Related Categories

Related Articles

Articles

AAII Investment Survey

17th June 2020

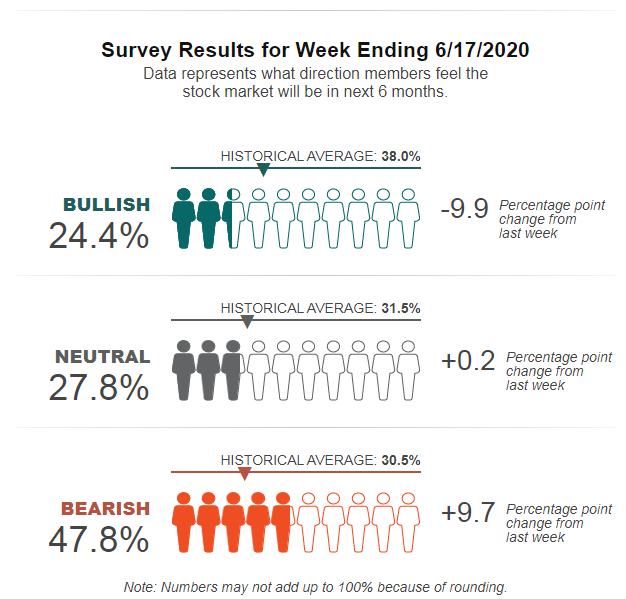

Bullish sentiment, expectations that stock prices will rise over the next six months, fell 9.9 percentage points to 24.4%. Optimism remains below its historical average of 38.0% for the 15th consecutive week and...

...the 20th week this year.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, edged up 0.2 percentage points to 27.8%. Neutral sentiment was last higher on February 26, 2020 (30.4%). Even with the continued increase, neutral sentiment is below its historical average of 31.5% for the 18th consecutive week and the 22nd time in 23 weeks.

Bearish sentiment, expectations that stock prices will fall over the next six months, jumped 9.7 percentage points to 47.8%. Bearish sentiment is above its historical average of 30.5% for the 17th consecutive week.

Optimism is back at an unusually low level (more than one standard deviation below its historical average). Pessimism is back at an unusually high level. Historically, both have generally been followed by above-average and above-median returns for the S&P 500 index, though the link is stronger for unusually low bullish sentiment than it is for unusually high bearish sentiment.

The current level of pessimism reflects the coronavirus pandemic and concerns about the economy. However, some AAII members have been encouraged by the rebound in the stock market from its March lows. Other factors influencing AAII members' sentiment include the economy, corporate earnings, the November U.S. presidential election and interest rates.

Background info:

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors.

The AAII Investor Sentiment Survey has become a widely followed measure of the mood of individual investors. The weekly survey results are published in financial publications including Barron's and Bloomberg and are widely followed by market strategists, investment newsletter writers and other financial professionals.