Related Categories

Related Articles

Articles

Inherent in this certain Investment-approach is that 1st: the selected companies are large or mega cap companies and 2nd there is an implied assumption that they will continue to operate as going concerns. So because this strategy is focused on Large Caps, an investor can be comfortable in knowing that there is a good possibility that each of these companies will still be around in a year (Enron and Worldcom, notwithstanding).To put this point into context, note that each of the components selected under this strategy has a market capitalisation in excess of USD 50 billion and revenues of over USD 20 billion.

Inherent in this certain Investment-approach is that 1st: the selected companies are large or mega cap companies and 2nd there is an implied assumption that they will continue to operate as going concerns. So because this strategy is focused on Large Caps, an investor can be comfortable in knowing that there is a good possibility that each of these companies will still be around in a year (Enron and Worldcom, notwithstanding).To put this point into context, note that each of the components selected under this strategy has a market capitalisation in excess of USD 50 billion and revenues of over USD 20 billion.

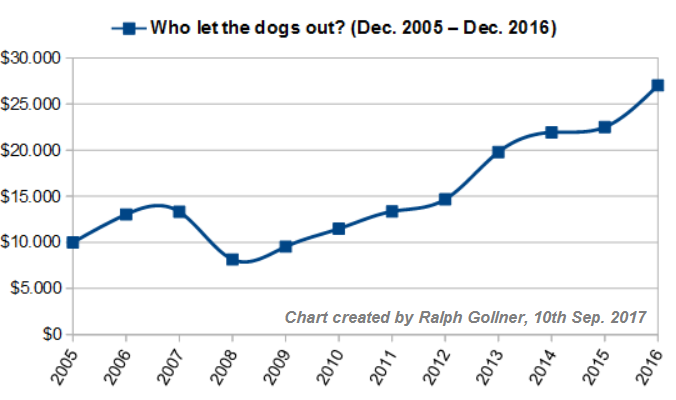

Rebalancing takes place (only) once a year (around Year-End / 1st trading day of the year) and the track-record looks nice :-) Here I made a computation of this long-lasting Portfolio-strategy - covering the period 2006 - 2016: