Related Categories

Articles

Goldminer-Purchase

I just had this idea of "repurchasing" a former Goldminer-Stock Holding (Gold Royalties-stock to be more precise) of mine. Following a podcast, where I listended to Stephanie Kelton. Keyword: Modern Monetary Theory (aka MMT)...

...Circa one hour ago I purchased some stocks of that company shown in the chart above. Also the current technical situation looks fine to me. I am satisfied with my Buy of the day >> even if one were to think about a potential Stop-Loss sale, if my theory would not work out. In that case the MA-200 lines are just near the 133-USD level or ...

JUST companies award

Nonprofit

Stakeholder capitalism will only thrive if more of us investors make a commitment to consider all stakeholders in our decisions on how we run our companies, where we work, where we invest, and what we buy.

The selection of 3 Industry Leaders above features the top performing companies in each of 3 freely chosen sectors. Each of America's Most JUST Companies is awarded a seal to demonstrate their leadership on the issues Americans care about most.

The selection of 3 Industry Leaders above features the top performing companies in each of 3 freely chosen sectors. Each of America's Most JUST Companies is awarded a seal to demonstrate their leadership on the issues Americans care about most.

Building a more just economy that better serves the needs of all stakeholders is an essential step in pursuing ...

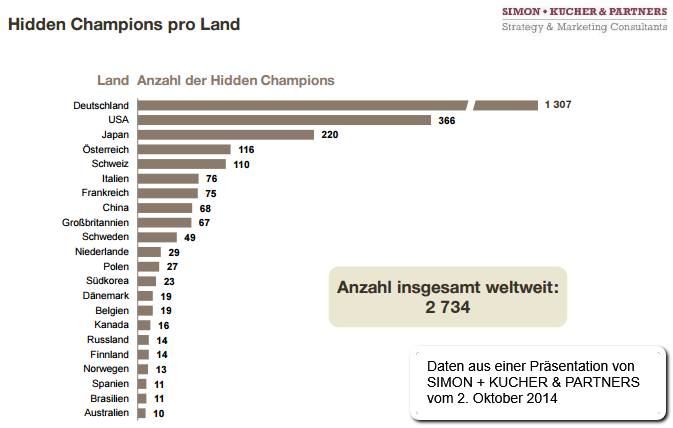

Hidden Champions

Was ist ein Hidden Champion?

♦ Top 3 in der Welt oder Nr. 1 auf seinem Kontinent

♦ Mittelständisches Unternehmen

♦ Geringer Bekanntheitsgrad im Publikum*

*Red Bull ist (somit) kein Hidden Champion

Aktuelle (per Aug. 2017 nachgereicht) Quelle zum Selber-Nachlesen:

https://salzburg.iv.at/media/filer_public (.pdf)

Selbständige Suche nach dem Fonds "Lupus alpha Smaller German Champions"

(Infos zu Mittelstandsunternehmen, aber auch unbekannte-re BIG CHAMPIONS)

english presentation/version (Poland, 2008): http://de.slideshare.net

crazy moves on high volume (weekly candles as per 28th Aug. 2015), updated weekly

...there is an easy way to set a stop-loss after last weeks' move (hint: just around the low of the week ending 28th Aug. 2015 ;-)

There are many other crazy charts to be looked at, a tiny selection of those you can find above and down here:

Procter & Gamble ( Snapshot @ 81.91 USD, 14th July 2015 intraday)

The Procter & Gamble Co. (PG) operates in 180 countries and territories, and it’s expanding its presence in the e-commerce market. One might think as a private person one has nothing to do with Procter & Gamble, but chances are you’re contributing to its top line on a regular basis. That’s because you likely have at least one of the following products in your home: Head & Shoulders, Olay, Pantene, Gillette, Mach3, Crest, Oral-B, Vicks, Dawn, Febreeze, Gain, Tide, Always, Bounty, Charmin or Pampers. The list goes on and ...

Wells Fargo ( Snapshot @ 56.1 USD, 4th June 2015 intraday)

Wells Fargo & Company (NYSE:WFC) has recovered well from the financial crisis, and maintained positive earnings throughout the period. This fact alone may intrigue many potential investors, as many believe in investing in great companies regardless of the price. However, Benjamin Graham, the father of value investing, taught that the most important aspect to consider is whether the company is trading at a discount relative to its intrinsic value. It is through a thorough fundamental analysis that the investor is able to make a ...

It could be that some of the listed semiconductor names are approaching levels for a possible outbreak to the upside (May ME 2015). A selection of some companies, filtered via the screening tool of www.finviz.com, you can find in the list(s) below:

selected semiconductor names

| Ticker | Company | Industry | Country |

| AUO | AU Optronics Corp. | Semiconductor - Broad Line | Taiwan |

| TER | Teradyne Inc. | Semiconductor Equipment & Materials | USA |

| BRCM | Broadcom Corp. | Semiconductor - Integrated Circuits | USA |

| RMBS | Rambus Inc. | Semiconductor- Memory Chips | USA |

| CRUS | Cirrus ... |

selected consumer goods - stocks (USA), prices & valuation metrics as per 22nd May 2015 (market close)

| Ticker | Company | Industry | Market Cap | P/E | Price in USD | Fwd P/E | PEG | P/S | P/B | EPS past 5Y | EPS next 5Y | Sales past 5Y | |

|

Tyson Foods, Inc. | Meat Products | 17.43B | 16,7 | 43,0 | 11,5 | 0,9 | 0,43 | 1,9 | 29.30% | 19.00% | 7.10% | |

|

International Paper Company | Packaging & Containers | 22.35B | 23,4 | 53,1 | 12,3 | 1,7 | 0,95 | 4,6 | -3.20% | 13.95% | 0.20% | |

|

Whirlpool Corp. | Appliances | 15.10B | 22,5 | 192,0 | 12,6 | 1,1 | 0,74 | ... |

Related Articles

Fund Managers Holding Highest Cash Percentage Since Lehman

Posted July 14, 2015 by Joshua M Brown (a New York City-based financial advisor at Ritholtz Wealth Management)

as written by Joshua: Michael Hartnett is out with his latest Fund Manager Survey for Bank of America Merrill Lynch and it’s, ...

"how to ride a trend" - Skechers (SKX) im Jahr 2015

Vorab: Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Die Aktie, die in diesem Blogeintrag/Artikel behandelt/genannt wird, befindet sich aktuell (seit mehreren Monaten) im "Echt-Depot" von Mag. Ralph Gollner.

Die Linie ...

Berkshire Hathaway (Price-Book-Value)

Let us take a quick look at Warren Buffet's empire, more specific at Berkshire Hathaway’s share price and its book value, especially in these current weeks/months since the PB-relation seems interesting relative to its history.

As per 7th Sep. 2015 ...

Uwe Lang / "Börsenpfarrer" - Indikatoren (Timinghilfe), 27. Okt. 2015

Anleger müssen nur auf die Signale achten. „Börsenpfarrer“ Uwe Lang beschäftigt sich seit 45 Jahren mit den Märkten. Er hat ein System entwickelt, das Kauf- und Verkaufsignale gibt. Es geht darum, Wendepunkte an den Märkten ...

Auswahl an Aktien mit dem Siegel "Nachhaltigkeit" / "Gutes Gewissen"

Gratis-ökom-Research: http://www.oekom-research.com

Gratis-finance-ethics-Einzelaktien-Research: www.mountain-view.com/de/analysierte-unternehmen

Überblick über die 50 Global-Challenges-Index-Mitglieder: ...

Online-Retail (2015ff)

US versus other countries (please see graph below the graph below ;-)

“With e-commerce penetration at a mere 7% of U.S. retail sales (as per Q3-2015), the channel has significant room to expand,” said Edward Yruma, Jessica Schmidt, Noah Zatzkin and other Pacific ...

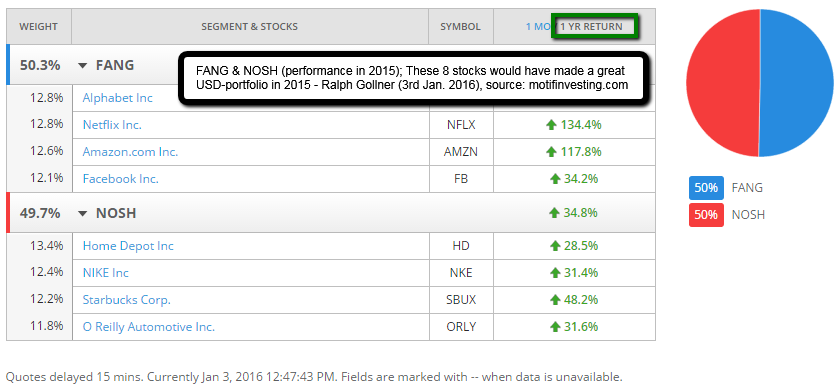

FANG, NOSH or SLAM ("the" 2015 stocks)

Ever heard of the famous "herd-stocks": FANG >> FB, AMZN, NFLX, Alphabet(Google), or

NOSH >> NIKE, O'Reilly, Starbucks, Home Depot? All delivered a great outperformance versus S&P 500 in the year 2015:

Following comparison betweeen the FANG & the NOSH ...

selected Oil stocks (US), 22nd Jan. 2016 (Chartshow - automat. updated / daily)

Phillips 66 (PSX), Occidental Petr. (OXY), National Oilwell Varco (NOV), Pioneer Natural Resources (PXD), Hess Corp. (HES), Helmerich & Payne (HP), Baker Hughes (BHI), Marathon Oil Corp. (MRO)

It will be ...

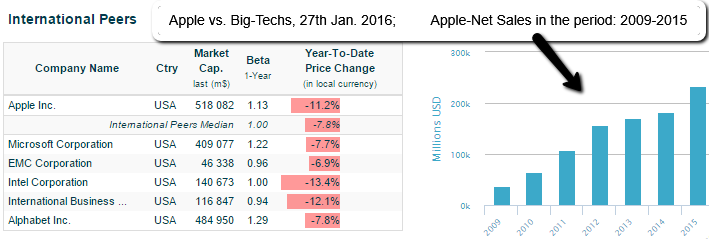

APPLE (Snapshot January 2016)

source: http://www.infinancials.com

source: http://www.infinancials.com

Apple-Stock-Valuation @ price per stock of 93.42 USD (27th Jan. 2016)

Market Cap: USD 517.97B*

Apple - Enterprise Value/EBITDA (ttm): 6.56*

Comparison/Group Computer Hardware - Enterprise Value/EBITDA (EV/EBITDA): 6.62*

S&P 500 - ...

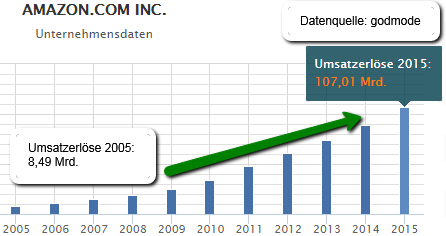

Amazon (2006 - 2016)

Text: Tobias Krieg; Grafiken: Mag. Ralph Gollner

Amazon wurde 1994 von Jeff Bezos gegründet, er entwickelte die Idee des elektronischen Buchhandels gemeinsam mit David E. Shaw, als Bezos in dessen Hedgefonds D.E. Shaw Group arbeitete.

Jeff Bezos verließ das ...

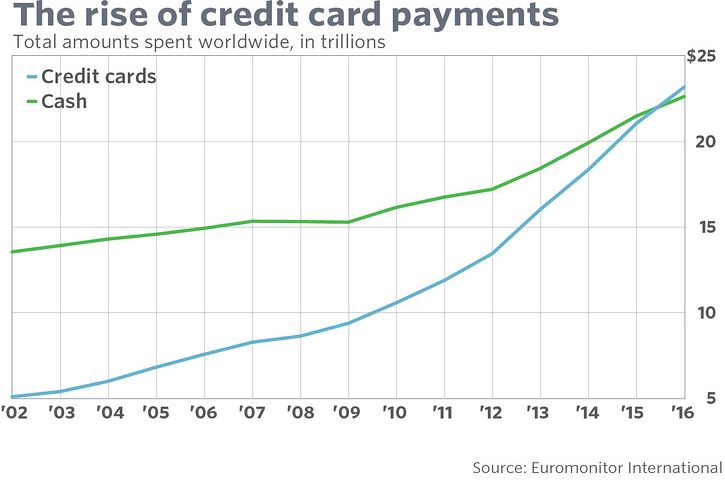

Credit Cards versus Cash

(CC vs. C)

Beginning of the end for cash? As consumers have increasingly used credit and debit cards and made purchases online and on apps, they've used less and less cash; in 2016, consumers will spend a greater amount on cards than they do with cash...

...for the ...

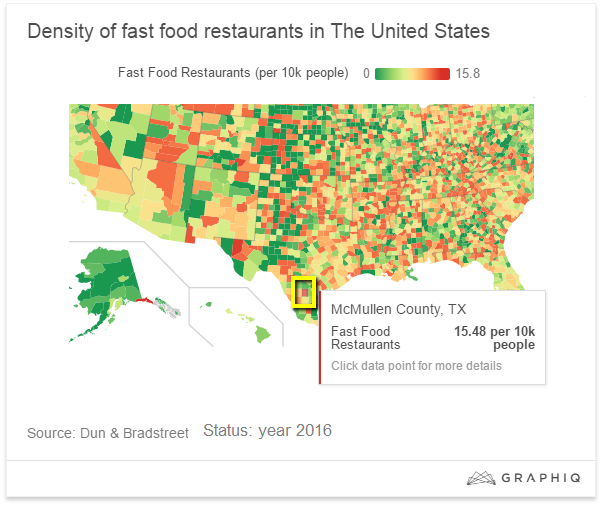

Fast Casual (Fast Food)

"There's pressure on the fast-food industry to try and match the strides made by the fast-casual better burger providers," said Steven Buckley, chief operating officer of BurgerFi International, a burger chain launched in 2011 in an interview with 'marketwatch'.

...

2015’s map of the largest company (U.S.A.)

2016's map of the largest company in each state by market cap from Broadview Networks looks much like the 2015 edition (see map here!). Apple Inc. is still the big cheese in California and ExxonMobil Corp. is king in Texas, while...

...J.P. Morgan ...

Victoria's Secret & Co. (L Brands)

At the right price, L Brands offers investors the opportunity to own a leading company in remarkably uncrowded categories, and one with a strong record of delivering shareholder returns...

L Brands Inc formerly known as Limited Brands, Inc., operates as a ...

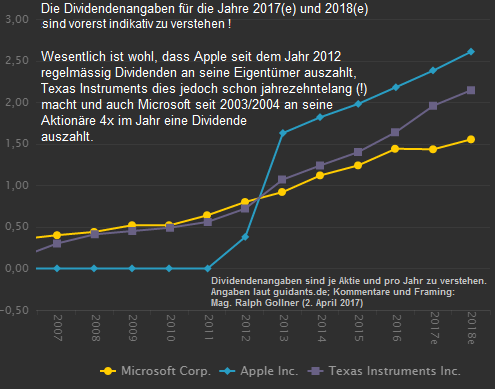

Big Players, Aktionäre und Dividenden

No-Brainer? Keine Ahnung, ABER: Der Aktionär ist Miteigentümer am Unternehmen und hat Anspruch auf einen Anteil des Gewinns, der in Form einer Dividende ausgeschüttet wird. Die Dividende ist von der Ertragslage des Unternehmens abhängig...

...und ...

How to Find Wide Investment Moats the 'Easy' Way

Finding a wide investment moat is critical to investing, especially for the long term; Warren Buffett's simple-is-better philosophy extends to his ability as a teacher to take complex subject matter and turn it into something we can...

...all ...

OMV und Preis-Buchwert-Verhältnis

OMV: Mit dem Energiekonzern kam 1987 der erste Staatsbetrieb an die Börse. Für den Konzern war das der Auftakt für die internationale Expansion. Für das Unternehmen selbst wirkte der Gang an den Kapitalmarkt wie ein Entwicklungsturbo.

Unter dem steigenden ...

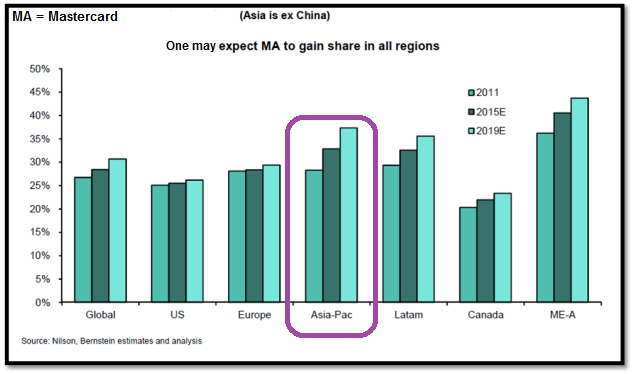

Mastercard (Ticker: MA)

Driven by global economic growth and a secular shift to electronic payments, one can believe Mastercard (ticker: MA) can grow net revenue by low double digits over the next several years. This, coupled with modest margin expansion and aggressive share buyback...

...

Get used to higher Risk/Return-products...

Original Article as per 19th June 2017

Investors are expecting aggressive, unrealistic returns and higher income than may be available from the retail products they are currently invested in. That is a key conclusion from the annual Global Investment ...

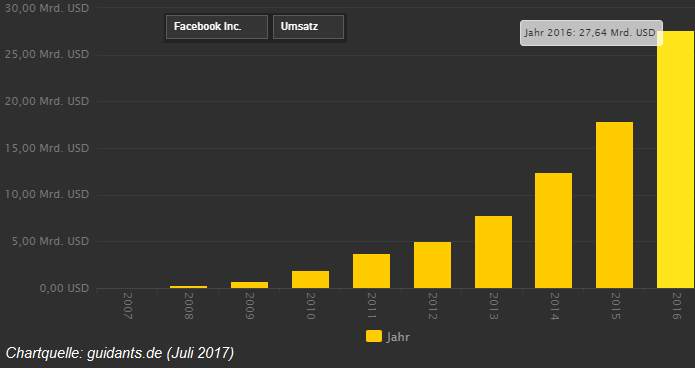

Facebook (earnings review)

quick n dirty

Let's check the latest metrics in the wake of Facebook’s robust Q2-2017 results on 26th July 2017. Its revenue increased to over USD 9 billion, up 45% versus a year ago - that is enormous growth for such a large company. But one concern is...

...that ...

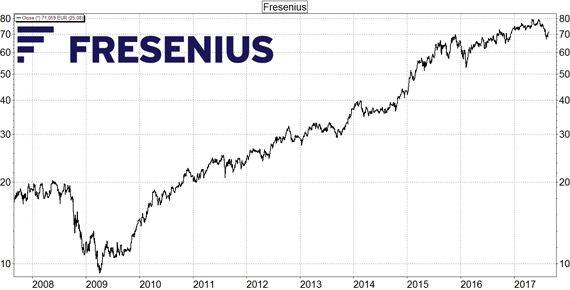

Fresenius SE & Co. KGaA

Die Fresenius SE & Co. KGaA ist ein international tätiges Medizintechnik- und Gesundheitsunternehmen. Der Hauptsitz liegt in Bad Homburg vor der Höhe. Gegründet wurde das Unternehmen 1912. Die Veränderung der Bevölkerungsstruktur sorgt bei Fresenius nach wie vor...

...

China & its platforms

(transformation into the year 2017)

Chinese companies transformed from the year 2000 (the year, when I bought stocks for the first time) up to the year 2017 their "normal" business-models into a wide platform strategy, covering different ecosystems. How it all started:

...

Alphabet hat sich im 1. Halbjahr (wieder) stark entwickelt

Der Technologiekonzern scheint kaum noch zu stoppen und nimmt vor allem im Suchmaschinengeschäft eine Monopolstellung ein. Das Werbegeschäft brummt. Der strukturelle Wandel ist in vollem Gange. Während die klassische...

...TV- und ...

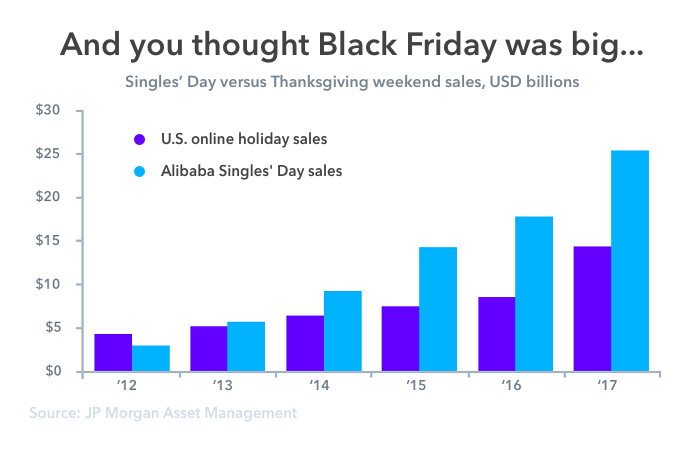

What's Behind Alibaba's USD 25 Billion in Sales on Singles' Day?

Since the early 2010s, China's e-commerce giant Alibaba Group has single-handedly turned Singles' Day into the biggest shopping event by launching large-scale shopping promotions centered around 11th November. Gradually,...

...

...

FACC

Eine mit Winglets ausgerüstete Boeing 737NG kann zwischen 360.000 und 490.000 Liter Kraftstoff pro Jahr je nach geflogenen Strecken, gegenüber einem Standardmodell einsparen. Der oberösterreichische Luftfahrtzulieferer FACC hat aktuell volle Auftragsbücher (nicht nur...

...

These 3 (NOT FANG)

Maybe these 3 stocks just "need a short rest." I (Ralph Gollner) am still invested in these three names, but there is some hot wind blowing out there. And I guess it's not just a hot summer-breeze (being still cold in NYC and here in Austria)...

The three names mentioned ...

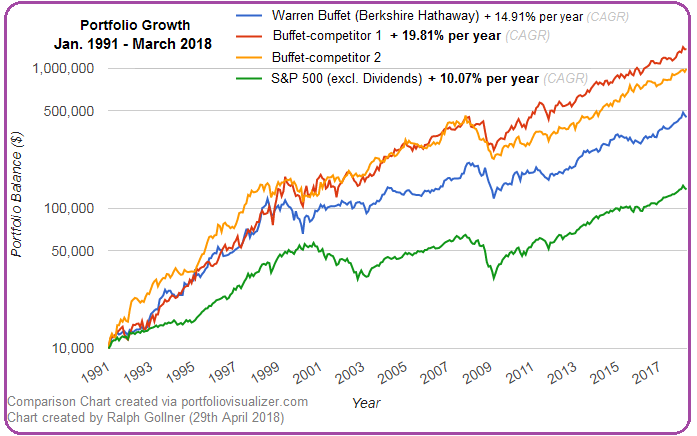

WTF = WBF

One of the "real" competitors of Warren Buffet's Investment vehicle "Berkshire Hathaway" delivers astonishing performance-results (Buffet-competitor 2). In the year 1986 you were able to buy 120 stocks (of the Buffet-competitor 2) for a total of 1,000...

...US-Dollar. If you were ...

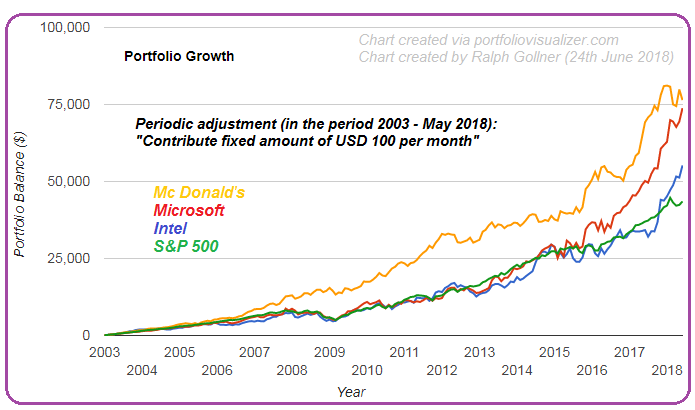

Examples: INTC, MCD, MSFT, S&P 500

If one has a long-term investment horizon, well, then there are several possibilities how to take the first steps...

In the chart above -also the tough period in the years 2008 until 2011- has been covered. Via "Cost-Average" one can "easily" bridge such ...

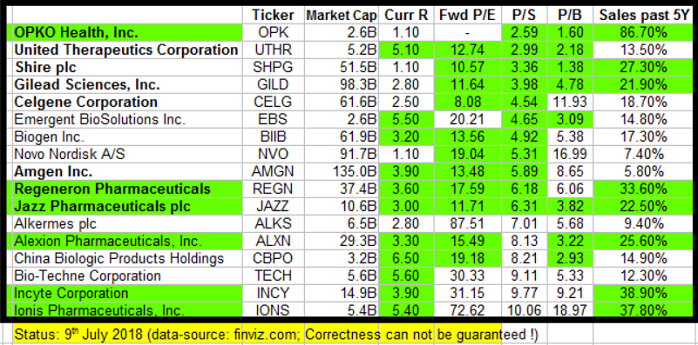

Biotech (9th July 2018)

When investors think of biotech stocks, visions of Amgen (AMGN) and Gilead (GILD) tend to dance in their heads. These companies aren't just among the biggest in the business - they're also a couple of the most successful in terms of revenue and...

...profits. ...

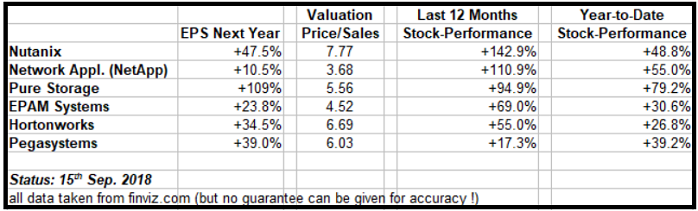

The new FANGS are in town?

Well, I don't know. But maybe those guys are not new in town...

At least NetApp is an old Player, which was a very hot company in the years 1999 and 2000!

I will watch these guys very closely within the upcoming 18 months.

cheers Ralph

PayPal

(Update vom April 2018)

Im Posting #1040 habe ich PayPal bereits charttechnisch beobachtet. Damals, am 28. April 2018, deutete sich bereits ein mögliches Zuspitzen auf ca. USD 100 per Q1-2019 an, sofern die Aktie ihr Kurslevel ÜBER USD 70 bis zum...

...Jahresende 2018 halten könnte.

...

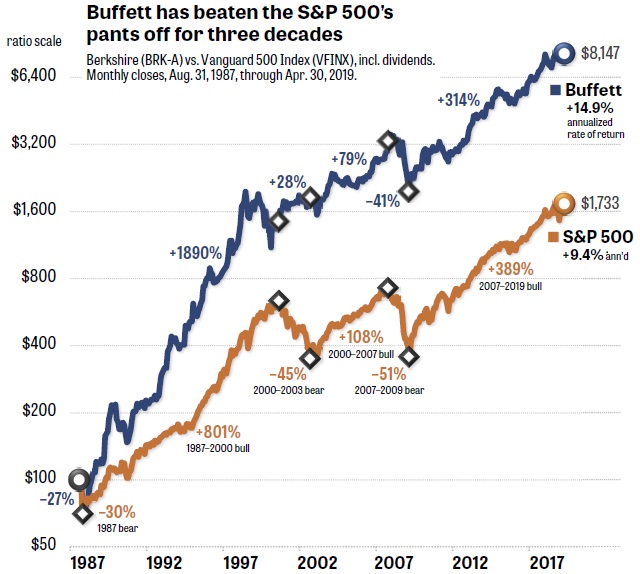

Warren Buffet

Million % Plus...

What happens if you compound +20.5% (each year) over 54 years? well, you will achieve an overall gain of 2.472 Million percent. ( + 2,472,627%). By the end of 2018, Berkshire Hathaway stock had risen...

...by 2,472,627% (that's not a typo) in the 54 years ...