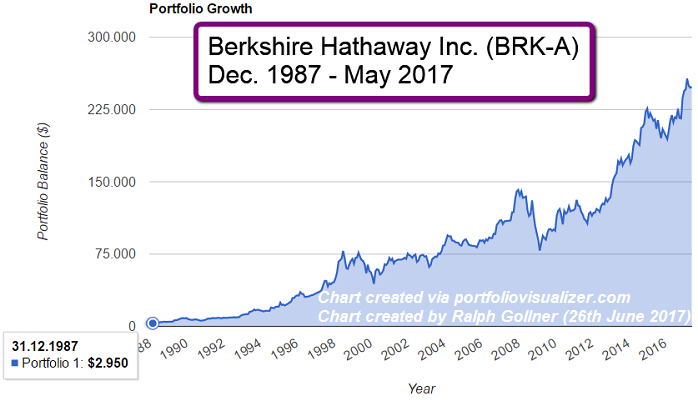

Die letzten 10 Jahre konnte man an den globalen Aktienmärkten einige fantastische Renditen einstreifen. Warren Buffet jedoch hatte in den letzten Jahren zusehends...

...Probleme bekommen. Wobei dies nur relativ gilt, weil auch seine Investmentgesellschaft "Berkshire Hathaway" in dem 10-Jahreszeitraum eine zweistellige Jahresrendite erwirtschaften konnte!

Das österreichische Monatsmagazin "Der GEWINN" gibt regelmässig auch eine Sonderedition heraus "Den TOP GEWINN" und bringt Rankings heraus, in welchen die stärksten Fonds der letzten Jahre einem ...

Mag. Ralph Gollner

Aktienquote per Ende Mai 2020

Seit Mai 2020 beträgt die Aktienquote im "Skizzen-Depot" ca. 74%. Allerdings verfolgt das Depot dabei...

...zwei Punkte:

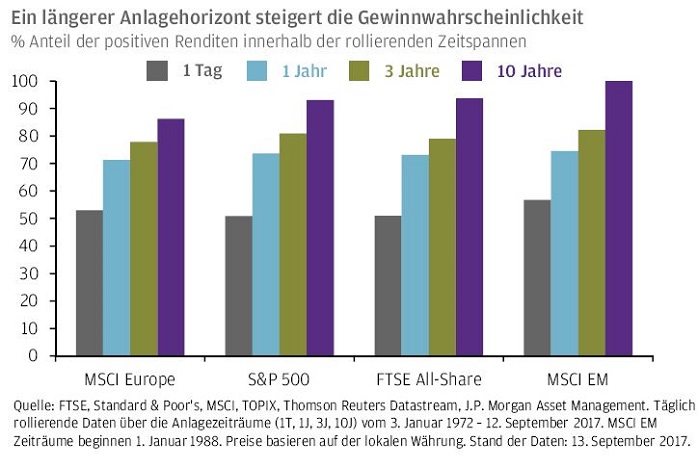

1) Solche eine recht hohe Investitionsquote (74% Portfolio-Anteil) bedingt -sowieso- einen langen Anlagehorizont zu haben.

2) Sofern es aber zu einem Waterfall-Drop an den Aktienmärkten kommen sollte -aus welchen Gründen auch immer- will

ich eine dynamische Aktienquote fahren.

Ben Graham (Prof. von Warren Buffet) meinte, dass ein Investor eine Aktienquote von 25% bis 75% "fahren könnte". Sofern man eben die passende ...

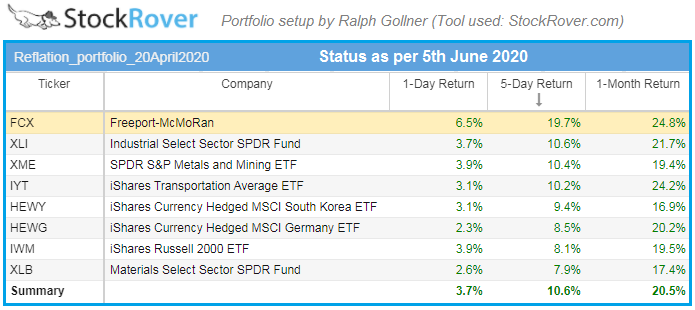

the REFLATION TRADE is on

(Status: 5th June 2020)

The Fed's aggressive stimulus measures, along with other central banks', are having the desired effect of reducing risk premiums and reflating risk assets. The "reflation trade," involving the most...

...economically sensitive assets, confirms that the central banks' actions are working.

Currently (especially now in the first week of June 2020), the market is loudly saying the Fed Bazooka worked to turn the tide, and risk assets are going higher.

The Fed "reflates" the economy by injecting liquidity to stimulate borrowing and reduce ...

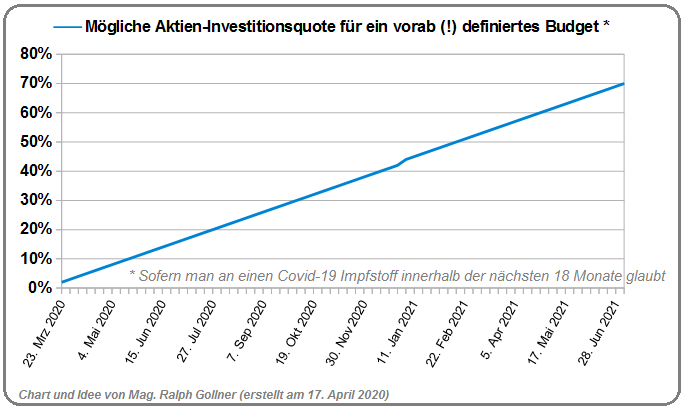

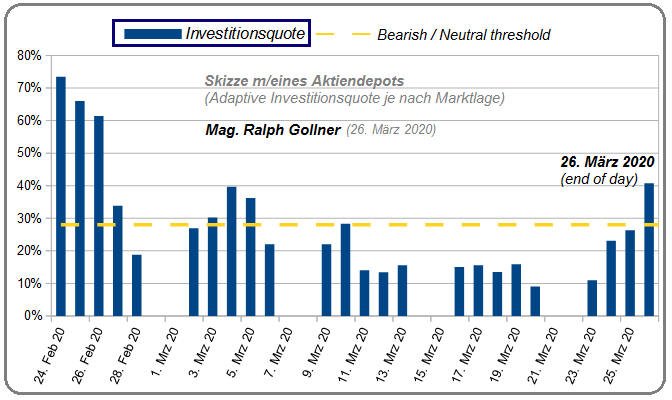

Gradueller Einstieg in Zeiten wie Covid-19

(Aktien-Investionsquote)

Sofern Jemand den Spruch "Kaufen, wenn die Kanonen donnern" ernst nimmt und nun tatsächlich in den Aktienmarkt einsteigen will, könnte man sich einen graduellen Einstieg vorstellen. Und zwar nicht ALL-IN (Einmalerlag),...

...sondern eventuell nervenschonend-er über mehrere Tranchen.

Der psychologische Vorteil wäre dann in den nächsten Monaten und Quartalen, dass man sich gar über fallende Kurse freuen könnte, weil man ja dann billiger zugreifen kann. Dahinter steht die (ewige) Überlegung, dass LANGFRISTIG (!) die ...

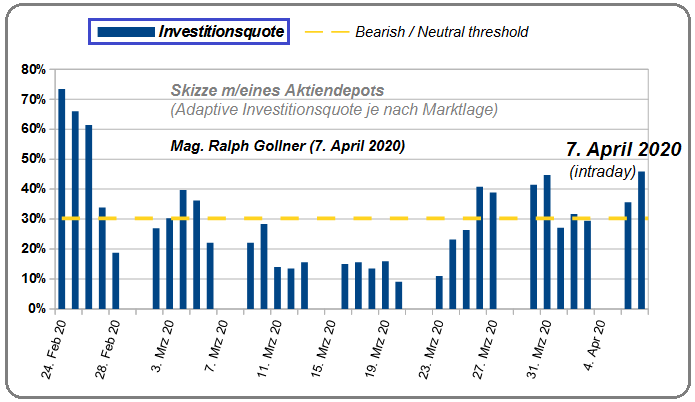

Aktienquote in m/einem Portfolio

Reminder von Ben Graham himself: The investor's chief problem - and even his worst enemy - is likely to be himself. Hier einer seiner "Quotes bzgl. einer möglichen Aktien-Investitionsquote" in einem...

...Portfolio:

"[...] investor divide his holdings between high-grade bonds and leading common stocks; that the proportion held in bonds be never less than 25% or more than 75%, with the converse being necessarily true for the common-stock component; that his simplest choice would be to maintain a 50-50 proportion between the two, with adjustments to ...

Aktienquote in einem Portfolio

(Aktien/Anleihen-Mix)

Reminder von Ben Graham himself: The investor's chief problem - and even his worst enemy - is likely to be himself. Hier einer seiner "Quotes bzgl. einer möglichen Aktien-Investitionsquote" in einem...

...Portfolio:

"[...] investor divide his holdings between high-grade bonds and leading common stocks; that the proportion held in bonds be never less than 25% or more than 75%, with the converse being necessarily true for the common-stock component; that his simplest choice would be to maintain a 50-50 proportion between the two, with ...

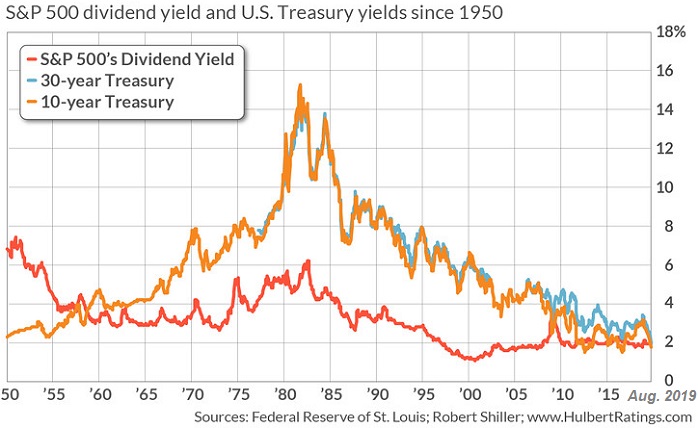

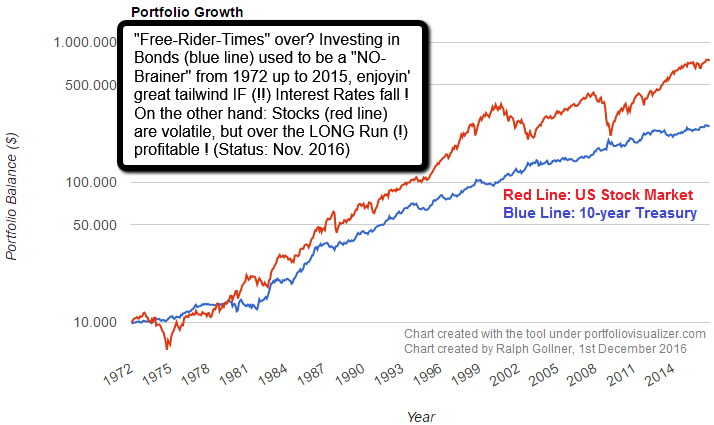

Bonds versus Stocks

(Bond yield versus Dividend yield)

The yield on the 30-year Treasury bond which this week just fell below the S&P 500's dividend yield SPX, was reversing a relationship that - with only a couple of minor exceptions in recent years - has held since the year 1958.

Individual stocks now yield more than 5-, 10-, and 30-year US Treasury bonds, according to Bespoke's (Investment Group) research. As of this week (Last week of August 2019), two-thirds of the stocks in the S&P 500 yield more than the 5-year. More than 60% yield more than the 10-year, and roughly half are ...

(Real)

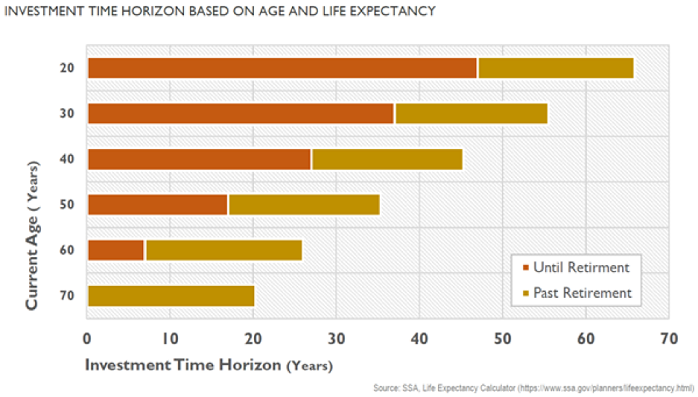

Long-Term-Investing

(20 years+)

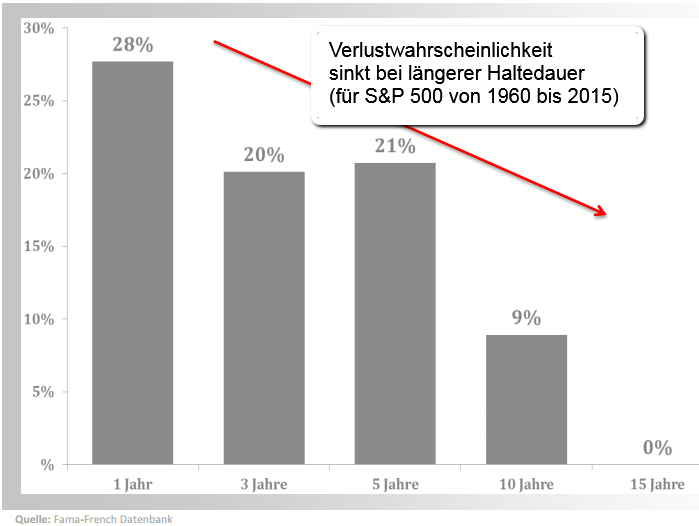

Long Term is longer than you might think! Investment time horizon is a critical concept in building wealth. Most investors have very long investment time horizons, typically decades or more. Investment managers also...

...require long time horizons to deliver on their investment thesis. Finally, stock market volatility diminishes substantially over time, with a 75% decrease in variability for 10 years versus one year. As a result, developing patience and a long-term perspective are key to building wealth.

!PATIENCE!

We are living longer and need ...

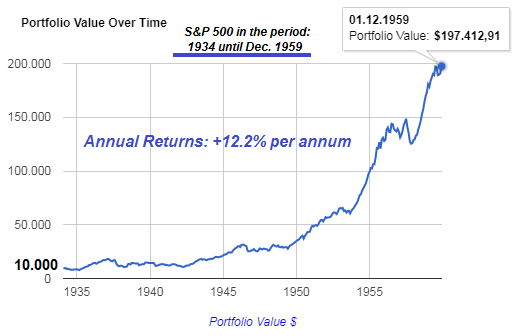

25Jahres-Perioden am US-Aktienmarkt

"und was planst Du in 25 Jahren?"

Bereits in den Dekaden 1934 bis 1959 konnte man in "USD-denominated stocks" investieren. Manche haben dies per Einmalanlage gemacht. Das Beispiel hier rechnet einfachheitshalber mit einer Einmalanlage von USD 10.000,-

In der nächsten Beobachtungsperiode (1960 bis 1985) kam es zu weiteren historischen Begebenheiten, wobei nach 1945 kein Weltkrieg mehr in einem 25Jahres-Geldanlage-Zeitraum tobte, dafür gab es andere Krisen:

-) Kuba-Krise

-) Bau der Berliner Mauer

-) Kennedy-Attentat

-) Eskalation des Vietnam-Krieges

-) ...

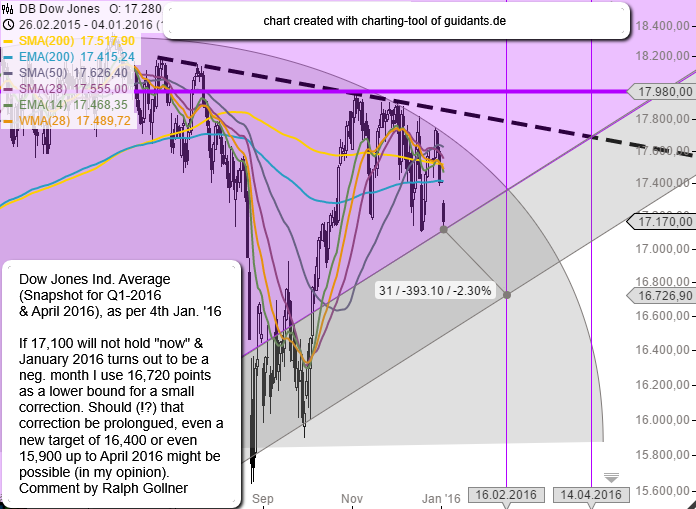

Trump and the Trend-Follower

Artificial Intelligence?!? well, stupid is what stupid does...

...Turns out the algorithms behind so-called trend-following quants are rather primitive and suffer from many of the same weaknesses a mortal brain might. They've struggled to react fast enough to the unforeseen side effects of ending a decade of central bank stimulus, and even seem to get baffled by U.S. President Donald Trump.

"The models can't move as fast as the tweets," said Brooks Ritchey, senior managing director at Franklin Templeton"s K2 Advisors unit who oversees USD 3.6 billion and ...

Geht's der globalen Wirtschaft gut, geht's MEINEN (!) Aktien recht gut :-)

Aktueller Status (inkl. Projektion) in diesem Kurzvideo der OECD:

https://oecdcomms-mediahub.keepeek.com/pmisVbl30q

LG Ralph

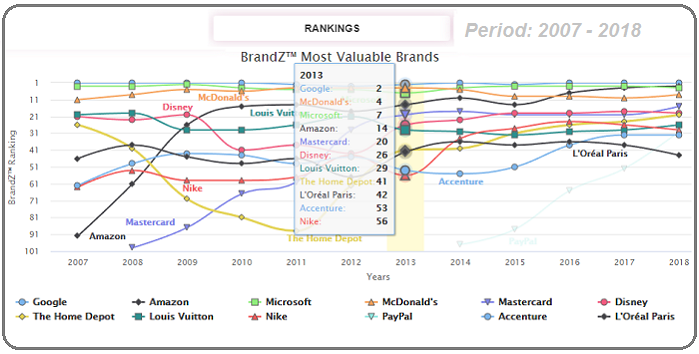

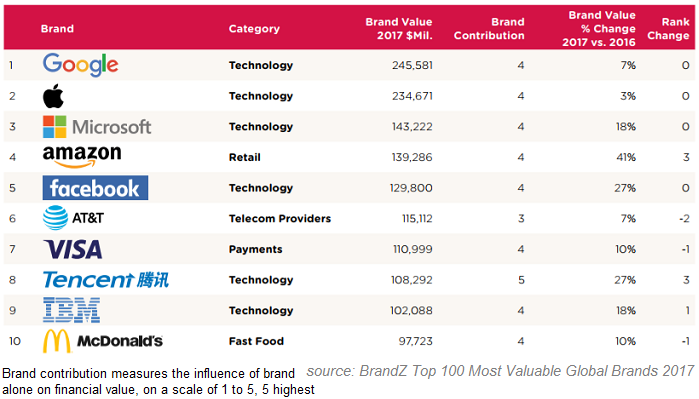

Top Brandz (2018)

Kantar and WPP have published the 2018 BrandZ™ Top 100 Most Valuable Global Brands ranking and report. The report tracks the value of the world's most valuable brands and provides insights on the potential of strong brands. The total brand value of...

just a "random" selection of some of the "TOP100-companies", selected by Ralph Gollner

just a "random" selection of some of the "TOP100-companies", selected by Ralph Gollner

...the 2018 BrandZ Top 100 is USD 4.4 trillion following a record 21% growth - equating to a rise of nearly USD 750 billion. China continues to grow its presence on the world stage with both Tencent and Alibaba ranking in the Top 10, ...

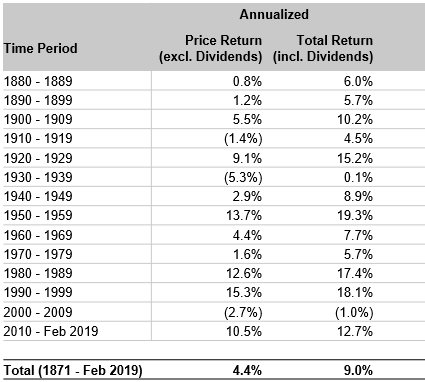

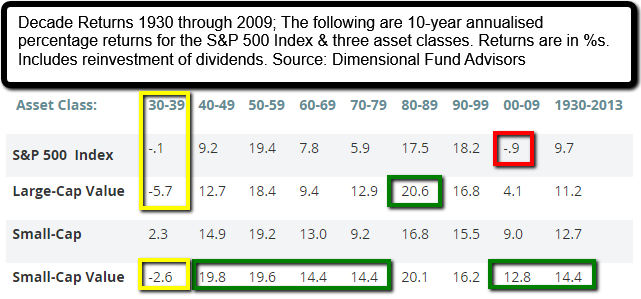

U.S. Stock Market Returns by Decade

Across the entire period spanning from the year 1871 until February 2019, U.S. stocks have increased at +4.4 % per year excluding dividends, +9.0 % per year including dividends.

Well (apart from the decade 2000 - 2009) >> The trend of real total returns by decade has not changed significantly...

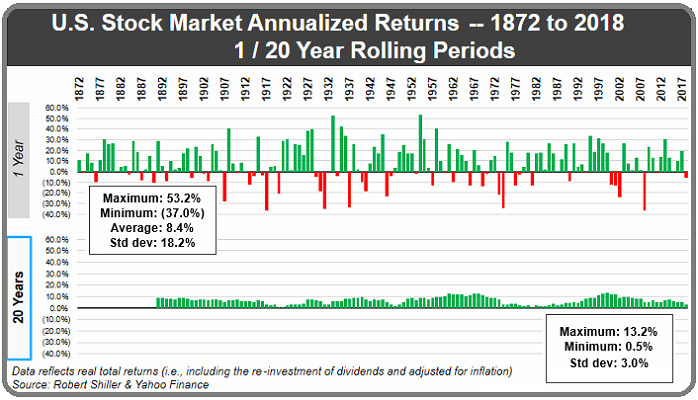

Stock Market Returns Over Different Time Periods (1872-2018)

1 year and 20 years (!)

"Rolling Periods"

Across the entire period spanning from the year 1871 until February 2019, U.S. stocks have increased at +9.0% per...

...year including dividends. Note: when we refer here to the "U.S. stock market", this refers to the S&P Composite index from 1871 to 1957, and the S&P 500 index from 1957 until today.

U.S. stock market returns in any single year can be extremely volatile. The market has lost between 30% - 40% in five different years (1917, 1931, 1937, 1974, 2008), while the market has ...

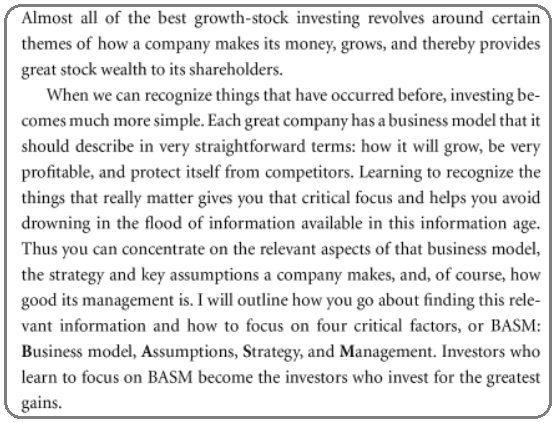

Picking Great Growth Stocks ("BASM")

--------------------------------------------------------

Investing is actually common sense along with a focus on the key factors that drive the greatest stocks. In fact, investors need to focus on only four factors that seem to be...

...common, identifying traits of the greatest companies and stocks, following the experience of Fred Kobrick. Fred Kobrick has termed these four factors BASM (a) - (d):

♦ Business Model: How the company plans to grow, be profitable and protect itself from competitors.

♦ Assumptions: The key assumptions the company ...

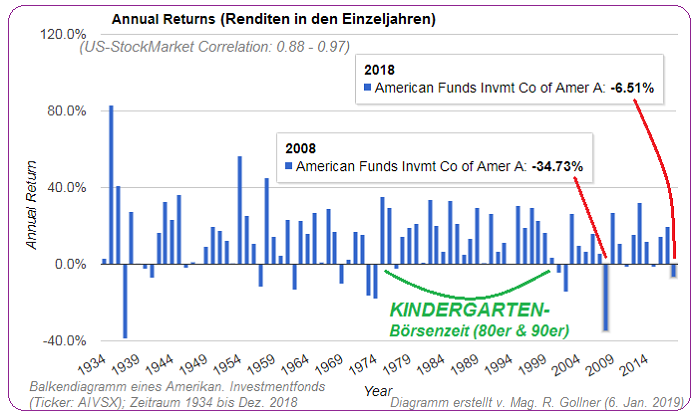

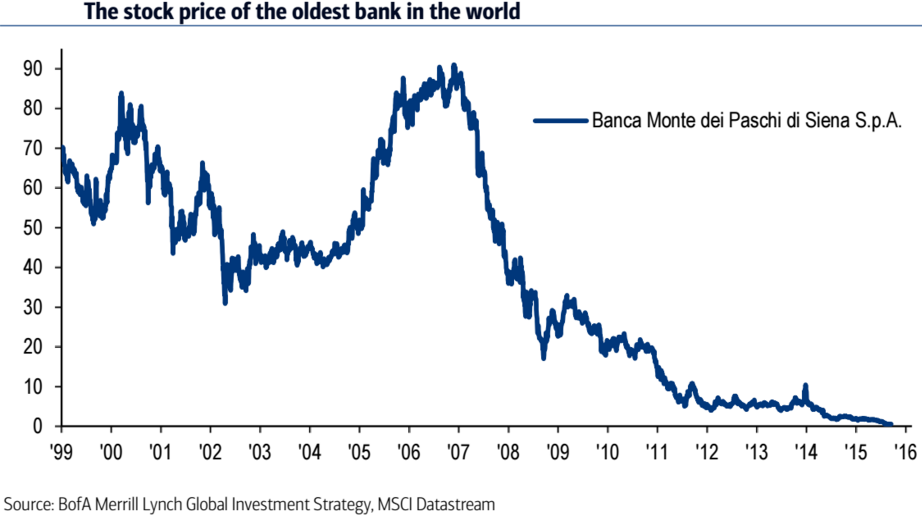

Investmentfonds-Methusalem

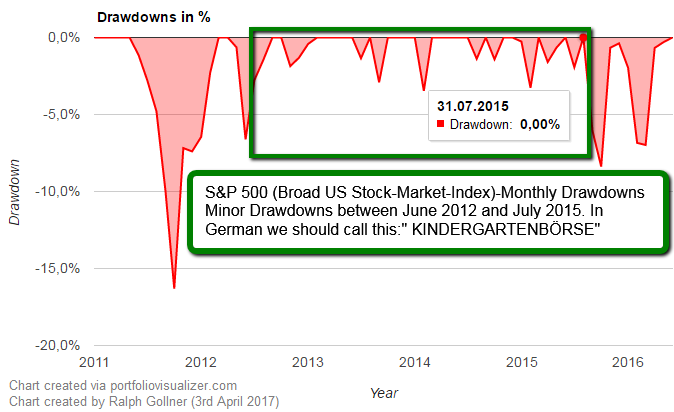

(1934 bis Dez. 2018)

Man sollte wohl (nicht nur als Greenhorn) anfagen, die Anzahl der negativen Jahre zu zählen und überdenken, ob sich ein Langfrist-Investment in Aktien (Aktienkorb, ETF, nachhaltig erfolgreiche ? Investmentfonds) lohnen könnte:

Die Dekaden VOR dem Jahr 1980 waren auch sehr spannende Börsenjahre, wenn auch nicht "so einfach" wie die beiden Dekaden zu Ende des letzten Jahrhunderts! Ich nenne diese 20 Jahre dann immer -recht trefflich- Kindergarten-Börse.

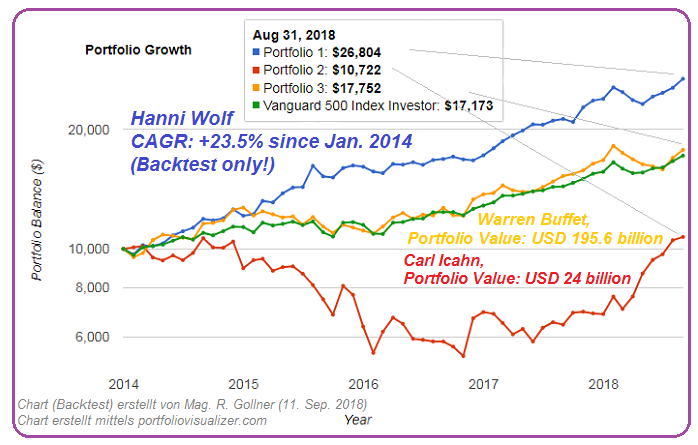

The old men go, the younger ones strive NOW !

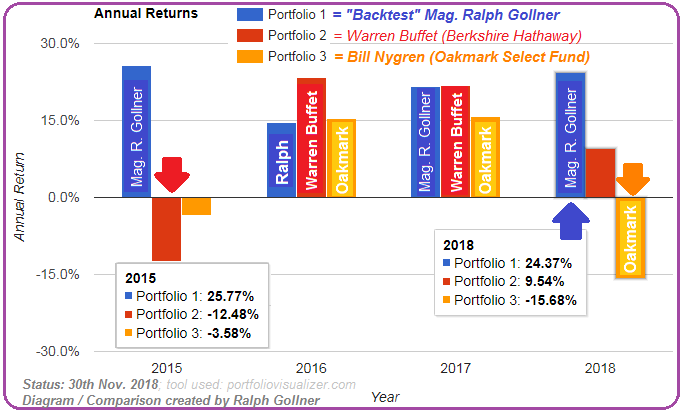

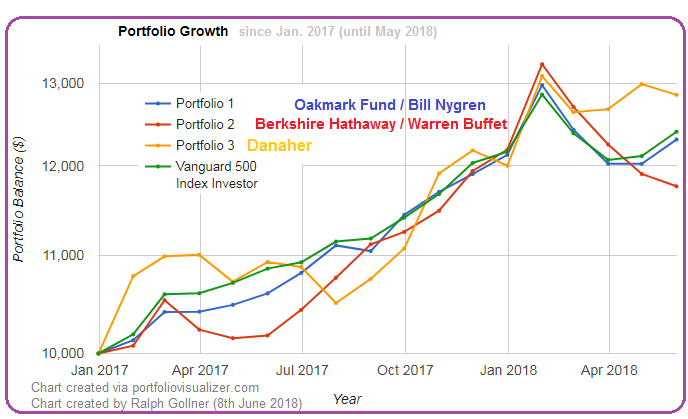

Two big FLAGSHIPS, which I want to compete with :-)

Well, take a look at "Oakmark"; then you may go on by reading some stories under the links given below: Oakmark Funds was established in 1991 and...

...is said to be dedicated to value investing, particularly in companies that are strong free-cash-flow generators and have shareholder-friendly management teams. In total, Oakmark offers seven different mutual funds, six of which were begun in the 1990s.

Value investor William Nygren has more than 30 (!) years of investment experience. Now a ...

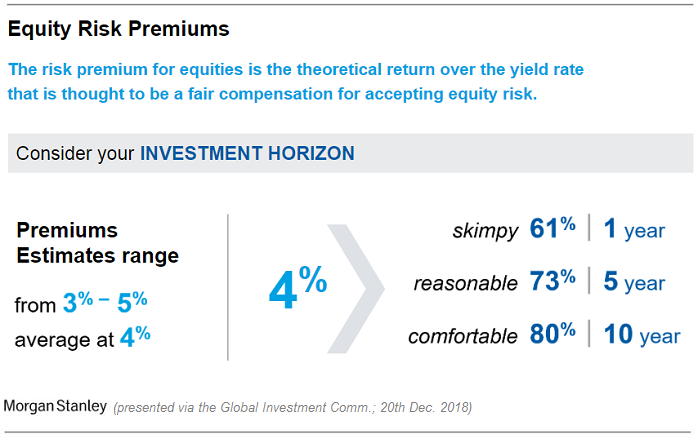

Implied Equity Risk Premium (ERP) Update

Implied ERP on 1st December 2018= 5.29% (Trailing 12 month, with adjusted payout)

would mean (annual) returns of: 2.8% (US T-Bond as per 20th Dec. 2018) + 5.29% = 8.09%

link:

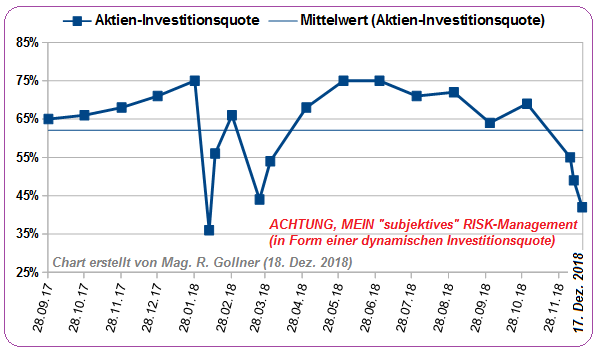

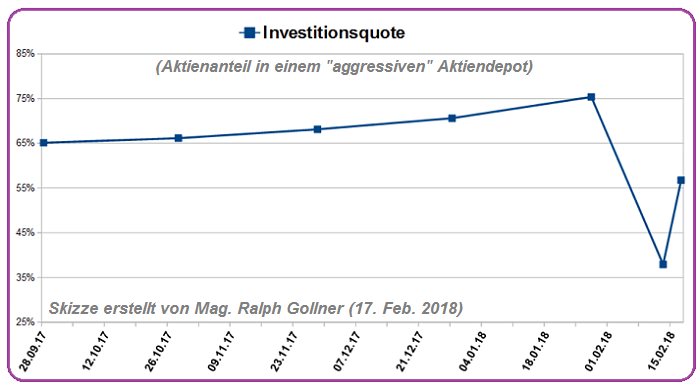

Meine -theoretische- Aktien-Investitionsquote

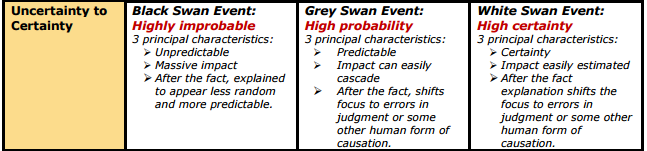

(Sep. 2017 bis inkl. 17. Dez. 2018)

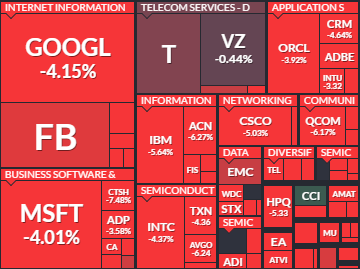

Vor dem "Grey Swan"-Event morgen (19. Dez. 2018: FED-Sitzung inkl. Zinserhöhung?) habe ich meine Aktien-Investitionsquote versus Sommer 2018 kräftig heruntergeschraubt. Aktuell könnte man diese bei ca. 40%...

...ablesen (siehe Schaubild). Im Okt. und Nov. 2018 konnte man an den US-Aktienmärkten einen kräftigen Verlust bei vielen US-Einzelwerten verzeichnen. Die ehemaligen US-Aktienmarktleader in Form der FANG-Gruppe (Facebook, Amazon & Co.) haben stark an Zugkraft verloren - im Gegenteil: Sie ...

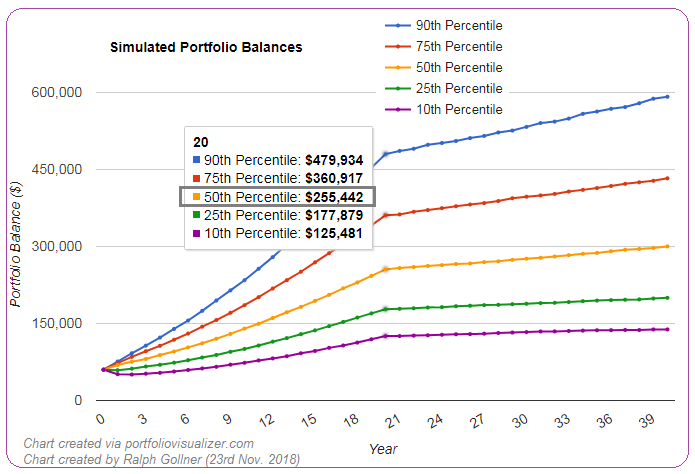

"Ich baue mir (m)eine Privatpension"

(nur für mich alleine!)

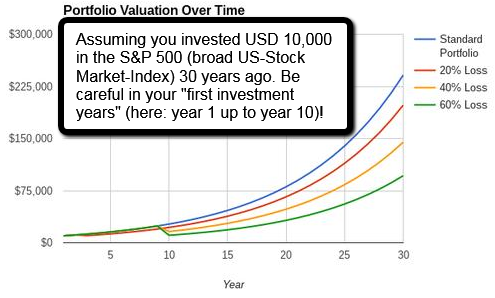

Fiktive 60k USD anfangs

(wären aktuell ca. EUR 52.000,--)

Gerne hätte man dann wohl einen DICKEN PUFFER am Ende der 20jährigen Ansparphase >> Im besten Fall sollte dieser PUFFERBETRAG dann im Jahr 20 zwischen USD 250.000...

...und USD 500.000 liegen; Siehe Grafik oben: "Simulated Portfolio Balances" (gelbe & blaue Linie).

a) Ansparphase (bis zum 20. Jahr)

b) "Retirement-Phase" / Entnahmeplan (ab dem Jahr 21)

Prämisse Nummer 1 für mich: Mit einer 81%igen Wahrscheinlichkeit rechne ich in meinem Szenario in den nächsten 20 Jahren ...

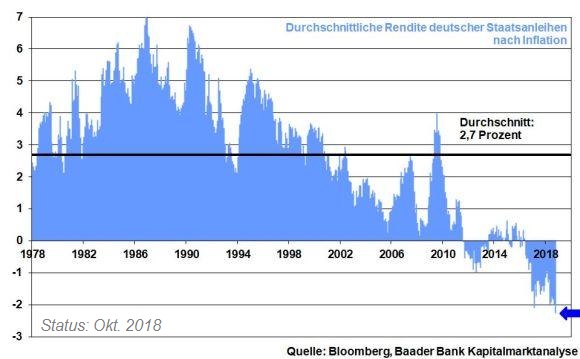

WELTSPARTAG im Oktober 2018

"Na dann: wünsch ich >> Eine gute Nacht!"

In Europa stellt der Anleihemarkt weiterhin keine lukrative Anlagealternative dar. Wohl eher das Gegenteil, die durchschnittliche Rendite deutscher Staatsanleihen (10jährige Staatsanleihen, "German BUNDs") nach...

...Abzug der Inflation ist dramatisch negativ und zuletzt sogar auf ein neues Allzeittief gefallen. So viel zum Weltspartag!

Sustainable Investments / Nachhaltige Geldandlage

Historische Einführung: Das Umweltprogramm der Vereinten Nationen (englisch United Nations Environment Programme, UNEP) hat seinen Hauptsitz in Nairobi, Kenia. Das Umweltprogramm wurde 1972 auf der Konferenz der Vereinten Nationen über die Umwelt des Menschen (UNCHE) mit der UN-Resolution 27/2997 vom 15. Dezember 1972 ins Leben gerufen. Nach seinem Selbstverständnis ist das Programm die "Stimme der Umwelt" bei den UN. UNEP wirkt als Auslöser, Anwalt, Lehrer und Vermittler für den schonenden Umgang mit der Umwelt und einer nachhaltigen ...

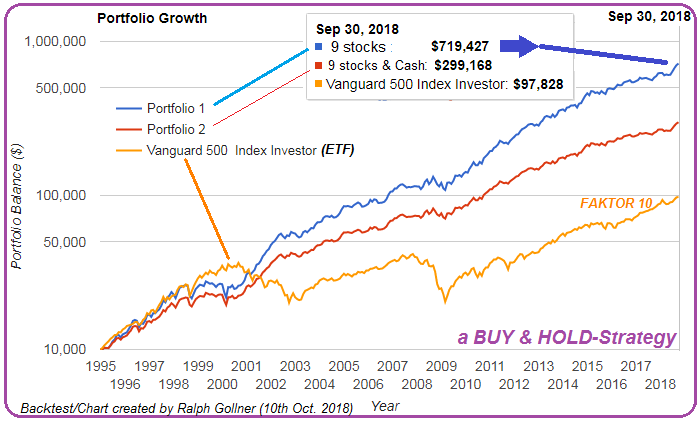

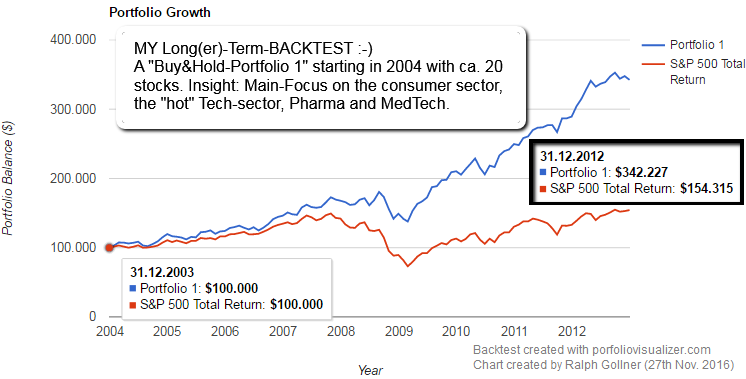

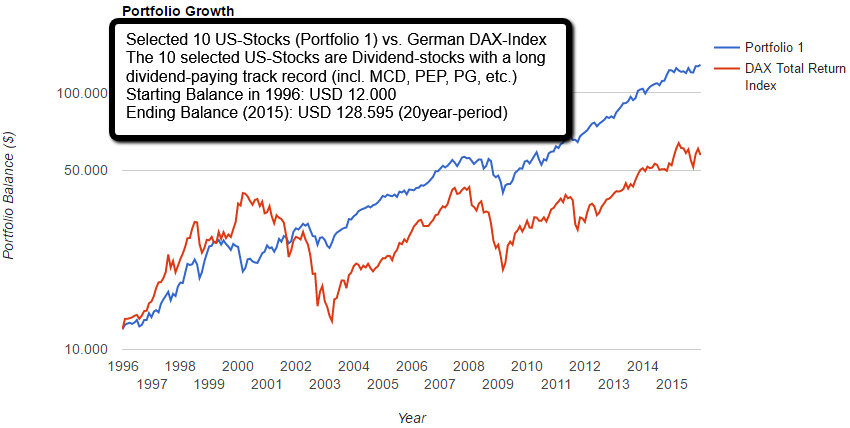

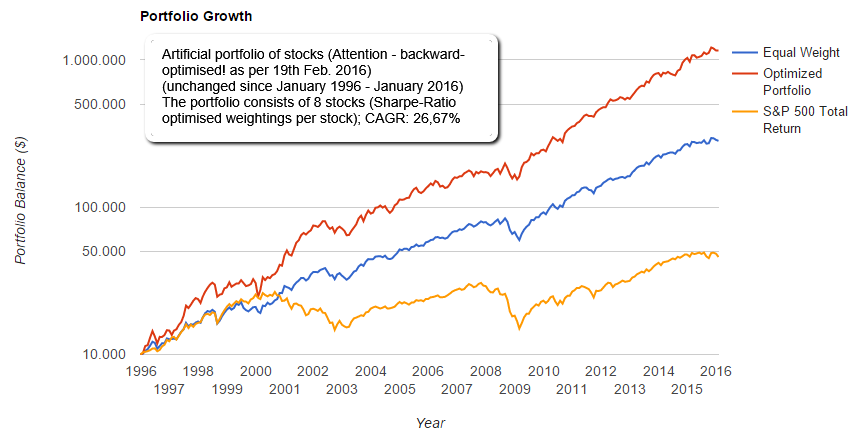

Gr8 OUTPERFORMANCE versus S&P 500 (broad US-Stock Market)

BACKTEST Jan. 1995 - Sep. 2018

No negative year in 24 years (timespan: 1995 - Sep. 2018)!

The low-Volatility portfolio (BUY&HOLD) started with 9 stocks and a Cash-ratio of ca. 24% (red line-Portfolio). The USD 10,000 were...

...therefore split in USD 7,600 among 9 USD-denominated stocks and USD 2,400 CASH. Eventually this investment-sum managed a FACTOR 30 (reaching > USD 299,009) by the end of September 2018. A dedicated stocks-portfolio (USD 10,000 fully invested in stocks as per Jan. 1995, BLUE LINE) would have reached a ...

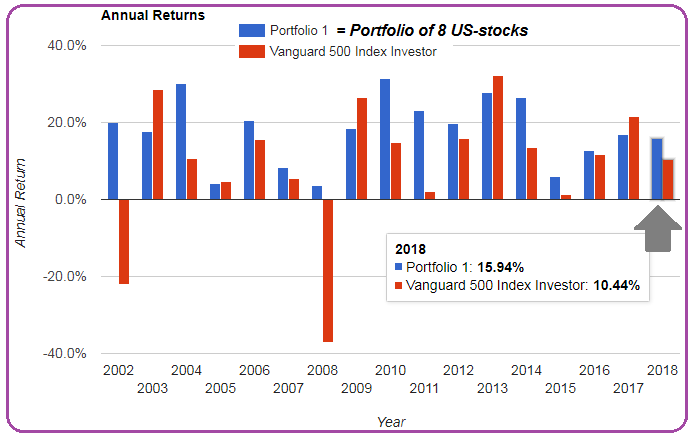

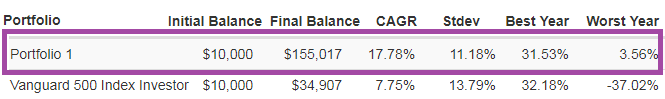

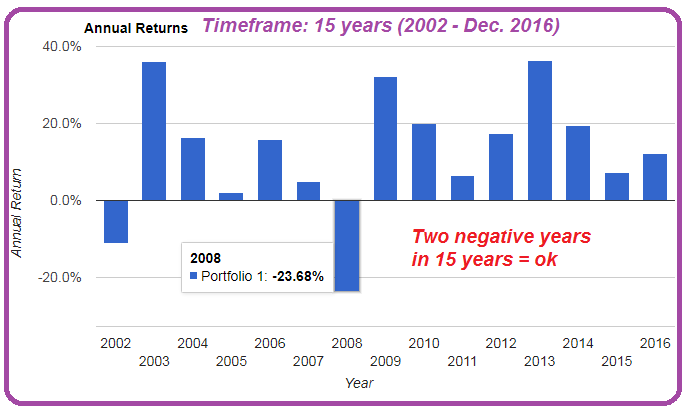

Backtest of 8 US-Stocks

(2002 - Sep. 2018)

Great outperformance versus the US-Stock Market (S&P 500) and positive returns in each of the past 18 years!

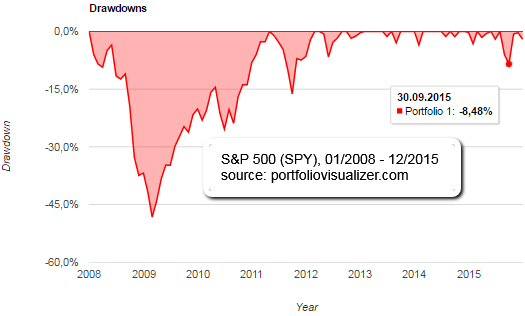

There are still many ways to achieve an unbelievable outperformance against a "risky S&P 500" (see the Drawdowns of the broad US-Stock Market in the last decades, like in the year 2002 or 2008!).

An annual return of over +17% over the last 18 years with lower fluctuations than the broad Stock Market (S&P 500) shows what is possible. The BUY&HOLD-portfolio-Backtest was possible via adapting academic research and a senseful ...

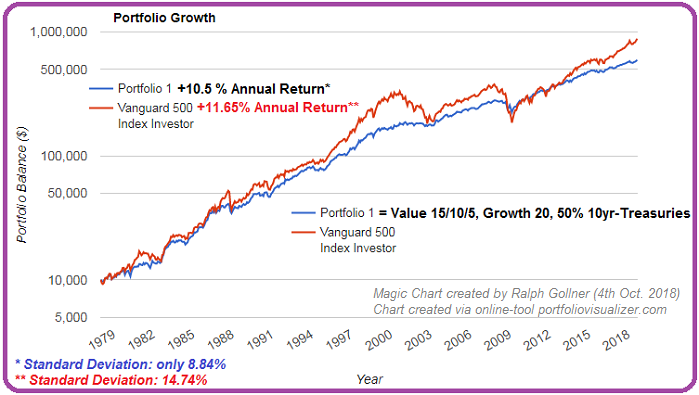

ETF-Cocktail

(Backtest since my birthday ;-)

Well, this might be to far-fetched. But indeed, I started a backtest over the period 1978 until the 2017. Below the following backtest-charts I added a real ETF-Cocktail, explaining on how to reshuffle specific ETFs, which are on the market:

Over long periods the power of compounding is too obvious to be overlooked (see chart above). In the next diagram you can then follow up on the yearly performance-bars. Fascinating detail (to my point of view): that there is only one year, where the performance was clearly negative (the famous ...

Zinsen werden durch den "privaten Zins-Tilgungsträger"

beglichen (Beispiel)

Man stelle sich vor, man nimmt einen Hypothekar-Kredit auf, und zwar über 15 Jahre. Aktuell ist dies in Österreich gar machbar für einen effektiven Zinssatz von 2,3%p.a. fix...

Bei einer Kreditsumme von EUR 200.000 hätte man somit Zinsen von insgesamt ca. EURO 42.000,- über die nächsten 15 Jahre zu stemmen. Sollte man sehr firm mit Geldanlagen und Leverage sein, könnte man gar als "privaten Tilgungsträger" EURO 15.000,- beiseite schaffen und über den Zeitraum 2018 bis 2034 in 13 Dividendenaktien investieren. ...

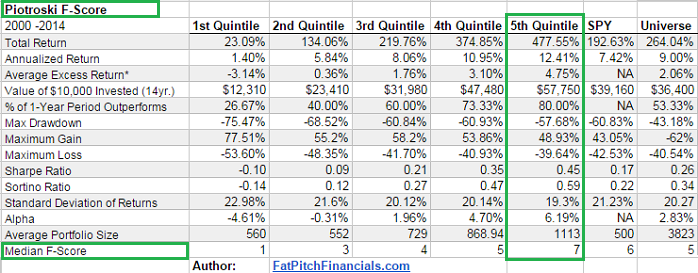

Piotroski F-Score

(Backtest 2000 - 2014)

The Piotroski F-Score is an advanced compound fundamental analysis strategy developed by Joseph D. Piotroski. Piotroski detailed this strategy in his 2002 academic paper, "Value Investing: The Use of Historical Financial Statement...

...Information to Separate Winners from Losers." The F-Score gives stocks one point for passing each of the following simple accounting-based fundamental tests:

♦ Positive net income

♦ Positive operating cash flows

♦ Higher return on assets than the previous year

♦ Operating cash flows greater than net income

♦ Lower ...

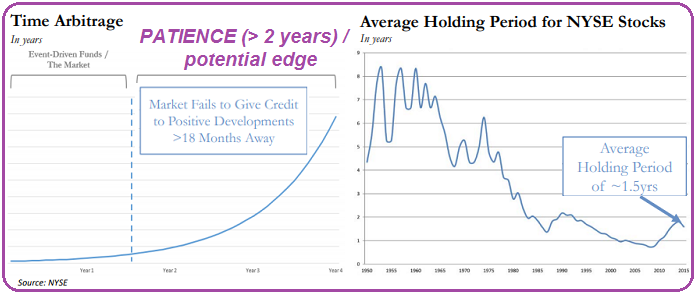

All we need is just a little patience!

"TIME ARBITRAGE"

Time Arbitrage: The ability to invest on a longer time horizon than most other people is one of the most important advantages.

♦ Institutional investors are increasingly seeking low-volatility returns, and have resorted to investing in short-term "events" toachieve this.

♦ As a result, average holding periods have decreased to less than 2 years (ca. 18 months) today.

♦ This is great opportunity for long-term investors. If we're willing to look beyond the market's horizon of 18 months, we can receive the value of future ...

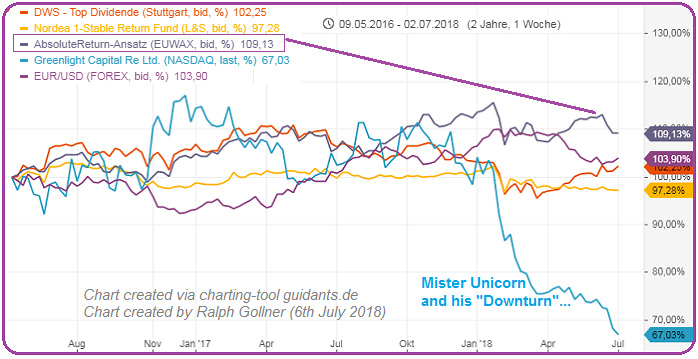

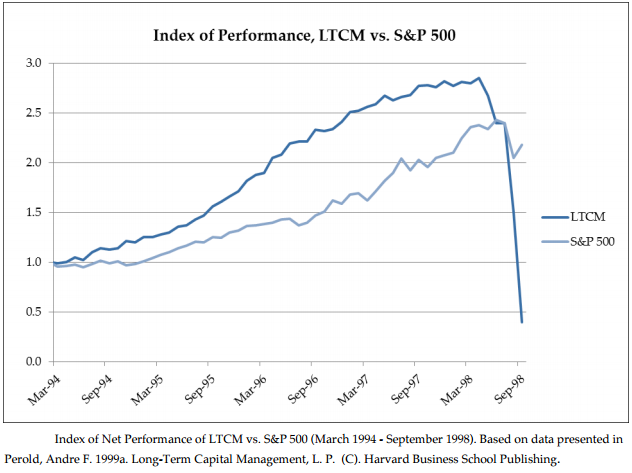

David Einhorn is losing

("Greenlight Capital")

The global financial crisis that unfolded in 2008 was terrible for the hedge fund industry-on average, it lost a record 19%. Strangely, though, it added to the mystique of the hedge fund manager. David Einhorn (with "his Greenlight Capital"),...

...Paulson, and Howard were part of a small cohort who showed foresight at a time when other investors were racing toward the cliff. And that's exactly what hedge funds are supposed to do. While regular mutual funds largely ride the market's ups and downs, hedge funds charge high fees ...

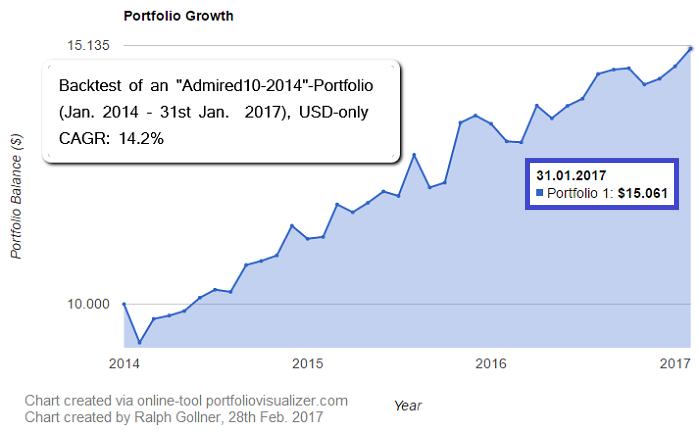

My little nephew just celebrated his birthday yesterday!

Here is his highly concentrated stocks-portfolio, which we built togther last year (2017). I backtested the portfolio selection and rebalanced the composition annually for the years before (Starting balance in Jan. 2014: USD 10k):

Long-Term investing requires LESS of YOUR TIME!

Long-Term investing is SIMPLE, but not easy (requires a certain temperament).

Less transactions, less fees; Reduce your propensity to sell (& buy new) stocks. Think about "Slow-Changing Industries for Long-Term Investors".

His (HANNI-) stocks in the ...

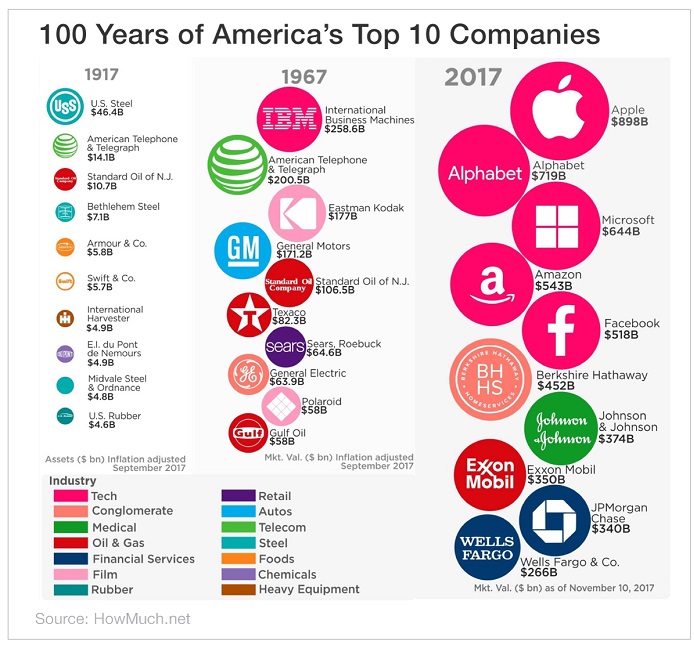

"US Top 10 companies"

The world is changing at a phenomenal pace and nothing illustrates this better than looking at changes in rankings of the world's largest companies. Mind you this is not a global trend, but region specific. Let me tell you more. Stating the obvious, you...

...will not be surprised it is the technology sector that is the key catalyst for change in the world. Technology companies not only dominate our daily lives (how many times have you checked your iPhone today?) but also the ranking of world's biggest companies.

Who do you think the smartest graduates want to ...

Venture Capital (VC)

and the magic 12%-Return (?)

The talk somehow pivoted from my seed-seeking startup into talking about the macro view of venture capital and how it doesn't actually make sense. "95 % of VCs aren't profitable," a well-known Israeli startup investor said. To...

...be clear: Ninety-five percent of VCs aren't actually returning enough money to justify the risk, fees and illiquidity their investors are taking on by investing in their funds. The other 95 percent are juggling somewhere between breaking even and downright losing money (remember to adjust for inflation).

A ...

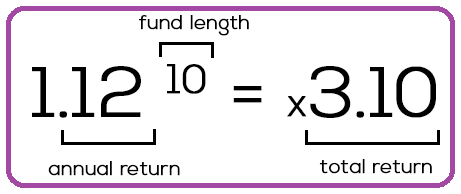

Well, his best days are gone?

Mr. Buffet

Well, in such a competitive field one should either stay competitive or give to charity or invest in the Education-field?! Anyway: My Backtest with 15 stocks from 2001 until July 2018 delivered stellar results:

...and the "Game" is just starting (starting to take off) - we are ready for "take-off" >>> Compounding interest starting kicking in :-)

The year 2018 has been "so far so good" (Backtest-Portfolio up more than +10%), but the interesting part will be the upcoming period: 2019 until 2029. Nearly a decade, in which the 15 stocks in this ...

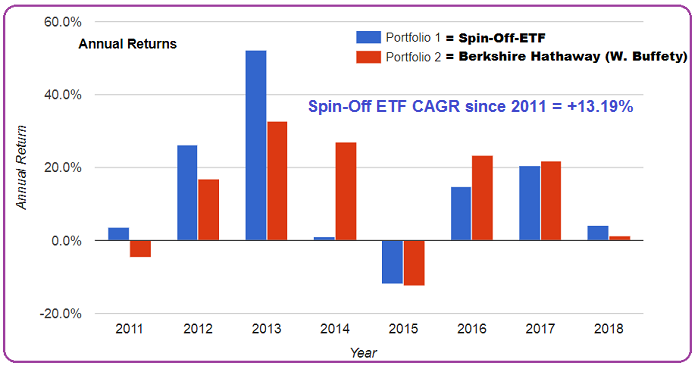

Spin-off

Investment opportunity (?)

The frequency of corporate spin-offs ebbs and flows with general economic activity. After a spin-off occurs, investors can invest separately in entities that were previously presented as a single investment opportunity. For active investors, the question...

...of whether to invest in one or both (or neither) of the separated entities ebbs and flows with spin-off market activity. Beginning in 1965 and ending in 2000, the evidence suggested that a strategy of investing in the spun-off subsidiaries and holding the shares for 22 months, while ...

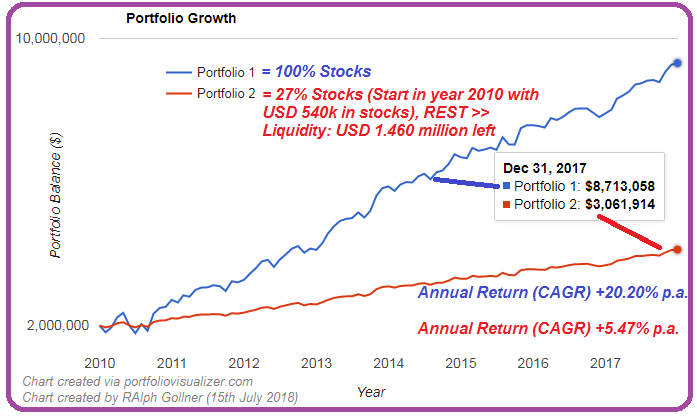

It is always a trade-off between LIQUIDITY and RETURN

(Wiener Zinshausmarkt versus USD-Aktien-Portfolio)

ODER: Dividendeneinahmen versus potenzieller Mieteinnahmen, bzw. Preissteigerungspotenzial Unternehmenswert versus Immobilienwert. Vorab die Info, dass Wiener Hausherren bei aktuellem...

...Kauf (per Juli 2018) wohl eine Rendite von ca. 2% bis 4% in Wien zu erwarten haben. Theoretisch, weil Keiner kann sagen, wie sich die Nachfrage in AT entwickeln wird - insbesondere aufgrund des recht hohen Niveaus. Aktuell scheint sich auch der Markt in Richtung "Privatpersonen"-Käufermarkt zu ...

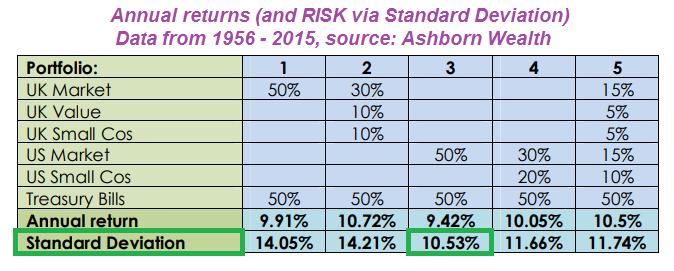

"Return-figures and Standard Deviation"

Let's illustrate how increasing diversification can help optimise returns within a given risk profile, let's revisit the scenario below based on Data from 1956 to 2015:

Looking at a rebalanced 50/50 Treasury Bill and UK Equity portfolio, one can find the following:

50/50 Shares / Bills

Return: +9.9% p.a.

Standard Deviation ("old" Risk-definition): 14.1%

But let's recheck what happens if one diversifies by building in overseas equities, and small companies. Here the data is based on UK and US equity markets, for which there are good long term ...

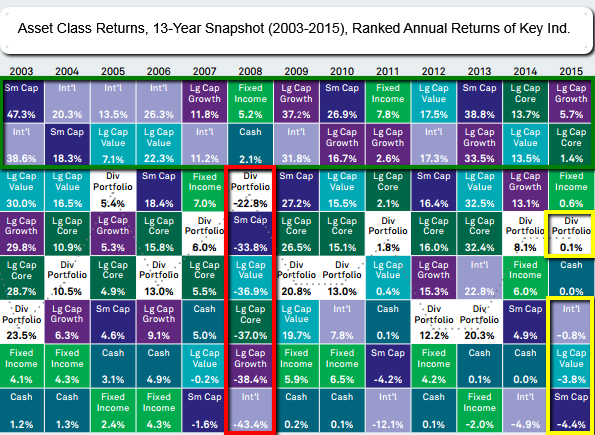

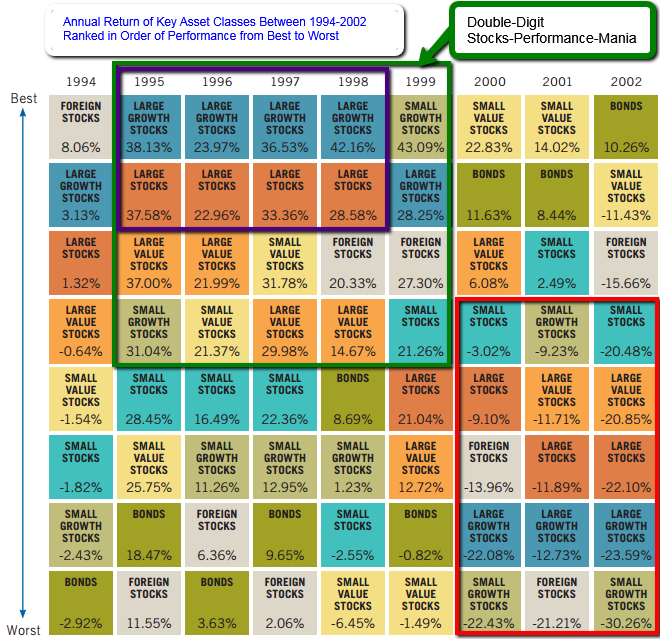

Asset classes-Returns / History

Hint: Please click onto the table in order to get a bigger and more interactive experience :-)

Source: novelinvestor.com

Source: novelinvestor.com

David Einhorn's Greenlight Capital shrinks by half

>>> Investors flee

For years David Einhorn's Greenlight Capital (NASDAQ:GLRE) thrived on buying beaten-down stocks of companies on the brink of turnarounds and selling those of overvalued companies. Now his investment approach looks less...

...robust - Greenlight has slid quite heavy since the end of 2014 and clients have pulled more than USD 3 billion during the last two years, Bloomberg reports. Einhorn isn't changing his tack: He's long on General Motors (NYSE:GM) and short on a "bubble basket," which includes Netflix (NASDAQ:NFLX) ...

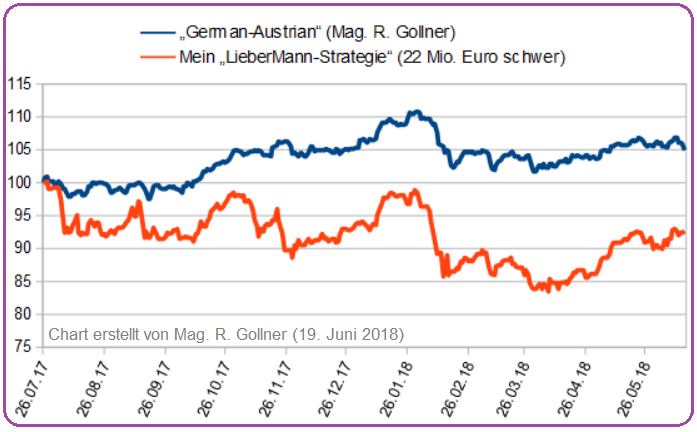

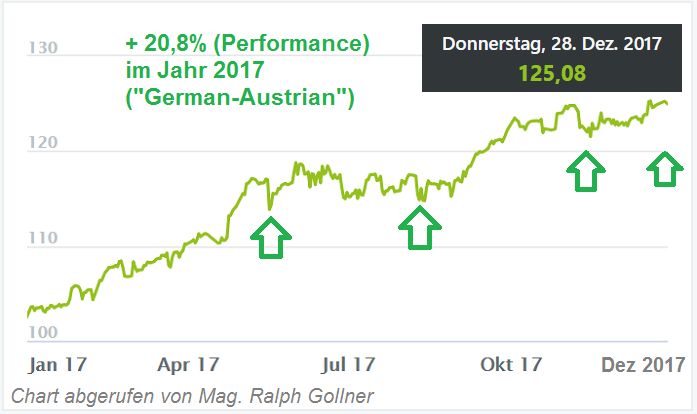

"German-Austrian"

vs.

"Mein LieberMann-Strategie"

In folgendem "real-life" Beispiel ein Vergleich von meinem "German-Austrian"-Portfolio versus einem bekannten "LIEBERMANN-Portfolio", welches aktuell ca. 22 Millionen Euro schwer ist (Status: 19. Juni 2018). Einige der...

...letzten (Börsen-)Jahre waren "einfach zu einfach" für Momentum-(Free)-Rider und sonstige Fondsmanager, welche sich teilweise nur auf die Asset-Klasse Small-Caps gestürzt haben. Wie schon oft gesehen denken solche Free-Rider, dass der einfache Anstieg der Aktienkurse ewig anhalten würde. Grundsätzlich mag dies (so)gar ...

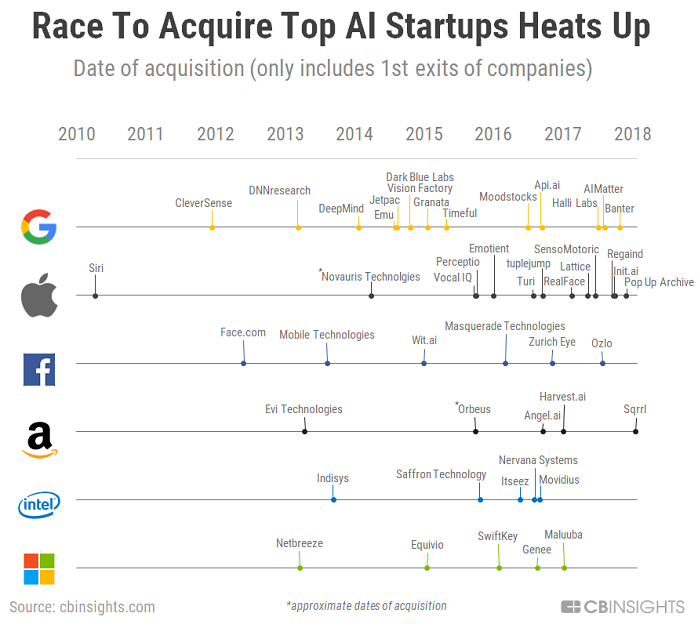

The Race For AI

("Artificial Intelligence M&A")

Big corporations across every industry, from retail to agriculture, are trying to integrate machine learning into their products. At the same time, there is an acute shortage of AI talent. A combination of these...

...factors is fueling a heated race to scoop up top AI startups, many of which are still in their early stages of research and funding.

The timeline above shows the M&A activity of corporations that have made 4 or more acquisitions since 2010.

Google is the top acquirer of AI startups, with 14 acquisitions under its belt ...

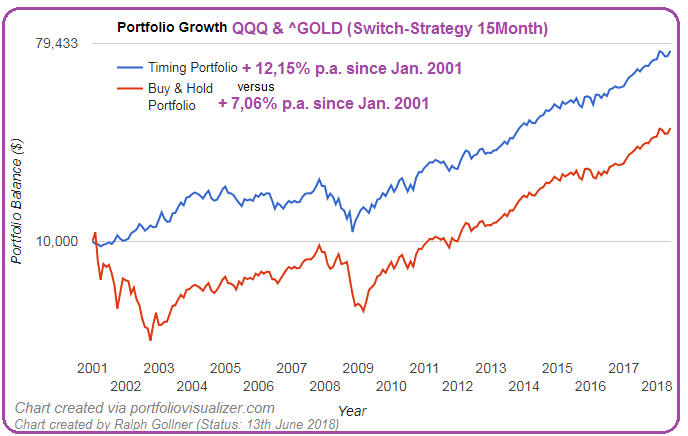

QQQ & ^Gold "Timing Portfolio"

The Invesco QQQ tracks a modified-market-cap-weighted index of 100 NASDAQ-listed stocks. QQQ is one of the best established and most traded ETFs in the world. It's also one of the most unusual. Per the rules of its...

...index, the fund only invests in nonfinancial stocks listed on NASDAQ, and effectively ignores other sectors too, causing it to skew massively away from a broad-based large-cap portfolio. QQQ has huge tech exposure, but it is not a 'tech fund' in the pure sense either. The fund's arcane weighting rules further distance it from anything ...

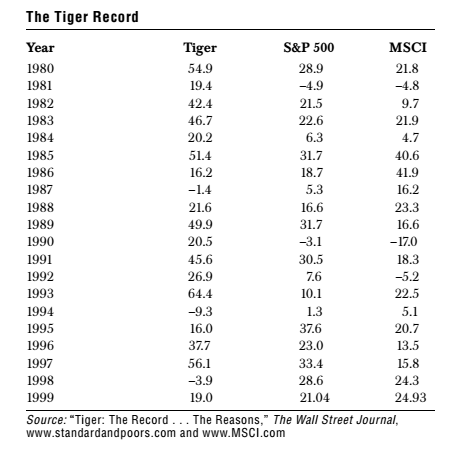

Julian Robertson ("Tiger")

The returns Julian Robertson (let's just call him here: "THE TIGER") has generated are simply phenomenal. But, well, Tiger was active for the around 20 years - during (the so called) "Kindergarden-Börse-years". Furthermore, an interesting point might...

...also be, that Julian R. started his fund when he was 48 years old! The annual performance figures lead to the result of growing one USD into 139 USD in ca. 20 years!

His Investment Philosophy

Julian Robertson is a firm believer in the tenets of Value investing as mentioned by Graham in Security ...

Well, all good things come to an end...

Two elder legends are fighting to stay in the game...

It seems that "Danaher" is winning again

>>>

At least it worked (again) in the (very) short period: Jan. 2017 - May 2018

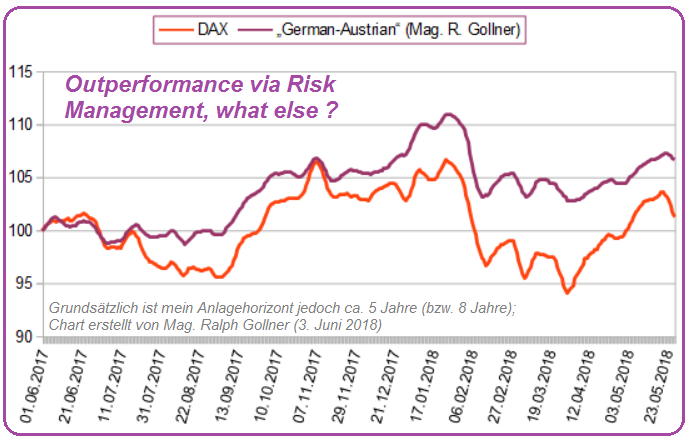

"German-Austrian" (Mag. Ralph Gollner)

versus DAX

Ein Schwalbe (bzw. 1 Jahr) macht noch lange keinen Sommer...A propos: Die Sommerzeit wird nun bald auch an der Börse ankommen. Bis zum Okt./Nov. 2018 kann es sehr spannend bleiben. Aktuell beträgt der "Vorsprung...

...im Jahresabstand" im Portfolio "German-Austrian" versus der einfachen Benchmark, dem DAX, ca. 5%.

Im Q4-2018 plane ich dann, evtl. wieder offensiver zu werden. Dies soll heißen: Aktuelle Positionen werden weiterlaufen, sofern es zu keinem starken Dip an den Märkten kommt und Teilverkäufe vorgenommen werden (müssten).

...

Mission Impossible (?) 2019 - 2028

(if you do not double, we're in trouble ;-)

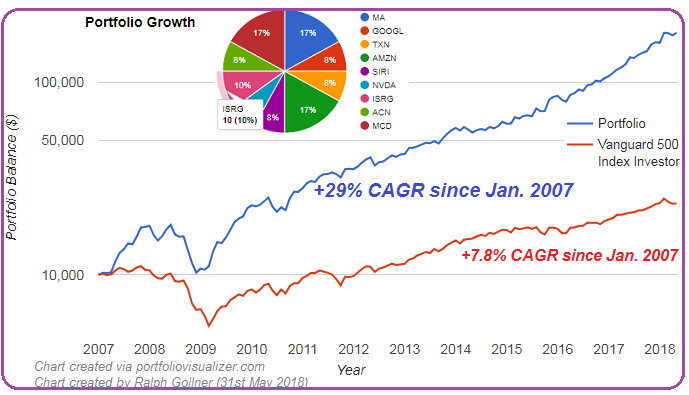

Well, we will see, if one can stick to such a portfolio. But this is just theory and a backtest (2007 - April 2018), but some of these stocks should still be around in 9 years...

Most important might be, that some of the most relevant companies of our times are currently part of this theoretic "Master-portfolio". Pretty concentrated this selection, but many of these companies should still play highly important roles in their respective fields - also within the next years/decade...

Disclaimer: Ralph Gollner ...

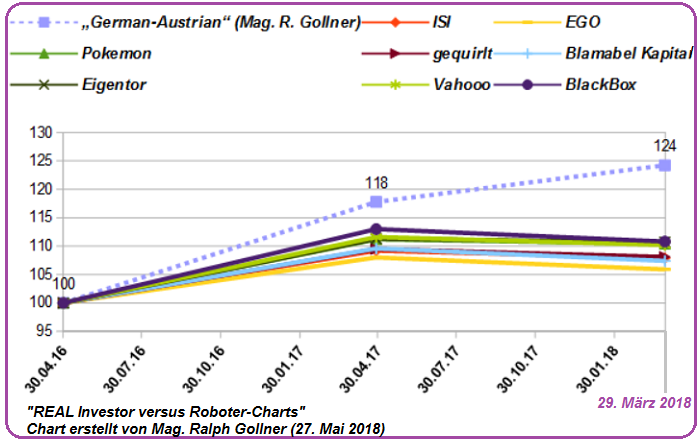

Roboter und Marketing (...)

Ich denke, die Botschaft ist klar: Folgend eines dynamischen Risiko-Managements (Stichwort: Investitionsquote) kann man relativ zielsicher den anderen "Investmentvehikeln", welche Alle wohl doch mit dem gleichen Wasser kochen, sehr gut die Stirn bieten!

Gleichgültig, wie hoch das Marketingbudget von den Marktanbietern auch ist; Der einzige nachhaltige, ehrliche und transparente Weg geht über:

a) Financial Education für Alle (!) und

b) durch bewiesene, langfristig erfolgreiche Performance/Leistung. Interessierte sollten klar die Unterschiede zwischen ...

Möglicher Anlagezeitraum (30 Jahre?)

Magische Lernkurve

8% (72er Regel)

+1k*1,08^30 (Jahr 2018)

+2k*1,08^23 (7 Jahre später, somit 2025)

+3k*1,08^17 (13 Jahre später nach Erstanlage)

+1k*1,08^12 (18 Jahre später nach Erstanlage)

+1k*1,08^8 (22 Jahre später nach Erstanlage)

Bzw. mit anderen Worten

1) Faktor 10 = 1k wird zu 10k in 30 Jahren (1,08^30)

2) Jahr 7: 2k werden zu 11,7k im Jahr 30 (Folgend den ersten 7 Jahren Entwicklung und "Monitoring" >>> ist man evtl. für ein weiteres Investment "Mindset-technisch" bereit...)

3) Jahr 13: 3k (Neuanlage) werden zu 11,1k im Jahr 30

4) ...

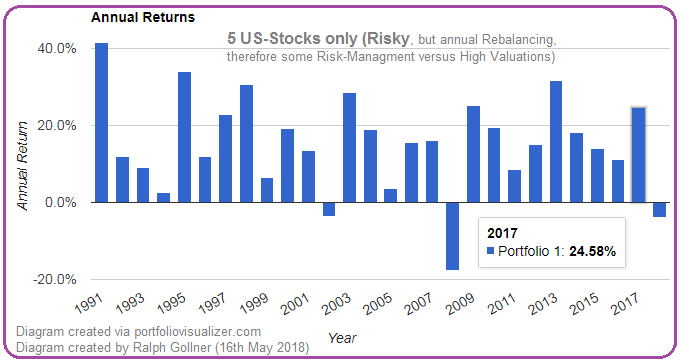

5 US-Stocks Portfolio

(High Risk, Annual Rebalancing)

Warren Buffet says, sometimes concentration can help you in achieving great Return-figures. But only, if you really know what you are doing. Well, here I made a backtest of 5 US-Stocks, which are from the Food & Drinks...

...Sectors, but also from the IT and Industrial sector. It can also be said, that two stocks are currently components of the Dow Jones Industrial Average-Index.

A CAGR of 15% since the year 1991 looks like a nice return. From Jan. 1991 until April 2018 this compound annual return figure led to a final outcome of + ...

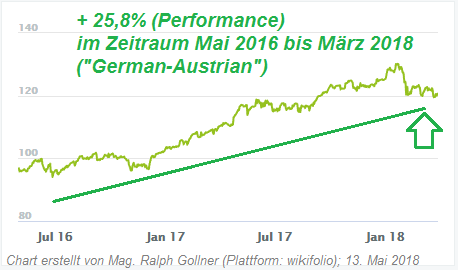

German-Austrian

Aktuell beträgt die Investitionsquote im Portfolio "German-Austrian" ca. 61,6%. Das theoretische Maximum beträgt naturgemäß 100%. Ich würde dies jedoch dann mit 100% Gier gleichstellen. Somit wird sich die Quote wohl bei max. 75%...

...bis 80% einpendeln, sofern die Märkte dies erlauben werden...

Im Vergleich mit theoretischen Mitbewerbern aus dem "Robo-Universum" ergibt sich folgendes Bild gemäß der erbrachten Leistung (!) im Test-Anlagezeitraum Mai 2016 bis März 2018:

| Testphase Mai 2016 bis März 2018 | |

| "German-Austrian" (Mag. R. Gollner) | +25,8% |

| ... |

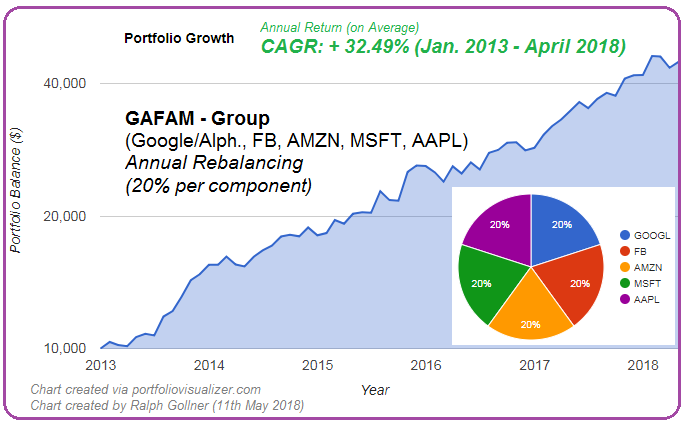

GAFAM (sehr konzentriert, Risky Risky)

Ein solch konzentriertes Depot (bestehend aus nur "5 Tech/Consumer-Aktien", das GAFAM-Quintett) wäre sehr, sehr riskant gewesen. Dennoch hätte es sich in den letzten Jahren (hier seit dem Jahr 2013) exremst positiv ausgezahlt, siehe da:

Die "GAFAM"-Aktien Google (jetzt Alphabet), Amazon, Facebook, Apple und Microsoft sind schon wieder auf Rekordfahrt. Denn das Quintett hat in der jüngsten Berichtssaison ein glänzendes Bild abgegeben.

Nicht zu stoppen ist derzeit vor allem die Amazon-Aktie

Im ersten Jahresviertel 2018 stiegen die Erlöse um satte ...

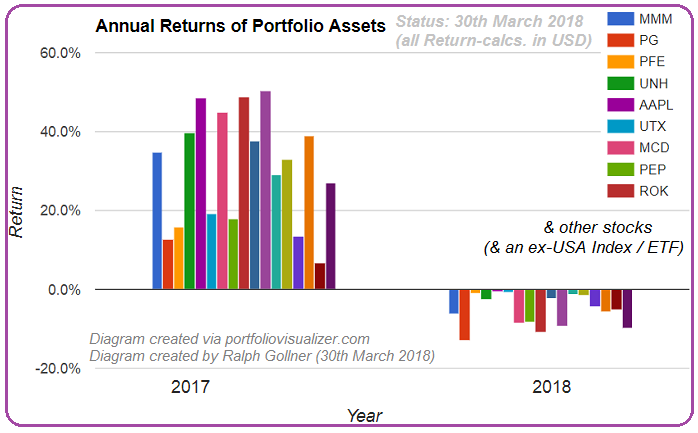

Portfolio "German-Austrian"

Ein gutes Jahr 2017 mit relativ niedrigen Schwankungen ist vorüber - und auch das Q1-2018 haben wir hinter uns gebracht. Aktuell steht die Investitionsquote im Aktienportfolio bei 59,3% (Cashquote somit: 40,7%).

Zusatzinfo bzgl. "einem dynamischen Risiko-Management Ansatz" über die Aktien-Investitionsquote: Bei einem Level von ca. 120 (Indexpunkten) wurden einige Teilverkäufe im Depot vorgenommen, bzw. einzelne Positionen zur Gänze verkauft.

In den letzten Handelstagen (nun im Mai) widerum wurden einige neue Positionen bei Einzelwerten aufgebaut, bzw. ...

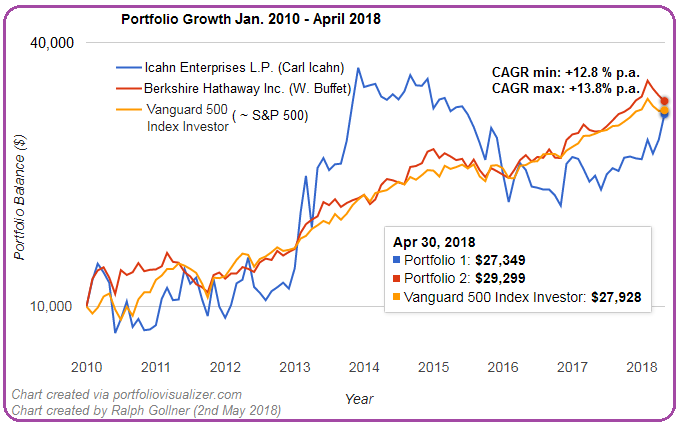

Warren Buffet vs. Carl Icahn

(Chart: 2010 - Apr. 2018)

Icahn Enterprises L.P. (IEP) is a diversified holding company with operating segments in Investment, Automotive, Energy, Gaming, Mining, Railcar, Food Packaging, Metals, Real Estate and Home Fashion. IEP is majority owned and...

...controlled by Carl Icahn.

♦ Over many years, Carl Icahn has contributed most of his businesses to and executed transactions primarily through IEP

♦ As of December 31, 2017, Carl Icahn and his affiliates owned approximately 91.0% of IEP’s outstanding depositary units

Like Berkshire (Warren Buffet's ...

Two rivals of the U.S. Stock Market

The U.S. Treasuries (Maturity-Terms: 2 years and 10 years)

weekly updated charts below

To be sure, what we are talking about here, please check out this wikipedia-link: https://en.wikipedia.org/wiki/United_States_Treasury

...and here the Chart of the "shorter" Brother (2 year "U.S.-Government-Bonds"):

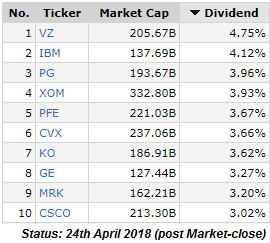

10year US-Treasuries and selected (!) Dow Dividend Stocks

Both Instruments carry a yield of (at least) ca. 3% (some stocks show even much higher dividend yields). Please check out my most recent snapshot of the Dow Jones Index-components after today's market close (24th April 2018):

Tgether with a bunch of 10Year-Treasuries I am wondering what performance a 50/50 (Stocks/Bonds) portfolio would deliver at the start of Year 2028 (potential final year of a 10year-investment period). Following a hold-till-maturity approach for the "Risk-free-asset" (US-Treasuries) and a belief in the ...

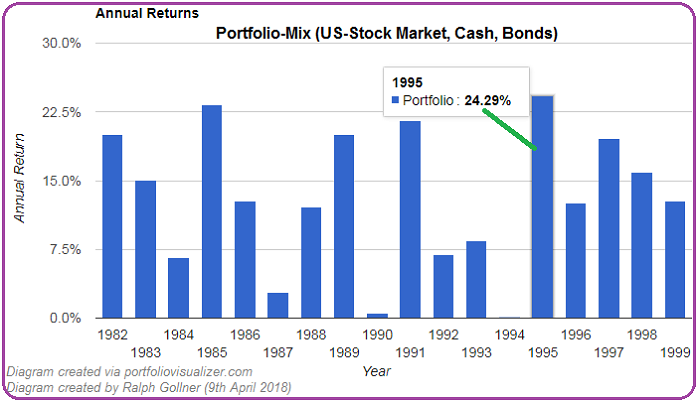

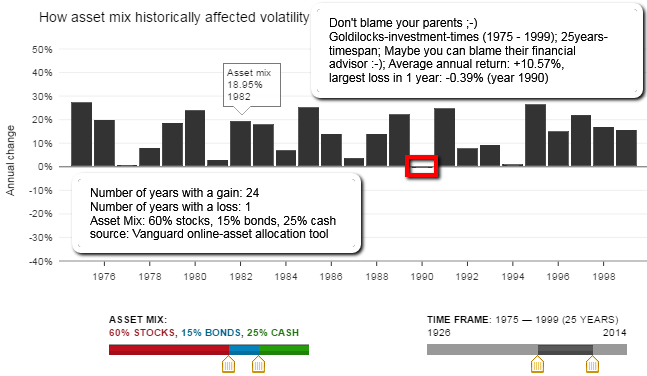

The period 1982 - 1999 (Kindergarden)

I call this investment-period the so called: "KINDERGARDEN". It was really an easy playing-field. Even ex-post one is allowed to say that - I assume. In the following chart and diagram one may see what i mean:

If you were 48 years old in the year 1981 and started your investment-strategy in the upcoming year (1982) by allocating ca. 52% of your assets into stocks, well you may have received an Asset Allocation-Split like this one: 52% Stocks, 33% Cash, 15% Bonds. Nice outcome i may say >>> Calculating the returns of such a portfolio (rebalanced ...

RISK MANAGEMENT

@ least some RM-measures; NEVER (!) "Going ALL IN", etc.

Fsten your seat-belt !

link: www.ft.com/content

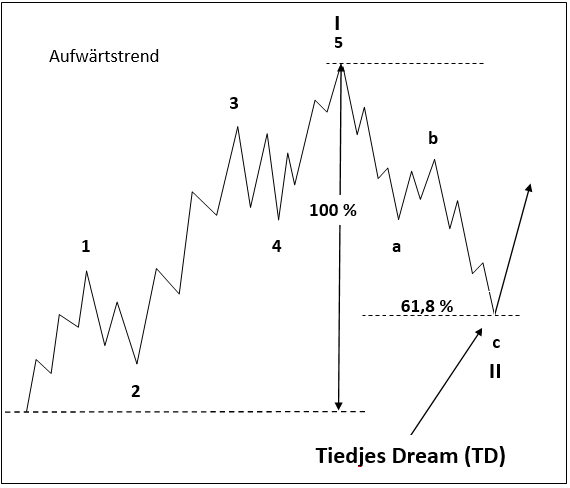

Eine mögliche Definition einer dynamischen Investitionsquote

Sofern man einige Seiten im Buch "The Intelligent Investor" von Benjamin Graham geblättert hat, ist einem die Vorab-Definition einer möglichen Aktienquote im Depot sicher ein Begriff. Mr. Graham schwankte ein Verhältnis von 25%...

...bis 75% Aktienquote in einem Anlegerportfolio vor, aber natürlich ist dies keine feste Regel. Benjamin Graham, der Uni-Professor von einem gewissen Warren Buffet, versuchte seinen Studenten sogenannte Schablonen mit auf ihren Karriereweg zu geben. Mit diesen Leitregeln kann man folgend, je nach ...

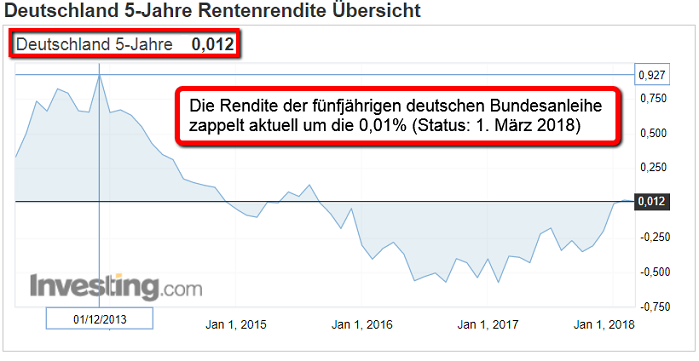

Anleihen vs. Aktien

"Reminder": Wer Deutschland heute 5 Jahre Geld leihen will, zahlt -nach Inflation- wohl drauf...Dies kann man ganz klar an der Entwicklung der Renditen der 5-jährigen Bundesanleihen ablesen. Was hätte damals im Jahr 2012 Warren Buffet zu solch einem "ähnlichen...

...US-Tatbestand gesagt?" Well, please go on and read his short essay on that topic (extract from his most recent shareholder letter 2017):

When Future Returns of an Existing Investment Drop to Unattractive Levels, Sell and Reinvest The Proceeds Elsewhere (so the potential conclusion of following ...

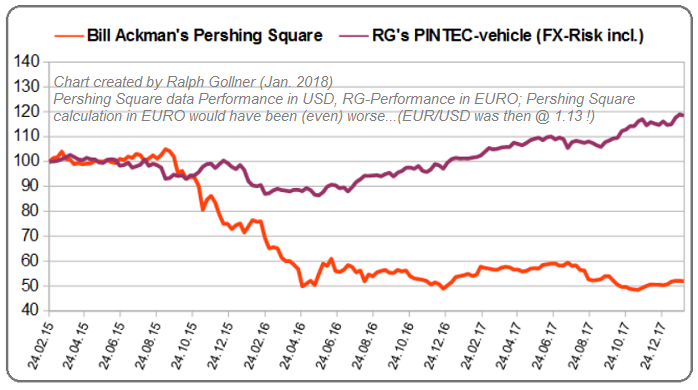

Pershing Square

The firm of Bill Ackman returned losses in each of the past three years - of Minus 4%, Minus 13.5% and more than Minus 20%; These losses come against gains in the S&P 500 (broad stock market index) in this 3year-period. The Pershing losses took...

...its net assets down to USD 9.3 billion from USD 18.3 billion.

In May 2017 the firm still managed about USD 11 billion but this number fell further down according to the website for Pershing Square Holdings, a publicly traded Pershing Hedge fund-vehicle (where Bill Ackman is the head of it all).

Hedge funds often have a ...

Well, he admits it...

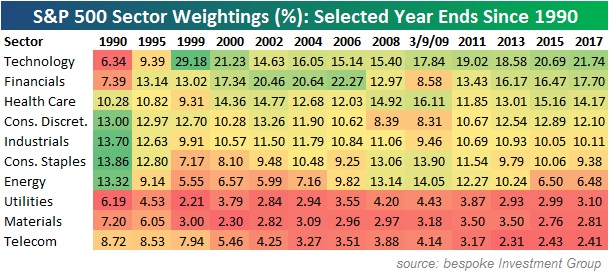

He was born at the right time, a time - where you did not have to invest into TECH in order to potentially (!) outperform the stock market over a certain stretch of time. The logic truth may also be: The more predominant the TECH-Sector is becoming, the less...

...chances Mr. Buffet and the elder regime will get...

In the overview above >> showing the evolution of each sector weigthings in the S&P 500 (US-Stock Market Index) during the last decades it is easy to see, that TECHNOLOGY was only ranked Number 9 out of 10 sectors in the year 1990.

In the meantime, ...

Eine mögliche Definition einer dynamischen Investitionsquote

Sofern man einige Seiten im Buch "The Intelligent Investor" von Benjamin Graham geblättert hat, ist einem die Vorab-Definition einer möglichen Aktienquote im Depot sicher ein Begriff. Mr. Graham schwankte ein Verhältnis von 25%...

...bi 75% Aktienquote in einem Anlegerportfolio vor, aber natürlich ist dies keine feste Regel. Benjamin Graham, der Uni-Professor von einem gewissen Warren Buffet, versuchte seinen Studenten sogenannte Schablonen mit auf ihren Karriereweg zu geben. Mit diesen Leitregeln kann man folgend, je nach ...

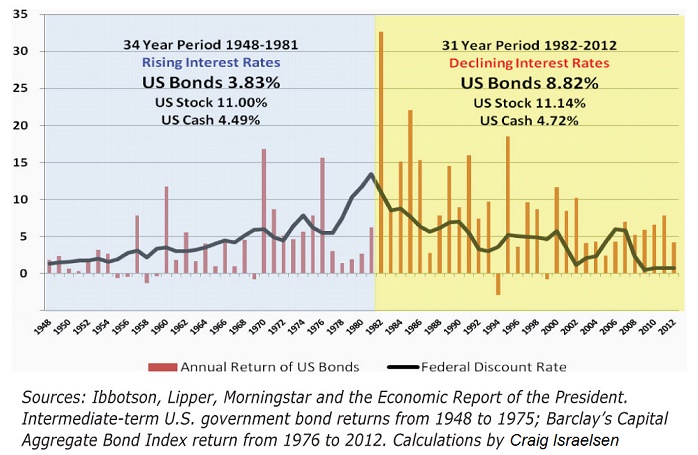

Bonds in a rising interest environment (History)

Allocation to Bonds When Current Rates Are Low? The performance of bonds is related to movement in interest rates. Those two phenomena are related - that much we know. This posting reviews how interest rate movement and bond returns have..

...been related to each other since 1948.

Over the time period 65 years (1948–2012) interest rates have risen, and then fallen. During the 34-year period 1948–1981, the Federal Reserve's discount rate increased-not every year, but as a general trend. In 1948, the Federal Reserve's discount rate was ...

XLB (US-"Materials Sector")

The Materials Select Sector SPDR ETF tracks a market-cap-weighted index of US basic materials companies. The fund includes only the materials components of the S&P 500. This Index is primarily composed of companies involved in such industries as chemicals,...

...construction materials, containers and packaging, metals and mining, and paper and forest products. Among its largest components are DowDuPont, Monsanto, Praxair and Ecolab (as per 2nd Jan. 2018).

The Estimate Weight of XLB Components in the S&P 500 as of 29th December 2017 was ca. 3 %.

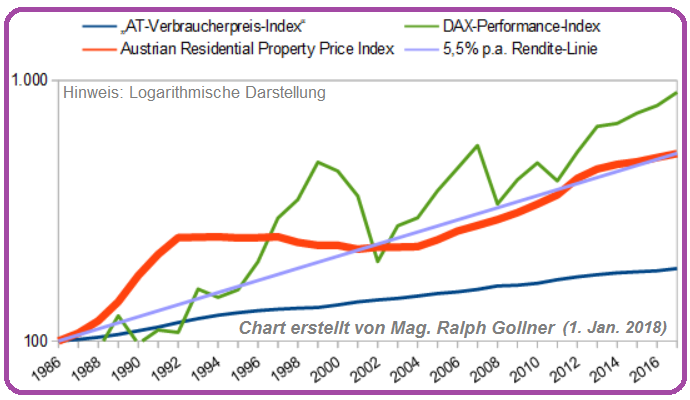

Immobilienmarkt Österreich (Wien)

"versus DAX"

Der/Die Österreicher-in und "Sachwerte"; Snapshot: In Wien ist nicht einmal jeder Fünfte Eigentümer der eigenen Bleibe, im Burgenland sind es aber fast drei Viertel. In Europa liegt die Eigentumsquote bei 70 %, Österreich ist hier mit...

... 49 % deutlich darunter und belegt nur den viertletzten Rang.

Wie vorhin angemerkt: Beim Wohnungseigentum sind die regionalen Unterschiede in Österreich aber groß! Ich habe im obigen Schaubild den "Austrian Residential Property Index" herangezogen und dem deutschen Aktien-Barometer, dem deutschen ...

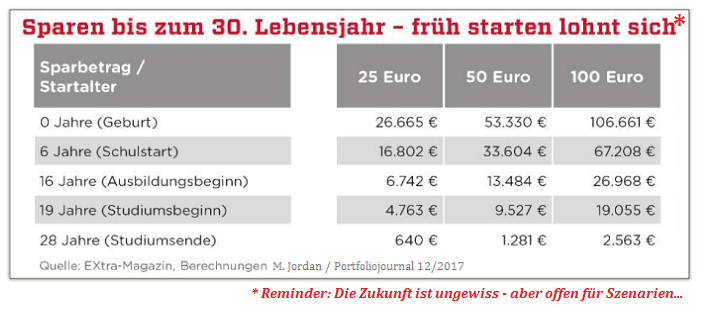

Finanzstarke Zukunft (wo)möglich

Der Zinseszinseffekt kann über einen langen Zeitraum seine volle Kraft entfalten! Je früher >> desto besser. Der wichtigste Vorteil beim Sparen für Kinder ist die Anlagedauer. Denn innerhalb der ersten 16 bis 18 Jahre wird das Kind in der Regel...

...noch von den Eltern versorgt und hat daher noch keinen richtigen Bezug zu Geld und schon gar nicht zum Thema Altersvorsorge oder Sparen. Und daher könnte (evtl. sollte) man wohl genau diese Zeit für den Vermögensaufbau nutzen - sei es mit einem noch so geringen Betrag (sofern es dann die jeweiligen ...

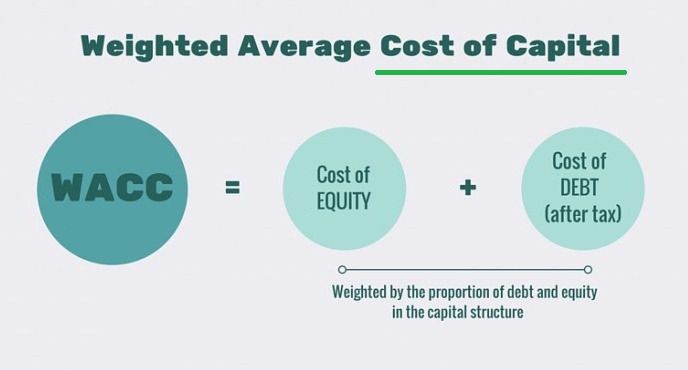

Cost of Capital (WACC)

There is no number in finance that is used in more places or in more contexts than the cost of capital. In corporate finance, it is the hurdle rate on investments, an optimizing tool for capital structure and a divining rod for dividends. In valuation, it plays..

...the role of discount rate in discounted cash flow valuation and as a control variable, when pricing assets. Notwithstanding its wide use, or perhaps because of it, the cost of capital is also widely misunderstood, misestimated and misused. (Quoted by: Mr. A. Damodaran).

In a recent paper issued by ...

Top BrandZ 2017 - Selection from Top 100

Technology giants Google, Apple, Microsoft, Amazon and Facebook take the top 5 places in the 2017 BrandZ top 100 most valuable global brands ranking released by WPP and Kantar Millward Brown.

It is also very interesting to see, that 25% of the total value of the 100 most valuable global brands is made up of the combined brand value of the tech's 'Fearsome Five', emphasising their dominant positions in the modern business landscape.

David Roth, CEO EMEA and Asia of The Store WPP said: "Dubbed the 'The Frightful Five' by some, the tech giants ...

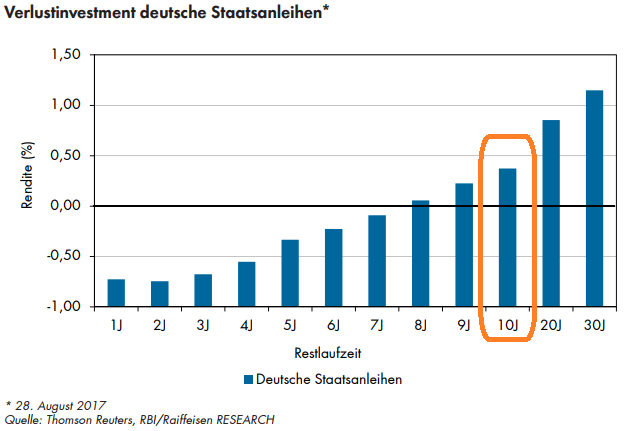

Rendite deutscher Staatsanleihen

(Reale Verzinsung neg.)

Die Wirkung der Anleihekäufe der EZB auf die Marktverzinsung von deutschen Staatsanleihen ist sicher substanziell. Ein Investment in deutsche Staatsanleihen ist bis zu einer Laufzeit von sechs Jahren mit einem Kapitalverlust verbunden:

Noch dramatischer zeigt sich die aktuelle Zinslandschaft, wenn man den zukünftigen Kaufkraftverlust des eingesetzten Kapitals berücksichtigt. Die reale Verzinsung (nominelle Zinsen minus gepreiste Inflationserwartungen) von deutschen Staatsanleihen liegt trotz günstiger Konjunkturaussichten auch ...

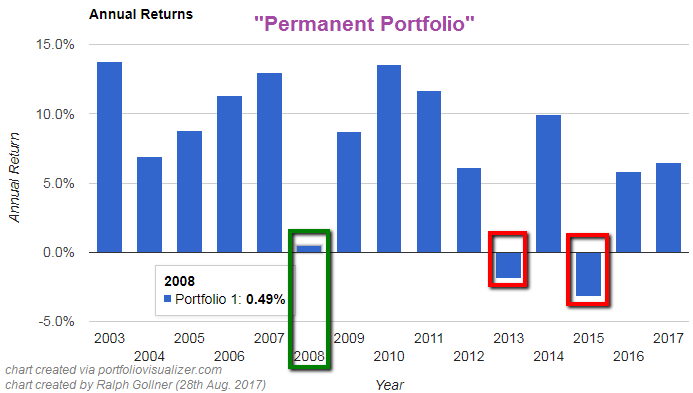

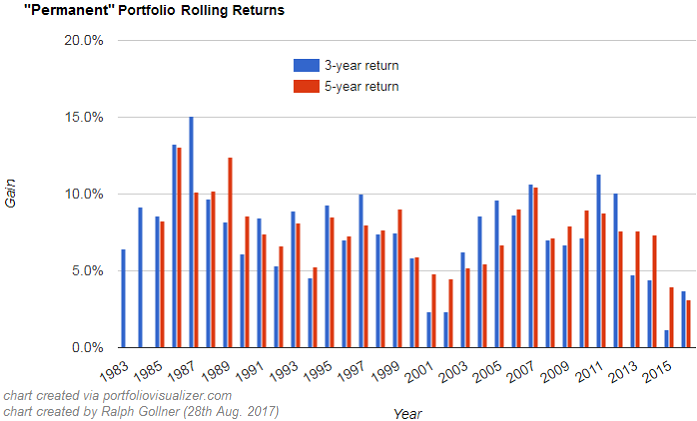

"The Permanent Portfolio"

The Permanent Portfolio is an approach to creating a diversified portfolio using a static asset allocation. I computed a Backtest on a reasonable "Minimum-Investment-Horizon" resulting in a 3 years-investing period as a senseful minimum in order to achieve a high...

...probability of achieving a positive outcome. The idea of a "Permanent Portfolio" may tempt some investors. The premise is simple: invest in a carefully chosen collection of non-correlated assets and occasionally rebalance. It sounds easy, but how did this "idea" perform?

The idea is about ...

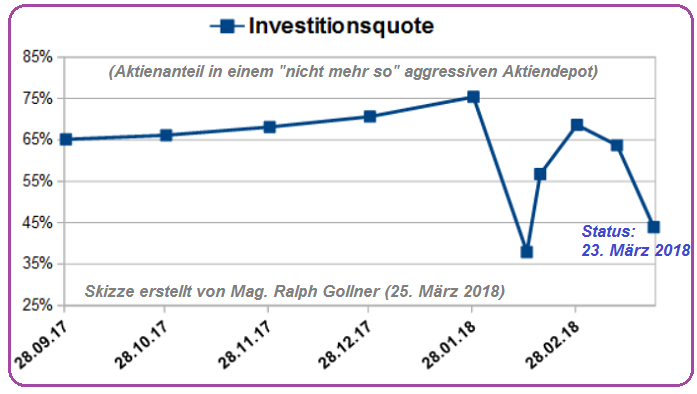

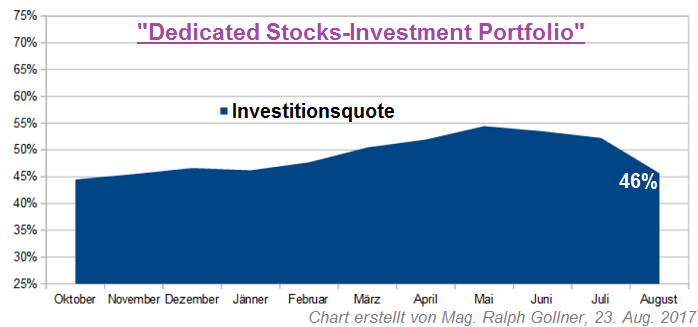

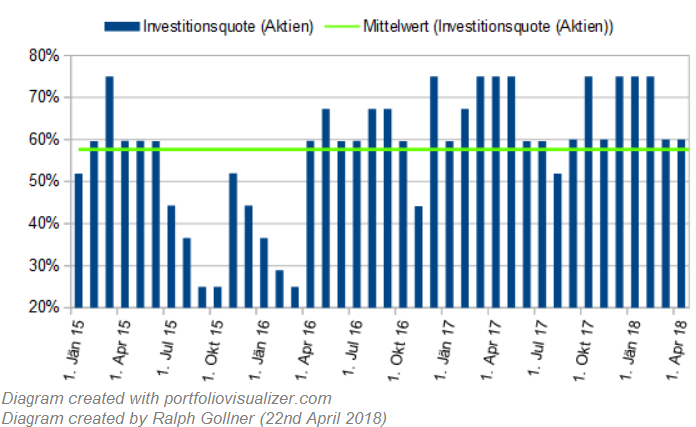

Investitionsquote "Aktien"

(Mag. R. Gollner, skizziert)

Wie hoch kann die Aktienquote in einem "dedicated stocks-portfolio" sein - immer 100% oder abhängig von Bewertungskennzahlen, etc. zwischen 25% und 75% schwankend? Die Investitionsquote kann man im Zeitverlauf mittels Zukäufen und...

...(Teil-)Verkäufen dynamisch steuern. In meinem hier skizzierten "Real-Depot" -Ansatz sieht man, dass die Aktienquote in meinem "dedicated Stocks-Investment-Portfolio" aktuell ca. 46% beträgt. Gründe hierfür sind tlw. die Saisonalität, (m)ein Faible für aktives Risiko-Management in tricky periods (D. ...

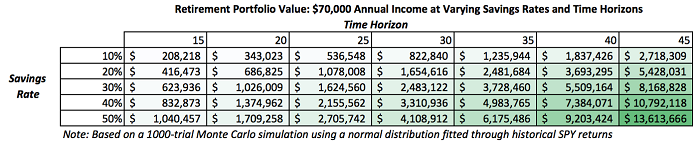

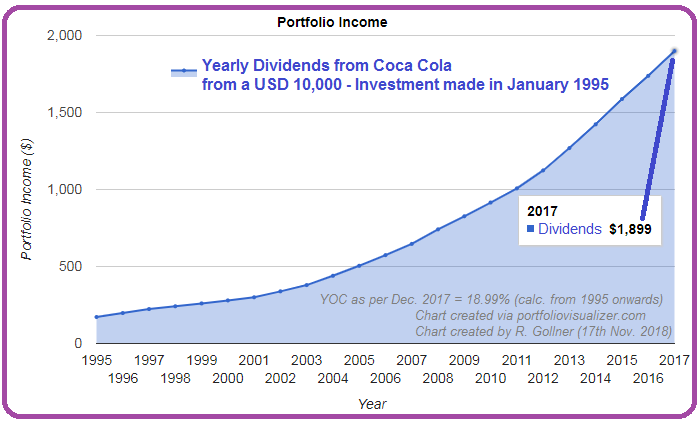

Retirement & Dividends

The end goal of many dividend growth investors is to create a dividend stock portfolio (composed of ETFs or even individual stocks) that generates enough income to cover their retirement expenses. With that in mind, this article investigates your chances...

...of retiring off of dividend income using different savings rates and time horizons.

Some Benchmark Parameters & Assumption

If you are investing in broad-based index ETFs (which is a great choice for the vast majority of investors), then the two most important factors in your long-term investment success ...

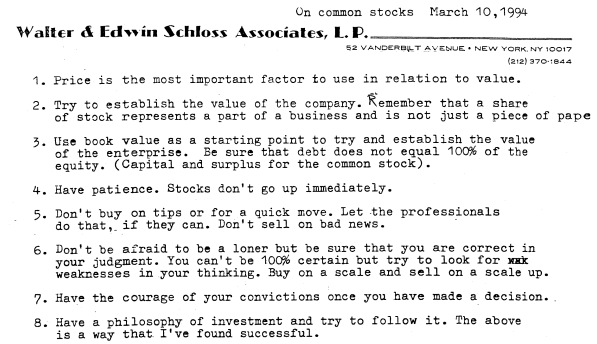

Walter Schloss

"Ben Graham - Student"

As he highlighted in Walter Schloss: Searching For Value, low Debt to Equity ratios were a cornerstone of his selection process. Another key consideration were dividends. It's common for management to think of their own bonuses before...

...the welfare of shareholders, especially as option grants have become more widespread. As a check on mindless self-interest, Walter Schloss also looked for dividends. [He said:] "I like the idea of company-paid dividends, because I think it makes management a little more aware of stockholders…"

In another ...

rG versus Warren Buffet

(*ggg*)

You may have never seen Buffett’s performance broken out by decade (?). Well, here are the annual returns against the S&P 500 starting in 1965 and going through 2009: The 80s and 90s I always refer to as the KINDERGARDEN-years...

...(easy returns, low risk), which led to the eventual greed-peak in the year 2008 (Real-Estate Bubble).

...(easy returns, low risk), which led to the eventual greed-peak in the year 2008 (Real-Estate Bubble).

My personal investing-strategy (Ralph Gollner) around my core-holdings in my stocks-portfolio is to concentrate the Long-Term Strategy around those companies, which already built and are still building their Moat in order ...

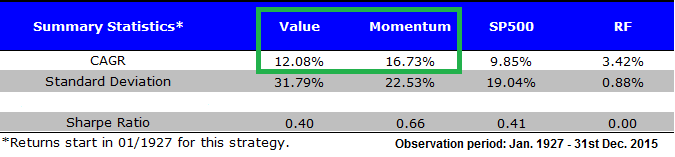

Why Investors may combine Value & Momentum Investing Strategies...

Many investors recognise that stand-alone value and momentum investment strategies have historically worked. Of course, these strategies don't work all the time and can also have long streaks of bad performance. But...

...long-only value and momentum investing, while interesting, don't represent the most puzzling anomaly from financial research (the table above will be explained in more detail below !).

Let's ask a basic question: What happens when one examine long-only value and momentum investment portfolios? So ...

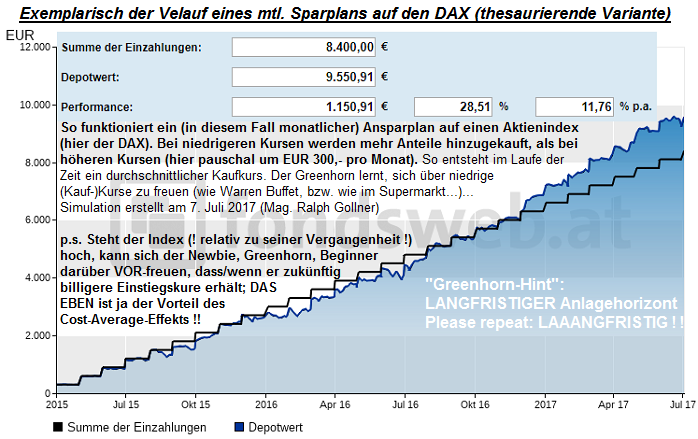

Sparplan-Simulation auf den DAX

(April 2015 - Juni 2017)

Im April 2015 lag der Indexstand des DAX beim damaligen Allzeithoch: bei ca. 12.370; Der Tiefpunkt wurde dann im Jahr 2016 bei ca. 8.750 Punkten markiert. Durch einen regelmässigen Ansparplan kann man solche Schwankungen nutzen!

Um ca. 7% p.a. (oder mehr wie im Beispiel) zu erzielen muss bei Aktien ein langfristiger Anlagehorizont gewählt werden. Der DAX hat sich mit einem Investment von 1970 - 2015 dabei mit jährlich 8,4% p.a. entwickelt. Diesen Wert und alle weiteren bis 1965 kann man auf der Homepage des DAI nachschlagen (DAI ...

Die Phase des Vermögensaufbaus

a) Die Herausforderung: Vermögensaufbau für das Alter ist eine Sache der Disziplin - vor allem in jungen Jahren. Wer Monat für Monat und Jahr für Jahr spart, kann aus kleinen Summen einen großen Kapitalstock heransparen,...

...der später im Ruhestand aufgezehrt werden kann. Vor allem der Zinseszinseffekt hilft: Wer etwa mit 37 Jahren 1.000 Euro für 8 Prozent (Geduld und etwas Wissen vorausgesetzt) anlegt, kann daraus mit 67 Jahren auch schon eine schönes Sümmchen gemacht haben. Wer schon mit 27 anfängt, hat wohl indes mehr als ...

Berkshire Hathaway versus Renaissance Technologies

"Warren Buffet vs. James Simons"

A Hedge fund makes 2.4 more than Buffett...

While many believe that value king Warren Buffett is the greatest investor of all time, his 17.1 per cent average annual return over the last 29 years looks...

...very pedestrian compared to those produced by the 90 PhDs employed by the USD 10 billion quant shop, Renaissance Technologies.

According to Bloomberg, the notoriously secretive hedge fund has delivered an extraordinary compound annual average return of 40.6 per cent after its huge fees since 1988 ...

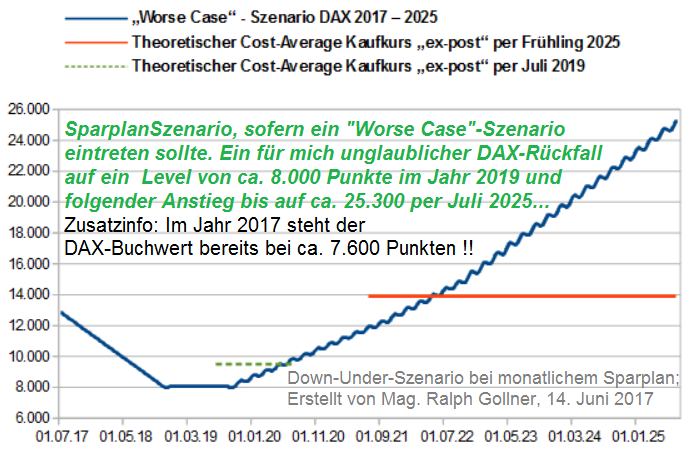

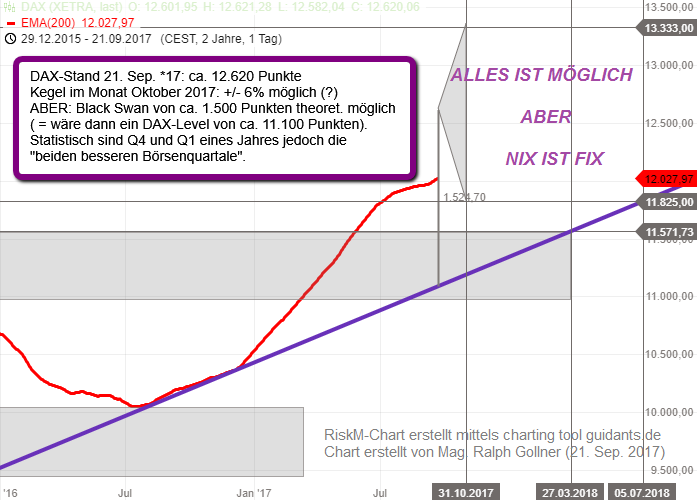

DAX-Sparplan - Szenario bei "Worse Case"

(Juli 2017 bis Juli 2025)

Anlagehorizont somit ca. 8 Jahre

Der durchschnittliche Kaufkurs eines monatlichen DAX-Sparplans, welcher nun per Juni/Juli 2017 starten würde, würde bei einem starken Absturz des DAX auf ca. 8.000 Punkte bis in das Jahr 2019...

...hinein, bei ca. 9.630 DAX-Punkten liegen (Durchschnitts-Kauf-Level von ca. 9.630). Nachdem Aktienindizes grundsätzlich nicht auf Null (also WERTLOS) fallen, würde der DAX somit dann früher oder später wieder drehen und langfristig steigen.

Als kurzer Reminder sei im folgenden Schaubild die ...

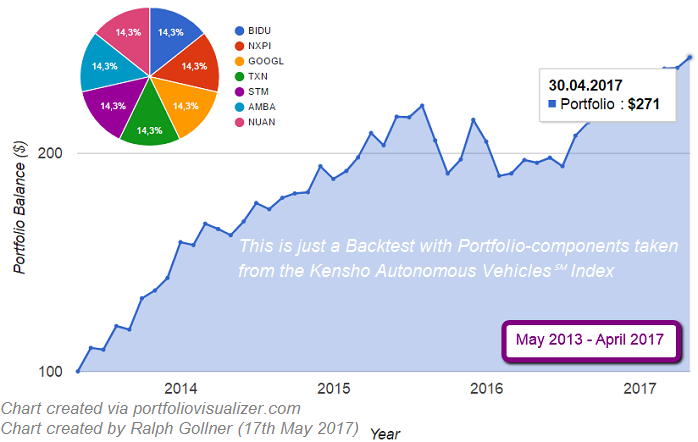

The "connected cars" market

Transportation is a key enabler of the economy, and the global automotive industry itself generates USD 5trillion in annual output. Companies involved in transporting people and goods are increasingly focused on introducing autonomous...

...alternatives, those which can operate without human input using sensors, radars, cameras etc. Although fully self-driving vehicles are not yet in the mainstream, partially autonomous cars and trucks are already a reality today. Some of the main companies are well-known players in the automotive industry, but aspiring ...

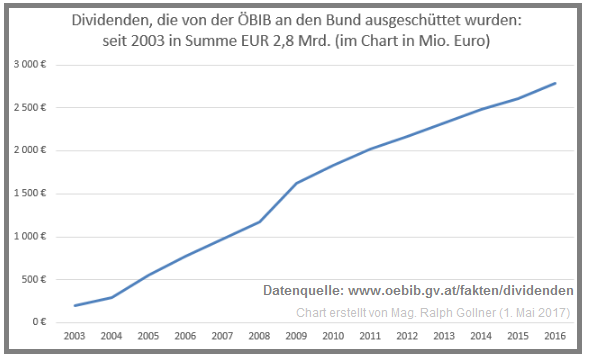

ÖBIB

Folgend einem Artikel in der Wiener Zeitung vom 6. März 2017 schlägt Infrastrukturminister Leichtfried vor, mit den ÖBIB-Dividenden aufstrebende Start-up-Firmen teilzuverstaatlichen, um sie und die Arbeitsplätze im Land zu halten. Die ÖVP zeigt ihm die kalte Schulter.

Die ÖBIB könnte so zu einem Instrument für die Standortsicherung ausgebaut werden, erklärt der Minister. Dabei gehe es ihm darum, Jobs und Firmen in Österreich zu halten. "Ich möchte, dass wir in Österreich mehr für den Standort tun."

Leichtfried schlägt vor, die Dividenden der ÖBIB - in den vergangenen fünf ...

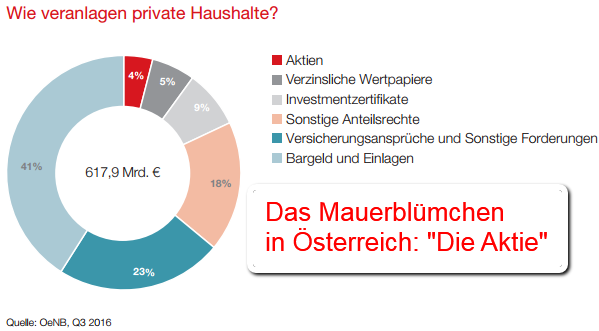

Geldanlage: Hohes Sicherheitsbewusstsein der Österreicher

In kaum einem anderen Land ist die Scheu vor Anlagealternativen so groß wie in Österreich. Einzeltiteln wird besonders hohes Risiko zugesprochen. Am wohlsten fühlt man sich hierzulande mit Immobilien gefolgt vom Sparkonto.

Das "gefühlte Risiko" ist besonders hoch, vor allem bei Einzeltiteln. 68% der Österreicher sind der Meinung, dass mit dem Kauf von Unternehmensaktien ein hohes finanzielles Risiko verbunden ist. 51% sprechen Investmentfonds ein hohes Risiko zu und 44% den Anleihen. Deutlich schwächer ist die Angst vor ...

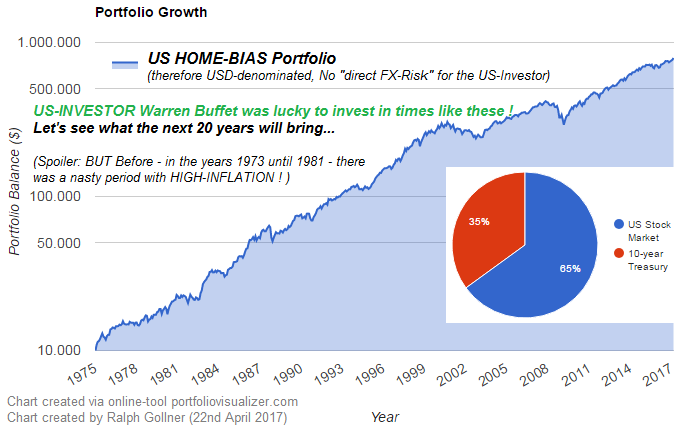

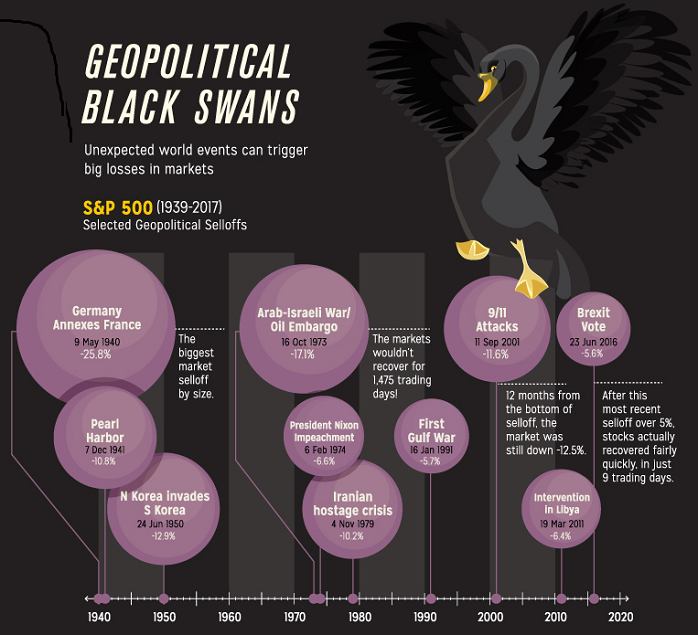

USA (Home-Bias)

Period: 1975-March 2017

Fascinating: Everyone is afraid of the BIG BLACK SWAN. Even if this animal may only occur once in a time-period of 42 years. Isn't life much too short to be afraid of ONE Black Swan? Think about it ;-)

Sometimes a chart says more than a thousand words, but well there are exceptions. Bankers used to say one should stick to a portfolio with 60% stocks and 40% bonds. I just want to mention that Bonds usually rise, when interest rates fall. Just a short reminder, that interest rate fell from 1990 onwards...to a low level (where we are just ...

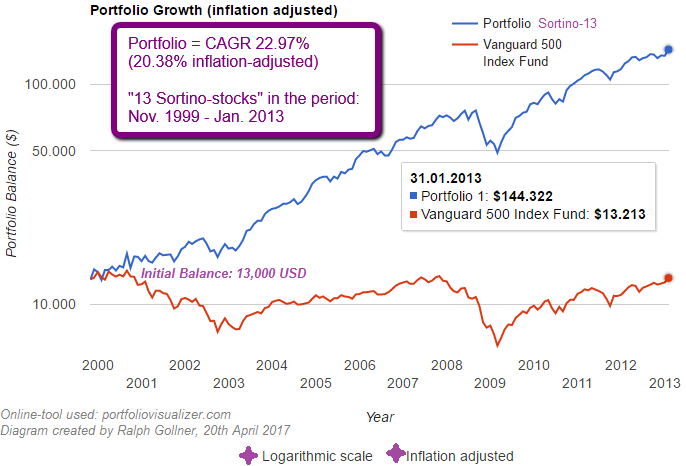

What is the 'Sortino Ratio' ?

The Sortino ratio is a variation of the Sharpe ratio that differentiates harmful volatility from total overall volatility by using the asset's standard deviation of negative asset returns, called downside deviation. The Sortino ratio takes...

...the asset's return and subtracts the risk-free rate, and then divides that amount by the asset's downside deviation. The ratio was named after Frank A. Sortino.

BREAKING DOWN 'Sortino Ratio'

The Sortino ratio is a useful way for investors, analysts and portfolio managers to evaluate an investment's return ...

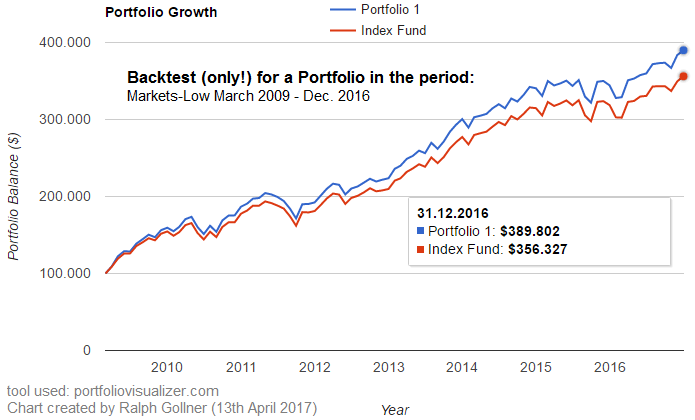

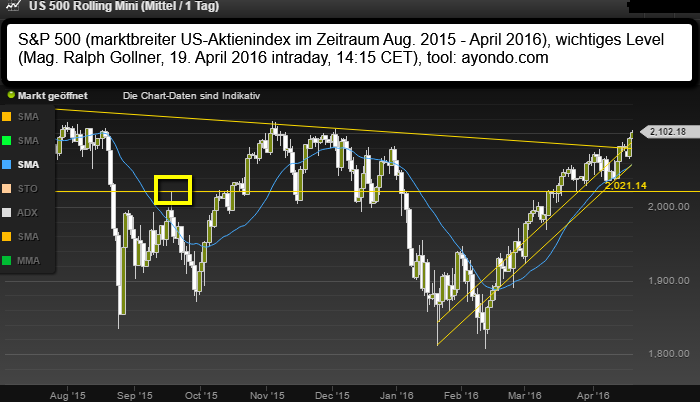

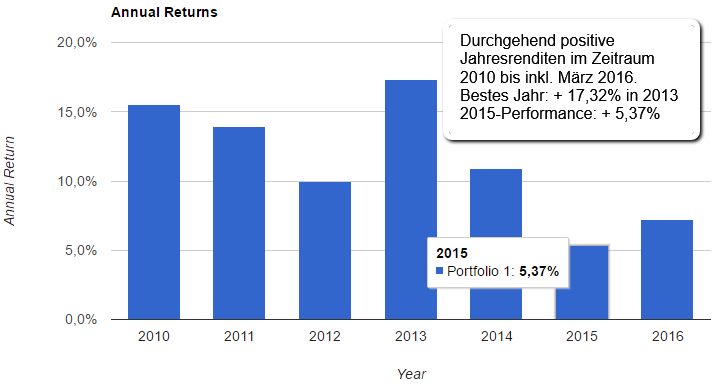

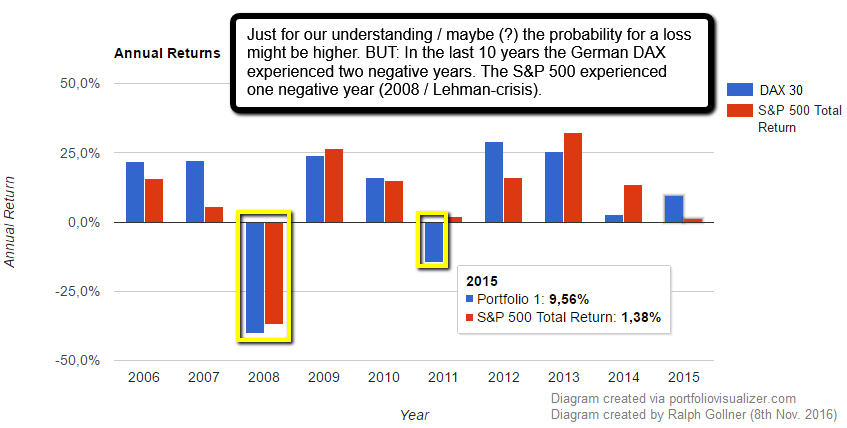

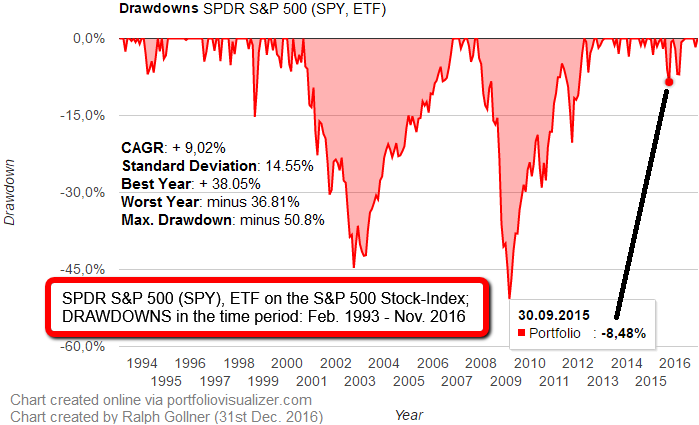

Backtest (March 2009 - 2016)

In the year 2009 the market was definitvely undervalued, if one believed in the continuation of the financial system...(please recheck valuation metrics, like Price-Book or Price/Sales, etc.). I made a backtest (one of many) and eventually may...

...have found a possible Asset-Allocation for resilience in these markets. (I named my backtest "Portfolio 1"; a possible Benchmark for a pro-risk-approach-Benchmark is given here with an "Index Fund").

Some rules on the way (in German we say: "Der Weg ist das Ziel"):

Preparing a Strategy. Knowing about history, ...

30years Investment Horizon (?)

Starting point: Check out the current Valuation (e.g. Price/Earnings)

People really motivated to invest for a time frame of 30-years? Given the lack of ability, and or desire, to save in younger years most people begin to get serious about saving money around...

...35 years of age on average. Let's assume a retirement age of 65 which puts our saving and investing time frame at 30-years. If, as a millennial investor, you really want to save and invest for retirement you should understand a minimum of how the markets really work.

Markets are highly ...

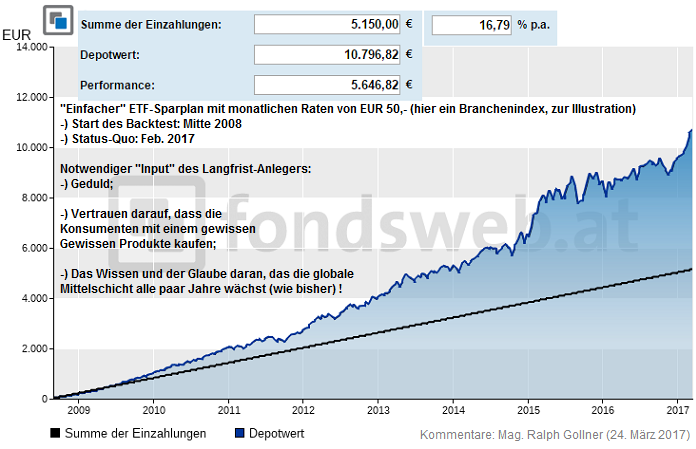

Branchen-ETF

(more risk, some fun?)

Hier ein Backtest (somit reine ex-post Betrachtung und Berechnung) eines Sparplans auf einen Branchen-ETF, welcher auf Unternehmen konzentriert, die im Consumer-Goods Bereich tätig sind:

Gleich ein Sprung ins kalte Wasser:

Zufriedenheit sollte sich mit einer positiven Rendite einstellen (Status Quo: Positive Jahresrendite - bzw. Rendite auf 'rollierender' 12-Monatsbasis). Diese Zufriedenheit kann noch weiter gesteigert werden, sofern diese positive Rendite über...

der "durchschnittlichen Gesamtmarkt-Rendite" (der letzten 12 Monate) liegt.

Unzufriedenheit mit einer negativen Rendite (einfach gesagt: negative JAHRESRENDITE): Interessanterweise betrifft dies wohl sehr viele Österreicher, die zwar nominal eine positive Rendite auf ihr angespartes Geld erhalten (positiver ...

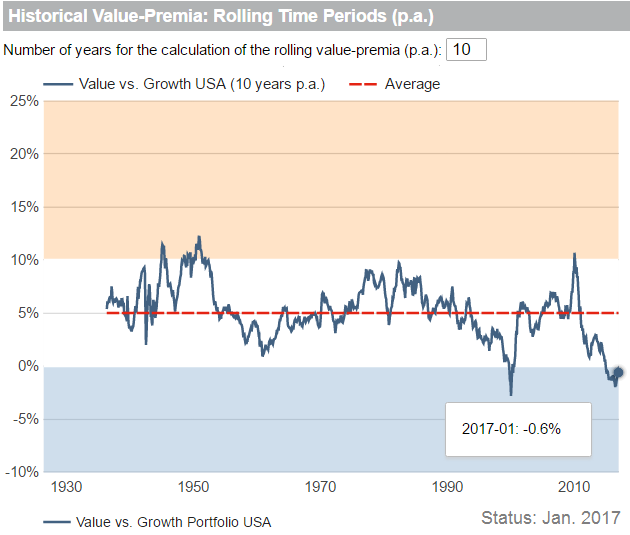

Der Value-Zyklus (NOW?!)

Value-Investoren profitieren von Markt-Ineffizienzen. Der heutige Wirtschaftsnobelpreisträger Fama und sein Kollege French wiesen 1992 - wie andere Wissenschaftler vor und nach Ihnen - in den USA im Zeitraum von 1962-1989 die Existenz einer Value-Prämie nach.

Quelle: www.starcapital.de/research/value-zyklus

Quelle: www.starcapital.de/research/value-zyklus

In ihrer Studie erreichten Firmen, die ein niedriges Verhältnis zwischen Buch- und Kurswert aufwiesen (günstige oder Value Aktien), langfristig höhere Renditen als Firmen mit hohen Buch-Kurswert Verhältnissen (teure oder Growth Aktien). Obwohl die ...

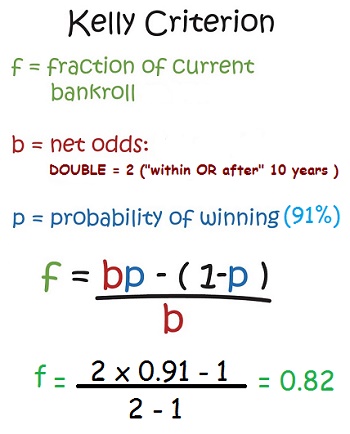

Long-Term Investing (Recheck Kelly-formula!)

John Larry Kelly war eigentlich ein renommierter Physiker bei AT&T. Berühmt wurde er jedoch aufgrund einer - nur auf den ersten Blick - schrägen Errungenschaft: einer auf einem wahrscheinlichen Wissensvorsprung...

... beruhenden Gewinnformel...für Pferderennen. Das könnte auch auf dem Kapitalmarkt funktionieren.

Das nach ihm benannte Kelly-Kriterium geht so: Ein Spieler, der zwar nicht sicher weiß, wie das Rennen ausgeht, es aber aufgrund seiner Erfahrung, etc. besser weiß als sein Buchmacher, kann seine Gewinne auf mittlere und lange ...

THE MOST ADMIRED Companies SURVEY

As Fortune has in the past, Fortune collaborated with their partner Korn Ferry Hay Group on this survey of corporate reputations. From that list I am backtesting a 10-stocks-portfolio:

The company which could hold its #1-place in all three years (2014, 2015, 2016) was: Apple, therefore I had to choose that company as a Portfolio-component for each of my Backtests (Portfolio1, 2 and Portfolio 3). In the last year, following the Fortune-Survey 2016 I had to switch two companies to make place free for 2 new components, being Microsoft and Facebook.

In ...

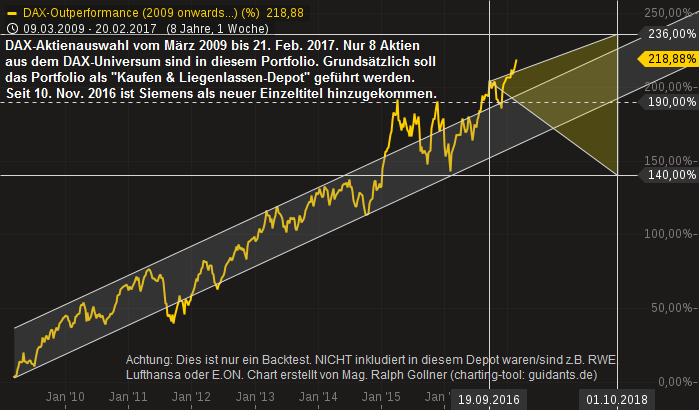

DAX vs. 8 Aktien - Experiment/Backtest

03/2009 - 02/2017

Hätte man sich im März 2009 entscheiden, einige deutsche Aktien in sein Portfolio zu packen, wie hätte sich dieses (evtl.) entwickelt? Dieser hypothetischen Frage habe ich mir angenommen, welche Aktien man wohl gekauft hätte?

Im Zuge der (damaligen) Weltuntergangs-Stimmung hätte man wohl zu Aktien gegriffen, welche zumindest noch in 5 oder 10 Jahren für die globale Wirtschaft relevant "gewesen" wären, bzw. deren Dividendenrenditen oder Bilanzen einen zuversichtlichen Eindruck hinterlassen haben.

Wie gesagt geht es um den ...

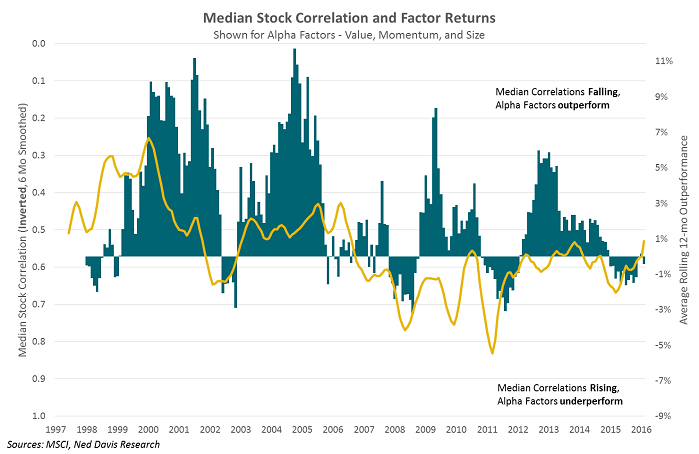

Factors (Value, Size, Momentum)

versus Correlation

Looking over the past 15 years of factor returns for value, momentum, and size, one can see a pretty consistent picture of outperformance, and in some cases quite sizeable outperformance. We'll call these "alpha factors"...

*12-Month rolling average excess returns (vs MSCI USA) for MSCI USA Enhanced Value, MSCI USA Momentum, and MSCI USA Size Tilt indexes are shown against the 6-month average of median S&P 500 1-day correlations over the past trading quarter.

*12-Month rolling average excess returns (vs MSCI USA) for MSCI USA Enhanced Value, MSCI USA Momentum, and MSCI USA Size Tilt indexes are shown against the 6-month average of median S&P 500 1-day correlations over the past trading quarter.

...as their general design is to outperform indices overtime, typically as ...

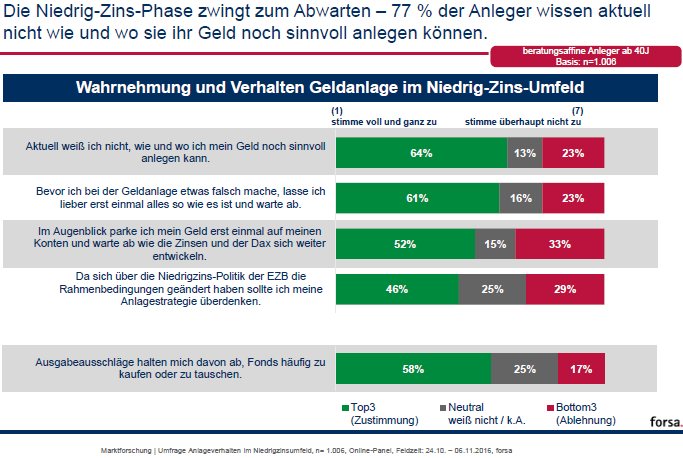

Anlegerverhalten (Umfrage 2016)

Die Mehrheit der deutschen Anleger ist verunsichert bis ratlos. Mehr als Dreiviertel der Deutschen wissen nicht, wo und wie sie ihr Geld noch sinnvoll anlegen können. Gleichzeitig ist mehr als ein Drittel unzufrieden mit ihrer Anlage.

Dies zeigt eine aktuelle Studie (Dez. 2016); Während Profis immer komplexere Antworten auf das Niedrigzinsumfeld finden, verzweifeln die meisten Privatanleger mittlerweile an der Herausforderung Kapitalanlage. Das jedenfalls legt eine repräsentative Umfrage nahe, die die das Meinungsforschungsinstitut Forsa im Auftrag ...

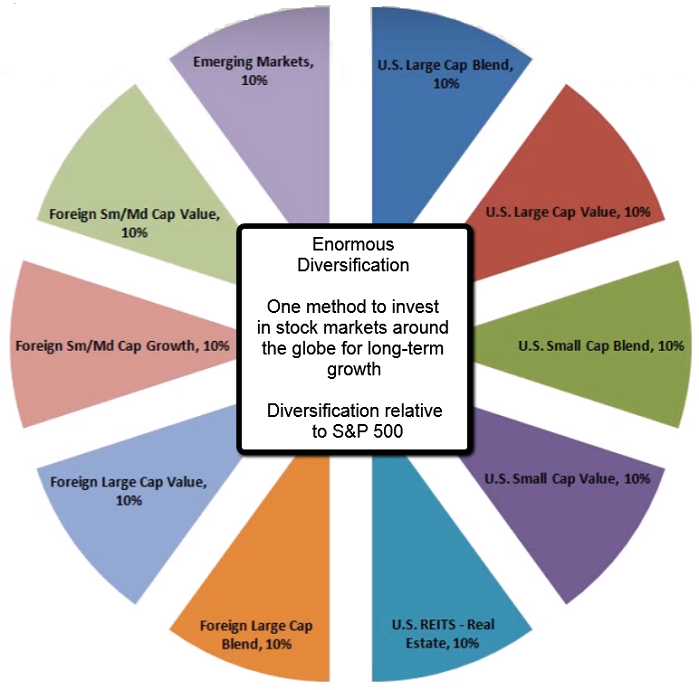

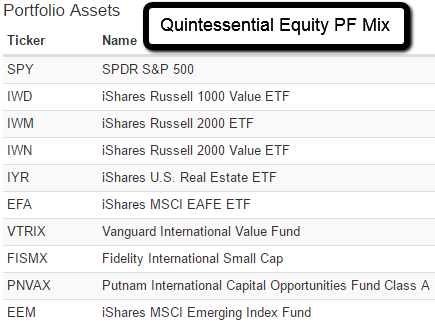

Riding through a FULL MARKET CYCLE (Bull cycle incl. Bear-Market-cycle) the famous point of Diversification while holding on to your investments through the full cycle - should prove to be of value. Let's see, what some pundits want you to believe to be a reasonable equity-centric Quintessential Global Portfolio:

The portfolio-split above can be replicated with ETFs; A possible selection would look like the following:

Hypothetical portfolio for illustrative purposes only !

To get a quick idea, what the long-term evolution of such a Quintessential-Portfolio looked like, please ...

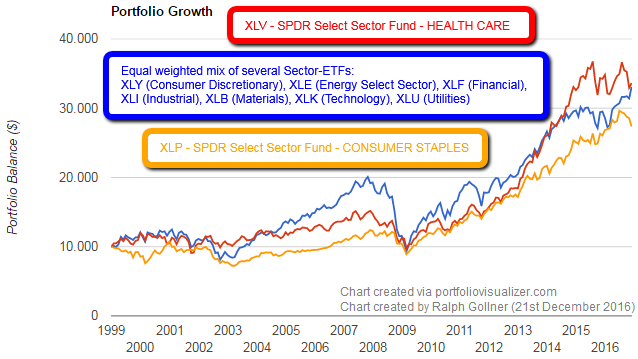

Sectors - Performance U.S.A. (1999 - Nov. 2016)

Earnings & Sector-Performance (!)

It is always interesting to see, that investors forget that it is more about sticking with the right sectors than picking the right stocks at the right time. In theory most know that...

But the chart above only gives you an idea of the possible returns over a long period from the year 1999 (shortly before the .COM-BUST) through the financial crisis in 2008, 2009 unitl Nov. 2016, when the presidential election of Donald Trump took place. In the next table you will see the average annual returns, expressed ...

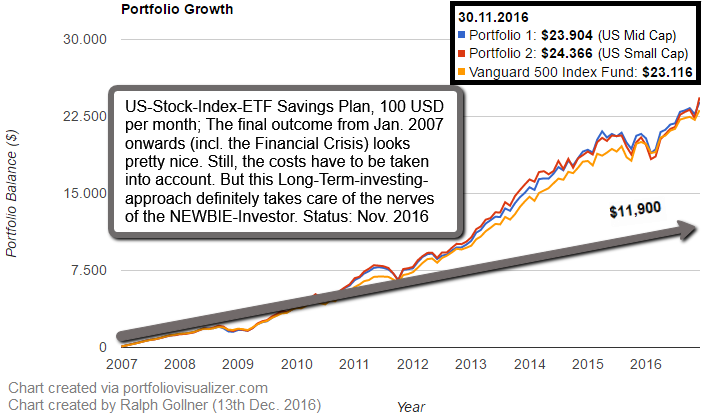

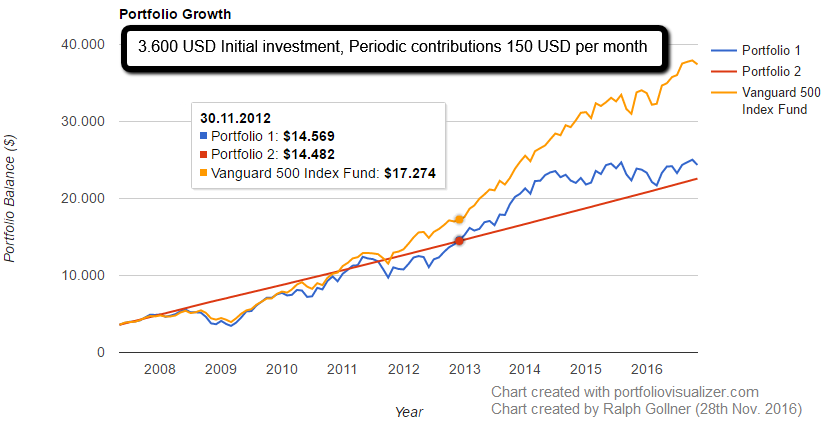

ETF-Savings/Investment Plan (2007-Nov. 2016)

Vanguard's market share keeps growing. Only Vanguard and Dimensional Fund Advisors saw net inflows in November 2016. The Vanguard Group now has one in every five dollars in the USD 16 trillion mutual fund industry, according to Morningstar.

Vanguard, which has nearly USD 3 trillion in U.S. mutual fund assets, is riding the wave of passive investing, which shows no sign of cresting. Overall, passively managed U.S. stock funds saw an estimated net inflow of USD 9.6 billion in November, versus a net outflow of USD 67.5 billion from actively ...

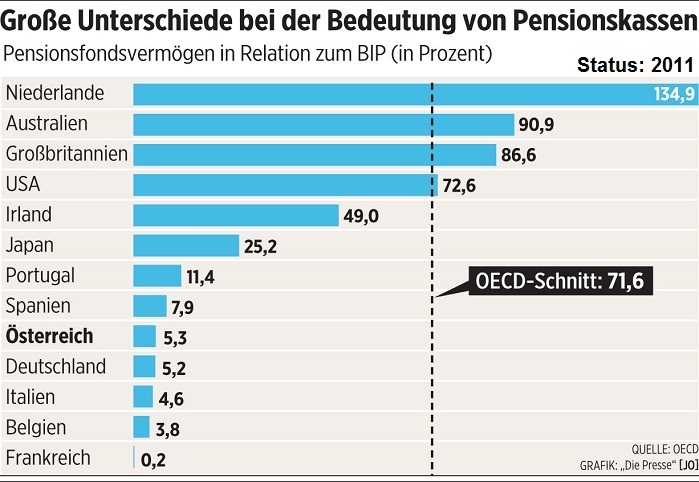

Artikel erstellt auf Basis des genialen Inputs von C. Schmale. Folgende Grafik zeigt, wie viel Vermögen Pensionsfonds verschiedener Länder im Vergleich zur Wirtschaftsleistung angehäuft haben. Das Urteil ist ganz deutlich.

What's the Worst 10 Year Return From a 50/50 Stock/Bond Portfolio?

Here my chart from 1972 up to Oct. 2016. I then had the idea to research for possible "hard periods before". I finally found an answer to my question about what the worst 50/50 portfolio of stocks and bonds...

...would look like. I found some research on the internet: Mr. Ben Carlson decided to run the numbers. But before showing the table with the Rolling-Returns for a 10-year period of a fifty/fifty portfolio made up of stocks & bonds, please take a look at the Compound Average Returns for each of the two assets ...

Initial investment and monthly contributions (ca.7 years)

How to invest into the stock market while being risk-averse regarding ones emotions ("loss aversion"), but still feeling motivated to directly invest into stock-index-products? Well, here i am displaying a...

...US-Stock-INDEX-ETF (Portfolio 1/orange) and a European Stocks-Investment (Portfolio 2/blue). The red line, more or less linear, represents the cumulative amount over the whole investing period. From year to year the investment amount is rising by USD 1,800 since the monthly contribution-plan is established at USD 150.

...

Who or what is Renaissance (Competition ;-)

(My backtest 2004 - Oct. 2016)

These guys are amazing and brilliant. The gentlemen at Renaissance succeeded in achieving unbelievable annual returns from 1988 onwards. Motivated by them I created a backtest, which I want to present here:

Well, I have seen far better performing benchmarks than the S&P 500 - so I am now even more motivated knowing what is THEORETICALLY achievable, especially on a constant base (recurring).

MY BACKTEST (only) Performance-Data and Risk-Numbers (2004 - 2012)

...

Benjamin Graham on "Asset Allocation"

Warren Buffett once stated in an interview that Graham's book, "The Intelligent Investor," had changed his life and set him on the right path. Buffett was referring to Graham's theories on value investing and bringing a form of professional analysis to the investment markets.

Graham is often called the "Dean of Wall Street" and the father of value investing. One of the most important early proponents of financial security analysis, Graham was so influential that he helped draft the Securities Act of 1933. He championed the idea that the investor ...

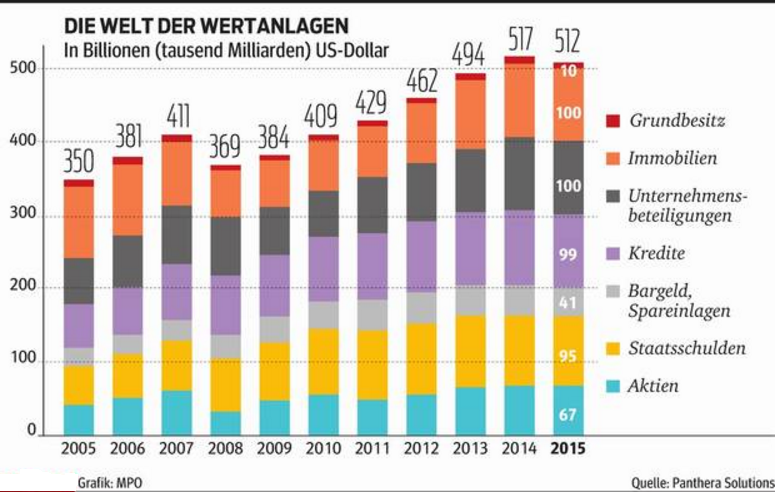

Das "Marktportfolio" (Status: 2015)

Panthera Solutions hat den globalen Kapitalstock vermessen! 1964 postulierte William Sharpe das Marktportfolio als Ausgangspunkt der Portfoliokonstruktion. Nach zwei Jahren Forschung legt Panthera Solutions eine Näherung zum Marktportfolio vor:

Für die Vermessung des globalen Kapitalstocks wurde das Anlagevermögen der folgenden 11 Assetklassen für den Zeitraum 2005 bis 2015 erhoben: Aktien, Staatsanleihen, Bankanleihen, Unternehmensanleihen, Securitized Loans, Non-Securitized Loans, Cash Equivalents, Cash, Immobilien, Land und Privatunternehmen.

...

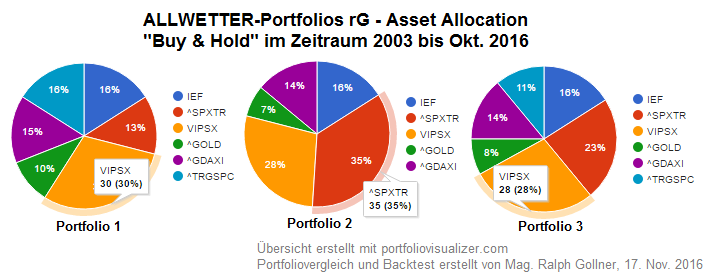

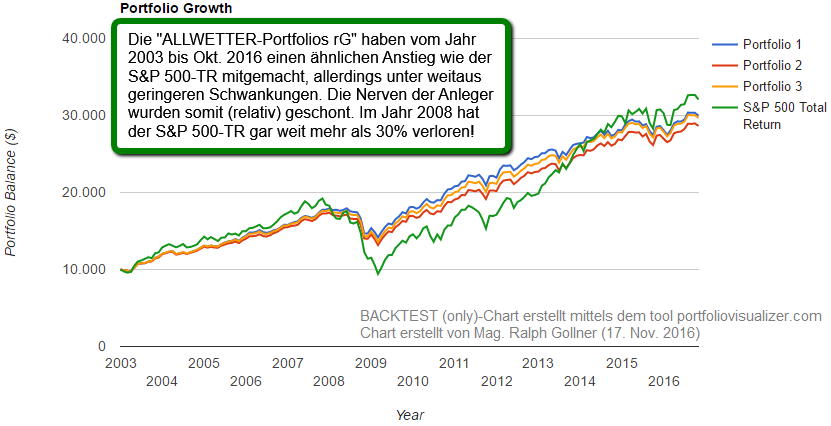

Inflationproof (?) ALLWETTER_rG_Portfolios

(Backtest)

Der Zeitraum 1980 - 2007 war -als Paket- ein hochprofitabler Anlagezeitraum für Aktionäre. Aber auch Anleihe-Investoren durften den Rückenwind von fallenden Zinsen geniessen (Finanztheorie: Fallen die Zinsen, steigen Anleihepreise):

Konnte man in den 80ern und 90ern des letzten Jahrhunderts relativ blind mit Aktien und Anleihen die steigenden (globalen!) Finanzmärkte mitreiten, hat sich das Anlageuniversum in den ersten Jahren nach dem Millenium as etwas herausfordernder dargestellt.

Die Jahre 2000, 2001 und 2002 dienten ...

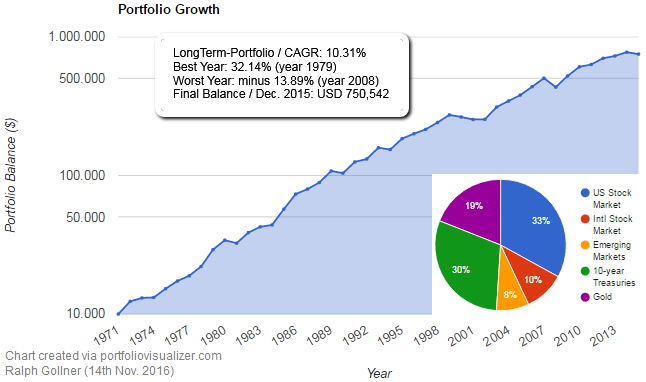

The power of a "US-biased" Portfolio

(covering the period 1972 - 2015)

Warren Buffet knows this period very well. In the year 1973 the wealth of Mr. Buffet stood at ca. USD 34 million. In 2013 it stood around USD 58.5 billion. That is the power of compounding interest !

In the example above I took a more conservative approach - in this backtest. A Buy & Hold Asset-Allocation structure, which relied on the US-Stock-Market, International stocks, EM-stocks, the 10-year-treasuries as Bond-component and Gold as a 19%-buffer. This collection of assets performed pretty well over the long ...

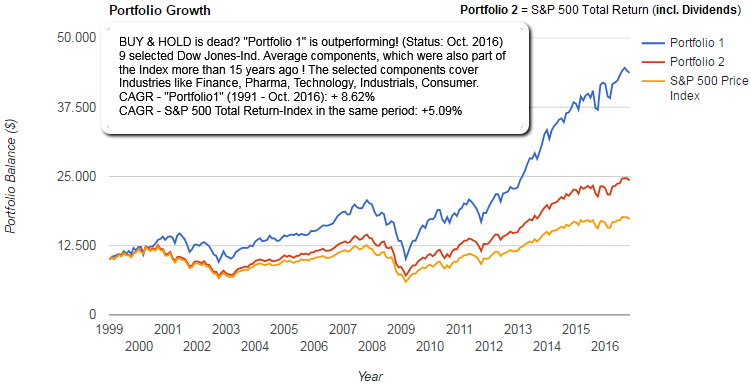

Dow Jones Ind. Average-components (1999-10/2016)

(9 selected stocks of the DJIA-universe)

In the last years, but also in the recent decades, people want to call the "BUY & HOLD"-Strategy over and gone. Well, following charts might tell a different story. Take a look:

The "Portfolio 1", consisting ONLY of 9 selected Dow Jones Industrial Average-components which were also part of the DJIA back in the year 1999 (!), before the .COM-Bubble finally burst is still holding up strong against its own mothership, the Dow Jones IA, but also against the very broad Stock-Market, indicated by the ...

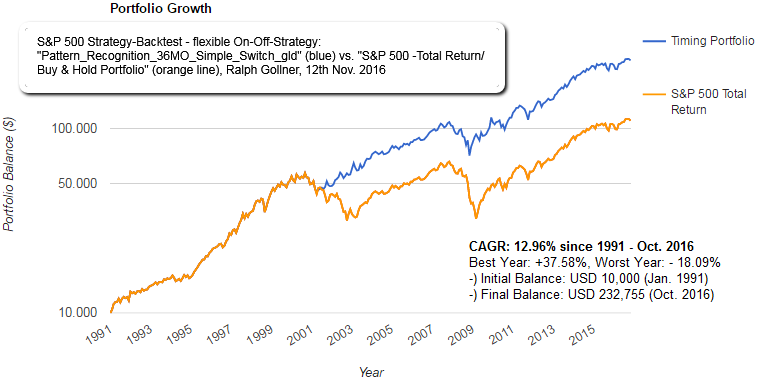

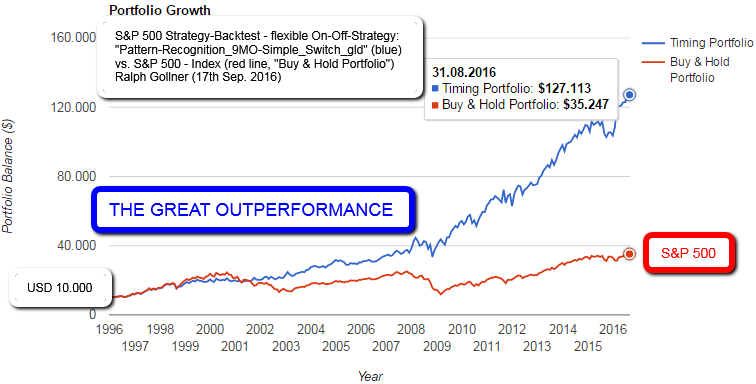

Timing Strategy (Risk-reduction in US-Stock-Markets)

I call this Timing-Strategy (BACKTEST only!) "S&P 500-Pattern-Recognition-36MO-Simple-Switch_gld". I checked different styles, but eventually this version produced only 3 neg. years since 1991, versus 23 POSITIVE YEARS:

The good part about this strategy is, that it helped to avoid some of the biggest Downturns in the years after the .COM-Bust in the year 2000. The Strategy was staying invested in the S&P 500 from 1991 until February 2001. After taking a break until Oct. 2003 and investing in "alternative assets" (avoiding the ...

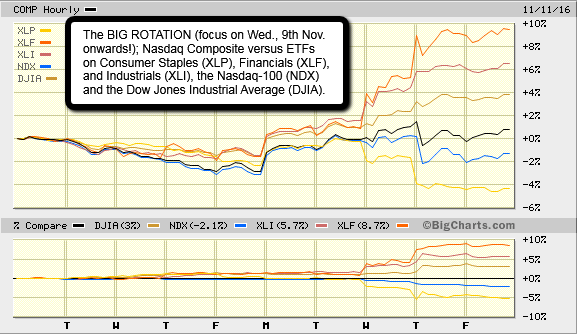

Watch out for the BIG ROTATION (Trump-effect)

Especially Industrials and Financials got a boost since Wednesday, 9th Nov. 2016, post-Trump-election day. On the other hand NASDAQ-100- and Consumer-Staples- stocks took a hit since then:

Furthermore, the Small-Caps-Stocks-Index, the Russell 2000 (RUT) strongly outperformed the standard broad-market Indices like the S&P 500 (SPX) and the Nasdaq-100 (NDX) in recent days, as can be seen in the following chart (Status "today": market-close Friday, 11th Nov. 2016):

Small-cap shares had the biggest single-day rally over the larger peers in ...

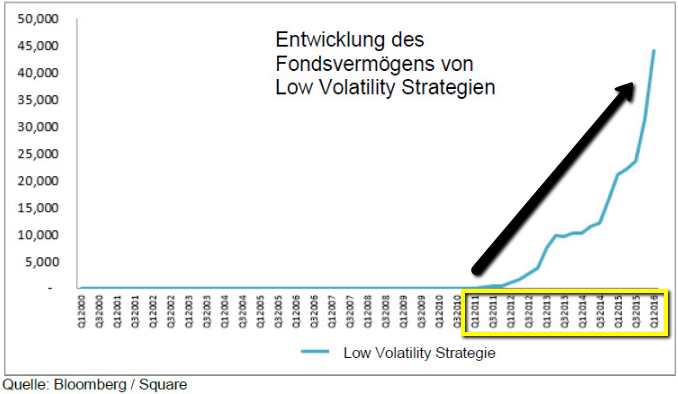

Minimum Vola-Strategien

(Zertifikate, ETFs, etc.)

"Wenn die Jagd nach Sicherheit in die Performance-Falle führt"; Low Vola-Fonds und -Zertifikate, die ausschließlich in Aktien mit niedriger Schwankungsbreite investieren, sind so beliebt wie nie zuvor. Gleiches gilt für einzelne Aktien, die...

...in der Vergangenheit relativ konstante Aufwärtstrends vorweisen konnten. Der Clou dabei: In den letzten Jahren haben diese Aktien auch noch besser performt als der Aktienmarkt insgesamt.

Geringere Schwankungen bei höherer Rendite also. Ein Anlegertraum ist wahrgenommen und immer noch mehr ...

Magic-Stock-Portfolio (2004 - Sep. 2016)

What does the Private Investor want? S/he wants the Professional to know/understand the risk-tolerance of the potential investor. The Professional should help the Private Investor to minimise the risk AND to MAXIMISE the return - as far as possible.

The portfolio ("Portfolio 1") displayed and backtested is made up of 15 USD-stocks (incl. one "China"-ADR-Stock), but excluding new highflyers like Facebook, Alibaba or Mastercard, etc. due to their relative young history on the stockmarket (IPO after the year 2004!). In order to have a buffer to ...

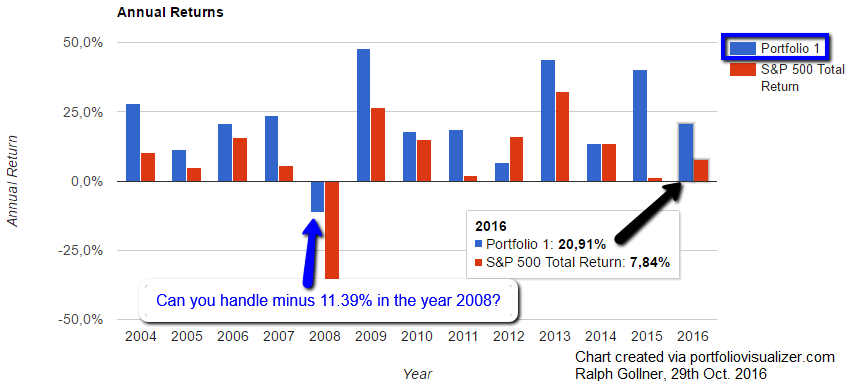

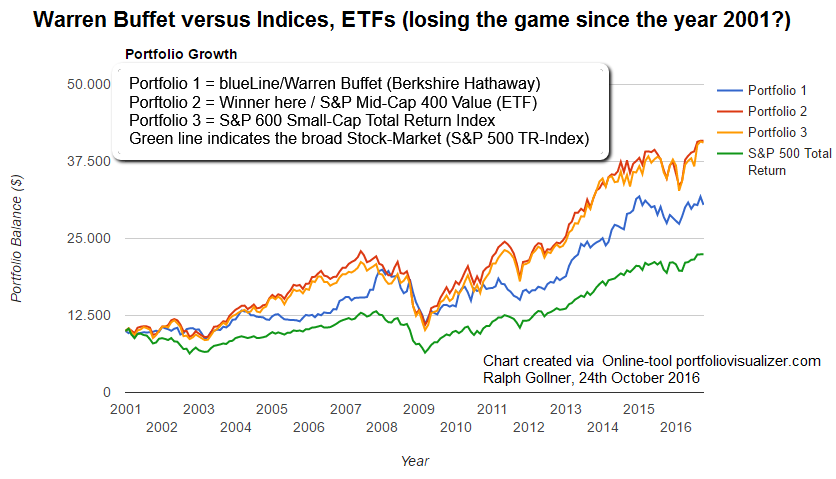

Warren Buffet vs. Indices, ETFs

Ever looked at ETFs? Ever looked at the possible advantages and negative points of ETF-Investments? Well, additionally also take a look at the historical performance of Warren Buffet and how he did versus Indices & ETFs:

There has been a long fight between the proponents of Active Asset-Management versus Passive Investing via Index-products like ETFs. The main argument for the latter may be the low expenses versus the high Total-expenses which might occur if one buys an actively managed Investment-fund.

It gets even worse if the actively managed ...

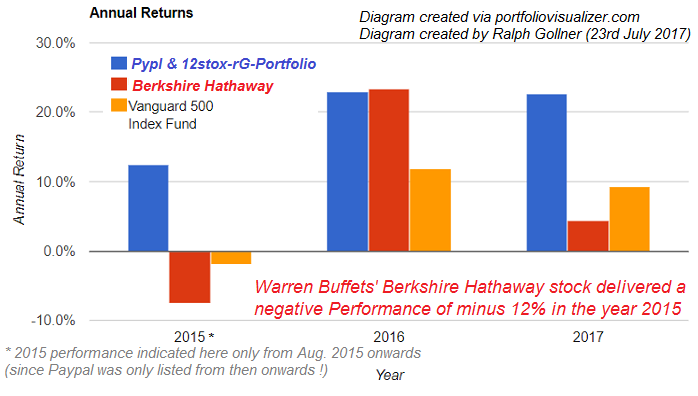

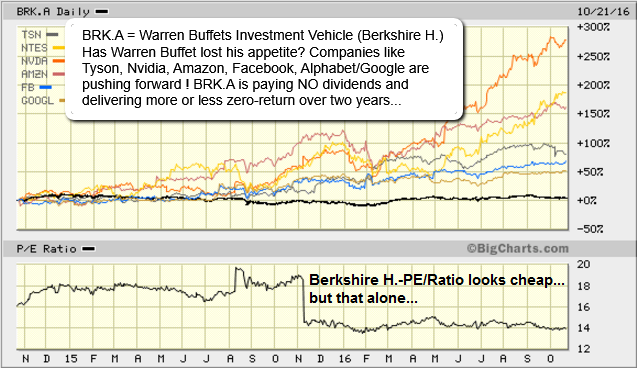

Has Warren Buffet Lost His Appetite?

2015 has proved to be one of those rare years that Warren Buffett’s Berkshire Hathaway (BRK.A) has badly lagged the market. Berkshire H. finished the year 12% down. There stands the question: Is Warren Buffett losing his mojo?

Efficient Market Hypothesis: Warren Buffett’s investment style has mainly focused on value picks of companies with sizable moats that makes it difficult for them to succumb to competition. But it appears as if the moats surrounding some of his companies are drying up and the walls being breached.

A good case in point is IBM, ...

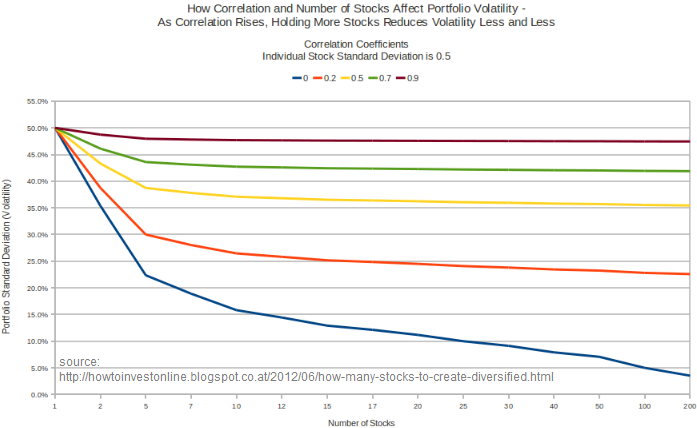

Correlation between stocks

Investors want to minimize the risk associated with a given expected return. Diversification can play a role by minimizing firm-specific risks. Example: Nike and Disney had a fabulous run from 2009 up to Aug. 2015 - but then something happend:

When you add new assets to your portfolio, you are adding the possibility that they will do well during the times your existing assets perform poorly, and vice versa. So without changing your expected return, you are able to lower the variability of returns. In fact, through careful selection of assets to add to your ...

David Blood, Al Gore

Generation Foundation

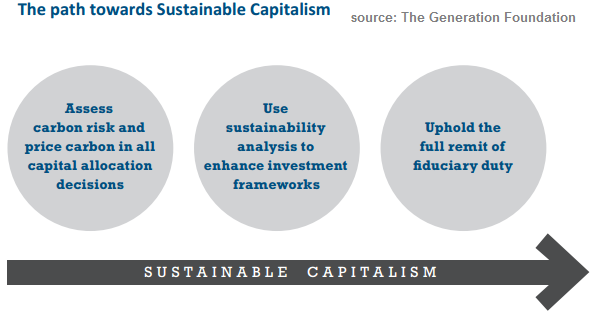

Definition of Sustainable Capitalism: Sustainable Capitalism is an economic system within which business and capital seek to maximise long-term value creation, accounting for all material ESG (environmental, social and governance) metrics.

Integral to this framework is the consideration of all costs and benefits, regardless of whether they are currently attributed with an economic "price tag" by society. While this framework is designed with a long-term horizon, it also has meaningful short-term implications, providing a process for ...

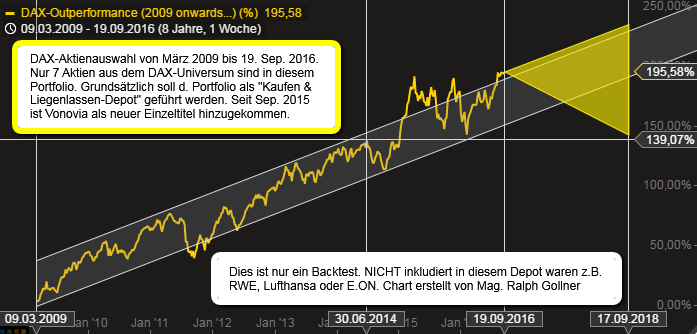

DAX vs. 7 Aktien - Experiment/Backtest

03/2009 - 09/2016

Hätte man sich im März 2009 entscheiden, einige deutsche Aktien in sein Portfolio zu packen, wie hätte sich dieses (evtl.) entwickelt? Dieser hypothetischen Frage habe ich mir angenommen, welche Aktien man wohl gekauft hätte?

Im Zuge der /damaligen) Weltuntergangs-Stimmung hätte man wohl zu Aktien gegriffen, welche zumindest noch in 5 oder 10 Jahren für die globale Wirtschaft relevant "gewesen" wären, bzw. deren Dividendenrenditen oder Bilanzen einen zuversichtlichen Eindruck hinterlassen haben.

Wie gesagt geht es um den ...

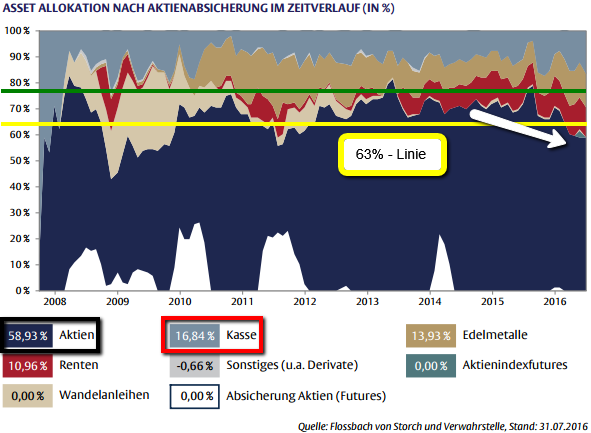

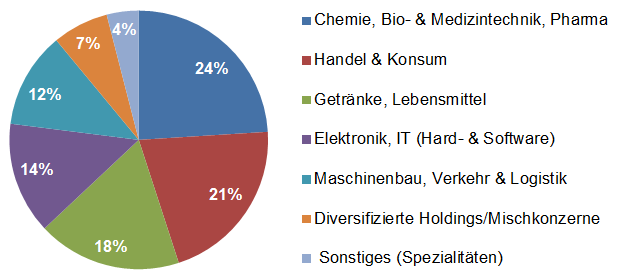

Asset Allocation (Bsp. aus Juli 2016)

Folgend ein Schaubild der Asset-Allocation einer recht bekannten deutschen Vermögensverwaltung (Stichtag: 31. Juli 2016). In der Asset-Allocation anbei wird im Aktienanteil von ca. 59% in 38 verschiedene Aktien direkt investiert.

Die eher defensive Ausrichtung der Aktieninvestments kann daran abgelesen weren, dass sich ca. 24% der Aktieninvestments im nicht zyklischen Konsum befinden, weitere 22% im zyklischen Konsumbereich, somit ca. 46% des Aktienanteils in der Konsumbranche. Summa summarum sind ca. 27% des vermögensverwaltenden Fonds in der ...

The Timing-Portfolio - Strategy

from Jan. 1996 - Aug. 2016

There is the story, that timing does not pay off for the average. Well, for the average - yes, maybe NOT...But: for people who know how to handle the Ups & Downs of the Market (Mr. Market) that story may just be a nice fairytale.

And I don't believe in fairytales anymore, since I passed elementary school. Being extremely interested in the mechanics of the financial-markets, the moods of Mr. Market and the strange moves the Stock-Indices and Commodity-Markets can make, I experimented quite some time on how to establish a sound ...

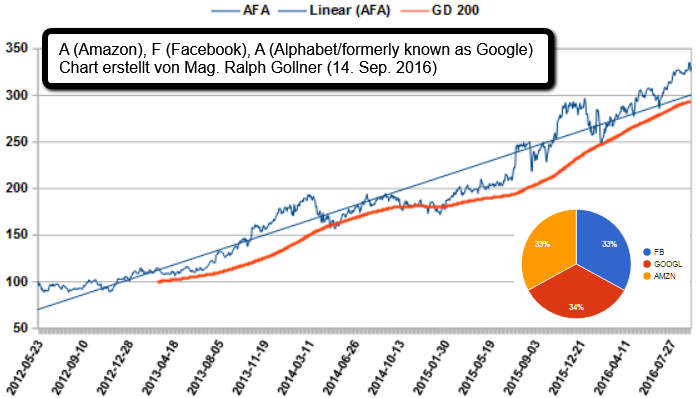

AFA statt FANG

("da waren's nur noch 3")

Das glorreiche Trio am Aktienmarkt war in den letzten Jahren eindeutig Amazon, Facebook und Google/Alphabet. Kurzfristig durfte das eine Unternehmen immer wieder durchschnauffen, während die beiden Anderen durchstarteten.

Im obigen Chart/Kursverlauf (indexiert ab Mai/Juni 2012) habe ich die 3 Aktien jeweils zu einem Drittel gewichtet, wobei ich eine Aktie stärker gewichtet habe, als die Anderen (34% versus 33% vs. 33%). Zusätzlich wurde das "System" jedes Jahr wieder "rebalanced" - soll heissen: Auch wenn eine Aktie extrem gut performte, per ...

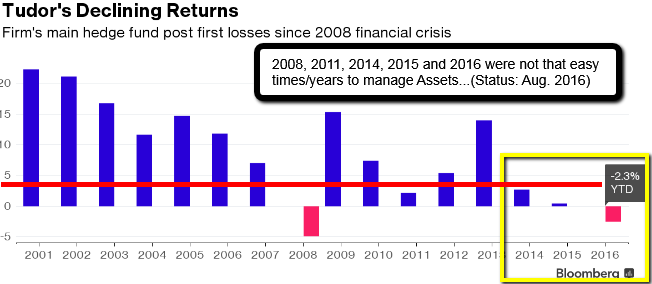

Hedge Fund (Paul Tudor Jones)

"tough times"

Paul Tudor Jones, who's facing his worst performance since the global financial crisis, wants to show investors he hasn’t lost his mojo.

Jones, the legendary macro trader, told investors in an Aug. 16, 2016-letter that he will manage a larger chunk of their money himself.

"We have to think outside the box," Jones, 61, said in the letter obtained by Bloomberg. "I firmly believe the changes we have made put us in a position to be successful even in this desultory macro environment."

Tudor, which Jones founded in 1980, hasn’t in recent years ...

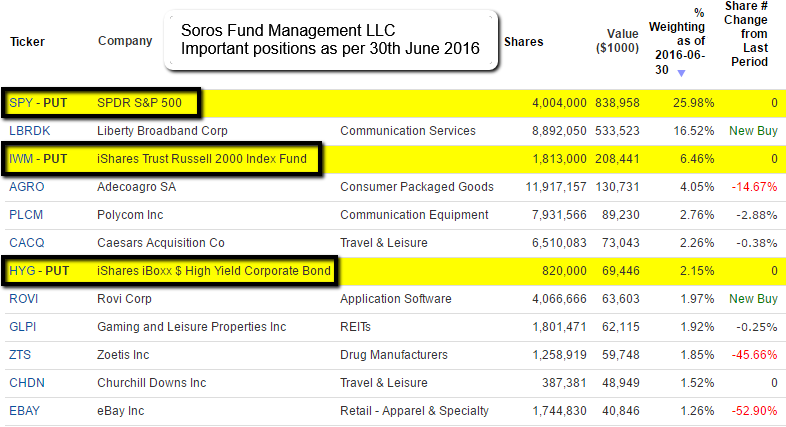

George Soros & Carl Icahn

Old men, but still fit (?)

Carl Icahn turns apocalyptic: "I Am More Hedged Than Ever, A Day Of Reckoning Is Coming". George Soros: The 86-year-old’s fund disclosed in a regulatory filing it had increased its bet against the S&P 500,...

...the main index used to measure big-stock performance in the U.S., reporting "PUT" options on millions of shares as of 30th June 2016 in exchange-traded funds that tracks the indices. That"s up from "puts" on 2.1 million shares as of 31st March 2016.

Snapshot / Portfolio Holdings of George Soros at Soros Fund Management LLC ...

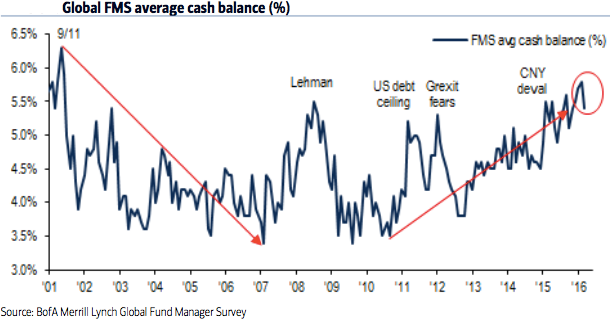

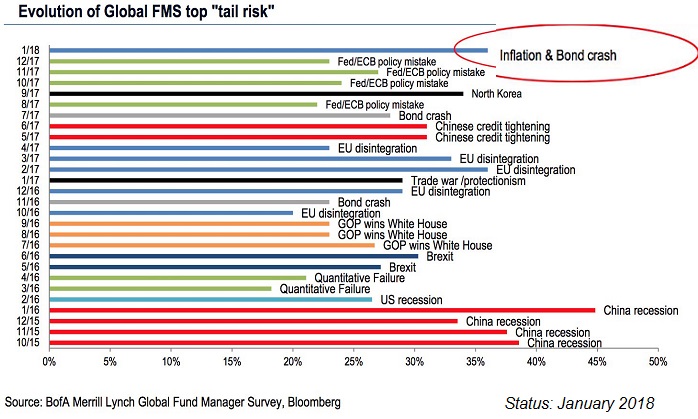

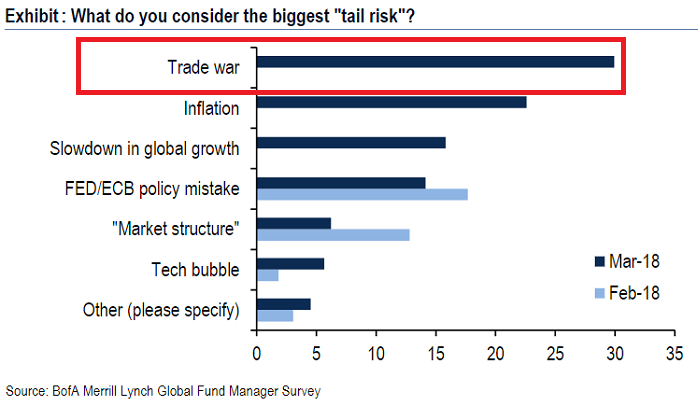

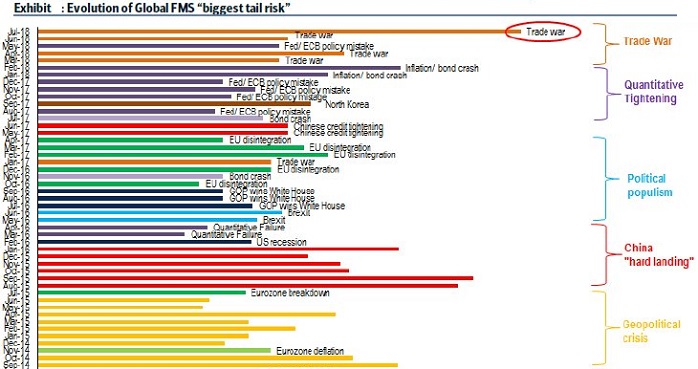

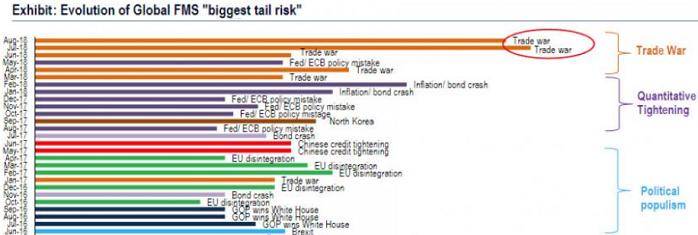

BOFA Fund Manager Survey (Aug. 2016)

Cash levels coming down from a 15-year high

Investors are still hoarding cash according to Bank of America Merrill Lynch’s survey of fund managers published 16th Aug. 2016. According to the survey, cash levels dropped to 5.4% from 5.8% last month,...

...but were still at the highest levels since 2001. An overall total of 211 participants, with assets under management of $628 billion, took part in the survey, taken Aug. 5-11, 2016.

Still, fewer fund managers are trying to hedge against a sharp fall in equity markets in the next three months. They ...

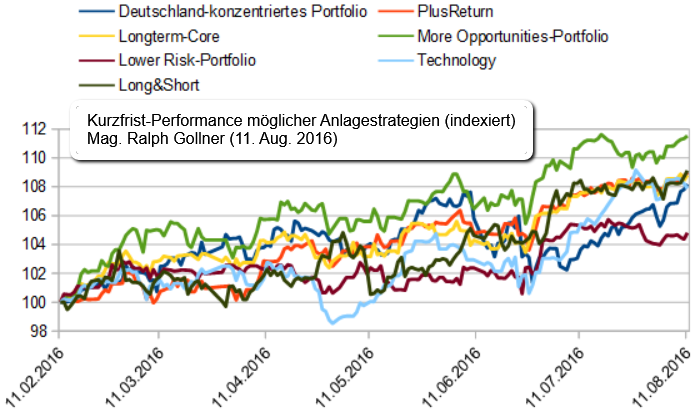

Anlagestrategien (Schwankungen "6 Monate")

Sie müssen wissen, wie viel Volatilität Sie vertragen können, und Ihr Portfolio entsprechend anpassen. John Maynard Keynes konnte große Schwankungen aushalten, vor allem weil er seiner Aktienauswahl dauerhaft vertraute.

Nur wenige Menschen wissen, wie erfolgreich Keynes als Anleger war. Tatsächlich war er einer der größten Anleger des 20. Jahrhunderts, wenn man bedenkt, dass die Zeit, in der er sein Geld anlegte, zwei Weltkriege und die Große Depression umfasste.

Anders als die der meisten anderen großen Volkswirte war Keynes' Weltsicht von ...

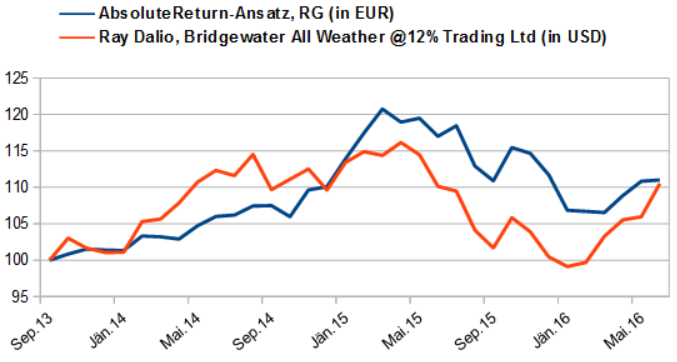

AbsoluteReturn-Ansatz versus Ray Dalio

Bridgewater All Weather @12% Trading Ltd

Ray Dalio's Bridgewater Associates has USD 155 billion in assets under management and counts the World Bank among its investors. He's advised various U.S. treasury chiefs including, Tim Geithner and Larry Summers.

However, Bridgewater's All Weather portfolio, a long-only fund designed to hold a well-diversified asset mix, ended 2015 down 7 percent. "All Weather ... is a portfolio in which the assets are supposed to balance each other," Dalio said. "[But] the problem last year (2015) is that almost all asset ...

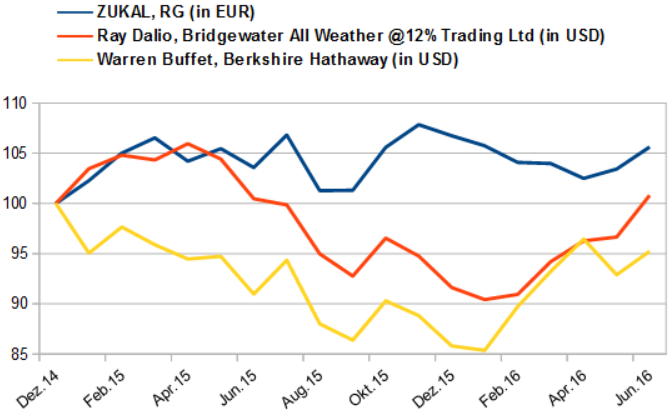

Ray Dalio versus ZUKAL und W. Buffet

(Dez. 2014 bis Juni 2016)

Man sollte sich eine Benchmark zurechtlegen, die sich mal von den Standardbenchmarks abhebt. Ich habe hierzu Ray Dalio's Anlegevehikel und Warren Buffet mit seiner Berkshire Hathaway-Aktie gewählt; mehr zu Ray Dalio weiter unten:

Die Wiege der Revolution steht in den Wäldern Conneticuts. Einige Kilometer außerhalb des Städtchens Westport hat Ray Dalio eine neue Methode entwickelt, das Geld seiner Kunden so auf Aktien, Anleihen und Rohstoffe zu verteilen, dass es in jedem Wirtschaftsumfeld wächst. Der 66-jährige ist so ...

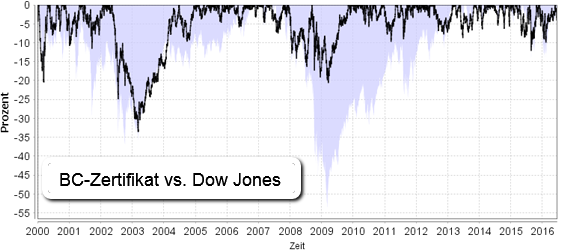

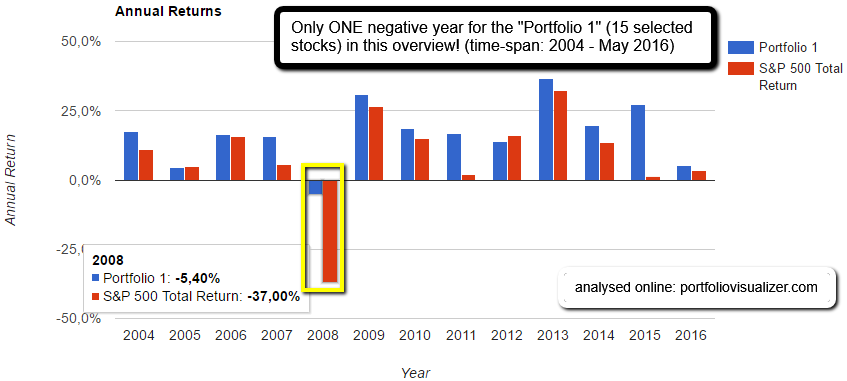

Ralph Gollner vs. BC-Zertifikat

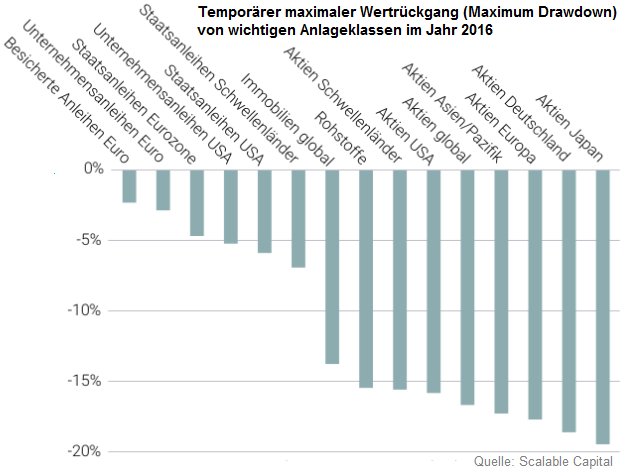

(Drawdownphasen 2000-5/2016)

An der Börse besitzt die Qualität der Defensive eine große Bedeutung. Im Vergleich mit dem "BC-Zertifikat" und des Ralph Gollner-Backtest "Portfolio 1" kann dies anhand von sogenannten Drawdown-Charts ausführlich erläutert werden:

Die Diagramme bringen zum Ausdruck, wie viel der Kurs seit dem bisherigen All-Time-High nachgegeben hat, was Börsianer als Drawdown bezeichnen.

BC-Zertifikat, und insbesondere Ralph Gollner-Backtest "Portfolio 1"

im Drawdown-Vergleich auf der "Siegerstraße"

Betrachten wir heute den Drawdown-Chart ...

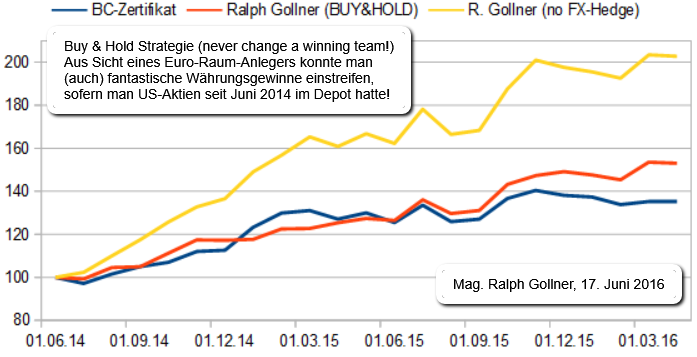

Buy & Hold-Strategie (Ralph Gollner)

(Juni 2014 bis Juni 2016)

Folgend ein Backtest einer Buy & Hold-Strategie. Gestartet wurde der Test im Jahr 2001. Hier ein Ausschitt mit einem am Markt erhältlichen Zertifikat (BC-Zertifikat) als Vergleich. Portfolio aus den 15 gleichen USD-Aktien:

Exklusive Fremdwährungsbewegungen erreichte das Buy & Hold-Portfolio in 2014 eine Jahresrendite von ca. 17%, im Jahr 2015 erreichte das Portfolio (exkl. FX-Impact) ca. 27% Plus. Wenn man nun auch die EUR/USD-Bewegung seit Juni 2014 miteinberechnet, hat sich das Portfolio im Zeitraum Juni 2014 bis April ...

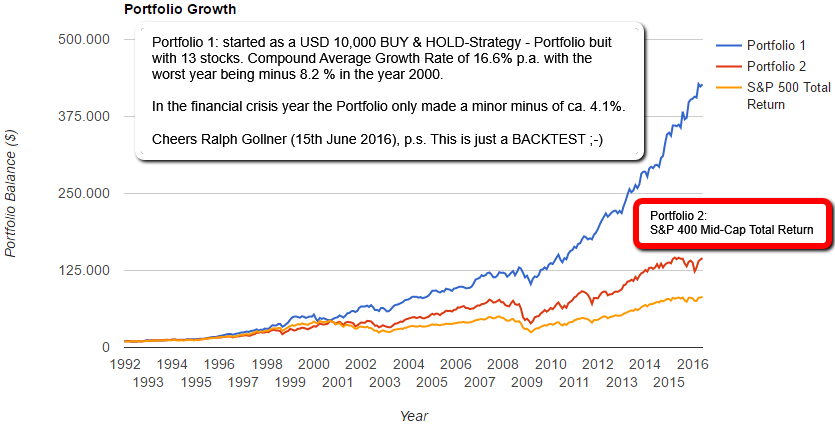

Buy & Hold Skyrocket-Portfolio

1992 - 05/2016

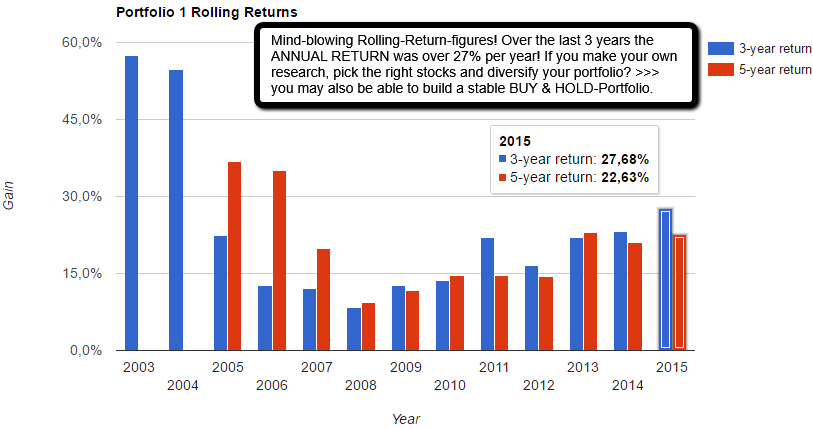

13 stocks may be enough to enjoy such a great - risk-reduced - outperformance over most of the benchmarks out there. Not to say: Against all benchmarks out there! YES :-). Don't forget: This Buy & Hold Strategy started in 1992!

Great Portfolio 1

(2001-05/2016, CAGR: >24% p.a.)

We Austrians and Germans hopefully are not infected by the dangerous HOME-BIAS! It may not kill your outperformance, but may dampen your performance in the short-run, and definitely also in the long-run ("recessions")!

You have to search, you have to recheck the correlations between the stocks, you should diversify between the different sectors, then you should be able to achieve a constant outperformance versus the broad US-Stock Market:

Since 2001 this portfolio has been put together (unfortunatelly only ex-post via backtesting ...

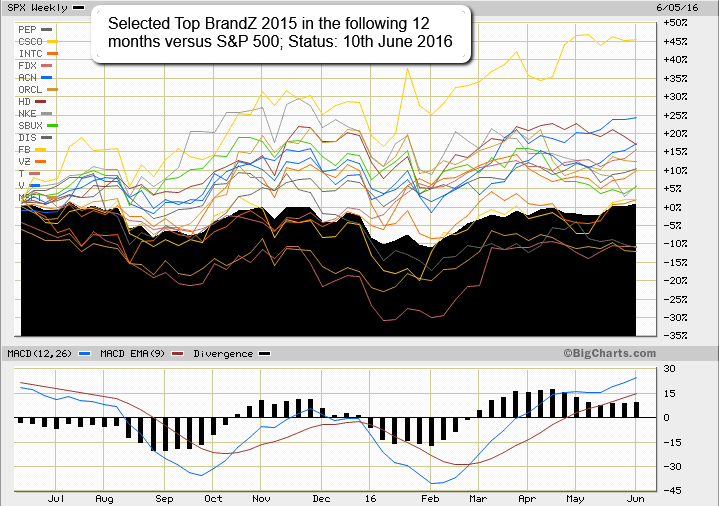

Top 100 BrandZ 2015 (Performance Recap)

June 2015 - 9th June 2016

Selected companies out of the Top 100 BrandZ list, which has been published in May 2015. Relative to the S&P 500 (broad US-Stock-Market, "black mountain") one can clearly see an outperformance of a basket of 15 stocks:

1year/retrospective, updated: http://bigcharts.marketwatch.com

1year/retrospective, updated: http://bigcharts.marketwatch.com

Following you will find an overview of some TOP BrandZ of the TOP100-list issued by Millward Brown and WPP. In the following selection Micrsoft, Visa, AT&T and Verizon were gaining places in the overall-ranking. This also had an impact regarding ...

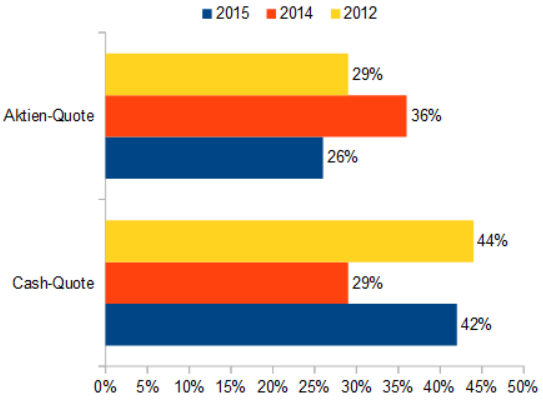

Umfrage unter österr. Vermögenden (Asset Allocation)

LGT Private Private Banking Report 2015

Die Finanzkrise 2007/2008 war für viele Anleger eine einschneidende Zäsur. So zeichnete der erste LGT Private Banking Report aus dem Jahr 2010 das Bild verunsicherter Bankkunden, die das Vertrauen...

Anmerkung: Grafik von Mag. R. Gollner erstellt. Basis sind die Umfragedaten vermögender Anleger aus Österreich. Umfragen wurden durchgeführt von jku und gfk im Auftrag der LGT Bank.

Anmerkung: Grafik von Mag. R. Gollner erstellt. Basis sind die Umfragedaten vermögender Anleger aus Österreich. Umfragen wurden durchgeführt von jku und gfk im Auftrag der LGT Bank.

...in die Stabilität des Finanzsystems verloren hatten. Viele Vermögende hatten ihre Portfolios in weniger ...

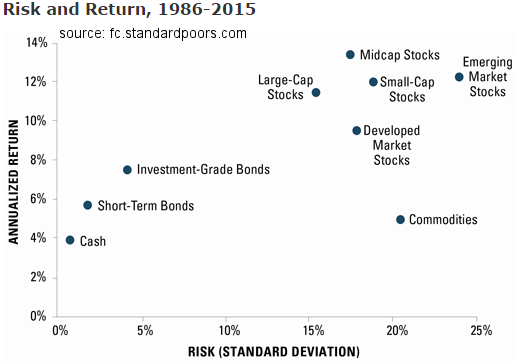

S&P 400 Total Return (great Index)

MidCap-stocks usually outperform in the long run. The academic answer is that smaller companies are riskier and therefore command a higher risk premium (aka trade at a discount to 'safer' large cap stocks).

The chart above shows the risk and return of various asset classes over the past 30 years. The performance shown includes reinvestment of any income or distributions. Large-cap stocks are represented by the S&P 500 index. Midcap stocks are represented by the S&P MidCap 400 index. Small-cap stocks are represented by a composite of the CRSP 6th-10th ...

I put togehter some abstracts of a longer text, originally written by James B. Cloonan (Chairmain of AAII).

At the end of this article you should see or you should be able to understand:

that for the long-term portion of invested wealth, stock investing offers an outstanding opportunity for wealth accumulation through growth at relatively low risk. It should be emphasized that the stock market is risky for short-term holding periods, but as an investor's time frame goes beyond five years (10 years, 20 years), this risk is greatly diminished. It should also be emphasized that an expected ...

Momentum Strategy (strong sectors/stocks)

The momentum factor is based on the price change of a stock over a specified period relative to all other stocks. It is considered to be an anomaly or a risk factor in the analysis of stock returns because...

The chart above, taken from the paper entitled “Value and Momentum Everywhere” (Clifford Asness, Tobias Moskowitz, and Lasse Pedersen), compares cumulative returns and annualized Sharpe ratios (SR) for a value strategy, a momentum strategy and a 50-50 value-momentum strategy (rebalanced monthly) as applied to an equal-weighted combination ...

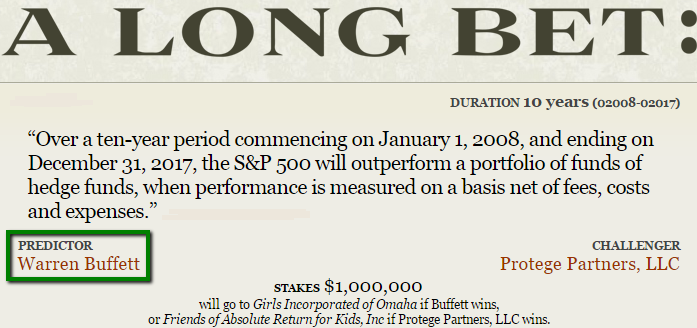

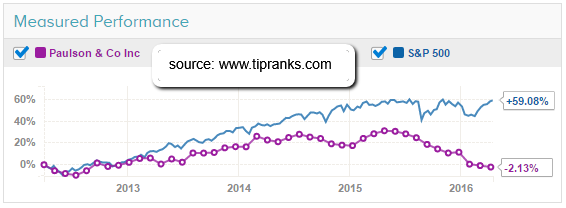

Warren Buffet vs S&P 500-ETF vs Hedge Funds

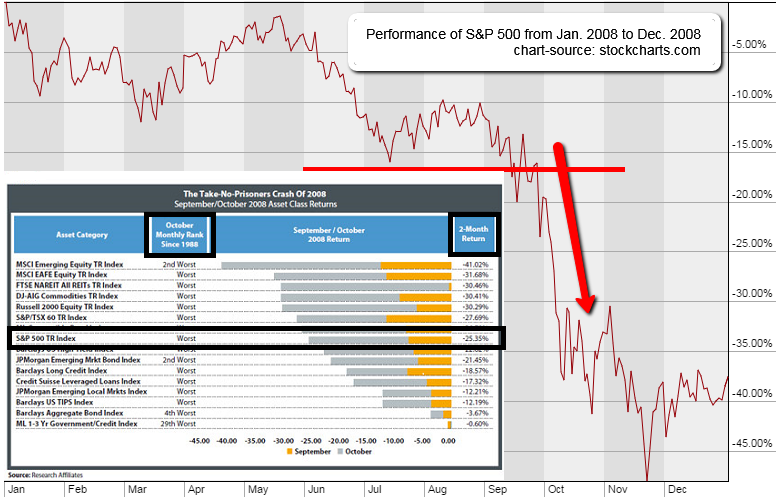

Jan. 2008 - Dec. 2015

Buffett’s Big Bet ("The Bet") took the view that high fees would ultimately doom hedge funds to underperform the S&P 500 over long periods of time. As he described it at the Bet’s inception: