Related Categories

Related Articles

Articles

Dow Jones - Dividend Yield

(History)

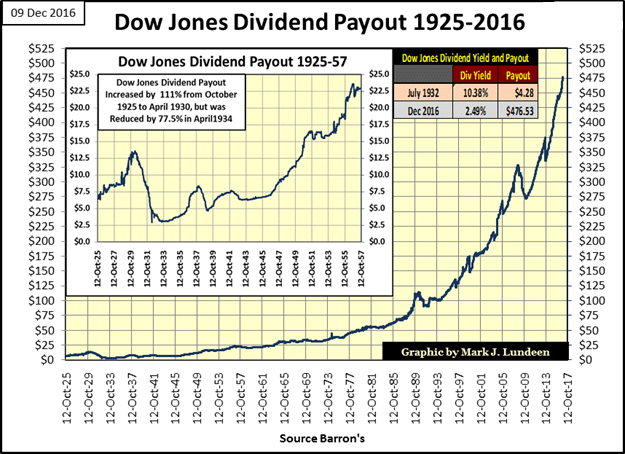

With the current low yield 10year-Treasuries @ 2.365%, it is not easy to justify putting one's hard earned money (only) into the U.S. Treasury. For investors looking for yield and inflation protection, the current "Dow"-dividend yield...

(see Dow table under following link: http://indexarb.com/dividendYieldSorteddj.html) - plus the potential stock price appreciation - of all 30 Dow Jones Industrial average stocks is looking a lot better than the < 2.4% yield on the 10-year Treasury.

Equities historically outperform bonds. So, the strategy here could be simple - get in on these blue chips when everyone else is still playing musical chairs over at the bond market. Then, sit tight knowing at least a portion of your profolio will ride the Dow 30's nice dividend yield, and the price appreciation may be coming from their solid long term top line growth.

Disclosure: Ralph Gollner hereby discloses that he directly owns some of the Dow-Jones-Industrial-Average securities (as per 27th February 2017): Pfizer, Cisco Systems, Mc Donald's, Procter & Gamble, Johnson & Johnson, 3M, Microsoft, United Technologies, United Health Group, Disney.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

links:

Dow Jones-components / current Dividend yields http://indexarb.com/dividendYieldSorted