Related Categories

Articles

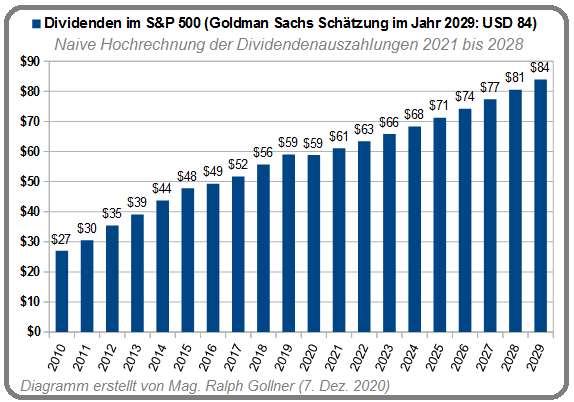

Dividenden im S&P 500 (2010 bis 2029)

Naiver linearer Anstieg der Dividenden bis in das Jahr 2029(!), folgend der Prognose von Goldman Sachs führt zu folgendem Diagramm im S&P 500. Die aktuelle Dividendenrendite im S&P 500-index bewegt sich bei circa 1,60%.

Lassen wir uns überraschen, ob die lineare Dividendenanhebung in der letzten Dekade sich im Zeitraum 2021 bis 2029 wiederholen kann!

Shareholder Yield

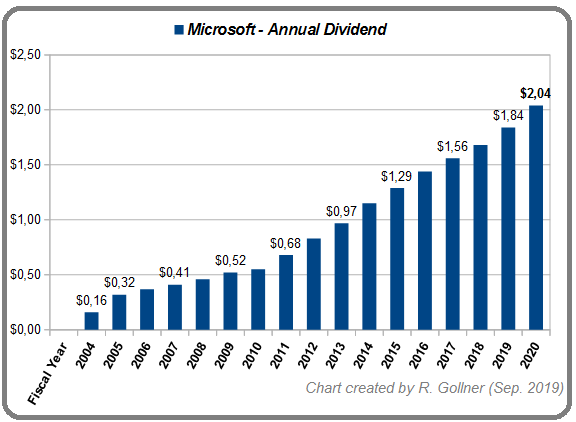

(Microsoft)

Dividends are the most common method that a company can use to return capital to shareholders. Dividend growth investors often place significant emphasis on dividend yields and dividend growth as a result. However, there are additional ways...

...for companies to create value for shareholders. In addition to dividends, share repurchases are also an important part of a healthy capital return program. Debt reduction should also be welcomed by investors. Here one example:

Microsoft Corporation, founded in 1975 and headquartered in Redmond, WA, develops, ...

Advantages of Using Yield on Cost

Upfront info: In the long run (> 10 years) there are many forces driving a Portfolio-Performance.

Here just one of the most logic ones: The yield on cost can be useful in assessing how productive an existing investment has been at providing income...

...in the past. If you're looking to see how much income you're receiving based on your original investment, yield on cost is a way of determining that. Yield on cost is also an easy way to gauge the dividend growth of stock investments retroactively.

For example (see also my following illustration where ...

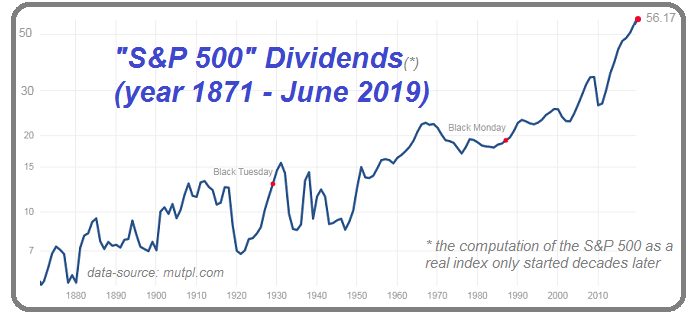

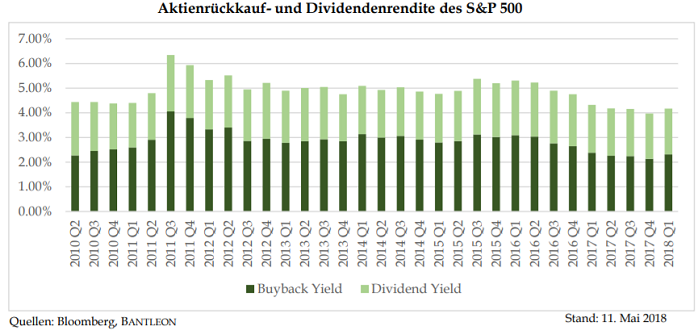

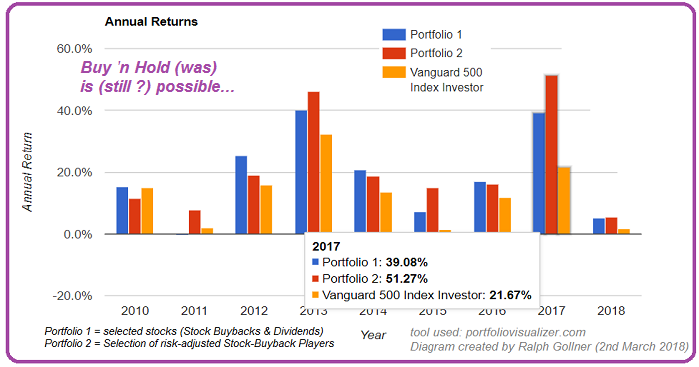

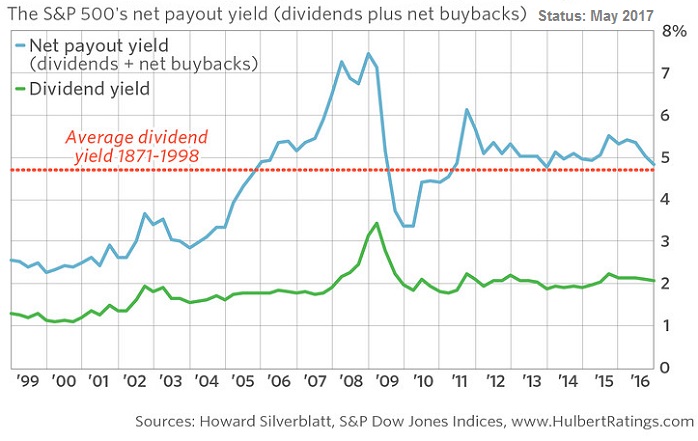

Buyback yield + Dividend yield

Recheck the total amount that companies are returning to shareholders - a total that includes both dividends and share repurchases (or buybacks). Up until several decades ago, dividends were the predominant way in which companies returned cash to...

...shareholders, so up until then the dividend yield was a good approximation of shareholder yield (also known as payout yield).

Since then, however, the dividend yield has become less of a good proxy for payout yield, since companies have increasingly turned to buybacks as a way of returning cash to ...

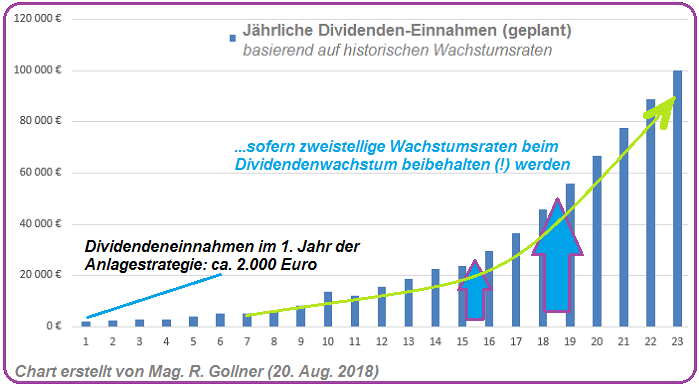

Dividendenzahlung ist (ein) passives Einkommen!

Wichtiger als die blosse Dividendenrendite ist (wohl) das jährliche Dividendenwachstum. Nach 23 Jahren hätte man im Beispiel anbei eine "persönliche" Dividendenrendite von...

...100% (sofern wir von einem Startkapital von EUR 100.000,-- ausgehen) - gerechnet auf den Einstandskurs im Jahr 1.

Diese "Yield on cost" im Jahr 23 (im Bsp. "freaky 100%") ist unabhängig vom Kursverlauf der Aktien. Es versteht sich jedoch (wohl?) von selbst, dass bei dekadenlangem Dividendenwachstum jedoch ziemlich sicher die dahinterliegende Aktie auch im KURS ...

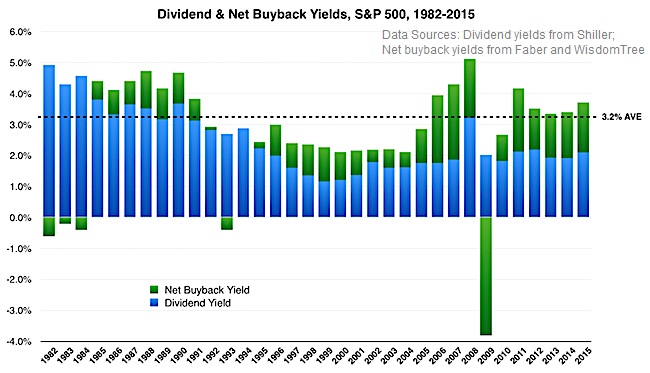

Shareholder Yield

(Buyback yield + Dividend yield)

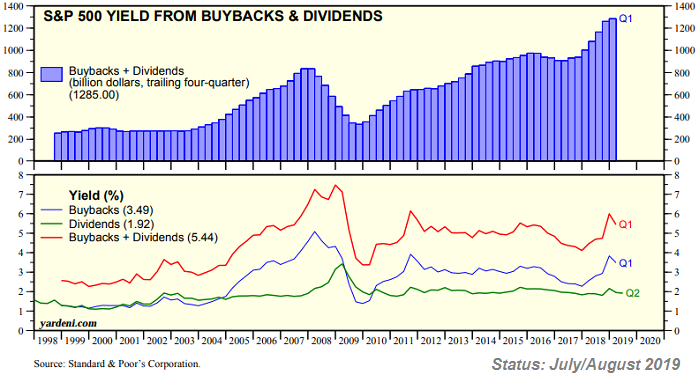

Der Rückkauf eigener Anteile durch die ausgebende Gesellschaft wird je nach Quelle als "Buy Back", "Repurchase" oder "Aktienrückkauf" bezeichnet. Anfang der 1980er Jahre wurden Buy Backs in der US-amerikanischen...

...Wirtschaft erstmals in einem bedeutenden Umfang durchgeführt.

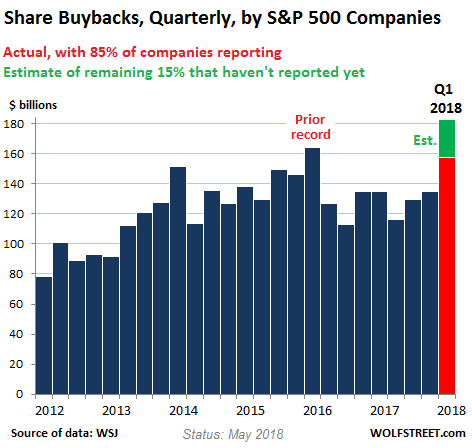

Seitdem zeigt die Nutzung von Rückkaufprogrammen in den USA einen weiteren massiven Anstieg. Die Ausschüttung über Aktienrückkäufe übersteigt mittlerweile die Ausschüttung über Dividenden, wie auch die obige Grafik zeigt.

Mögliche Motive für Rückkäufe

Die ...

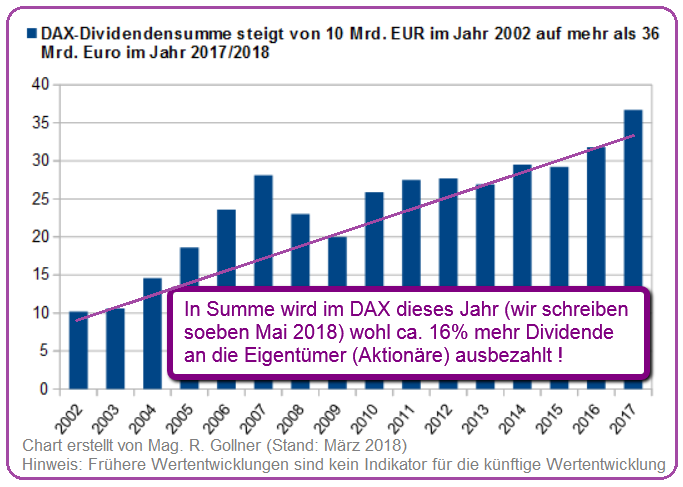

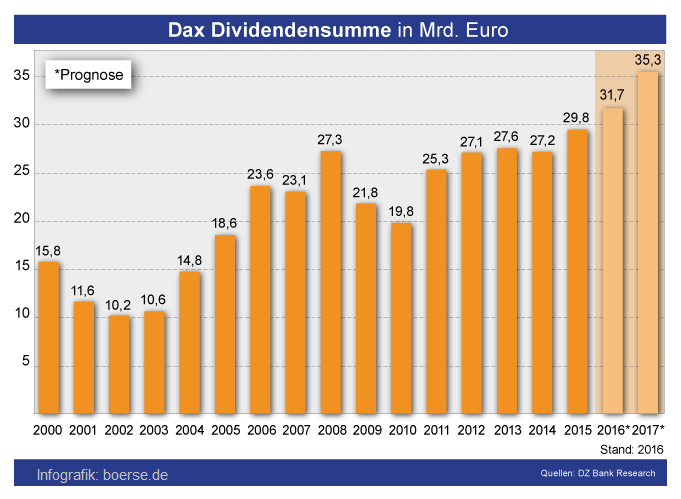

DAX-Dividendensumme

(für das Geschäftsjahr 2017)

Für das Geschäftsjahr 2017 haben ca. 25 Unternehmen Dividendenerhöhungen angekündigt, bzw. bereits die gegenüber dem Vorjahr erhöhte Dividende an ihre Aktionäre ausbezahlt. Somit hat...

...sich die ausbezahlte DAX-Dividendensumme final um mehr als 4,5 Mrd. Euro gegenüber dem Vorjahr erhöht (ein Anstieg von +16%).

"Der starke Dividendenanstieg spiegelt die gute Entwicklung der meisten Dax-Konzerne im operativen Geschäft und auch die sehr gute Gewinnentwicklung wider", erläutert Mathieu Meyer, Mitglied der Geschäftsführung bei Ernst & ...

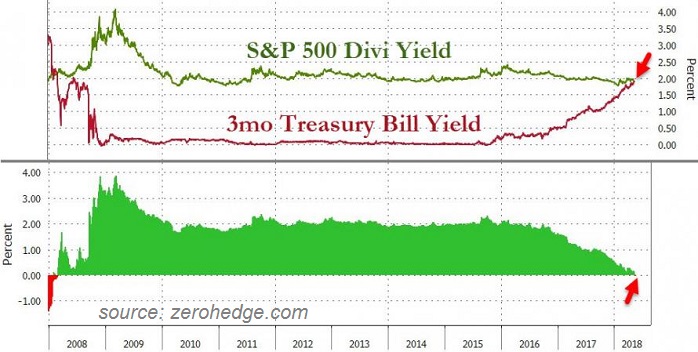

The New Game in town:

3month Yield vs. S&P 500 dividend yield

The United States 3 Month Bill Yield is now sitting at ca. 1.92%. This is a tiny difference to the current S&P 500 dividend yield, which is also hovering around 1.9%. Therefore you could sail the potential tricky summer period...

...along with your US-3month bills and come back in September (2018) or even only in Q4-2018 altogether.

At least you are then sure to avoid potential hickups in the stock market during the summer months via this strategy. Let's see what the big "boys" are doing...

link:

...

Buyback yield

(Aktienrückkäufe / Marktkapitalisierung)

Ca. USD 22,5 Trillionen schwer ist die Marktkapitalisierung des US-Aktienindex S&P 500. Aktienrückkäufe im S&P 500 im Jahr 2018 sollten einen neuen Rekordwert von ca. USD 700 Mrd. bis USD 720 Mrd. erreichen können. Zusammen mit einer...

...aktuellen Dividendenrendite von ca. 1,83% erhält man somit eine "Total yield" von 5,02% (1,83% + 3,19%).

Diese liegt somit weit über einer möglichen 3%-Rendite einer 10jährigen US-Staatsanleihe (Status: Mai 2018).

Nebenrechnung: USD 720 Mrd. / USD 22.560 Mrd = 3,19% (Yield der Aktienrückkäufe / ...

US-Stock Buybacks

(record expected in the year 2018)

S&P 500 companies may buy back a record USD 800 billion of their own shares in 2018, funded by savings on tax, strong earnings and the repatriation of cash held overseas. That will far exceed the USD 530 billion in share buybacks that...

...was recorded in 2017, analysts led by Dubravko Lakos-Bujas wrote in a note. Interesting insight: Stocks with higher buyback yields and new announcements tend to outperform their peers, especially during corrections and recessions. Since they year 2000, those stocks have outperformed peers by 150 ...

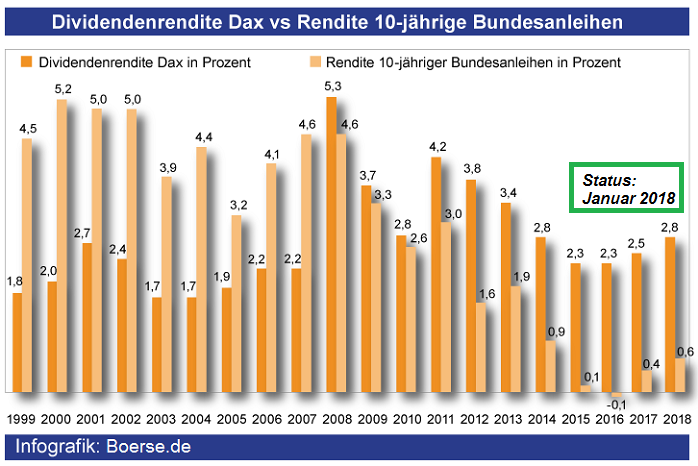

DAX-Dividendendenrendite

versus

10-jährige Deutsche Bundesanleihen

Die Korrektur an den Aktienmärkten hat dazu geführt, dass die Dividendenrenditen wieder etwas gestiegen sind. So bietet der DAX eine Dividendenrendite von etwa 3,2% (aktuell). Als Gegenspieler zu den DAX-Dividenden...

...lässt sich immer einfach die deutsche Bundesanleihe anführen. Die 10-jährigen Deutschen "BUNDs" rentieren aktuell mit ca. 0,65% p.a.

Ergo: 3,2% > 0,65% (eigentlich ohne Worte ;-)

Aktuell liegt eben die Rendite der 10-jährigen Deutschen Anleihen (BUNDs) bei ca. 0,65% per anno. Also erfolgt beim heutigen ...

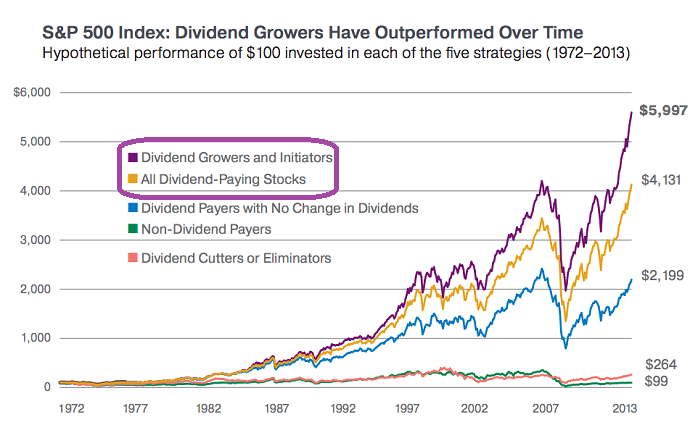

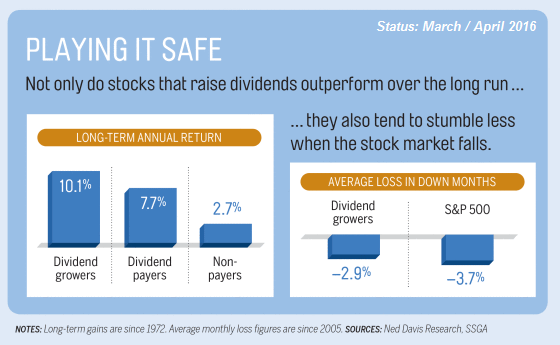

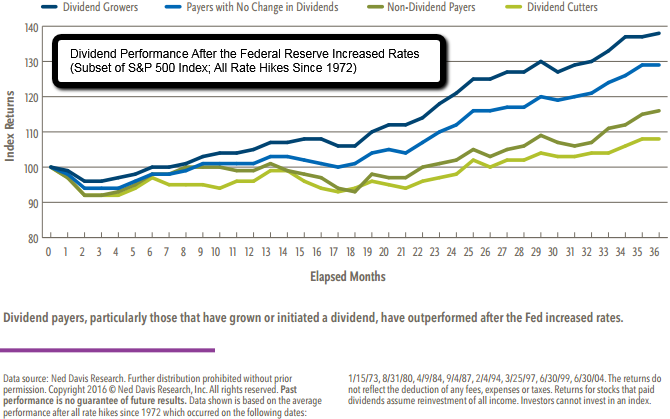

Stocks with Rising Dividends

(Long-Term Returns)

Here's a simple fact that many people don't know: Over the past four decades, stocks with rising dividends outperformed every other type of stock. This 44-year study from Ned Davis Research and Oppenheimer Funds tells a clear story:

In the diagram above one can clearly see that stocks with rising dividends greatly outpaced the stocks that cut their dividends or simply did not offer a dividend in the first place.

What does that mean in real numbers? Here is the answer:

♦ USD 100,000 invested 44 years ago in stocks with no dividends ...

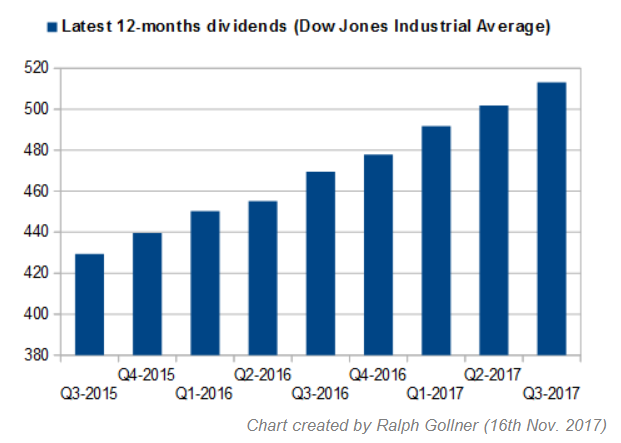

Dow Jones Industrial Average Dividends (2015 - 2017)

quarter over quarter (12-months dividends)

The table shows the the total dividends paid out by the Dow Jones Industrial Average-stocks in the timeframe: Q3-2015 until the most recent quarter Q3-2017 (calculated in Index-points).

The total dividends of the component stocks are based upon the record date and adjusted by the Dow Divisor in effect at quarter end. The payout is calculated as per Dow-Index points and shows the latest 12-months dividends divided.

data-source: www.barrons.com/public

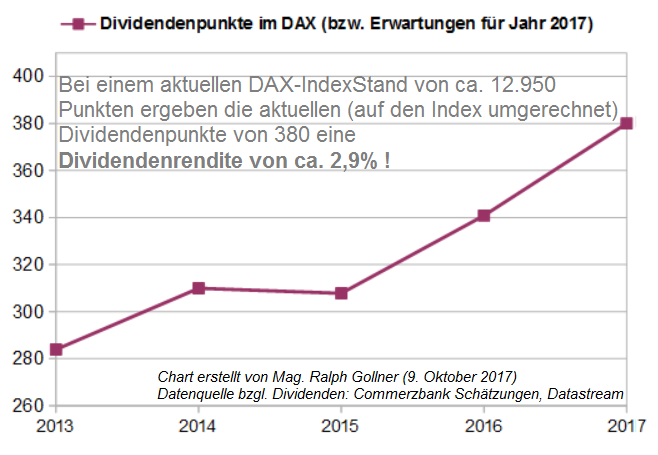

DAX-Dividenden (in Punkten 2013 - 2017)

Als einer der wenigen großen Indizes weltweit wird der DAX, wie ihn die Allgemeinheit kennt, als Performanceindex berechnet. Das heißt, bei dieser Berechnung fließen die Dividenden mit ein. Sie werden als Reinvestment berücksichtigt. Im...

...langfristigen Zeitfenster zeigt sich dadurch eine erhebliche Performancedifferenz zum DAX Kursindex, bei dem die Dividenden eben keine Berücksichtigung finden (Hinweis: "Reinvestment" >> heisst hier, dass Jahr für Jahr die Dividendenauszahlungen wieder in Aktienkäufe reinvestiert werden, somit nicht ...

Dividend growth investing

Dividend growth investing stands the test of time. There is plenty of academic evidence to show that stocks with consistently rising dividend payments tend to outperform the broader stock market. Identifying stocks with strong dividend growth...

...prospects, however, can be difficult. BUT: History is on our side here - dividend history matters. Stocks with long streaks of dividend increases are highly likely to continue increasing their dividends for years to come.

This investment strategy (Dividend growth investing) has been studied/written about since at ...

Inherent in this certain Investment-approach is that 1st: the selected companies are large or mega cap companies and 2nd there is an implied assumption that they will continue to operate as going concerns. So because this strategy is focused on Large Caps, an investor can be comfortable in knowing that there is a good possibility that each of these companies will still be around in a year (Enron and Worldcom, notwithstanding).To put this point into context, note that each of the components selected under this strategy has a market capitalisation in excess of USD 50 billion and revenues of ...

Inherent in this certain Investment-approach is that 1st: the selected companies are large or mega cap companies and 2nd there is an implied assumption that they will continue to operate as going concerns. So because this strategy is focused on Large Caps, an investor can be comfortable in knowing that there is a good possibility that each of these companies will still be around in a year (Enron and Worldcom, notwithstanding).To put this point into context, note that each of the components selected under this strategy has a market capitalisation in excess of USD 50 billion and revenues of ...

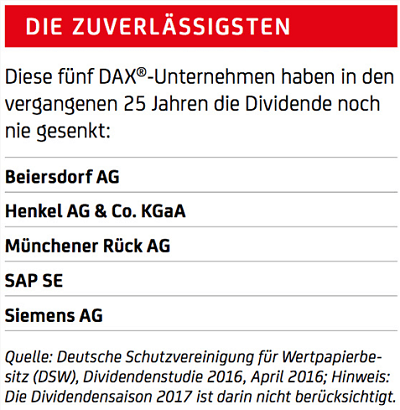

DAX

(Auswahl zuverlässiger Dividendenwerte)

Dividendenwerte sind folgend langfristiger Studien grundsätzlich stabilere Aktien als Aktien von jenen Unternehmen, welche keine Dividenden an ihre Eigentümer auszahlen.

Disclaimer: Ralph Gollner hereby discloses that he directly owns securities of some stocks (Beiersdorf AG, Henkel AG & Co. KGaA, Münchener Rück AG, SAP SE) mentioned above (as per 16th June 2017).

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Die Aktien von Beiersdorf AG, Henkel AG & Co. KGaA, Münchener Rück AG und SAP SE, die in diesem ...

Dividend GROWERS ! (not only payers)

Some ideas: Quality & Dividends (Dividend Growers); Follow Buffett's lead (maybe?). Look for companies with competitive advantages in their industries - what Warren Buffett calls "wide moats" - that keep rivals at bay. Then you may look for...

...businesses with strong balance sheets marked by little or no debt and solid cash flow and earnings. One profit measure one may rely on is return on equity, which gauges how efficient companies are at generating net income. The historical average ROE for U.S. stocks is roughly 10%, so you want to look for ...

Buyback yield + Dividend yield

Recheck the total amount that companies are returning to shareholders - a total that includes both dividends and share repurchases (or buybacks). Up until several decades ago, dividends were the predominant way in which companies returned cash to...

...shareholders, so up until then the dividend yield was a good approximation of shareholder yield (also known as payout yield).

Since then, however, the dividend yield has become less of a good proxy for payout yield, since companies have increasingly turned to buybacks as a way of returning cash to ...

Dividends & Share Buybacks

Equities continue to have a strong cash return story, even with interest rates having moved higher since bottoming last year. The S&P 500 Index sports a current Dividend yield of ca. 2.0%, a level that has been fairly consistent in recent years.

Dividend increases have been running strong since 2011, and one can expect mid- to high-single digit cash dividend growth this year and next as modest economic growth continues. Share repurchases remain an ongoing benefit to valuations as well. When combining net share repurchases with dividend yield, one can ...

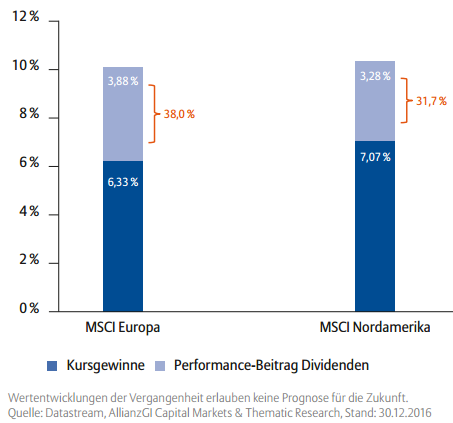

Dividendenhistorie (1971 - 2016)

Dividendenpapiere können Stabilität für's Depot bringen. Im folgenden Schaubild erkennt man den Anteil an der p. a. Gesamtperformance der Dividenden und Kursgewinne 1971 bis Ende 2016 im internationalen Vergleich (annualisiert):

Über den gesamten Zeitraum (1971-2016) war die annualisierte Gesamtrendite der Aktienanlage für den MSCI Europa zu ungefähr 38% durch den Performance-Beitrag der Dividenden getragen. Aber auch in anderen Regionen, wie Nordamerika (MSCI Nordamerika) oder Asien-Pazifik (MSCI Pazifik) war die Gesamtperformance zu ca. einem Drittel ...

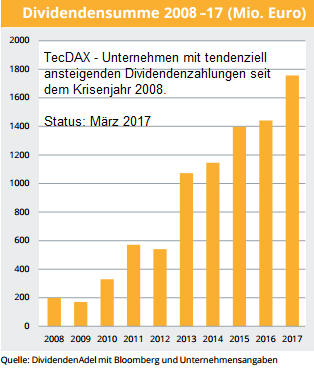

TecDAX und

DIVIDENDEN

Der Anteil der ausschüttenden TecDAX-Unternehmen liegt nun bei 73% (22 von 30) - doppelt so viele Zahler wie im Jahr 2009 und deutlich mehr als im NASDAQ 100 Index, wo die Quote unter 50% liegt!

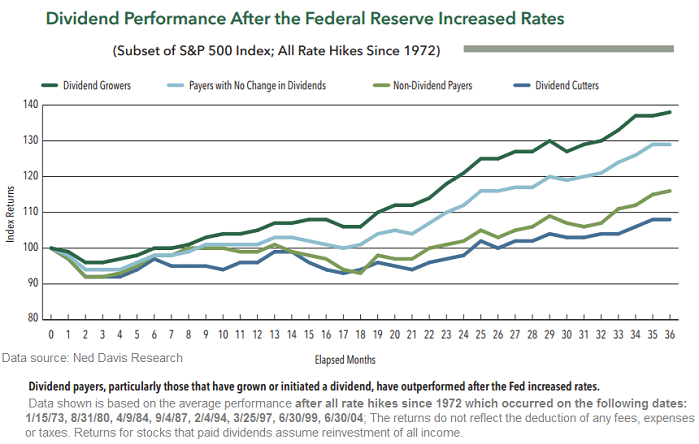

Why stock market investors should not fear

Fed rate hikes

In theory, rising interest rates are supposed to hurt the stock market because it makes interest-rate instruments relatively more attractive and reduces liquidity in the marketplace. But in reality, interest rates and the stock...

...market usually trend in the same direction over the long term. That is because the conditions that lead to higher rates, such as an acceleration in economic growth, also fuel bull markets for stocks, while the drivers of rate cuts, like an impending economic recession, are often behind bear ...

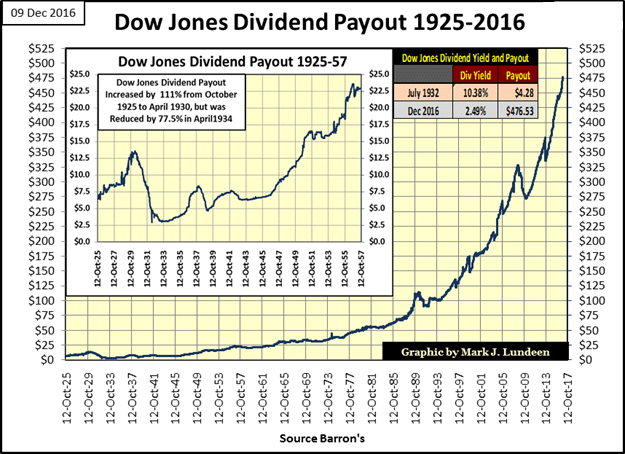

Dow Jones - Dividend Yield

(History)

With the current low yield 10year-Treasuries @ 2.365%, it is not easy to justify putting one's hard earned money (only) into the U.S. Treasury. For investors looking for yield and inflation protection, the current "Dow"-dividend yield...

(see Dow table under following link: http://indexarb.com/dividendYieldSorteddj.html) - plus the potential stock price appreciation - of all 30 Dow Jones Industrial average stocks is looking a lot better than the < 2.4% yield on the 10-year Treasury.

Equities historically outperform bonds. So, the strategy here ...

DAX-Dividendensaison 2017

& Historie

Die Redaktion von finanzen.net erwartet folgende Dividendenbewegungen in 2017. Bei acht DAX-Unternehmen wird es 2017 wahrscheinlich (!) keine Dividendenerhöhung geben, doch glücklicherweise auch keine Kürzungen...

DAX-Schwergewichte wie BASF und Bayer sollten ihre Dividende mindestens konstant halten. So wird der Ludwigshafener Chemiekonzern 2017 eine Dividende von 2,90 Euro bezahlen und die Konkurrenz aus Leverkusen mindestens 2,50 Euro.

DAX-Schwergewichte wie BASF und Bayer sollten ihre Dividende mindestens konstant halten. So wird der Ludwigshafener Chemiekonzern 2017 eine Dividende von 2,90 Euro bezahlen und die Konkurrenz aus Leverkusen mindestens 2,50 Euro.

Bei dem Konsumgüterkonzern Beiersdorf wird sich die Dividende auch im nächsten Jahr auf mindestens 0,70 Euro ...

DAX-Dividendenrendite (1998-2016)

In der Regel erhalten Aktien-Investoren einmal im Jahr eine Dividende. Allerdings schwanken die Kurse von Aktien, sodass die tatsächliche Rendite nur schwer prognostizierbar ist. Per Sep. 2016 rentiert das deutsche Leitbarometer mit ca. 2,95 Prozent.

Gemessen an den letzten 20 Jahren liegt die Dividendenrendite damit vergleichsweise hoch. Es gab nur wenige Zeiträume, in denen ein Aktieninvestment aus diesem Blickwinkel betrachtet attraktiver gewesen wäre. Kurzfristig, rund um die Finanz- und Eurokrise, lagen die Renditen gar noch höher, teilweise ...

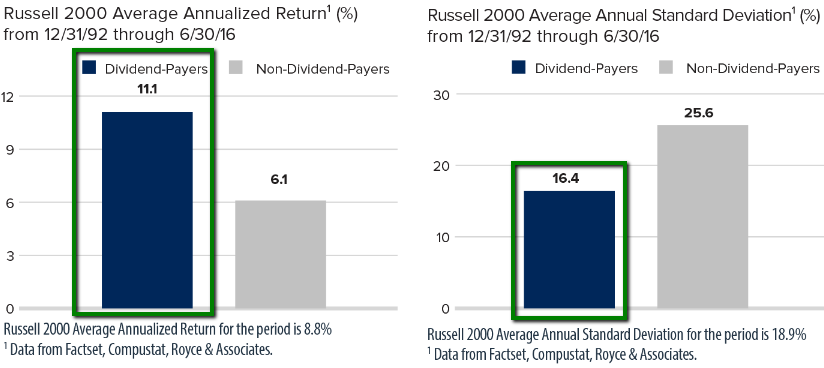

Dividend-Paying Small-Caps (Russell 2000-components) outperformed...

Non-Dividend-Paying Small Caps WITH LOWER VOLATILITY! Standard deviation is a statistical measure within which total returns have varied over time. The greater the standard deviation, the greater a stock's volatility.

If you look at the Russell 2000 (Small-Cap-Index) over time and you slice it into the companies that pay dividends and the companies that don't pay dividends, over time the dividend-paying companies have done better. The dividend-paying companies have had less volatility. And particularly in the down ...

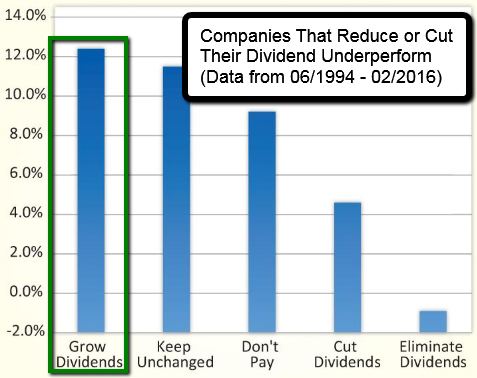

Dividend Growers outperform "the rest"

There is the existence of a return penalty for seeking out too high of a dividend-yield. Why would this be the case? Yield can be a proxy for risk. Stocks with the highest yields are those most likely to be perceived as risky by investors...

Source: "Investment Strategies for Non-Dividend Payers,"

Source: "Investment Strategies for Non-Dividend Payers,"

Ned Davis Group. Data from June 30, 1994, through February 29, 2016

...the perception becomes justified when such companies encounter business or financial problems.

Should those problems result in the dividend being cut, the return suffers. Ned Davis ...

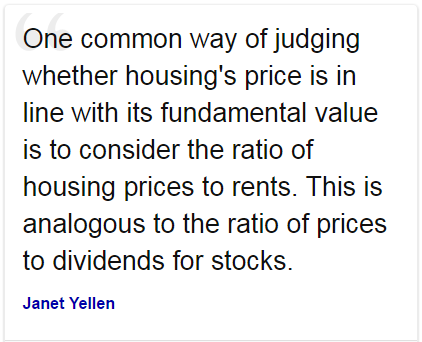

Nice Reminder Janet Y.

I found this quote from the current Federal Reserve Chair Janet Yellen; So why not check out the dividend-ratios of well-run companies/stocks and re-check, if these may really "deserve" such a high dividend-ratio...implying(?)...

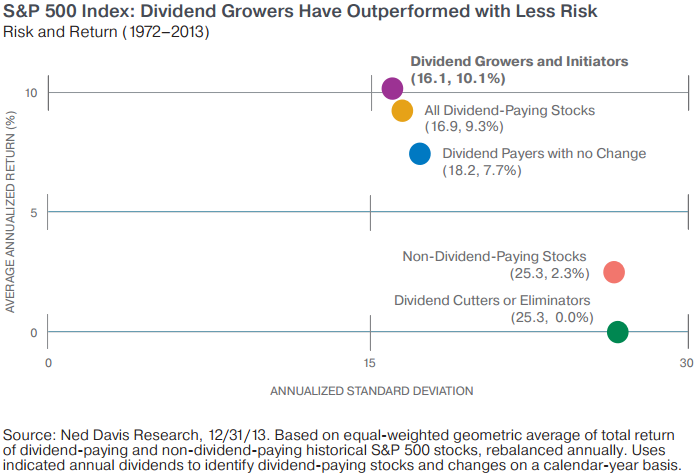

History 1923 - 2013

(Ned Davis Research)

This research-outcome helped me in surviving the stormy markets in the year 2015 and in the first 5 months of 2016. Dividends have been the lifeblood of long-term investors - helping them achieving high returns! year-over-year:

The performance shown represents the risk-return characteristics of each of the categories with annualized standard deviation (measure of risk) measured on the x-axis and the average annualized return measured on the y-axis. Risk is represented by standard-deviation, a statistical measure of the degree to which the ...

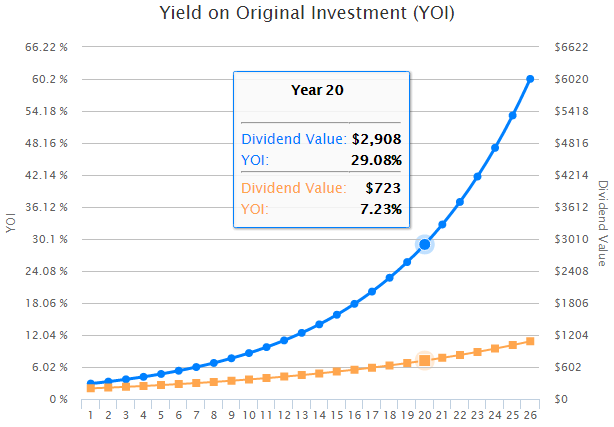

YOI or YOC

The Power of Compounded Growth and Reinvested Dividends! Buying a 2.9%-Dividend-Yield stock, which is raising its dividend payments 10% year-over-year leads to following YOI or YOC (yield on cost) after 20 years (check the blue line):

YOI stands for "yield on original investment (YOI)". YOI is simple; it’s the income yield you'd have today on an investment you made some time in the past. Harnessing this concept, an investor can achieve annual income returns of 10%, 20%, 30%, 50%, and more on original investment during an ordinary adult life. These are not "gains" in the ...

Yield on Cost (20 years/holding period)

You want to know how your yield on cost and income will grow if you bought 10 shares of a $100 stock for a total investment cost of USD 1,000?! Example: Your stock started with a 3% yield (ca.) and has an annual dividend growth rate of 12%...

| Year | Income | Yield on Cost | Holdings Value |

| 1 | $30.00 | 3.00 | $1,030.00 |

| 2 | $33.99 | 3.40 | $1,063.99 |

| 3 | $38.62 | 3.86 | $1,102.61 |

| 4 | $44.03 | 4.40 | $1,146.64 |

| 5 | $50.36 | 5.04 | $1,197.00 |

| 6 | $57.83 | 5.78 | $1,254.84 |

| 7 | $66.69 | 6.67 | $1,321.53 |

| 8 | $77.26 | 7.73 | $1,398.79 |

Wer nichts weiß, muss alles glauben

(Dividenden - "steady income stream")

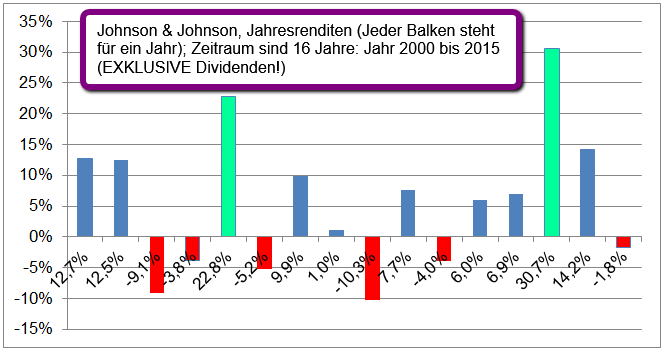

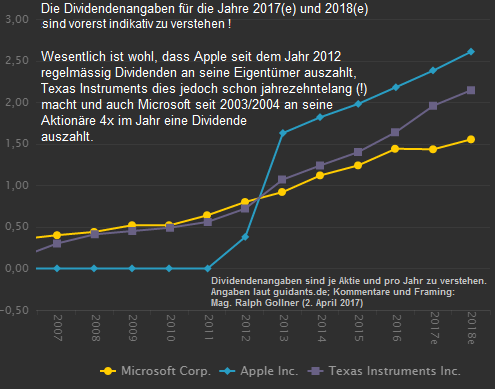

Dividende ist der Betrag je Aktie, den eine AG an ihre Aktionäre jährlich ausschüttet. Folgend werden vorab die jährlichen Aktienrenditen von 3 Unternehmen angeführt (2000 bis 2015, ABER OHNE Dividenden!):

Die meisten Aktiengesellschaften schütten nicht ihren gesamten Gewinn, sondern lediglich einen Teil davon (Ausschüttungsquote, z.B. 60 %) an ihre Eigentümer bzw. Anteilseigner aus. Die Höhe der Dividende wird durch die Hauptversammlung beschlossen. Setzt man die Dividende ins Verhältnis zum aktuellen Kurswert ...

Search for Dividends! (March 2016)

Dividend payers, particularly those that have grown or initiated a dividend, have outperformed after the Fed increased rates; Historical recap:

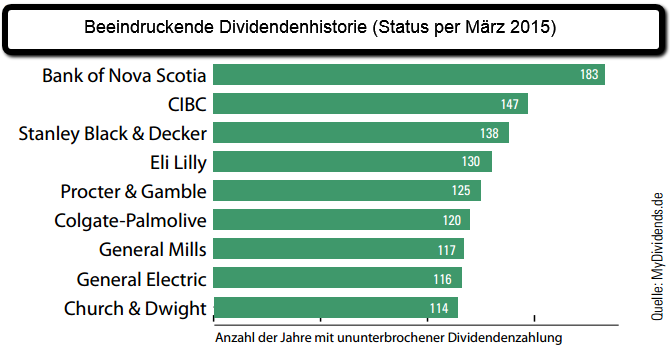

Dividendenzahler - Methusalems

Es gibt tatsächlich einige Unternehmen, die bereits im 19. Jahrhundert mit der Zahlung einer Dividende begonnen und diese tatsächlich bis heute niemals unterbrochen haben!

Achtung an sogenannte "leichtgläubige Blindflieger": Natürlich ist dies keine Garantie, dass es auch zukünftig Dividenden, bzw. Dividendenerhöhungen bei diesen Werten gibt. Aber das Beispiel zeigt, was für ein Potenzial hinter erstklassigen Dividendenwerten steckt.

Dividend stocks for bear markets/if you really wanna stay invested(?)

Dividend-paying stocks often come out ahead during a market sell-off. The majority of following stocks remained stable during the last sell-off periods (names given in text below, SPX stands for US-Benchmark S&P 500):

In 2008, when Standard & Poor’s 500-stock index nosedived 37%, the S&P 500 Dividend Aristocrats, an index of large companies that have raised their dividends every year for the past 25 years, surrendered a more tolerable 22%.

Some dividend stocks have a better record than others. At Kiplinger, they’ve ...

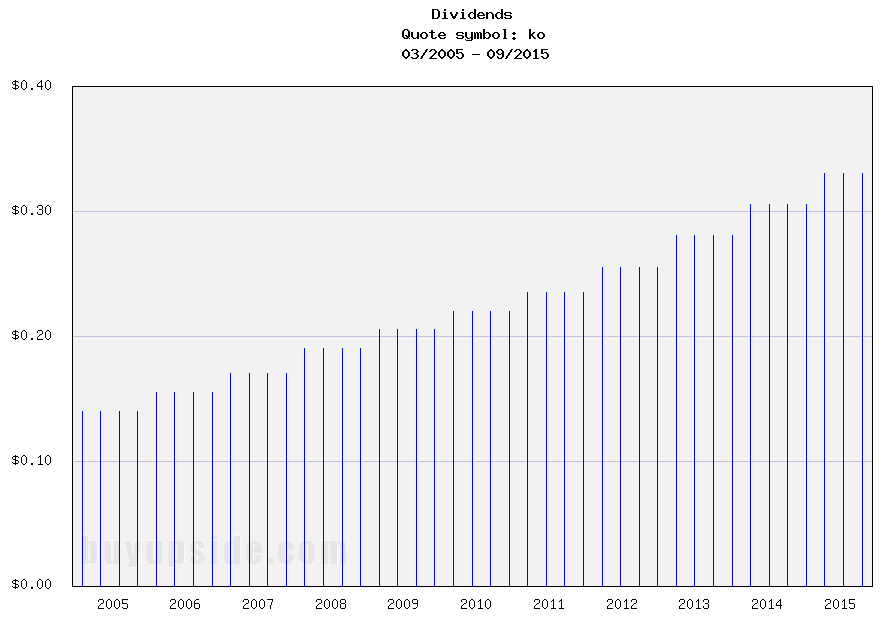

Definition of 'Yield On Cost - YOC' (example: Coca Cola/ticker: KO)

"YOC" ist the annual dividend rate of a security divided by the average cost basis of the investments. It shows the dividend yield of the original investment. Here a chart of the div. payments (cash-out) to Coke-Investors: source: www.buyupside.com

source: www.buyupside.com

If the number of shares owned by the investor does not change, the yield on cost will increase if the company increases the dividend it pays to shareholders; otherwise it will remain the same. Following a chart of the dividend yields IN THE YEAR of a possible purchase in that ...

Dividend Investing for Newbies (5 min. - Video)

Dogs of the Dow (Foolish four?)

Dividend investors employ a variety of popular approaches to pick stocks including dividend growth, relative dividend yield and the Dogs of the Dow.

This article (source: http://www.ndir.com) is focusing on the Dogs of the Dow which is wildly popular in the U.S. but has its flaws.

The basic Dogs formula is to buy an equal amount of the top ten yielding stocks in the Dow each year. The approach was first advocated by Michael O'Higgins in his book Beating the Dow. From 1973 to 1996 the Dogs of the Dow returned 20.3% which far surpassed the Dow's ...

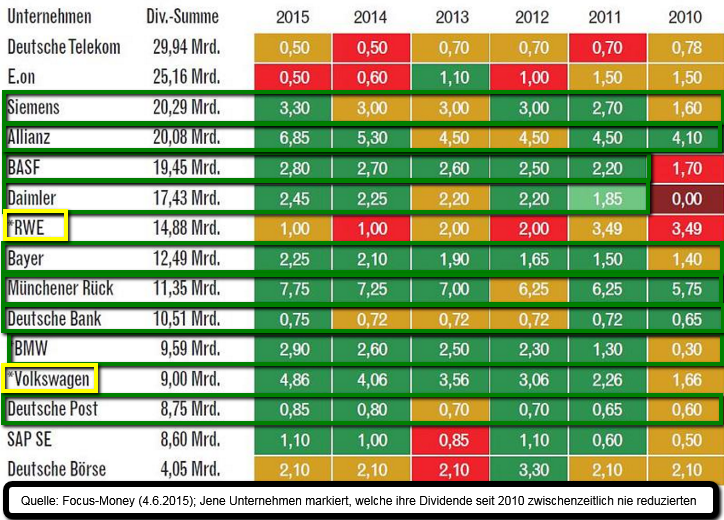

DAX-Dividenden-Goliaths

bezogen auf die absolute Dividendenhöhe (per Stand Juni 2015, Datenquelle: http://www.focus.de):

*RWE (Atomthema) und Volkswagen-Spezialfall "Dieselgate": Dividendenentwicklung ungewiss, ebenso E.on

Mehrere DAX-Unternehmen haben in den letzten Jahren regelmäßig einen warmen Geldregen auf die Aktionäre niedergelassen. Mehrere DAX-Goliaths (gemessen an den ausgezahlten Dividendenausschüttungen) haben in den letzten Jahren die Dividende pro Aktie erhöht, bzw. die Dividende zumindest unverändert gelassen. In der Legende wird die Farbenlehre zur obigen Tabelle ...

DIVCON 5 (the place to be ;-)

Reality Shares’ so-called DIVCON Indexes predict companies’ ability to raise dividends!

(see also this marketwatch-article from 5th Oct. 2015: http://www.marketwatch.com)

San Diego-based investment manager Reality Shares has a new way of selecting winners by predicting their ability to raise dividends. That may seem overly simplistic, but it takes into account quite a number of factors. A company’s financial health, indicated by a high likelihood of raising dividends, can serve you well...

The DIVCON is a score that predicts the likelihood a company will ...

Es gibt Unternehmen, welche seit mehr als 100 Jahren (Stichtag ist im Mai 2015) ihre Dividende ohne Unterbrechung zahlen. In manchen Perioden musste diese gekürzt werden, dennoch wurde immer eine Zahlung durchgeführt.

Einige Unternehmen, welche durchgehend über diesen langen Zeitraum ihre Dividenden gezahlt haben, sind folgende:

| Unternehmen | Dividende seit |

Aktuelle |

|

| Eli Lilly | 1885 | 2,73% | |

| Du Pont de Nemours | 1904 | 2,58% | |

| General Mills | 1888 | 3,18% | |

| Procter & Gamble | 1890 | ... |

Related Articles

Fund Managers Holding Highest Cash Percentage Since Lehman

Posted July 14, 2015 by Joshua M Brown (a New York City-based financial advisor at Ritholtz Wealth Management)

as written by Joshua: Michael Hartnett is out with his latest Fund Manager Survey for Bank of America Merrill Lynch and it’s, ...

"how to ride a trend" - Skechers (SKX) im Jahr 2015

Vorab: Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Die Aktie, die in diesem Blogeintrag/Artikel behandelt/genannt wird, befindet sich aktuell (seit mehreren Monaten) im "Echt-Depot" von Mag. Ralph Gollner.

Die Linie ...

Berkshire Hathaway (Price-Book-Value)

Let us take a quick look at Warren Buffet's empire, more specific at Berkshire Hathaway’s share price and its book value, especially in these current weeks/months since the PB-relation seems interesting relative to its history.

As per 7th Sep. 2015 ...

Uwe Lang / "Börsenpfarrer" - Indikatoren (Timinghilfe), 27. Okt. 2015

Anleger müssen nur auf die Signale achten. „Börsenpfarrer“ Uwe Lang beschäftigt sich seit 45 Jahren mit den Märkten. Er hat ein System entwickelt, das Kauf- und Verkaufsignale gibt. Es geht darum, Wendepunkte an den Märkten ...

Auswahl an Aktien mit dem Siegel "Nachhaltigkeit" / "Gutes Gewissen"

Gratis-ökom-Research: http://www.oekom-research.com

Gratis-finance-ethics-Einzelaktien-Research: www.mountain-view.com/de/analysierte-unternehmen

Überblick über die 50 Global-Challenges-Index-Mitglieder: ...

Online-Retail (2015ff)

US versus other countries (please see graph below the graph below ;-)

“With e-commerce penetration at a mere 7% of U.S. retail sales (as per Q3-2015), the channel has significant room to expand,” said Edward Yruma, Jessica Schmidt, Noah Zatzkin and other Pacific ...

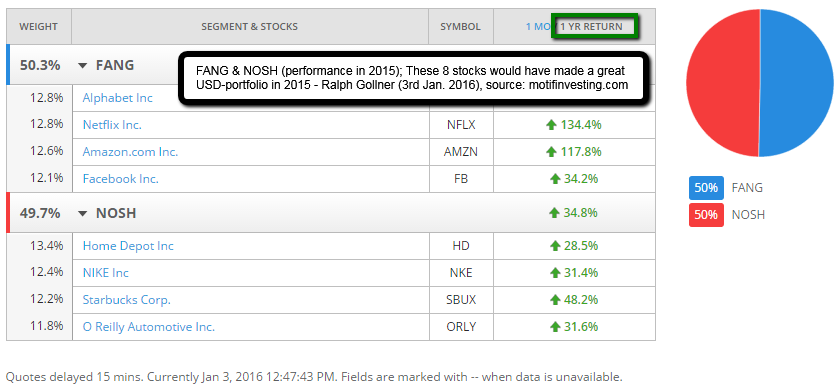

FANG, NOSH or SLAM ("the" 2015 stocks)

Ever heard of the famous "herd-stocks": FANG >> FB, AMZN, NFLX, Alphabet(Google), or

NOSH >> NIKE, O'Reilly, Starbucks, Home Depot? All delivered a great outperformance versus S&P 500 in the year 2015:

Following comparison betweeen the FANG & the NOSH ...

selected Oil stocks (US), 22nd Jan. 2016 (Chartshow - automat. updated / daily)

Phillips 66 (PSX), Occidental Petr. (OXY), National Oilwell Varco (NOV), Pioneer Natural Resources (PXD), Hess Corp. (HES), Helmerich & Payne (HP), Baker Hughes (BHI), Marathon Oil Corp. (MRO)

It will be ...

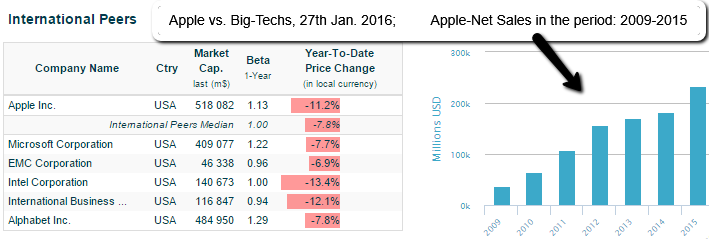

APPLE (Snapshot January 2016)

source: http://www.infinancials.com

source: http://www.infinancials.com

Apple-Stock-Valuation @ price per stock of 93.42 USD (27th Jan. 2016)

Market Cap: USD 517.97B*

Apple - Enterprise Value/EBITDA (ttm): 6.56*

Comparison/Group Computer Hardware - Enterprise Value/EBITDA (EV/EBITDA): 6.62*

S&P 500 - ...

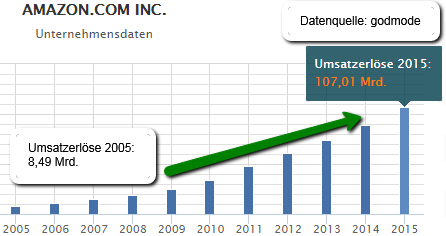

Amazon (2006 - 2016)

Text: Tobias Krieg; Grafiken: Mag. Ralph Gollner

Amazon wurde 1994 von Jeff Bezos gegründet, er entwickelte die Idee des elektronischen Buchhandels gemeinsam mit David E. Shaw, als Bezos in dessen Hedgefonds D.E. Shaw Group arbeitete.

Jeff Bezos verließ das ...

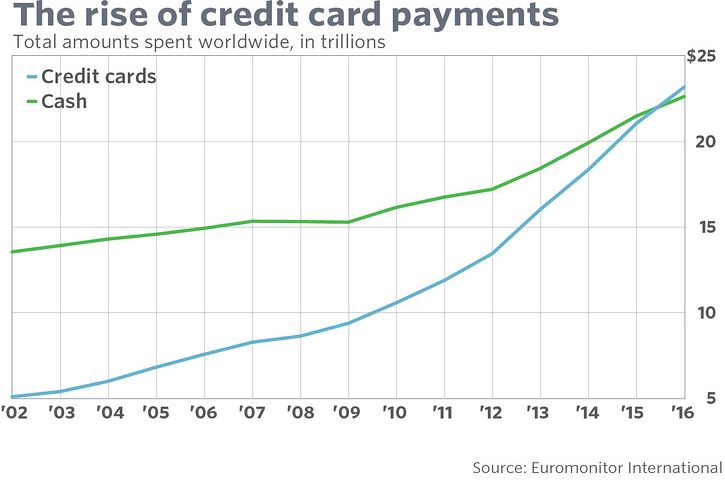

Credit Cards versus Cash

(CC vs. C)

Beginning of the end for cash? As consumers have increasingly used credit and debit cards and made purchases online and on apps, they've used less and less cash; in 2016, consumers will spend a greater amount on cards than they do with cash...

...for the ...

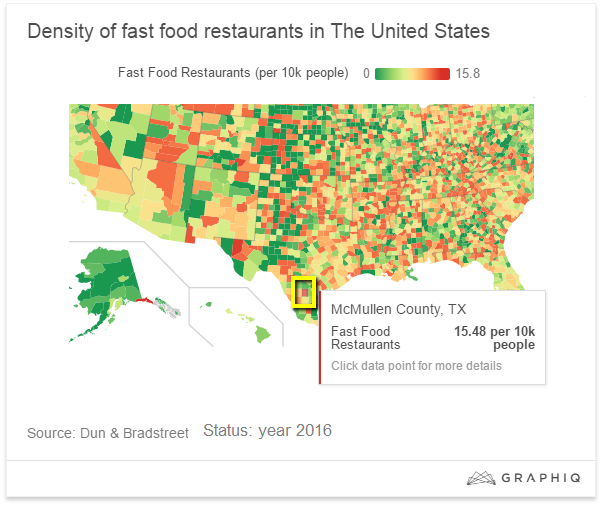

Fast Casual (Fast Food)

"There's pressure on the fast-food industry to try and match the strides made by the fast-casual better burger providers," said Steven Buckley, chief operating officer of BurgerFi International, a burger chain launched in 2011 in an interview with 'marketwatch'.

...

2015’s map of the largest company (U.S.A.)

2016's map of the largest company in each state by market cap from Broadview Networks looks much like the 2015 edition (see map here!). Apple Inc. is still the big cheese in California and ExxonMobil Corp. is king in Texas, while...

...J.P. Morgan ...

Victoria's Secret & Co. (L Brands)

At the right price, L Brands offers investors the opportunity to own a leading company in remarkably uncrowded categories, and one with a strong record of delivering shareholder returns...

L Brands Inc formerly known as Limited Brands, Inc., operates as a ...

Big Players, Aktionäre und Dividenden

No-Brainer? Keine Ahnung, ABER: Der Aktionär ist Miteigentümer am Unternehmen und hat Anspruch auf einen Anteil des Gewinns, der in Form einer Dividende ausgeschüttet wird. Die Dividende ist von der Ertragslage des Unternehmens abhängig...

...und ...

How to Find Wide Investment Moats the 'Easy' Way

Finding a wide investment moat is critical to investing, especially for the long term; Warren Buffett's simple-is-better philosophy extends to his ability as a teacher to take complex subject matter and turn it into something we can...

...all ...

OMV und Preis-Buchwert-Verhältnis

OMV: Mit dem Energiekonzern kam 1987 der erste Staatsbetrieb an die Börse. Für den Konzern war das der Auftakt für die internationale Expansion. Für das Unternehmen selbst wirkte der Gang an den Kapitalmarkt wie ein Entwicklungsturbo.

Unter dem steigenden ...

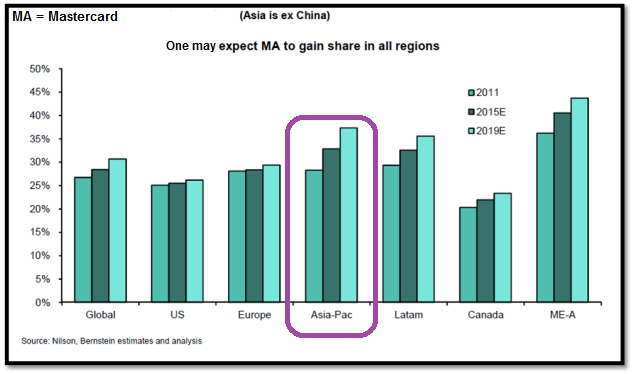

Mastercard (Ticker: MA)

Driven by global economic growth and a secular shift to electronic payments, one can believe Mastercard (ticker: MA) can grow net revenue by low double digits over the next several years. This, coupled with modest margin expansion and aggressive share buyback...

...

Get used to higher Risk/Return-products...

Original Article as per 19th June 2017

Investors are expecting aggressive, unrealistic returns and higher income than may be available from the retail products they are currently invested in. That is a key conclusion from the annual Global Investment ...

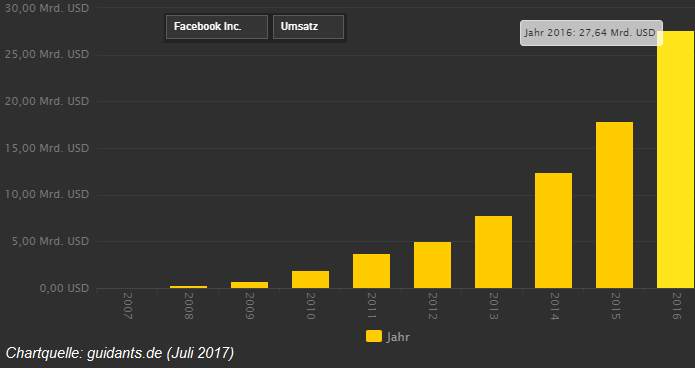

Facebook (earnings review)

quick n dirty

Let's check the latest metrics in the wake of Facebook’s robust Q2-2017 results on 26th July 2017. Its revenue increased to over USD 9 billion, up 45% versus a year ago - that is enormous growth for such a large company. But one concern is...

...that ...

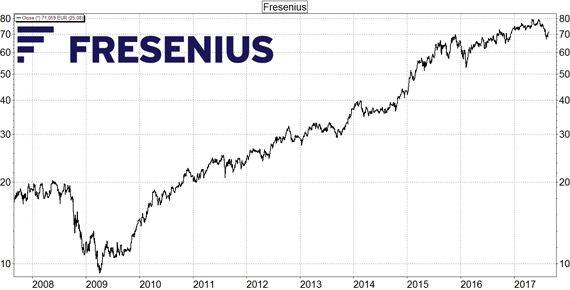

Fresenius SE & Co. KGaA

Die Fresenius SE & Co. KGaA ist ein international tätiges Medizintechnik- und Gesundheitsunternehmen. Der Hauptsitz liegt in Bad Homburg vor der Höhe. Gegründet wurde das Unternehmen 1912. Die Veränderung der Bevölkerungsstruktur sorgt bei Fresenius nach wie vor...

...

China & its platforms

(transformation into the year 2017)

Chinese companies transformed from the year 2000 (the year, when I bought stocks for the first time) up to the year 2017 their "normal" business-models into a wide platform strategy, covering different ecosystems. How it all started:

...

Alphabet hat sich im 1. Halbjahr (wieder) stark entwickelt

Der Technologiekonzern scheint kaum noch zu stoppen und nimmt vor allem im Suchmaschinengeschäft eine Monopolstellung ein. Das Werbegeschäft brummt. Der strukturelle Wandel ist in vollem Gange. Während die klassische...

...TV- und ...

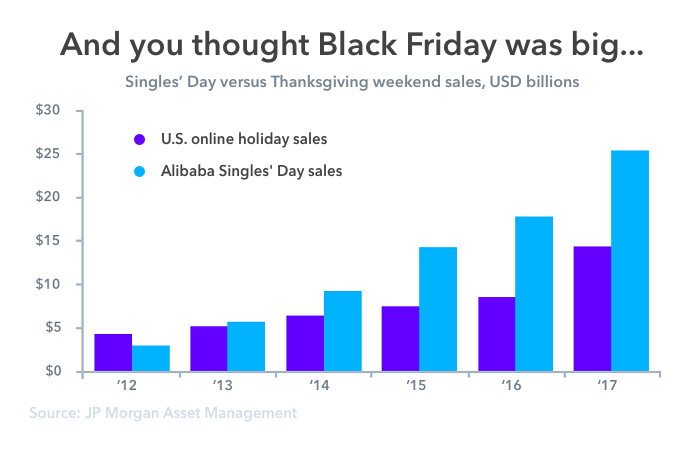

What's Behind Alibaba's USD 25 Billion in Sales on Singles' Day?

Since the early 2010s, China's e-commerce giant Alibaba Group has single-handedly turned Singles' Day into the biggest shopping event by launching large-scale shopping promotions centered around 11th November. Gradually,...

...

...

FACC

Eine mit Winglets ausgerüstete Boeing 737NG kann zwischen 360.000 und 490.000 Liter Kraftstoff pro Jahr je nach geflogenen Strecken, gegenüber einem Standardmodell einsparen. Der oberösterreichische Luftfahrtzulieferer FACC hat aktuell volle Auftragsbücher (nicht nur...

...

These 3 (NOT FANG)

Maybe these 3 stocks just "need a short rest." I (Ralph Gollner) am still invested in these three names, but there is some hot wind blowing out there. And I guess it's not just a hot summer-breeze (being still cold in NYC and here in Austria)...

The three names mentioned ...

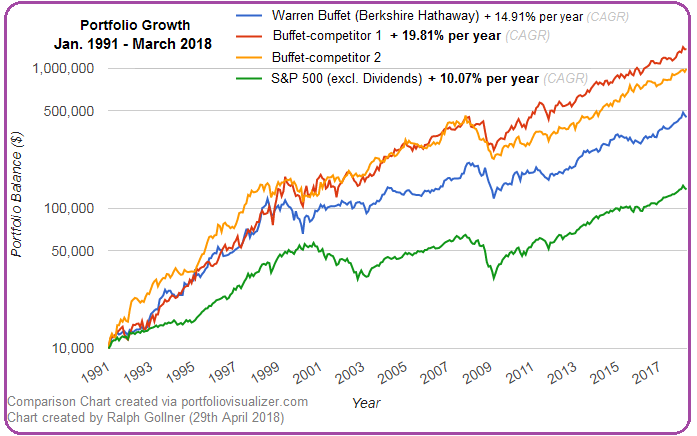

WTF = WBF

One of the "real" competitors of Warren Buffet's Investment vehicle "Berkshire Hathaway" delivers astonishing performance-results (Buffet-competitor 2). In the year 1986 you were able to buy 120 stocks (of the Buffet-competitor 2) for a total of 1,000...

...US-Dollar. If you were ...

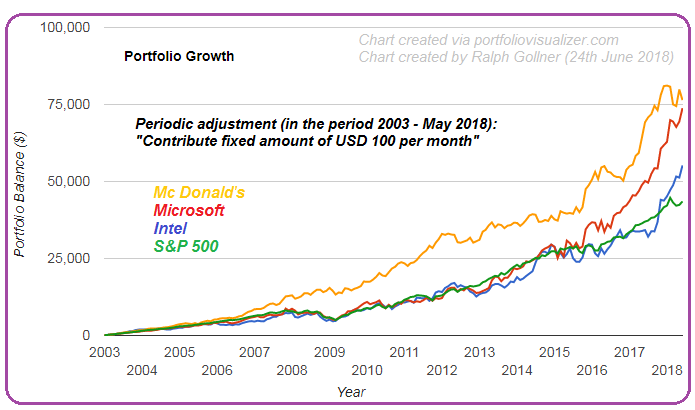

Examples: INTC, MCD, MSFT, S&P 500

If one has a long-term investment horizon, well, then there are several possibilities how to take the first steps...

In the chart above -also the tough period in the years 2008 until 2011- has been covered. Via "Cost-Average" one can "easily" bridge such ...

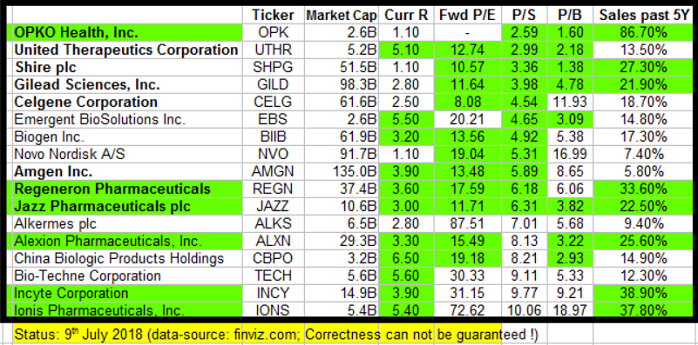

Biotech (9th July 2018)

When investors think of biotech stocks, visions of Amgen (AMGN) and Gilead (GILD) tend to dance in their heads. These companies aren't just among the biggest in the business - they're also a couple of the most successful in terms of revenue and...

...profits. ...

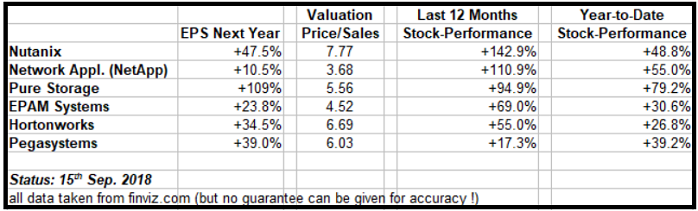

The new FANGS are in town?

Well, I don't know. But maybe those guys are not new in town...

At least NetApp is an old Player, which was a very hot company in the years 1999 and 2000!

I will watch these guys very closely within the upcoming 18 months.

cheers Ralph

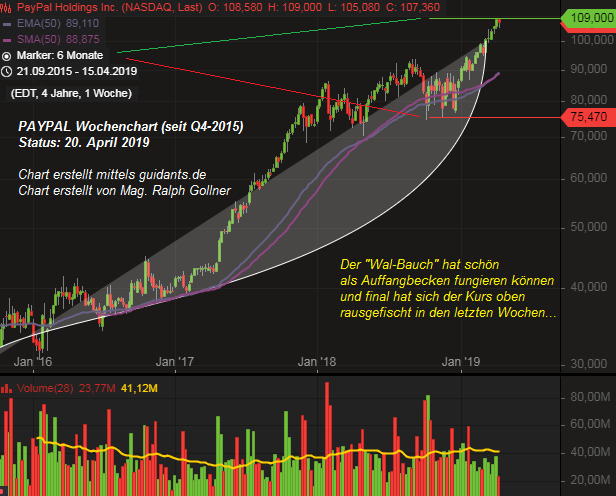

PayPal

(Update vom April 2018)

Im Posting #1040 habe ich PayPal bereits charttechnisch beobachtet. Damals, am 28. April 2018, deutete sich bereits ein mögliches Zuspitzen auf ca. USD 100 per Q1-2019 an, sofern die Aktie ihr Kurslevel ÜBER USD 70 bis zum...

...Jahresende 2018 halten könnte.

...

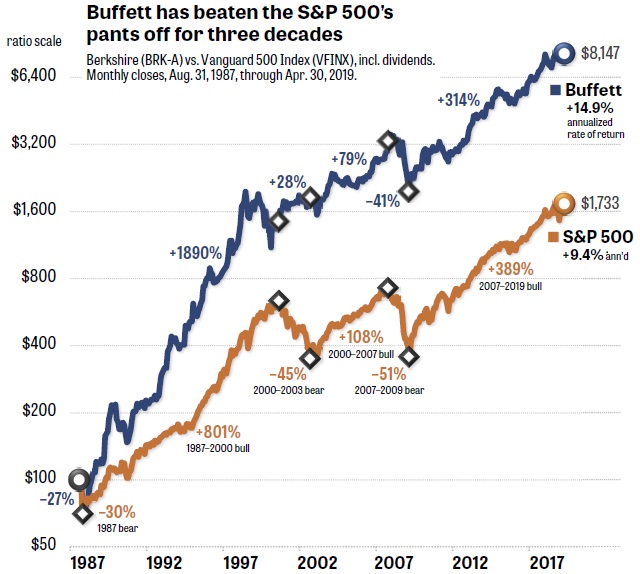

Warren Buffet

Million % Plus...

What happens if you compound +20.5% (each year) over 54 years? well, you will achieve an overall gain of 2.472 Million percent. ( + 2,472,627%). By the end of 2018, Berkshire Hathaway stock had risen...

...by 2,472,627% (that's not a typo) in the 54 years ...