Related Categories

Articles

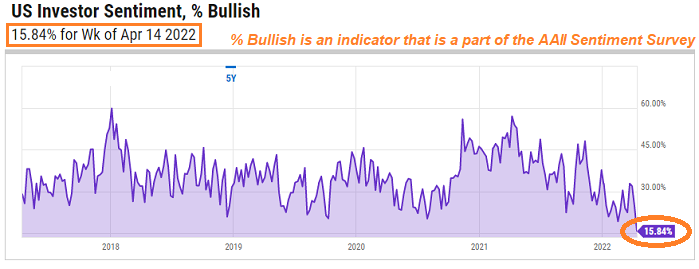

AAII-Bulls reading < 16%

(14th April 2022)

US Investor Sentiment, % Bullish is an indicator that is a part of the AAII Sentiment Survey. It indicates the percentage of investors surveyed that had a bullish outlook on the market. An investor that is bullish, will primarily think that...

...the market will head higher in the next six months. One of the highs of the bullish survey was in 2000 during the technology boom. This sentiment indicator reached 75% during that time frame.

Most recent reading as per 14th April 2022:

Bullish sentiment, expectations that stock prices will rise over ...

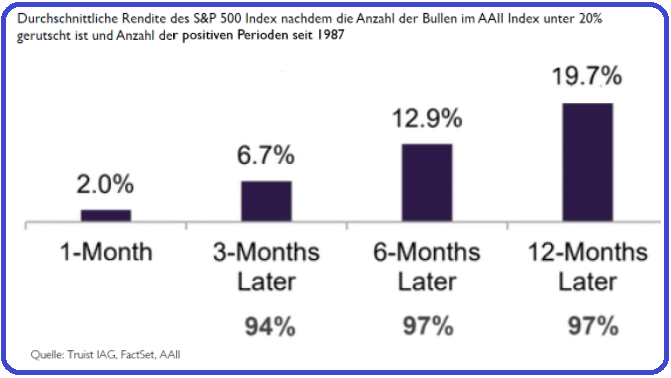

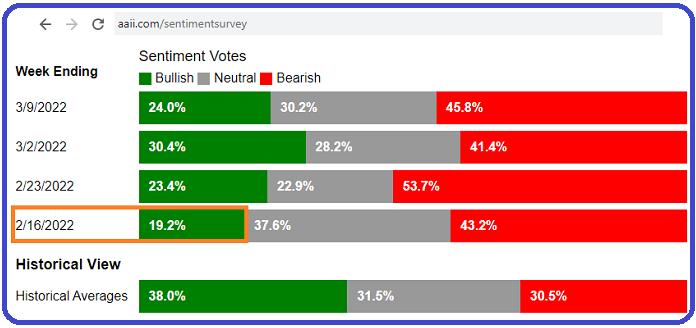

AAII-Bulls reading < 20%

(16.Feb 2022)

Die Geschichte der AAII-Befragungen zeigt uns, dass einer sehr geringe Bullenquote unter den Teilnehmern oft eine positive 12-Monatsperformance im S&P 500 folgt:

Am Mittwoch, 16. Feb. 2022, wurde von AAII eine geringe Bullenquote von 19,2% registriert, wie man in folgendem Schaubild ablesen kann:

Somit kann man von diesem Tag an die dann folgende, historische 12-Monatsrendite ableiten, welche aufgrund der bisherigen Beobachtungen seit dem Jahr 1987 eben folgte. Bis zum Feb. 2023 könnte man somit mit einem Indexstand von > 4.900 Punkten im S&P ...

AAII Investment Survey

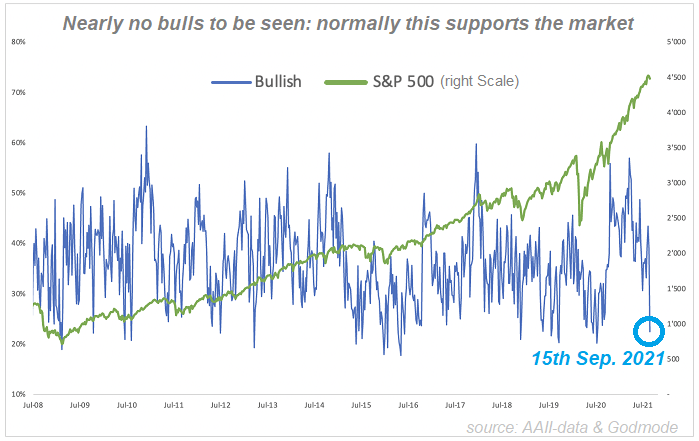

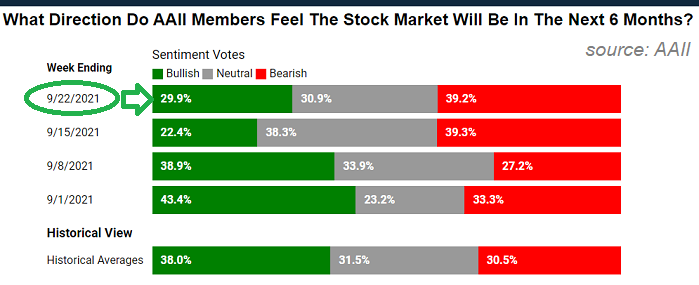

(15th & 22nd September 2021)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Optimism experiened...

...a pretty shard drop in the last weeks hitting a low of ca. 22% Bulls in the last week. The latest AAII Sentiment Survey now shows a higher levels of bullish sentiment - but still below the long term average of ca. 38% bulls.

...a pretty shard drop in the last weeks hitting a low of ca. 22% Bulls in the last week. The latest AAII Sentiment Survey now shows a higher levels of bullish sentiment - but still below the long term average of ca. 38% bulls.

Optimism is currently at a low level and Pessimism continues to stay at a ...

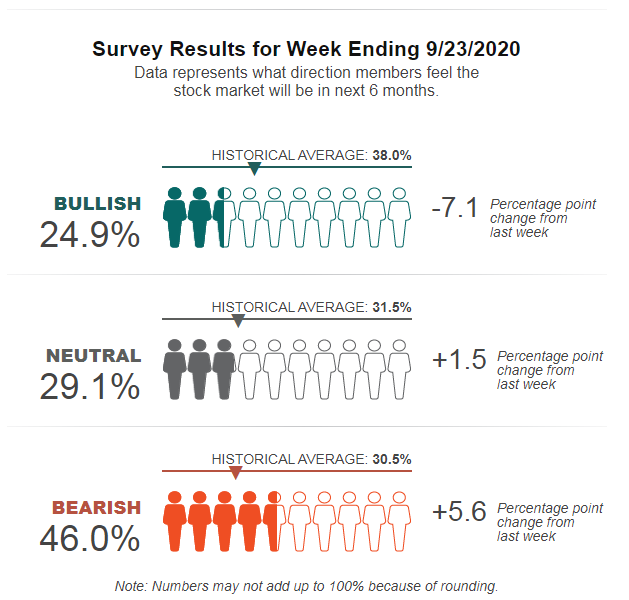

AAII Investment Survey (24th September 2020)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Optimism experiened...

...its largest weekly percentage-point drop since June 2020 and is now back at an unusually low level. The latest AAII Sentiment Survey also shows higher levels of neutral and bearish sentiment.

Bullish sentiment, expectations that stock prices will rise over the next six months, dropped by 7.1 %points to 24.9%. ...

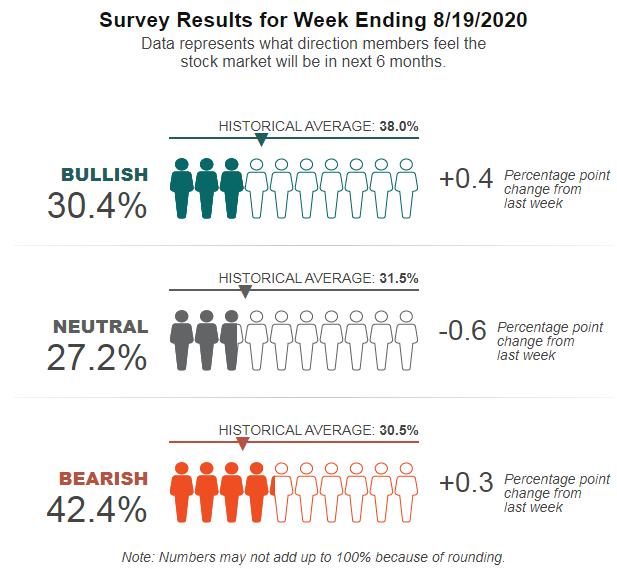

AAII Investment Survey (19th August 2020)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Pessimism among...

...individual investors about the short-term direction of the stock market extended its streak of staying above 40%. The latest AAII Sentiment Survey also shows modestly higher levels of bullish sentiment and a small decline in neutral sentiment.

Bullish sentiment, expectations that stock prices will rise over the next ...

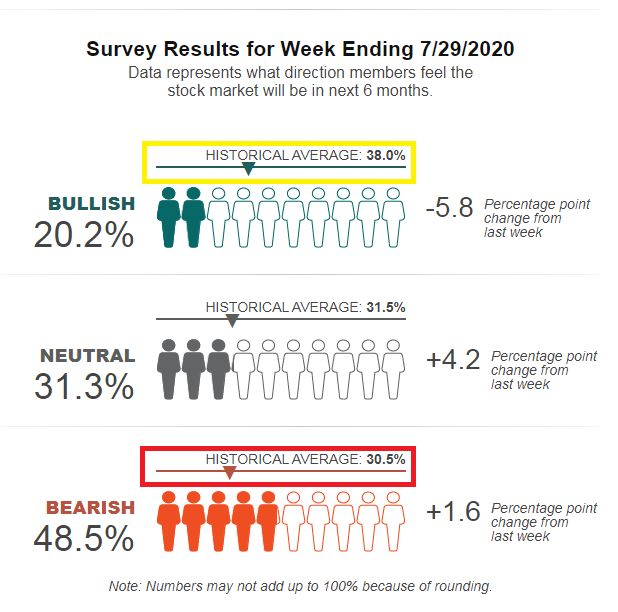

AAII Investment Survey (29th July 2020)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Optimism among individual investors about...

...the short-term direction of the stock market is at its lowest level in over four years. The latest AAII Sentiment Survey also shows higher levels of neutral and bearish sentiment. Bullish sentiment, expectations that stock prices will rise over the next six months, fell 5.8 percentage points to ...

AAII Investment Survey

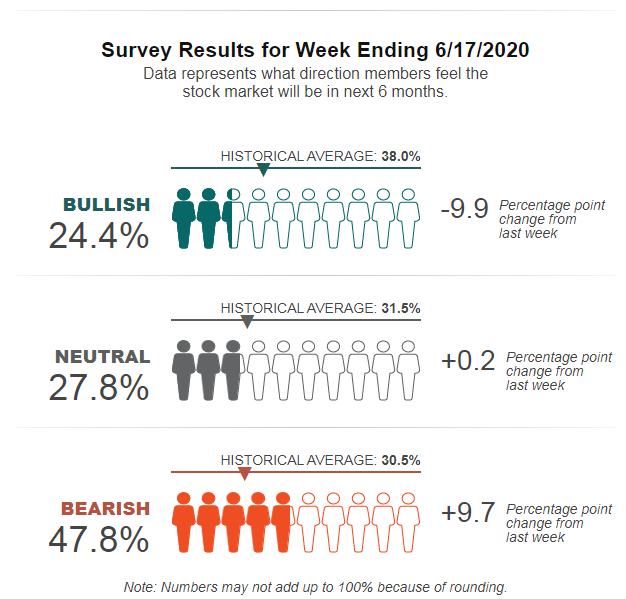

17th June 2020

Bullish sentiment, expectations that stock prices will rise over the next six months, fell 9.9 percentage points to 24.4%. Optimism remains below its historical average of 38.0% for the 15th consecutive week and...

...the 20th week this year.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, edged up 0.2 percentage points to 27.8%. Neutral sentiment was last higher on February 26, 2020 (30.4%). Even with the continued increase, neutral sentiment is below its historical average of 31.5% for ...

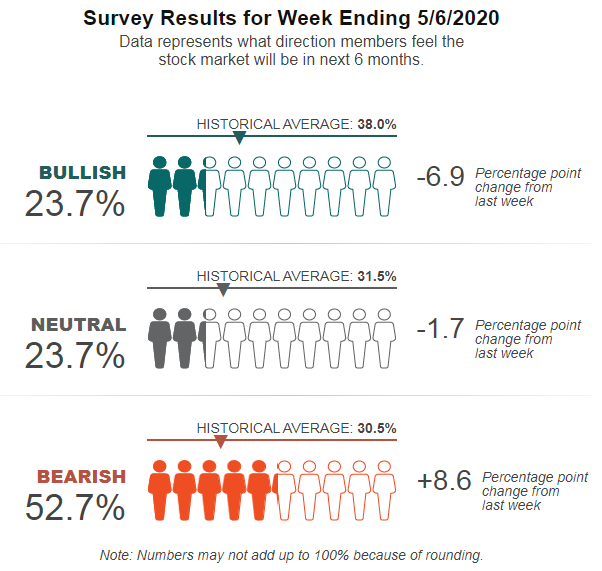

AAII Sentiment Survey (7th May 2020)

The level of pessimism among individual investors about the short-term direction of the stock market is at its highest level in more than seven years. The latest AAII Sentiment Survey also shows a drop in optimism and a decline in...

...neutral sentiment. Bullish sentiment, expectations that stock prices will rise over the next six months, fell 6.9 percentage points to 23.7%. Optimism was last lower on 9th October 2019 (20.3%). Bullish sentiment is below its historical average of 38.0% for the ninth consecutive week and the 14th week this year.

...

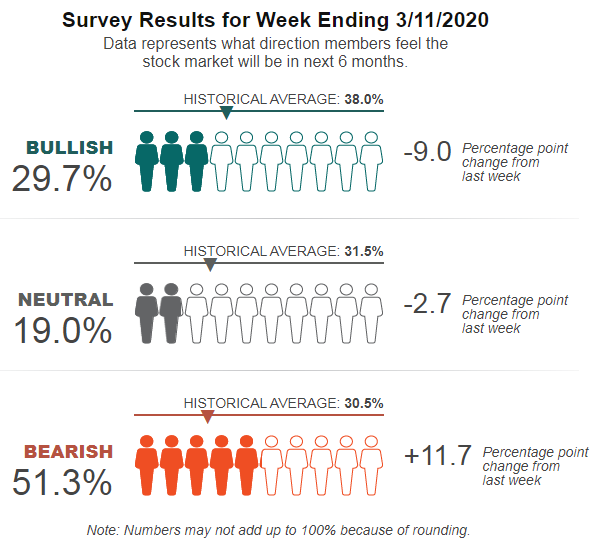

AAII Sentiment Survey (12th March 2020)

The percentage of individual investors expecting stocks to fall over the short term is at its highest level in seven years! The latest AAII Sentiment Survey also shows a steep drop in optimism and a continued decline in neutral sentiment...

Bullish sentiment, expectations that stock prices will rise over the next six months, plunged 9.0 percentage points to 29.7%. The drop more than reversed last week's gain and put optimism at its lowest level since 9th October 2019 (20.3%). The historical average is 38.0%.

Neutral sentiment, expectations that ...

AAII Sentiment

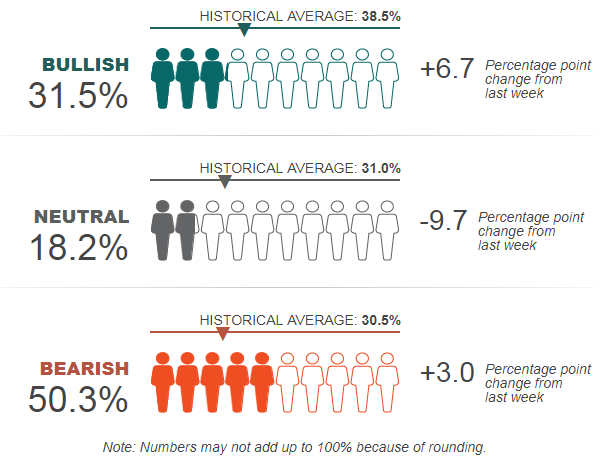

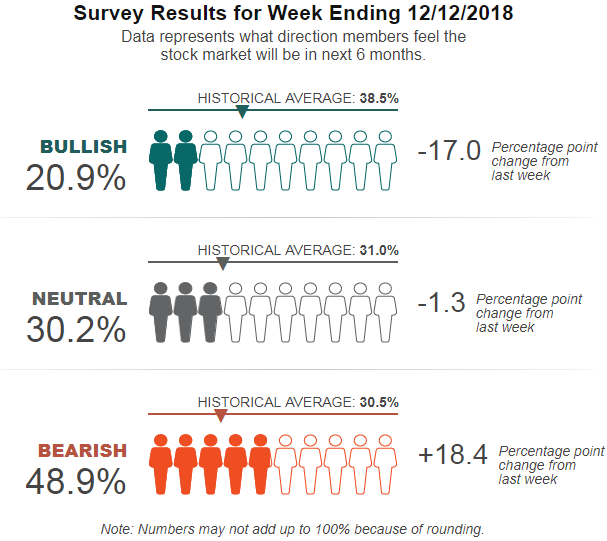

Survey Results for Week Ending 26th Dec. 2018

Data represents what direction AAII-members feel what direction the stock market will be in next 6 months.

Half of individual investors now describe themselves as "bearish" for the first time since 2013. The latest AAII Sentiment Survey shows greater polarization, with neutral sentiment falling to an eight-year low.

Bullish sentiment, expectations that stock prices will rise over the next six months, rebounded for a second consecutive week, rising 6.7 percentage points to 31.5%. Even with the big increase, optimism remains ...

Pessimism among individual investors jumped to its highest level in more than five and a half years in the latest AAII Sentiment Survey. Optimism plunged, and neutral sentiment declined.

Bearish sentiment, expectations that stock prices will fall over the next six months, spiked by 18.4 percentage points to 48.9%. This is the highest level of pessimism registered by the AAII-survey since 11th April 2013 (54.5%). The large increase keeps bearish sentiment above its historical average of 30.5% for the 10th consecutive week and the 13th out of the last 14 weeks.

At current levels, ...

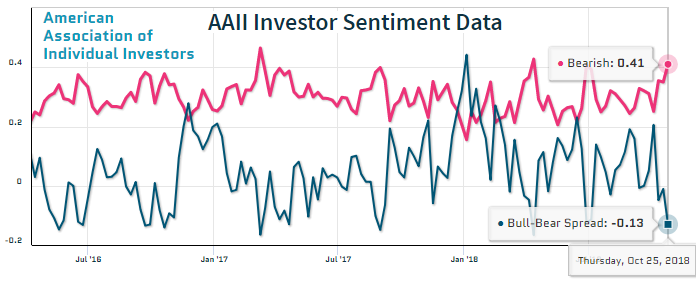

AAII Investor Sentiment

Pessimism about the short-term direction of the stock market is at its highest level in six months. The latest AAII Sentiment Survey also shows optimism among individual investors falling to an unusually low level. Bullish sentiment, expectations that...

...stock prices will rise over the next six months, fell 6.0 percentage points to 28.0%. Bullish sentiment was last lower on 4th July 2018 (27.9%). Bullish sentiment is below its historical average of 38.5% for a third consecutive week and the sixth time in the last seven weeks.

Neutral sentiment, expectations ...

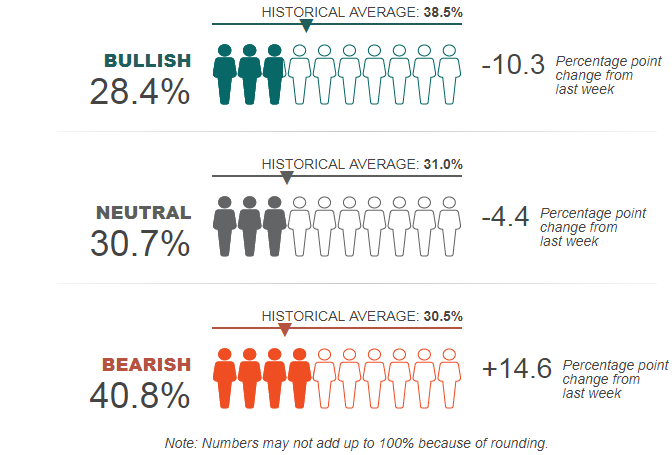

Survey Results for Week Ending 27th June 2018

Data represents what direction members feel the

stock market will be in next 6 months.

Pessimism among individual investors about the short-term direction of stock prices is above 40% for...

...just the second time this year. The latest AAII Sentiment Survey also shows a large drop in optimism and a decrease in the percentage of investors describing their outlook as neutral.

Bullish sentiment, expectations that stock prices will rise over the next six months, plunged 10.3 percentage points to 28.4%. The drop puts bullish sentiment below its ...

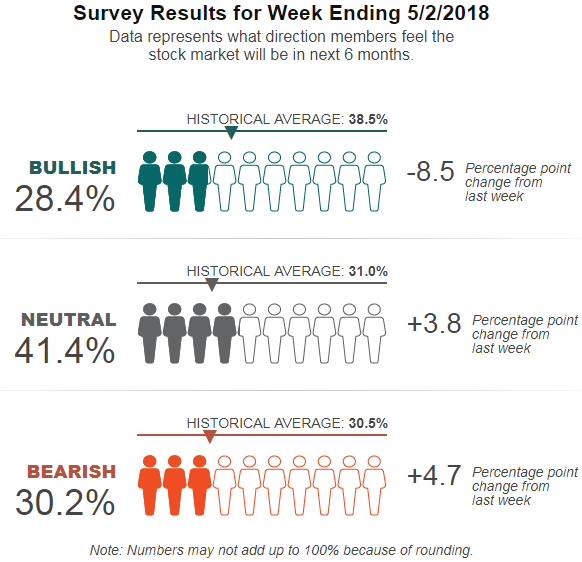

The percentage of individual investors who described their short-term outlook for stocks as "neutral" is above 40% for the first time in almost two months. The latest AAII Sentiment Survey also shows a big drop in optimism and a rise in pessimism.

Bullish sentiment, expectations that stock prices will rise over the next six months, plunged 8.5 percentage points to 28.4%. The drop keeps optimism below its historical average of 38.5% for the 10th consecutive week and the 11th time in 13 weeks.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the ...

History 1988 - year 2017

Optimism about the short-term direction of the stock market has been below average for 40 out of 50 weeks this year in the famous AAII Sentiment Survey. Given this trend, AAII was curious as to how the year 2017 compares to the 30 previous years.

...tracked by the survey. So, AAII updated the historical analysis I've been keeping on unusually high and low readings (see the table) and then conducted calendar-year analysis.

Year to date, bullish sentiment is averaging 34.5% (including this week's latest reading of 45.0%). Historically, bullish sentiment has ...

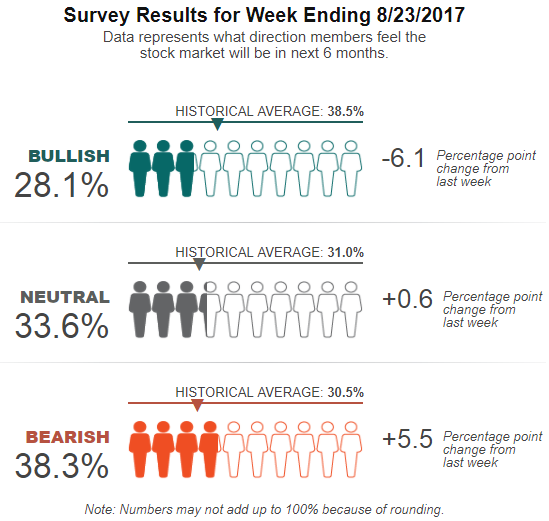

The latest AAII Sentiment Survey shows pessimism among individual investors being at its fifth highest level of the year. The jump in pessimism occurred as optimism dropped. Bullish sentiment, expectations that stock prices will rise over the next...

...six months plunged 6.1 percentage points to 28.1%. Optimism was last lower on 31st May 2017 (26.9%). This is the 26th consecutive week and the 31st time out of the last 32 weeks that bullish sentiment is below its historical average of 38.5%.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the ...

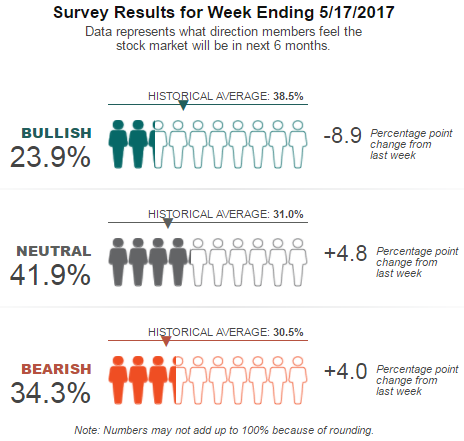

AAII Investor Sentiment (17th May 2017)

Optimism among individual investors about the short-term direction of stock prices fell to a new 2017 low in the latest AAII Sentiment Survey. At the same time, the percentage of individual investors describing their outlook as "neutral" is at a new...

...high for the year. Bullish sentiment, expectations that stock prices will rise over the next six months, plunged 8.9 percentage points to 23.9%. The drop keeps optimism below its historical average of 38.5% for 17 out of the last 18 weeks.

Neutral sentiment, expectations that stock prices will ...

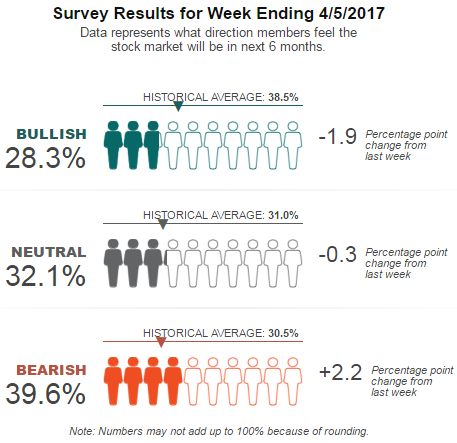

Pessimism among individual investors about the short-term direction of stock prices rose to nearly 40%, while at the same time, optimism fell below 30%.

Pessimism is above its historical average for 11 of the last 12 weeks, while optimism is below its historical average for the same amount of time.

Details/"Streaks"

Bullish sentiment, expectations that stock prices will rise over the next six months, fell 1.9 percentage points to 28.3%. This is the 11th time out of the last 12 weeks that optimism is at or below its historical average of 38.5%.

Bearish sentiment, expectations that ...

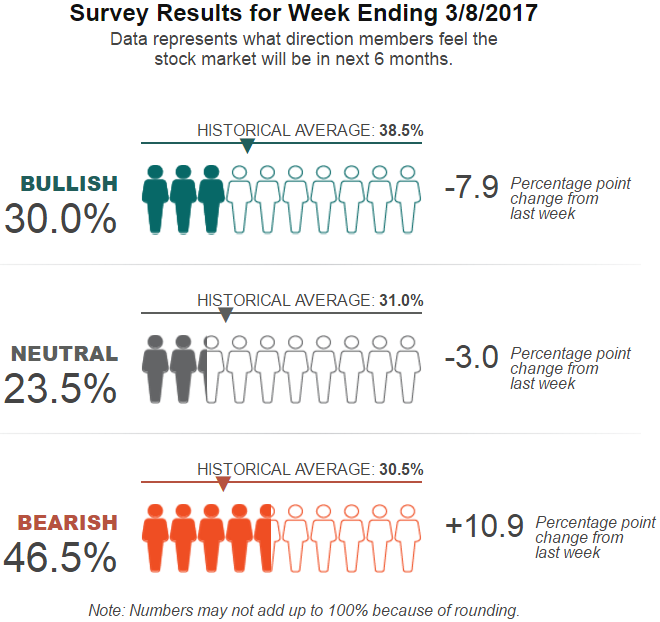

Weekly AAII Sentiment Survey (8/9th March 2017): Pessimism surged to its highest level since February 2016. Past occurrences of unusually high levels of bearish sentiment have a mixed record of being followed by bigger-than-average six-month gains in the S&P 500.

Pessimism among individual investors jumped to its highest level in more than year in the latest AAII Sentiment Survey. At the same time, the percentages of individual investors describing their six-month outlooks as "bullish" or "neutral" fell.

Bullish sentiment, expectations that stock prices will rise over the next six ...

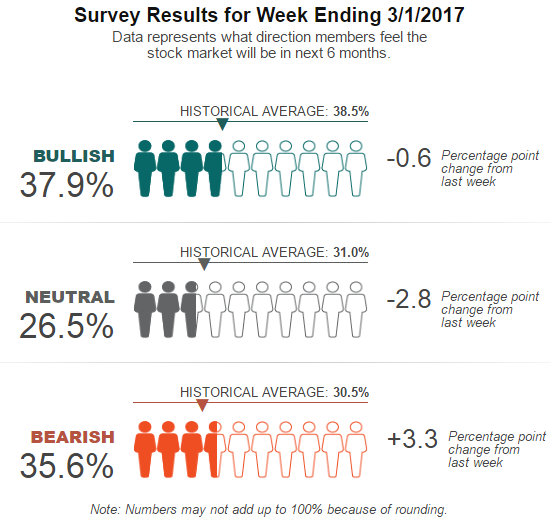

AAII Investor Sentiment (1st March 2017); Pessimism about the short-term direction of stock prices rose to a post-election high, though optimism remains near its historical average.

Pessimism among individual investors about the short-term direction of stock prices is at its highest level in more than four months. At the same time, optimism is near, though slightly below, its long-term average. The survey period runs from Thursday (23rd Feb. 2017) through Wednesday (1st March 2017). Most of the votes were recorded before Wed. (1st March 2017), when the Dow Jones Industrial average rose ...

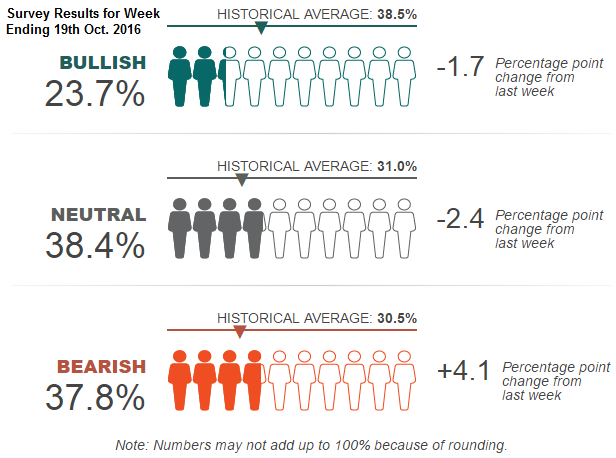

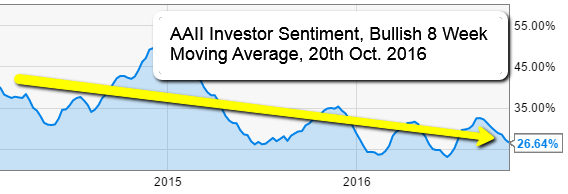

AAII Investor Sentiment (20th Oct. 2016)

Bullish sentiment, expectations that stock prices will rise over the next six months, fell last week 3.3 percentage points to 25.5%. This week, that gauge fell more than 1.7% to reach only 23.7%.

The drop of ca. 1.7% puts optimism below its historical average of 38.5% for the 50th consecutive week and the 83rd out of the past 85 weeks! In this respect we should also be reminded that bull markets USUALLY (!) don't end in such a pessimistic environment...

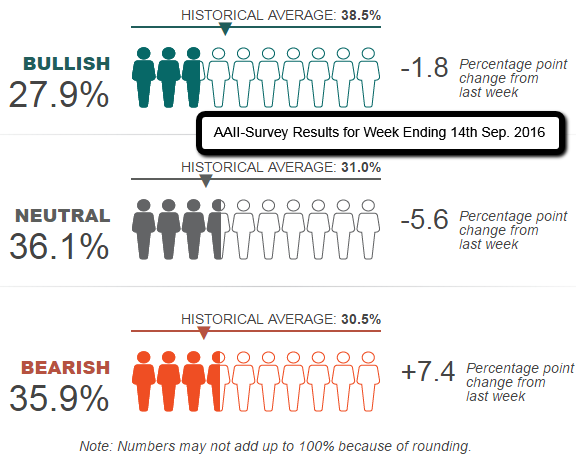

AAII Investor Sentiment (Sep. 2016)

The AAII Investor Sentiment Survey has become a widely followed measure of the mood of individual investors. Pessimism rose to its highest level since last June, while neutral sentiment fell to a level not seen since February 2016.

Pessimism jumped to a three-month high as more than one out of three individual investors described their short-term outlook as "bearish" in the latest AAII Sentiment Survey. At the same time, neutral sentiment fell to its lowest level since February 2016. Bullish sentiment is also lower. Please find following details, ...

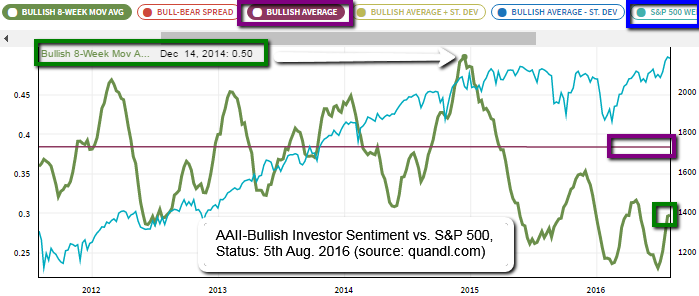

AAII-Bullish Investor Sentiment vs. S&P 500

(07/2011 - 5th Aug. 2016)

Bullish sentiment, expectations that stock prices will rise over the next six months, declined 1.5 percentage points to 29.8% as per 4th August. Optimism was last lower on 29th June 2016 (28.9%).

This is the 39th consecutive week and the 72nd out of the past 74 weeks with a bullish sentiment reading below its historical average of 38.5%!

Neutral sentiment is back at an unusually high level. At the same time, fewer than 30% of individual investors describe their short-term outlook as "bullish," for the first time ...

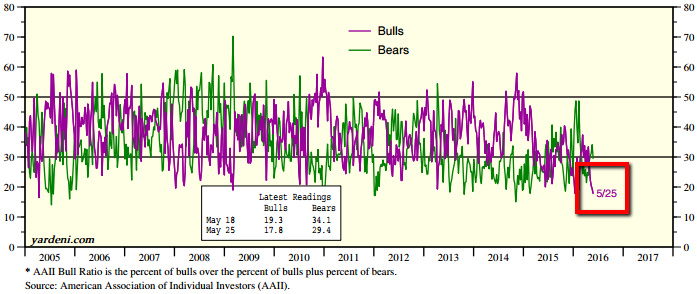

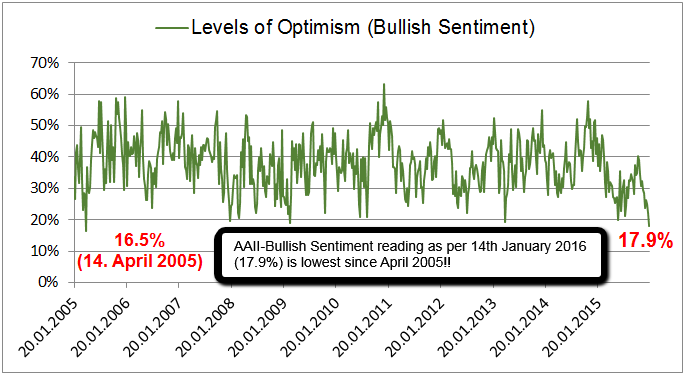

AAII Investor Sentiment (Bulls: LT-LOW)

The percentage of individual investors optimistic about short-term gains occurring in the stock market is at its lowest level in 11 years (17.8%). This is the lowest level of optimism recorded by that survey since 14th April 2005 (16.5%).

At the same time, the percentage of investors describing their outlook as neutral is at its highest level in 16 years, according to the latest AAII Sentiment Survey.

Bullish sentiment, expectations that stock prices will rise over the next six months, declined 1.6 percentage points to 17.8%. It is the 29th ...

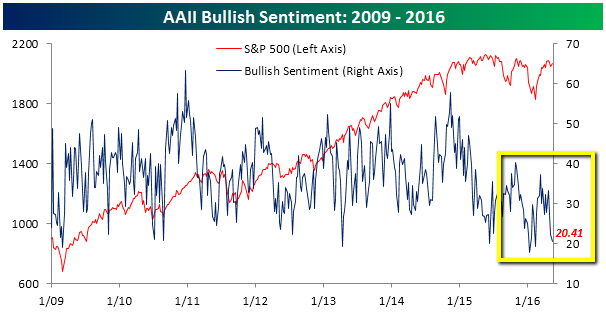

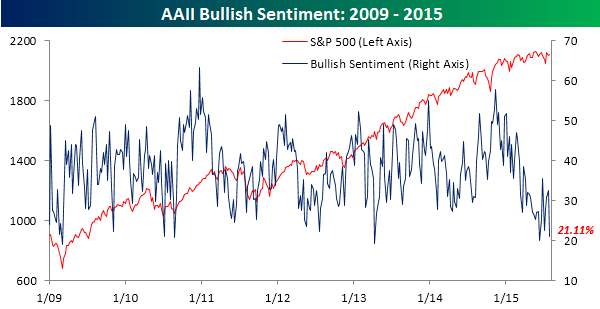

AAII Investor Sentiment vs. S&P 500 (2009-2016)

Optimism among individual investors about the short-term direction of stock prices remained at a three-month low according to the latest AAII Sentiment Survey. Pessimism is at an 11-week high, and neutral sentiment edged higher.

chart-source: www.bespokepremium.com

♦ Bullish sentiment, expectations that stock prices will rise over the next six months, fell 1.9 percentage points to 20.4%. Optimism was last lower on February 11, 2016 (19.2%). This is the 27th consecutive week and the 60th out of the past 62 weeks that bullish sentiment has ...

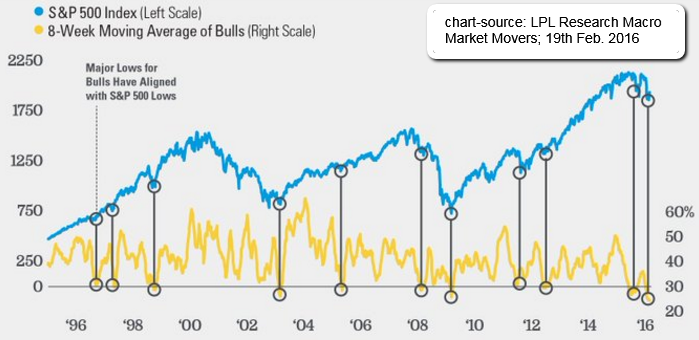

AAII Sentiment / 8week-Average (LongTerm-LOW)

The AAII 8-week moving average of bulls is below the 25%-threshold. This marks a lower level than in March 2003 and March 2009! The lack of bulls suggests, that a big majority may be betting on a big bad outcome.

My opinion: On average, the majority-opinion turns out to be wrong.

Still, this standard-outcome may just work, if everything turns out better than worse as it - most of the time - did in the past...

source: https://lplfinancial.lpl.com

AAII Bullish Investor Sentiment (01/2005 - 01/2016)

Each week, AAII asks its members a simple question: Do they feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)? Here the most recent reading:

In the graph above I put up the weekly bullish-sentiment-readings from 2005 up to 14th January 2016. Both the dates (April 2015 & 14th Jan. 2016) have one thing in common: a reading BELOW 18.5%!. Extraordinarily low levels of optimism have worked best as a contrarian signal for potential Long-positions in the broad ...

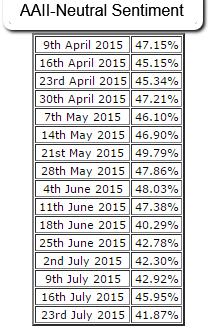

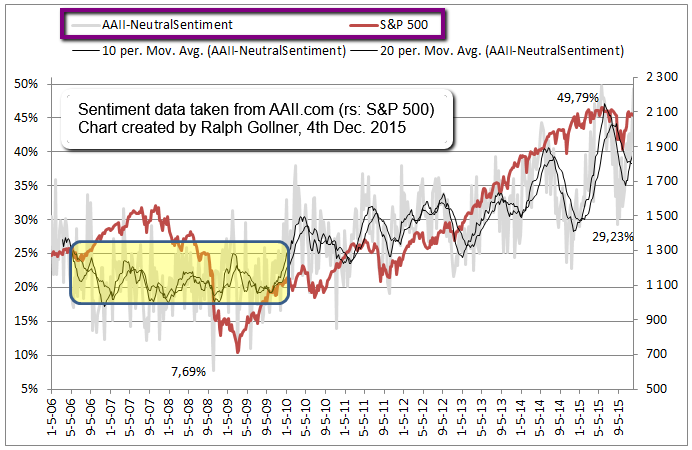

AAII Neutral Investor Sentiment (record streaks) & 1988 similarities

Time to recap on the bag of mixed signals of 2015. Therefore please find the AAII-Neutral-Investor-Sentiment-readings of summer 2015 right here below:

As per 9th July 2015 the 14-week streak of neutral sentiment readings at or above 40% (readings above 39.6% are unusually high) was the first such streak since 8th July 1988 through October 21, 1988.

As per 9th July 2015 the 14-week streak of neutral sentiment readings at or above 40% (readings above 39.6% are unusually high) was the first such streak since 8th July 1988 through October 21, 1988.

But the 16-week reading of Neutral Investor Sentiment recorded on the 23rd July 2015 was the highest of such a streak ever. Before that occurence the streak-record was ...

AAII Neutral Investor Sentiment (2006-12/2015)

The percentage of individual investors describing their six-month outlook as "neutral" is at its highest level since May 2015. The surge in neutral sentiment occurred as both optimism and pessimism fell.

AAII Sentiment Survey (3rd Dec. 2015), text-source/adapted: http://www.aaii.com

Bullish sentiment, expectations that stock prices will rise over the next six months, declined 2.9 percentage points to 29.5%. Optimism was last lower on 30th Sep. 30, 2015 (28.1%). This is the 37th out of the past 39 weeks with a bullish sentiment below its ...

Investor Sentiment (as per month-end July 2015)

Text/charts - source: https://www.bespokepremium.com

The latest survey (Status/30th July 2015) of investor sentiment from the American Association of Individual Investors (AAII) showed a large drop in bullish sentiment:

After climbing up to 32.5% last week, bullish sentiment dropped by over eleven percentage points to 21.1%

A bullish sentiment of 21.1% marks the lowest level since early June 2015 and the 18th straight week that it has been below the average reading of 38.19% since 2009.

The move in bearish sentiment was even larger, as ...

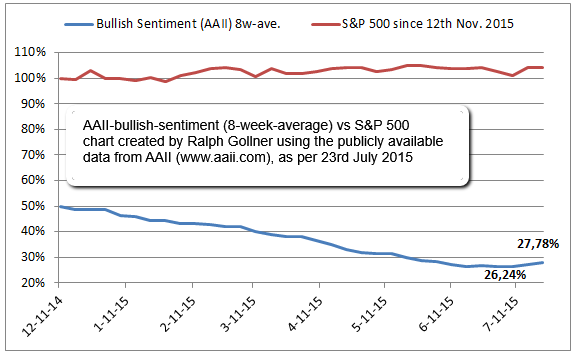

AAII Sentiment Survey vs. SPX (Q4-2014 - 23rd July 2015)

In the following chart a direct comparison (only) of the AAII-Bullish-Sentiment-8week-average versus the S&P 500, starting from the Q4-2015:

The intermediate low (bullish Sentiment/8week-average) was registered on the 2nd July at 26.38%, the current average as per 23rd July stands at 27.78%. Comment directly from the AAII-source: "Optimism rose to a four-week high in the latest AAII Sentiment Survey. Pessimism also rose as neutral sentiment fell to a five-week low." Further comments directly from AAII:

Bullish sentiment, ...

AAII Investor Sentiment (bullish Investors LOW @ 20%) versus Greece discussions, June 2015

in this context the short BBC-article should be mentioned, where the German Chancellor Angela Merkel has warned that time is running out for a deal to keep Greece in the eurozone. Speaking after the G7 summit in Germany, she said Europe would show solidarity but only if Greece "makes proposals and implements reforms". Earlier, Greek Finance Minister Yanis Varoufakis said it was time to stop finger-pointing and find an agreement.

source on the Greece-topic and short video: http://www.bbc.com/news

...

...

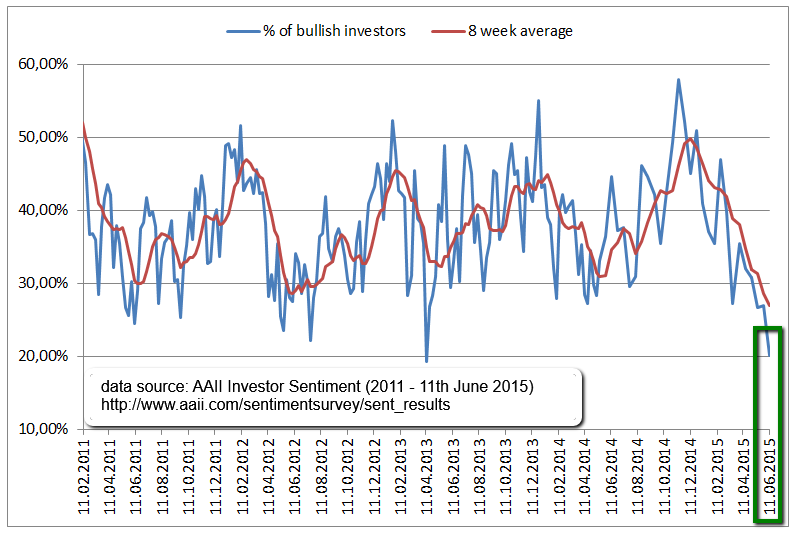

AAII Investor Sentiment (June 2015)

My Input with referring to articles of other authors (11th June 2015):

Contrarian investors should pay particular attention to the unusually low bullish reading in last week’s survey. There are about 160,000 AAII members. The typical member is a male, with a bachelor’s or graduate degree, and is in his mid-60s. The median portfolio size of members is just over $1 million.That makes the AAII Sentiment Survey a good proxy for the mood of the typical affluent retail investor.

Put simply, retail investors, as a group, tend to be very bad at timing the ...

Related Articles

Some of us are highly loss averse, but in general we’re all averse to losses to some degree. Empirical estimates find that losses are felt between two and two-and-a-half as strongly as gains. Thus the disutility of losing $100 is at least twice the utility of gaining $100. Evenutally loss ...

Anchoring (heuristic)

Anchoring is a particular form of priming effect whereby initial exposure to a number serves as a reference point and influences subsequent judgments about value. The process usually occurs without our awareness (Tversky & Kahneman, 1974), and sometimes it occurs when ...

Cognitive biases (incl. the Snake Bite Effect)

...are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment, and are often studied in psychology and behavioral economics (behavioral finance).

...are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment, and are often studied in psychology and behavioral economics (behavioral finance).

Although the reality of these ...

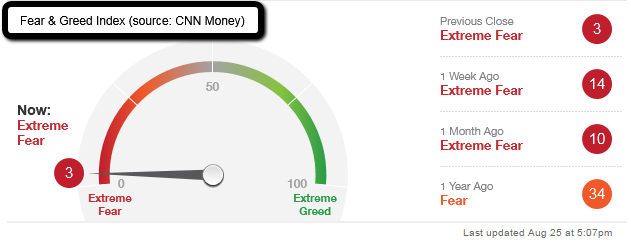

Fear & Greed (Index)

The last time the Index was near such low readings (3) was during the last correction in the US Financial markets, occuring in Oct. 2014. That time it took the index about one week to get out of that negative sentiment (such a quick turnaround may not be the standard).

...

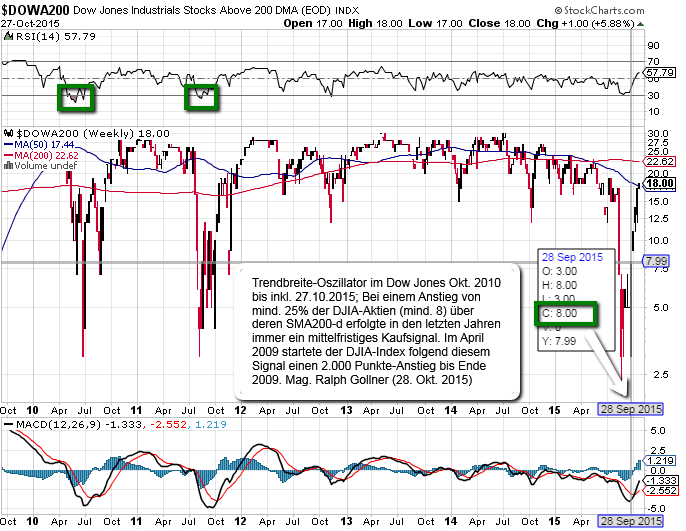

Dow Jones (IA) Trendbreite-Oszillator (kfr. MarktUNTERtreibung ?)

Vereinfacht gesagt wird mit diesem Oszillator die Marktbreite im Dow Jones Industrial Average (DJIA) gemessen.

Allgemein: Sofern eine Aktie über dem 200-Tage-Durchschnitt (SMA200) notiert, wird von einer guten Trendstärke ...

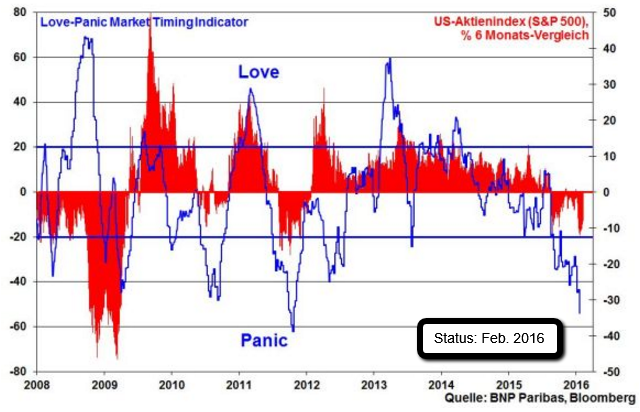

Love-Panic Sentiment (Feb. 2016)

Love panic is a sentiment indicator created by BNP and gives an idea if the equity market is in a phase that is either love, neutral, and panic. This is a contrarian indicator so a high reading would be considered too much love which can signal a market high.

...

...

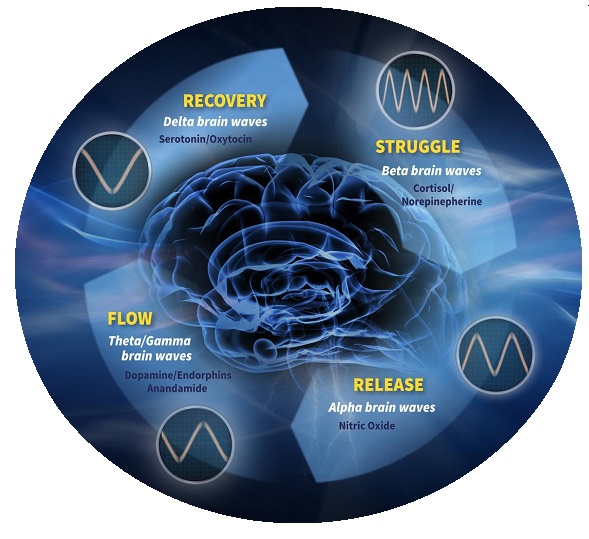

Oxytocin & Co. (Fear & Gier)

Stichworte: Nucleus Accumbens, Dopamin, Oxytocin, Adrenalin, Kontrollverlust

"Unser Gehirn ist süchtig nach Belohnungen"

Wer Geld gespart hat, überlegt, wie er es vermehren kann, etwa an der Börse. Aber unser Hirn kann nicht mit Geld umgehen, findet der ehemalige ...

Recency Bias (Q1/2016)

Recency Bias. We are all prone to recency bias, meaning that we tend to extrapolate recent events into the future indefinitely. Following the January 2016-sell-off period:

The peak recommended stock weighting came just after the peak of the internet bubble in early 2001 ...

The peak recommended stock weighting came just after the peak of the internet bubble in early 2001 ...

Mister Market (Psychogram)

In the investment world, we were first introduced to Mr. Market by Benjamin Graham in his 1949 book, The Intelligent Investor. Graham’s mentee, Warren Buffett, still calls this book "by far the best book on investing ever written."

Further he states that "chapters 8 ...

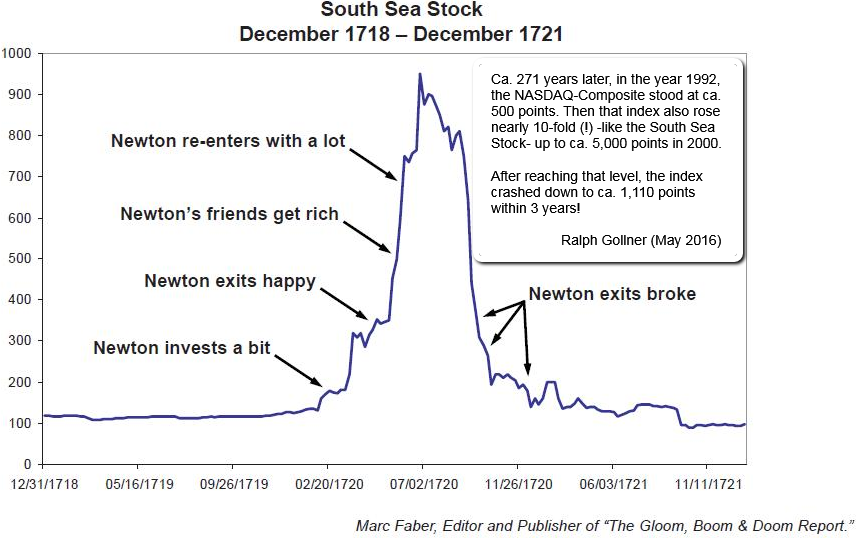

Bubbles (comparison years 1721 versus 2000)

South Sea Stock versus NASDAQ-Comp.

Bubbles can hit anyone! For practitioners of Schadenfreude, seeing high-profile investors losing their shirts is always amusing. But for the true connoisseur, the finest expression of the art comes...

...when a ...

Künstliche Intelligenz

Roboter vermehren das Geld

Wer den Namen Bernhard Langer hört, denkt vermutlich zuerst an Deutschlands berühmtesten Golfspieler. Etliche Anleger kennen aber noch einen anderen Bernhard Langer - er ist Fachmann für computergestützte Anlagestrategien.

Bild-quelle: ...

Bild-quelle: ...

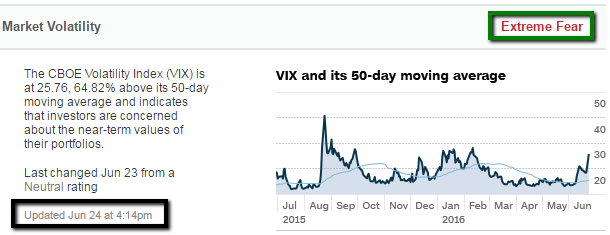

Fear & Greed Index (three indicators selected)

post Brexit (26th June 2016)

Investors are driven by two emotions: fear and greed. Too much fear can sink stocks well below where they should be. So what emotion is driving the market now? CNNMoney's Fear & Greed index makes it clear.

They look ...

Wissen ist nicht gleich "wissen"

Intelligenz bzw. Schläue spielt für uns in der Arbeitswelt eine wichtige Rolle. Doch der höchste Intelligenzquotient und das größte Allgemeinwissen bringen nichts, wenn nicht danach gehandelt wird. „Dumm ist der, der dummes tut“, sagt Forrest Gump...

...in ...

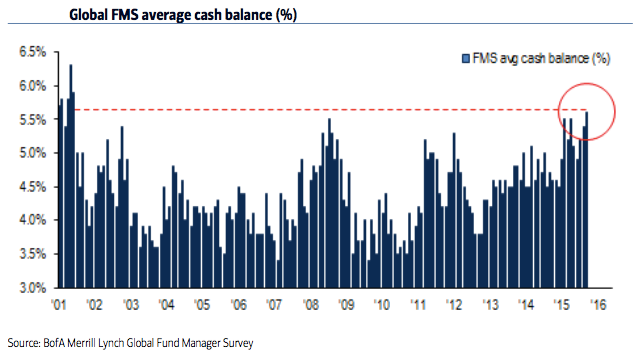

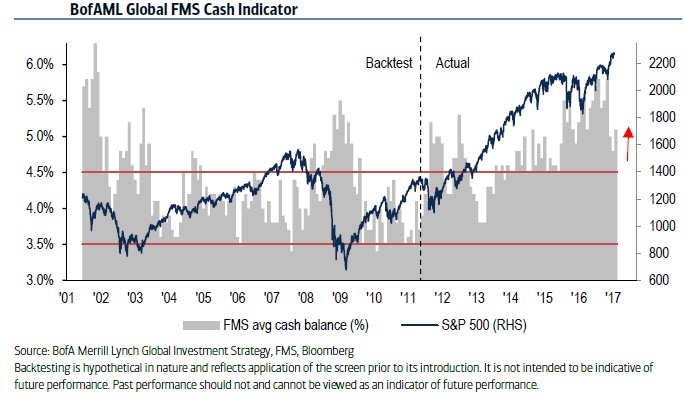

BOFA Fund Manager Survey (July 2016)

Cash levels at a 15-year high

Despite the post-Brexit market rally, fund managers have gotten even more wary of taking risks. Following Long-Term chart still shows the elder, lower reading of 5.6%, the most recent reading is now 5.8%.

The S&P 500 has ...

Viele Crashgurus unterwegs (Aug. 2016)

Aktuelle Stimmen aus der Börsenwelt (Mitte Aug. 2016):

-) Experten bezweifeln, dass der DAX 30 seine Rally nach dem Jahreshoch fortsetzen wird.

-) Das Jahreshoch des DAX 30 ist kaum von Bedeutung.

-) Experten geht die Rally zu schnell...

-) Kurse haben sich ...

Einige Todsünden des DURCHSCHNITTSANLEGERS!

Ausschweifung, Maßlosigkeit, Habgier, Faulheit, Zorn, Neid und Hochmut. Die 7 Todsünden lassen sich auch auf das Anlageuniversum übertragen. FundResearch und Aberdeen Asset Management zeigen warnende Beispiele, die jeder Investor beherzigen sollte.

...

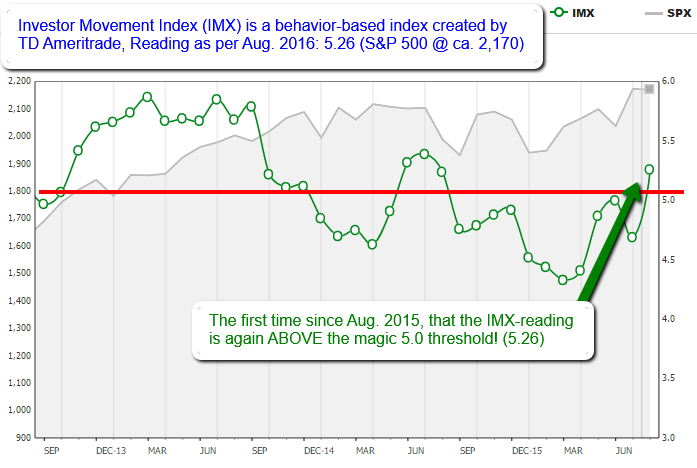

Investor Movement Index (IMX)

The Investor Movement Index, or the IMX, is a proprietary, behavior-based index created by TD Ameritrade designed to indicate the sentiment of retail investors. The IMX saw its largest ever single month increase in August as volatility hit a two-year low!

TD ...

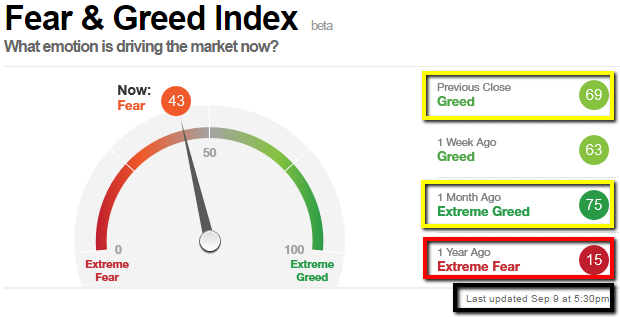

Fear & Greed (43 versus 69)

Now, that the Fear & Greed Index of http://money.cnn.com/data/fear-and-greed has fallen below the "50-points-threshold" this could give the markets the chance to breathe through for regaining momentum for the later months of the year 2016.

As can be seen from the ...

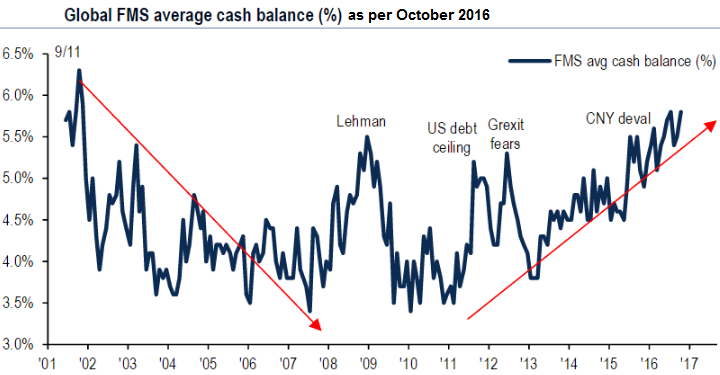

BOFA Fund Manager Survey (Oct. 2016)

Cash Allocations are Close to 15-Year Highs

Cash levels jumped from 5.5% in September to 5.8% in October 2016. Investors' average cash balance was last this high in July 2016 (post-Brexit vote) and in Fall 2001.

More precise: The share of cash hasn't been ...

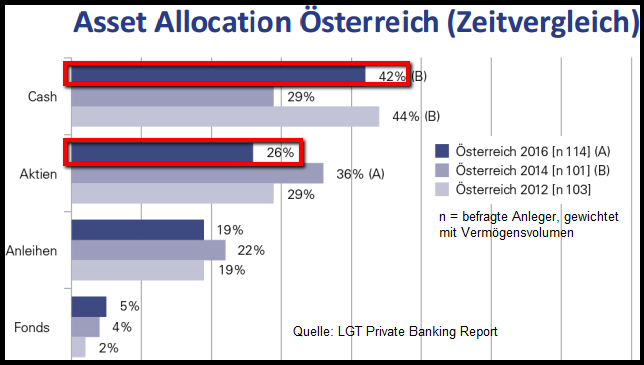

LGT Private Banking Report 2016

Studie im Auftrag von LGT; Durchführung: Abteilung für Asset Management der Johannes Kepler Universität Linz Leitung Univ.-Prof. Dr. Teodoro D. Cocca. Ziel: Befragung zum Kundenverhalten von Private-Banking-Kunden in Österreich, Deutschland und der Schweiz.

...

...

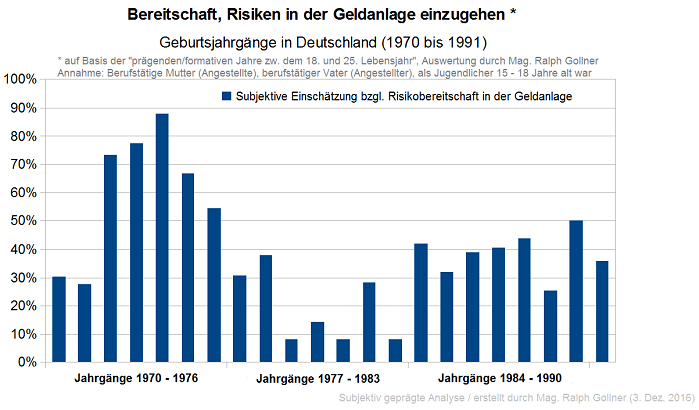

Behavioral Finance versus starrer Regulierungs-Wut?! Plausible/"Korrekte" Einschätzung vom Risiko und Wissen um die eigene Risikoaversion sind bei der Geldanlage unverzichtbare Bausteine, um eine passende mittel- bis langfristige Strategie erstellen zu können, die zur individuellen Person ...

Investing in the Rearview Mirror

(Hindsight-Bias)

"In the business world, the rear view mirror is always clearer than the windshield." W. Buffett; "You can't see the future through a rearview mirror" Peter Lynch; "Too often, investors are more inclined to look at the rearview mirror...

...

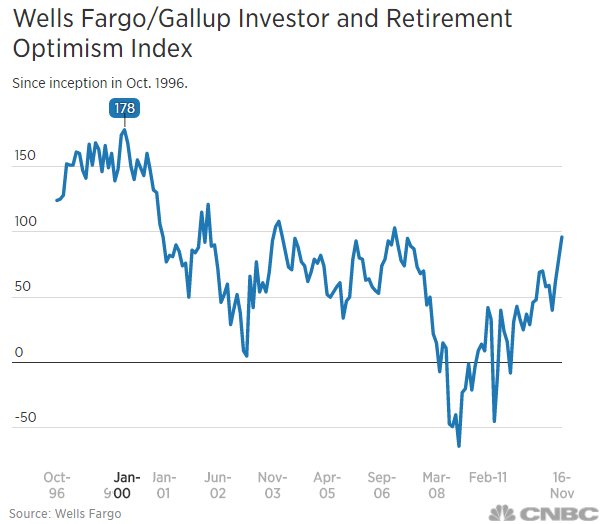

Positive Gallup Surveys (Nov./Dec. 2016)

-) Wells Fargo/Gallup Small Business Index at highest level since January 2008

-) Gallup Investor and Retirement Optimism Index jumps to 9-year high

Individual investor optimism jumped to a nine-year high in November 2016, according to the Wells ...

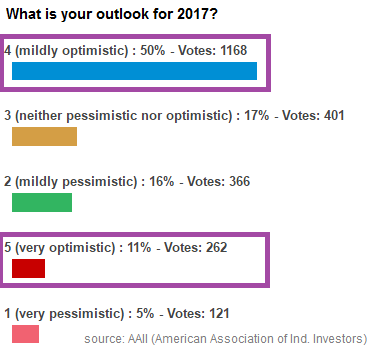

Shiny, happy people (!?)

Optimistic Individual Investors

The American Association of Individual Investors is regularly asking its members for feedback on their surveys. At the start of the year they asked following, more focused: the possible annual return of the S&P 500; But first:

Only 21% ...

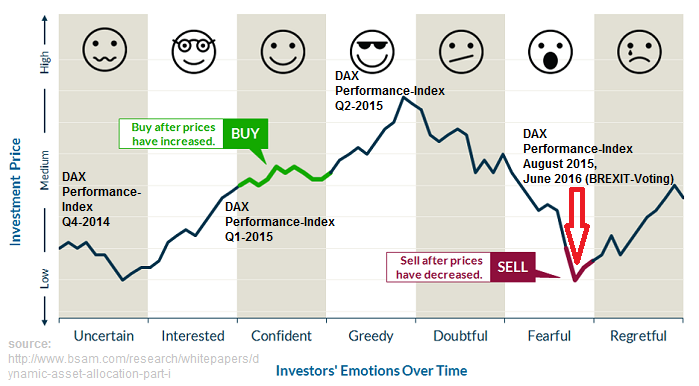

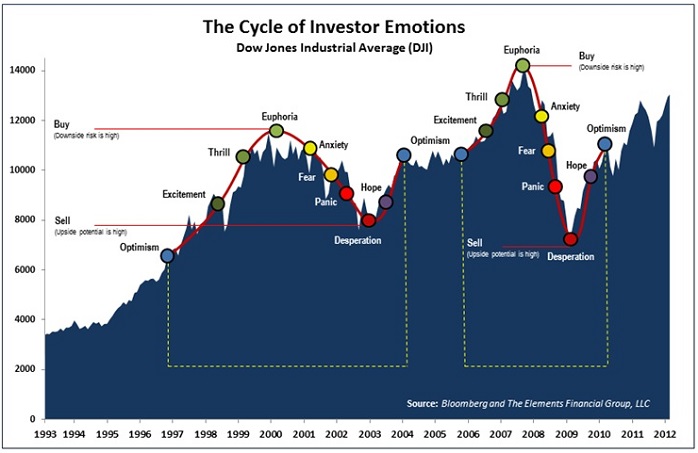

Emotions and DAX-Index

(Q4-2014 - Q4-2016)

A team of personal trainers, scientists and nutritionists can design the most sophisticated diet and exercise plan but it will have no chance of success if it is impractical for most people to follow.

Therefore it is of utmost importance to ...

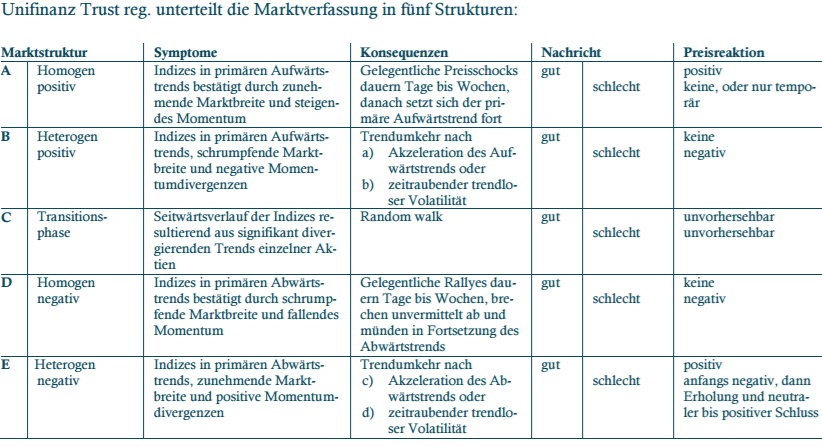

Marktstruktur, Marktbreite

(Phasen A bis E)

Die Aktienmärkte befinden sich evtl. noch immer in einer Transitionsphase (C-Struktur). Diese kann in einen Bullenmarkt münden, wenn es zu einer positiven Überraschung kommt, wie z.B. zu einer technologischen Innovation, die...

...ähnliche ...

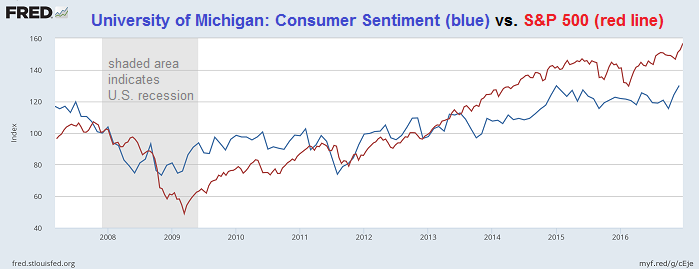

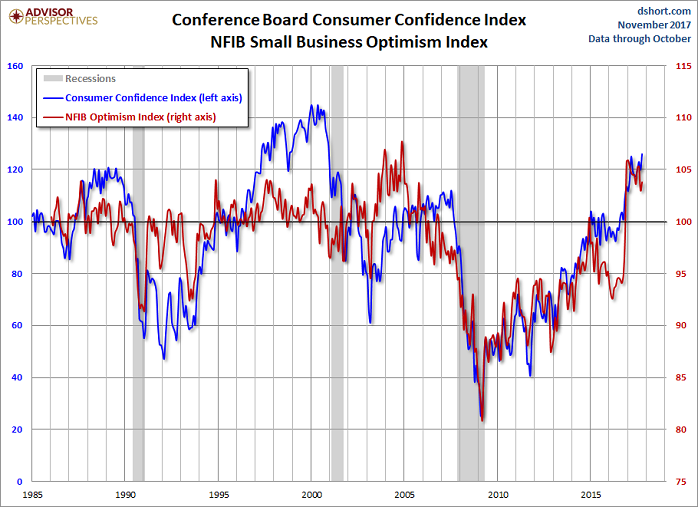

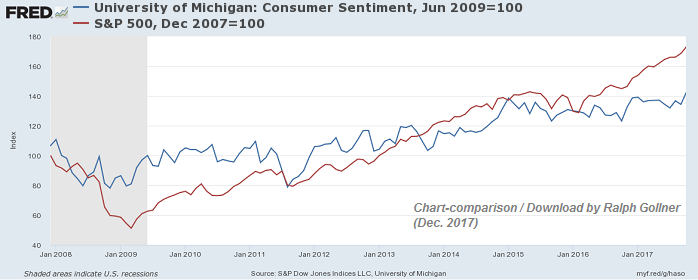

Consumer Sentiment vs. S&P 500

I created a chart comparing the Michigan Consumer Sentiment versus the U.S. Stock market (S&P 500) since the last recession (2008/2009). For the moment (Q1-2017) it seems that the famous "Animal spirits" have taken over...

The final reading of the University ...

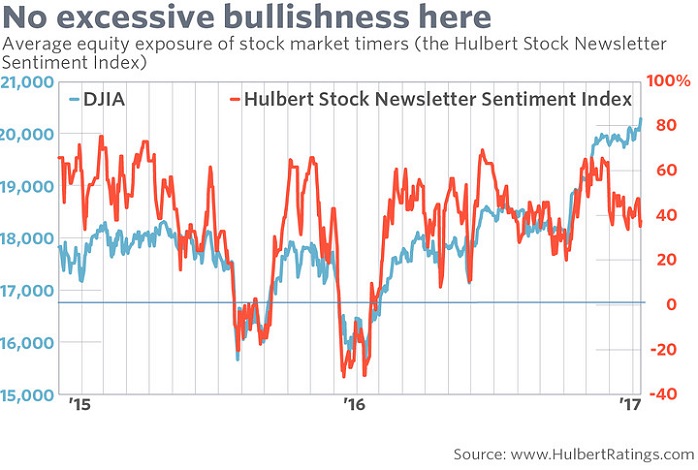

Stock Newsletter Sentiment

(HSNSI, Mark Hulbert)

Stock-market timers grow cautious, and that's good for equities. Market tops are usually characterized by stubbornly held bullishness, but that’s not what we're seeing today. Stock-market timers have been turning remarkably cautious. It's...

...

Cash Indicator and other great stuff from BofAML

(Jan./Feb. 2017)

The BofAML Fund Manager Survey (FMS) is a monthly survey of 200-250 primarily long-only investors. One of the key questions in this survey asks for cash balance as % of assets under management. A low cash balance indicates...

...

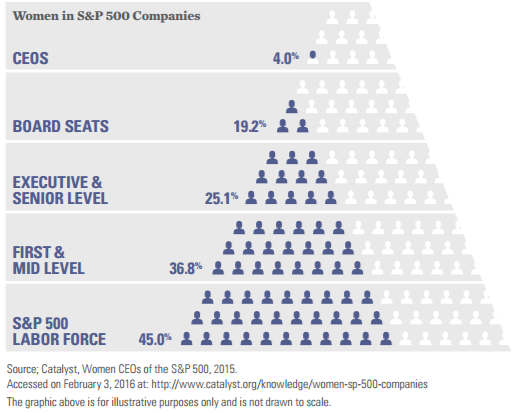

Why Invest in Women?

Research shows that companies that embrace gender diversity on their boards and in management often experience improved performance and profitability as a result. Consider the following: Invest in companies with women in CEO, board, or senior level positions, thereby...

...

...

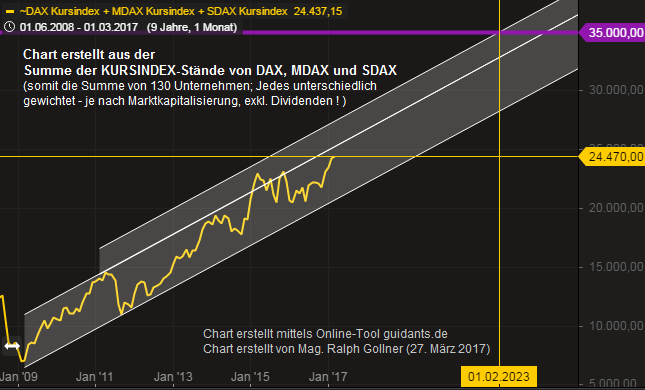

"Made in Germany"

ist das beliebteste Label der Welt

Für mich ist es glasklar: Warren Buffet hat einen Home-Bias (gerechtfertigt oder nicht will ich nicht beurteilen). Haben wir in Österreich & Deutschland auch einen Home-Bias? Wenn ja, gerechtfertigt? Die US-Wirtschaft würde gerne...

...

"Unser Gehirn kann nicht mit Geld umgehen, daher sind wir Idioten der Kapitalanlage":

So der Ex-Banker Roland Ullrich, der sich nun nach seinem Ausstieg aus der Banker-Welt, der Verhaltensökonomie und Hirnforschung verschrieben hat. Aus dem Literarischen wissen wir vom Rat eines guten...

...

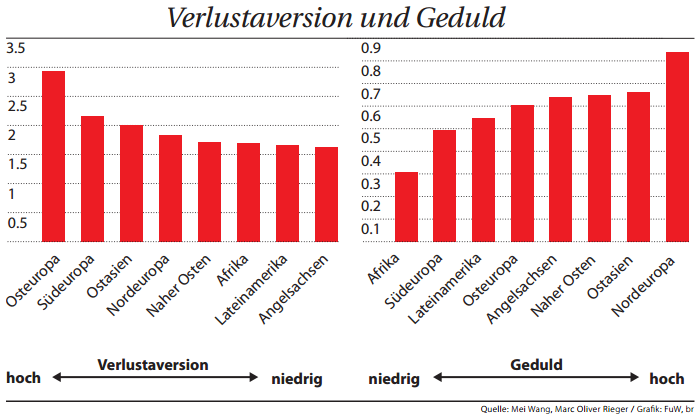

"Wie Kultur die Anleger beeinflusst"

Kulturelle Unterschiede auch in Finanzfragen - Nordeuropäer cool/er (geduldig)

Trotz der fortschreitenden Globalisierung gibt es weiterhin kulturelle Unterschiede. Auf der Welt werden rund 6.500 Sprachen gesprochen, die Essgewohnheiten sind...

...

Psychologie & DAX

In persönlichen Gesprächen höre ich in letzter Zeit oft: Die Aktien steigen doch immer die letzten Jahre - "ist ja ganz einfach". Nun, so einfach ist es wohl nicht. You gotta have SKIN IN THE GAME ! Eine einfache Stütze ist jedoch ein langfristiger Anlagehorizont!

"It's ...

Mr. Market

"Remember that the stock market is a manic depressive." (Warren Buffett)

Rules of logic often don't apply SHORT-TERM in investment markets. The well-known advocate of value investing, Benjamin Graham, coined the term "Mr. Market! (in 1949) as a metaphor to explain the stock market.

...

...

Home Bias versus Cosmopolitan

Everyone is guilty of home country bias, let's be different:

Try to invest/be(come) COSMOPOLITAN !

For many people, there's no place like home. But if you're only investing at home, first: you are taking high(er) risks and 2nd sometime you're missing out...

...

Wie viele Gefühle hat der Mensch?

Vorab stellt sich die Frage, wie relevant diese Frage für die "Behavioral Finance" ist? Nun, nicht nur für die Verhaltensökonomie ist die Auseinandersetzung mit Gefühlen extrem wichtig, auch für alle anderen Bereiche! Jeder hat Gefühle, aber...

...für viele ...

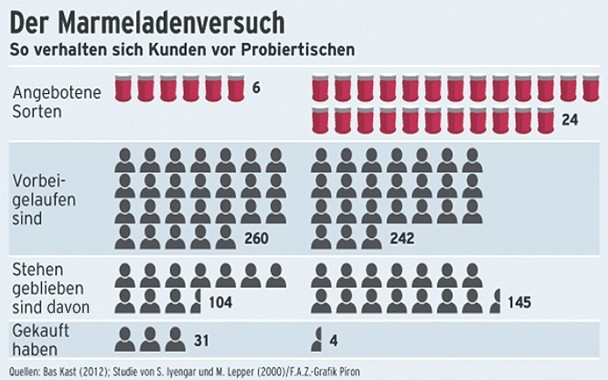

Der Marmeladenversuch oder

"Die Qual der Wahl"

In den Medien machen öfter Artikel die Runde, die zum Gegenstand die Neuroökonomie haben. Solche Artikel tragen zum Beispiel Überschriften wie "Gibt es ein schlaues Verhalten?" Für die Börse ist diese Thematik ein gefundenes Fressen. Denn...

...

Artificial Intelligence and the

Investment process

Using Artificial Intelligence (AI) in investment management is a possibility; But there are many aspects in the investment process where AI can and cannot function as a support. Even the most sophisticated machine learning...

...technologies ...

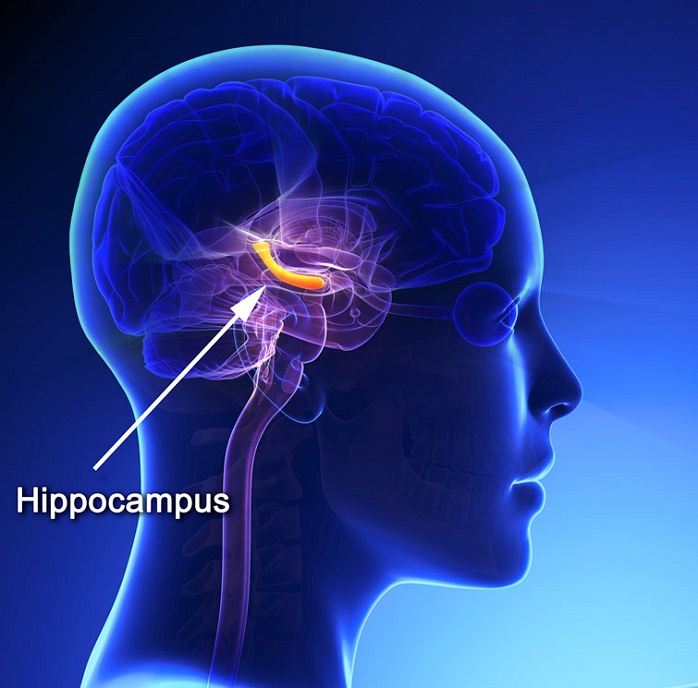

Hippocampus and the

"Whole-Brain State"

Imagine this: You've just had your largest loss ever (or big one), and you are feeling incredibly risk averse, almost to the point where nothing looks good to invest your money "now". With each new opportunity that comes, you find yourself...

...still ...

Herd behavior

This effect is evident when people do what others are doing instead of using their own information or making independent decisions. The idea of herding has a long history in philosophy and crowd psychology.

It is particularly relevant in the domain of finance, where it has ...

US-Consumer confidence

"Consumer confidence increased for a fifth consecutive month and remains at a 17-year high," said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions improved moderately, while...

...their expectations ...

FLOW

Optimal state of consciousness

(Intelligent Risk-Taking "can" go up, Creativity goes up)

Flow ist ein Zustand höchster Konzentration auf eine Aufgabe. Fast so, als wenn du in einer Blase sitzen würdest; Du nimmst die Dinge um dich herum nicht mehr richtig wahr. Sie werden zum...

...

Konsumentenvertrauen (U.S.A.)

Conference Board-Consumer Confidence (Michigan Consumer Sentiment); Das Conference-Board Verbrauchervertrauen misst das Level des Verbrauchervertrauens in wirtschaftlichen Aktivitäten. Es ist ein leitender Indikator, da es die Verbraucherausgaben...

...

Ein guter Ratschlag von "onemarkets"

Guter Rat ist also doch nicht teuer...

Hier von www.onemarkets.de

Sollten trotz des Hitzewitters die -doch unvermeidlichen- Sommergewitter auftreten, dann bitte nicht vergessen: Obwohl der DAX in den letzten 5 Jahren angestiegen ist, hat er in diesem ...

Volumen bei vier Aktien

(exemplarisch für viele USD-Aktien am Freitag, 15. Mai 2020)

Das Handelsvolumen oder Volumen ist die Anzahl der Aktien, die die Gesamtaktivität eines Wertpapiers oder eines Marktes

für einen bestimmten Zeitraum angibt. Das Handelsvolumen ist ein technischer...

...

Blasen am Aktienmarkt als Zeichen von Kapitalmarktanomalien

(Märkte sind wohl doch nicht so effizient)

In medias res: Rationale/fast rationale Blasen & Intrinsische Blasen sind nur zwei Varianten von grundsätzlich vier "Blasenarten". Wir werden uns diese beiden etwas näher anschauen; Eine...

...

...

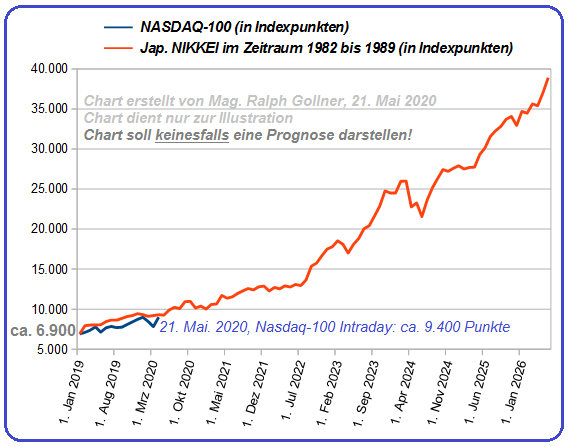

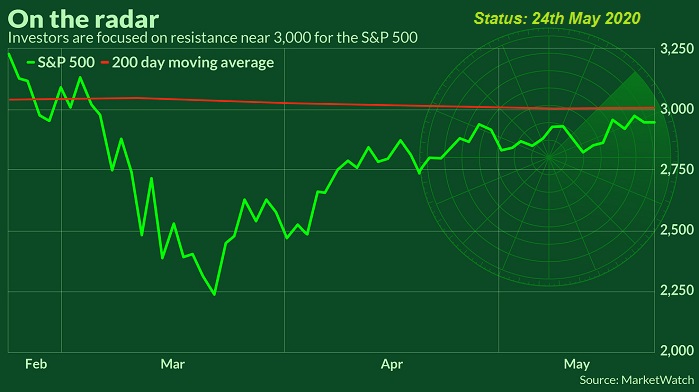

Magic 3k-level (S&P 500)

and 25k in the Dow Jones Industrial Average

Just looking at the market in these times, one thing jumps out across the charts. S&P 500 and the old Dow Jones Industrial Average are near round number-levels today. What I mean is near...

...price levels ending in zero ...

Charlie Munger - RIP

With 99 years of age Charlie Munger, the right Hand of Warren Buffet passed away on the 28th Nov. 2023. Following short 33-Minutes long podcast (pl. click here below) was recorded in the year 2015, where Ten Griffin give us -also- some insights into the thinking of ...