Related Categories

Related Articles

Articles

40 stocks & Diversification

Can/Do you sufficiently spread out your risk by holding a large number of different securities across sectors, industries, and companies? This spreading out of risk, or diversification, is one of the basic...

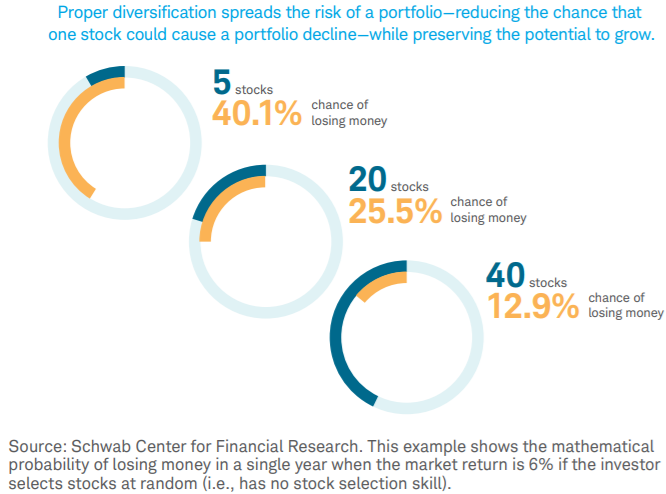

This example above shows the mathematical probability of losing money in a single year when the market return is 6% if the investor selects stocks at random (i.e., has no stock selection skill). Calculations include standard deviation assumptions of 23.8%, 9.1%, and 5.3% for the 5-, 20-, and 40-stock portfolios, respectively, and assume a normal distribution of returns.

...tenets of modern portfolio theory, which holds that you can reduce the risk (volatility) of the overall portfolio by owning a number of securities that tend to move independently of each other.

The illustration above shows how diversifying, or introducing more securities, helps reduce the overall risk of a portfolio. The fewer securities you hold, the likelier it is that a decline in one of them could adversely affect the whole portfolio; a larger pool of securities tends to spread that risk.

One way (and maybe the cheapest way) is to reap the benefits of diversification is through index investing - the practice of investing in a fund with a portfolio of securities that mirrors a particular index. But this method wasn’t always available! ETF & Co. another story...

Personally, I (Ralph Gollner) currently own more than 40 stocks and they are part of my intent for diversifying my portfolio.

link (.pdf/Document):

www.schwab.com/public/file