Related Categories

Related Articles

Articles

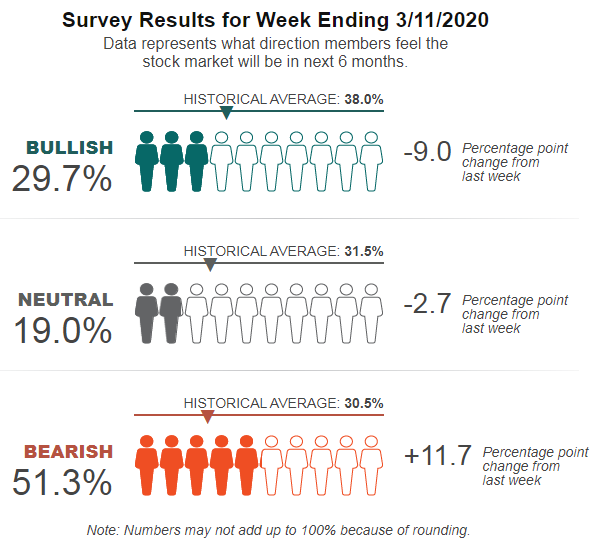

AAII Sentiment Survey (12th March 2020)

The percentage of individual investors expecting stocks to fall over the short term is at its highest level in seven years! The latest AAII Sentiment Survey also shows a steep drop in optimism and a continued decline in neutral sentiment...

Bullish sentiment, expectations that stock prices will rise over the next six months, plunged 9.0 percentage points to 29.7%. The drop more than reversed last week's gain and put optimism at its lowest level since 9th October 2019 (20.3%). The historical average is 38.0%.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, fell by 2.7 percentage points to 19.0%. Neutral sentiment was last lower on December 26, 2018 (18.2%). This week's drop keeps neutral sentiment below its historical average of 31.5% for the eighth time in nine weeks.

Bearish sentiment, expectations that stock prices will fall over the next six months, soared 11.7 percentage points to 51.3%. Pessimism was last higher on 11th April 2013 (54.5%). The large increase keeps bearish sentiment above its historical average of 30.5% for the fifth time in seven weeks.

Pessimism is now as per Thursday (12th March 2020) at an unusually high level (more than one standard deviation above the historical average).

The big jump in pessimism is a reflection of the downside volatility one has seen in the market, the COVID-19 (coronavirus) pandemic and the oil price cut announced by Saudi Arabia. Other factors influencing individual investors' sentiment include the November elections, corporate earnings, economic growth and valuations.