Related Categories

Related Articles

Articles

Wells Fargo ( Snapshot @ 56.1 USD, 4th June 2015 intraday)

Wells Fargo & Company (NYSE:WFC) has recovered well from the financial crisis, and maintained positive earnings throughout the period. This fact alone may intrigue many potential investors, as many believe in investing in great companies regardless of the price. However, Benjamin Graham, the father of value investing, taught that the most important aspect to consider is whether the company is trading at a discount relative to its intrinsic value. It is through a thorough fundamental analysis that the investor is able to make a determination about a potential investment's merits.

Graham strongly suggested that investors avoid speculation, in order to remove the subjective elements of emotion. This is best achieved by utilizing a systematic approach to analysis that will provide investors with a sense of how a specific company compares to another company.

Defensive Investor - Must pass all 6 of the following tests: Score = 6/6

Adequate Size of Enterprise - Market capitalization of at least $2 billion - PASS

Earnings Stability - Positive earnings per share for at least 10 straight years - PASS

Dividend Record - Has paid a dividend for at least 10 straight years - PASS

Earnings Growth - Earnings per share has increased by at least 1/3rd over the last 10 years using 3-year averages at the beginning and end of the period - PASS

Moderate PEmg (price over normalized earnings) ratio - PEmg is less than 20 - PASS

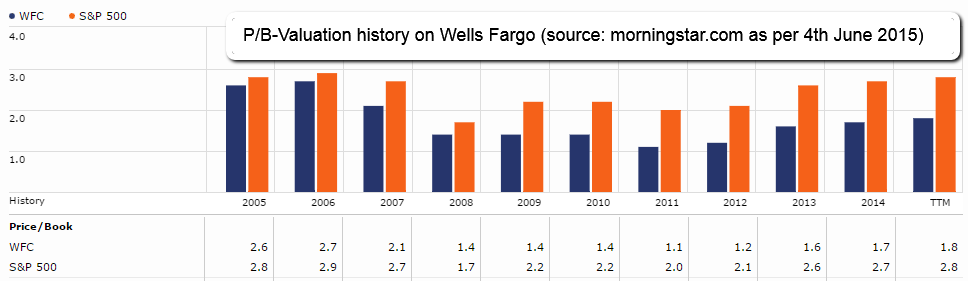

Moderate Price-to-Assets - PB ratio is less than 2.5 or PB x PEmg is less than 50 - PASS

Enterprising Investor - Must pass all 3 of the following tests or be suitable for a defensive investor:

Score = 3/3

Earnings Stability - Positive earnings per share for at least 5 years - PASS

Dividend Record - Currently pays a dividend - PASS

Earnings growth - EPSmg greater than 5 years ago - PASS

Daily updated chart (SMAs included)

Original Text-source: http://seekingalpha.com