Related Categories

Related Articles

Articles

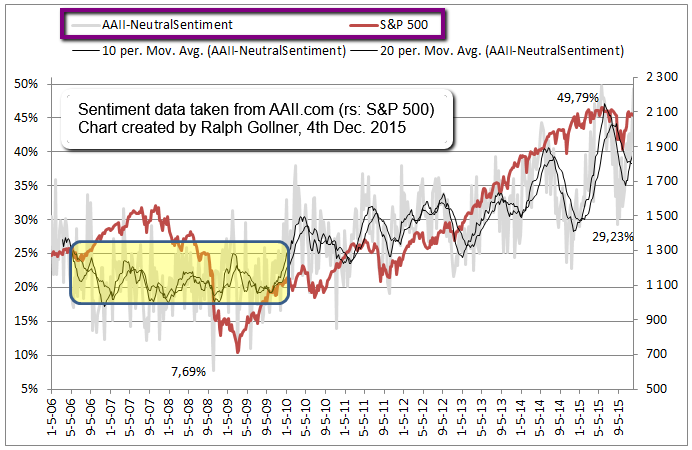

AAII Neutral Investor Sentiment (2006-12/2015)

The percentage of individual investors describing their six-month outlook as "neutral" is at its highest level since May 2015. The surge in neutral sentiment occurred as both optimism and pessimism fell.

AAII Sentiment Survey (3rd Dec. 2015), text-source/adapted: http://www.aaii.com

Bullish sentiment, expectations that stock prices will rise over the next six months, declined 2.9 percentage points to 29.5%. Optimism was last lower on 30th Sep. 30, 2015 (28.1%). This is the 37th out of the past 39 weeks with a bullish sentiment below its historical average-level of 39.0%.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, jumped 7.7 percentage points to 49.3%. The spike puts neutral sentiment at its highest level since 21st May 2015 (49.8%). It also keeps neutral sentiment above its historical average of 31.0% for the 12th consecutive week and the 46th week this year.

Bearish sentiment, expectations that stock prices will fall over the next six months, fell 4.8 percentage points to 21.2%. This is a four-week low. The drop keeps pessimism below its historical average of 30.0% for the 10th time in the past 12 weeks.

Neutral sentiment has now been above 40% for the fourth time in five weeks. Readings above 39.7% are unusually high (more than one standard deviation above the historical average) and have been associated with above-average market returns over the following six and 12-month periods!

Individual investors’ aggregate expectations for stock market returns continue to exhibit signs of restraint. Some AAII members are optimistic about the possibility of future gains, while others fret about further declines. The ability of the S&P 500 to continue trading near its record high, seasonal trends and potentially better-than-forecast third-quarter earnings surprises are having a positive impact. Conversely, concerns about third-quarter earnings, the pace of U.S. economic growth, geopolitics, monetary policy and U.S. politics are having a negative impact.

The most recent special question asked AAII members how third-quarter earnings impacted their outlook for stock prices. Nearly one of three respondents (29%) said that third-quarter profit reports have not caused them to alter their outlook. Several of these individual investors said that they maintain a long-term focus. About 22% said earnings had a negative effect. Some said that they reduced their expectations for stock prices as a result of third-quarter profit reports, while others said that the declines in earnings could lead to a reduction in stock prices. More than 13% said that they are more optimistic, mostly because of earnings growth.