Related Categories

Articles

Audius / Crypto is still not dead

A streaming-platform with free access and some good music; The Token: "AUDIO"

Enjoy the vibes ;-)

cheers Ralph

He is the man (for the moment)

www.tipranks.com/bloggers/luke-lango

As per July 2020 "TipRanks" has identified the financial blogs which have provided the best stock recommendations over the past year. The fintech company (TipRanks) measures and ranks the performance of...

...financial experts to provide accountability and transparency.

Tipranks-research shows that the top 10 bloggers outperform the S&P 500 by an average return of 23.4% on recommendations held for one year. TipRanks looked at three key criteria - success rate, average return of each recommendation, as well as the ...

Chuck Akre

Just some snippets from one of the friends of Charlie Munger, the successful investor Chuck Akre. He follows a playbook called the "the three legged stool"; In a few words one could describe that story the following way:

http://investorfieldguide.com/akre

Chuck Akre uses the visual analogy of an early 20th century 'three legged milking stool' to describe his investment process; a metaphorical 'stool' provides a more stable and reliable footing than a standard four-legged stool amidst the topography of chaotic markets. It also leverages the Power of Compounding!

In his ...

Mohnish Pabrai (gr8 insights)

Interviewer-Question: You humbly call yourself a "cloner" of other fund managers. How can we learn to follow Buffett and Munger's footsteps?

Pabrai: "Warren and Charlie have been very generous as they have shared a lot of their wisdom in the public domain. The first question for people that want to follow the footsteps of Warren and Charlie is are you wired for it? The psychological template of who you are as a person is determined by genetics and early childhood experiences, which cannot be easily changed. If you are wired to be a high-speed trader, you ...

Let them (be part of YOUR) DREAM

Warren Buffet-quote

Während Märkte allgemein rational funktionierten, machten sie gelegentlich "verrückte Dinge". Die sich daraus ergebenden Chancen zu nutzen, "erfordert keine große Intelligenz, keinen Abschluss in Wirtschaftslehre oder Vertrautheit mit dem Sprachgebrauch an der Wall Street wie etwa Alpha und Beta. Was Anleger dann stattdessen brauchen, ist die Fähigkeit, die Angst der Masse zu missachten und ein paar einfache Grundsätze zu beachten". Und er fügte dem an: "Die Bereitschaft, eine Zeit lang ideenlos zu erscheinen - oder sogar dummb - ist ebenfalls essentiell."

link:

...

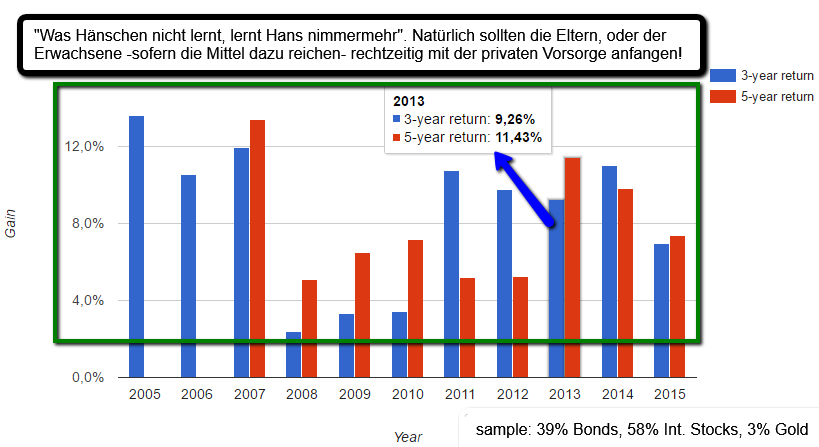

Financial Education

"wherever, whenever"

Financial Times

Elle MacPherson

Photo made by: Ellen von Unwerth (deutsch, geb. 1954)

ist eine Fotografin, die ursprünglich als Top-Model arbeitete. Sie wurde in Frankfurt am Main geboren und begann mit dem Modeln. Nachdem sie von einem Fotografen auf der Straße entdeckt wurde, zog sie nach Paris, um hier ihre Karriere als Model zu fortzusetzen. Während ihrer Jahre als Modell vermisste sie die Freiheit in dieser Branche.

Sie erhielt von ihrem Freund eine Kamera geschenkt und machte von nun an ihre eigenen Aufnahmen, u.a. auch bei einem ...

Nobody is perfect

"Just because you buy a stock and it goes up does not mean you are right. Just because you buy a stock and it goes down does not mean you are wrong."

Quote by Peter Lynch

A Random Walk Down Wall Street

"The harsh truth is that the most important driver in the growth of your assets is how much you save, and saving requires discipline. Without a regular savings program, it doesn´t matter if you make 5 percent, 10 %, or even + 15 % on your investment funds. The single most important thing you can do to achieve financial security is to begin a regular savings program and to start it as early as possible. [The only] reliable route to a comfortable retirement is to build up a nest egg slowly and steadily. Yet few people follow this basic rule [...]

It is ...

John Maynard Keynes

(Zitat)

"Um die Zukunft der Aktie einzuschätzen, müssen wir die Nerven, Hysterien, ja sogar die Verdauung und Wetterfühligkeit jener Personen beachten, von deren Handlungen diese Geldanlage weitgehend abhängt."

Ein Reminder (siehe bereits Posting # 1.128)

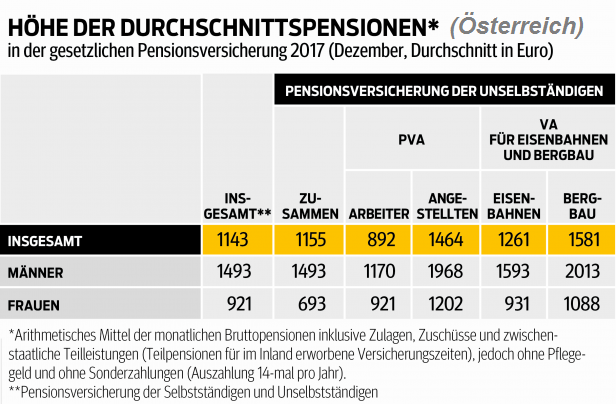

Pensionsvergleiche Frauen und Männer

Durchschnittliche monatliche Pension in Österreich (2017)

Noch immer gibt es deutliche Unterschiede. Egal, ob es um gleiche Chancen am Arbeitsmarkt, gerechte Bezahlung, ausreichende Pensionen oder alllgemein um die finanzielle Situation...

...geht. Nach wie vor verdienen Frauen im selben Job deutlich weniger als Männer. Die Gehaltsschere ist in den vergangenen Jahren zwar kleiner geworden, der Gender-Pay-Gap beträgt aber noch immer 19,9% und liegt somit über dem EU-Durchschnitt von 16%. Österreichs Frauen haben daher im Jahr 2017 wohl 73 Tage ...

Implementing Intergenerational Investing

You can't force your children and grandchildren to invest the way you'd wish (unless if a complex trust is involved, perhaps). But you can make sure they understand the concepts of:

♦ Compounding...

♦ Long-term investing; meaning:

>> Having a long-term perspective means investing in:

>>> Great businesses

>>> With strong and durable competitive advantages

>>> And attractive total return potential

♦ Investing in businesses / stocks / equities

♦ Avoiding panic selling

♦ Minimizing fees

Understanding all these points mentioned above makes it more ...

HOLIDAY

Greetings from DUBAI.

They are building here like crazy!!

All we need is just a little patience...

Freu, Ich habe eine Seite aus "meinem" Luxemburg gefunden:

Discipline & Patience,

what else?

He might be right...

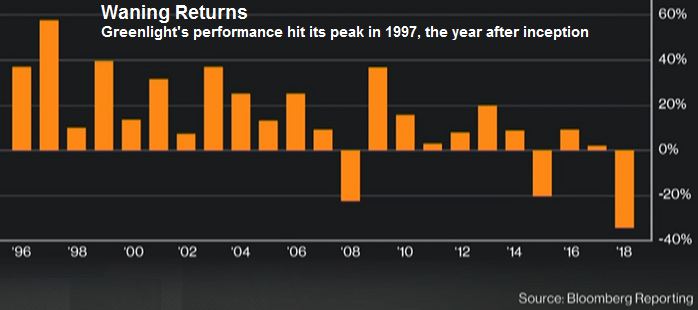

Billionaire hedge fund manager David Einhorn posted his worst year ever

since founding Greenlight Capital in 1996

After seeing returns sink 9% in December 2018, the New York-based firm’s main fund ended 2018 with a 34% loss, vastly underperforming the S&P 500's 7% loss. His strategies...

...did not pay off in 2018, however, as he posted 10 months of negative returns. In his third-quarter conference call, Einhorn cited short positions in an unnamed health care company and tech stock as main drivers of his poor returns. Electric vehicle maker Tesla, which he has compared to his call on ...

Seth Klarman and Goldman Sachs (versus GS)

He went on doing his own thing...

Seth Klarman is a value investor and Portfolio Manager of the investment partnership The Baupost Group. Founded in 1983, The Baupost Group now manages serval billion US-Dollars, and has delivered...

Seth Klarman Total Holding History (Assets in USD bn)

...high returns since their inception. Seth Klarman is the author of the book "Margin of Safety" which sells for over USD 1,000. Mr. Klarman attended Cornell University where he received a degree in economics, and later attended Harvard University where he earned ...

Sunday :-)

Cheers Ralph

Honeymoon (is calling)

Next Posting will follow in ca. 1 week again (11th Sep. 2018 onwards). Have a great week!

Cheers Ralph

VIVE LA FRANCE

JEAN-MARIE EVEILLARD

Jean-Marie Eveillard zählt zu den erfolgreichsten Fondsmanagern, die einen ValueAnsatz verfolgen. Jean-Marie Eveillard kam 1940 in Paris zur Welt. Nach dem Studium arbeitete er ab 1962 zunächst für die Société Générale. Im Jahr 1968 übersiedelte er dann nach New York. Hier ein guter Merksatz von ihm:

"Ich glaube, dass es ein konzentriertes Portfolio ein Phänomen des Bullenmarktes ist. Ein konzentriertes Portfolio in einem Bärenmarkt ist gefährlich, da man nie weiß, was mit seinen Aktien passieren wird."

Diversifizieren. Jean-Marie Eveillard wusste ...

J. M. Keynes (Börsenzitat)

John Maynard Keynes war neben dem bedeutendsten Ökonomen des 20. Jahrhundert auch Börsianer. Hier eines seiner Zitate:

"Um die Zukunft der Aktie einzuschätzen, müssen wir die Nerven, Hysterien,

ja sogar die Verdauung und Wetterfühligkeit jener Personen beachten,

von deren Handlungen diese Geldanlage abhängig ist."

Keynes prognostizierte anfangs vorwiegend langfristige volkswirtschaftliche Entwicklungen. Mit gehebelten Währungsspekulationen fuhr er starke Gewinne ein, verlor später jedoch ein Großteil seines Vermögens. Anstelle gesamtwirtschaftlicher Analysen ...

Andy Warhol

Heute kein richtiges Posting >>>

WEIL:

Wünsche dennoch eine (kühle?) gute Nacht!

You can't be paralyzed by fear or failure or you will never push yourself.

You keep pushing yourself because you believe in your vision and you know it is the right thing to do.

No pain, no gain.

Just a kind reminder:

The Stock Market is not a Casino!

one might forget this from time to time...

Chinese Proverb

Well, in my words: The best time to start investing was years ago. The second best time is now... (?)

My other "two bits": It's never too late to start learning about new things.

Seth Klarman

...is a value investor and Portfolio Manager of the investment partnership "The Baupost Group". Founded in 1983, The Baupost Group now manages several billions, and has averaged high returns since...

..its inception. Seth Klarman is the author of the book "Margin of Safety" which sells for over USD 1,000. Mr. Klarman attended Cornell University where he received a degree in economics, and later attended Harvard University where he earned an M.B.A.

Hi folks!

I will be out of Action until Monday, 21st May 2018.

HOLIDAY is calling :-)

"Erfolg (an der Börse) hat viel mit Inaktivität zu tun. Die meisten Anleger

können der Versuchung nicht widerstehen, ständig zu kaufen und zu verkaufen."

Passivität ist für Warren Buffet ein Schlüsssel zum Erfolg: Hat er sich für ein Unternehmen entschieden, gibt der diesem viel Zeit. Er bevorzugt "langweilige" Aktien, die über lange Zeiträume erfolgreich sind, gegenüber hoch gehandelten Start-ups, die ihren Erfolg erst noch beweisen müssen. Entsprechend sind Euphorie und hochfliegende Hoffnungen auch der Feind des Erfolges (so W. ...

Angst und HOFFNUNG

Angst, dies ist das Bild, das Europa im Jahr 2012 abgibt (Jedoch auch in einigen der Folgejahre). Wir sollten -dennoch- in 3 Wochen (9. Mai 2018) Europa feiern, nicht allein für das, was es uns gebracht hat, sondern für das, was es uns verspricht. Doch Europa ist nur...

Foto: Oliver Mark

...das, was die Mitgliedstaaten und ihre Bürger aus ihm machen. Im Moment zögern sie, sie basteln an Pakten und Reformen, ohne sich mit dem Wesentlichen zu beschäftigen.

Wir müssen warten, bis einige mutige Personen die Kühnheit haben werden, den Schlussakt einzuläuten und den ...

REMINDER

Time In The Market Beats Market Timing

...at least this is valid for the big majority of everyday-investors.

On what to watch in the stock market

(Quote: Ralph Wanger)

"[There's] an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog's owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment, there is no predicting which way the pooch will lurch.

But in the long run, you know he's heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the [dog watchers], big and small, seem to have their eye on the dog, and not the owner."

My two bits (R. Gollner) / ...

Warren Buffet (Zitat)

"Die meisten Leute interessieren sich für Aktien, wenn alle anderen es tun. Die beste Zeit ist aber, wenn sich niemand für Aktien interessiert."

Hedy Lamarr

Fascinating lady, born on the 9th November 1914 in Vienna, Austria

link / Bildersammlung: www.google.at/search?q=hedy+lamarr

MEET BENJAMIN GRAHAM'S MR. MARKET

May I introduce you to Mr. Market. But NOW (here) with his full name: Mr. BULL Market :-)

Mr. Market is a parable that Ben Graham used in his teachings and that's found it's way into the heart of value investing. Mr. Market helps us remember...

... the difference between market price and intrinsic value / so the story goes something like this:

Imagine that in some private business you own a small share that cost you USD 1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth ...

What history can teach us (Warren Buffet)

"What we learn from history is that people don't learn from history."

quote by Warren Buffet

link: www.thebalance.com/warren-buffett-quotes

William Glasser

The ultimate use of power is to empower others!

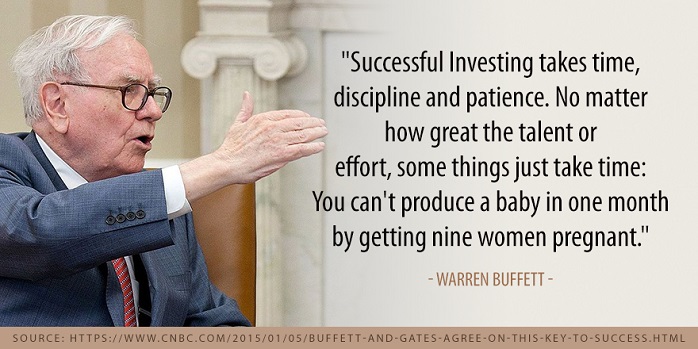

Warren Buffet sagt:

"Erfolgreiches Investieren benötigt Zeit, Disziplin und Geduld. Unabhängig davon, wie groß Dein Talent oder Deine

Anstrengungen sind, einige Dinge brauchen einfach Zeit: Man kann kein Kind in einem Monat bekommen, indem man 9 Frauen schwängert."

The "Do-Nothing" approach...

Take shots...

...if you wanna score.

G R E AT

(just gr8)

Enjoy your weekend

says

Ralph

Gier

(Textauszug aus: "Die Unstillbare Gier" von Jim Steinman)

[...] Doch die wahre Macht,

die uns regiert,

ist die schändliche, unendliche,

zerstörende

und ewig unstillbare Gier.

[...]

Happy New Year (31st Dec. 2017)

Wishing you all the best for the upcoming year 2018!

Frohes Neues Jahr und Beste Gesundheit wünsche ich!

LG Ralph Gollner

Picture / source: www.fool.ca/2017/12/29/2-resolutions-investors-should-make

mfG

Mag. Ralph Gollner

"Reminder" (Ben Graham)

"If the share price advances, it is because most investors expect earnings to grow."

Charlie Munger

...is Warren Buffett's business partner and vice-chairman of Berkshire Hathaway. Berkshire Hathaway is one of the world's most well-regarded corporations and owns a diversified portfolio of high-quality dividend stocks.

Munger managed his own investment partnership before partnering with Buffett to grow Berkshire Hathaway. Munger's partnership averaged returns of 19.8% a year from 1962 to 1975 versus just 5% a year for the DOW over the same time period...

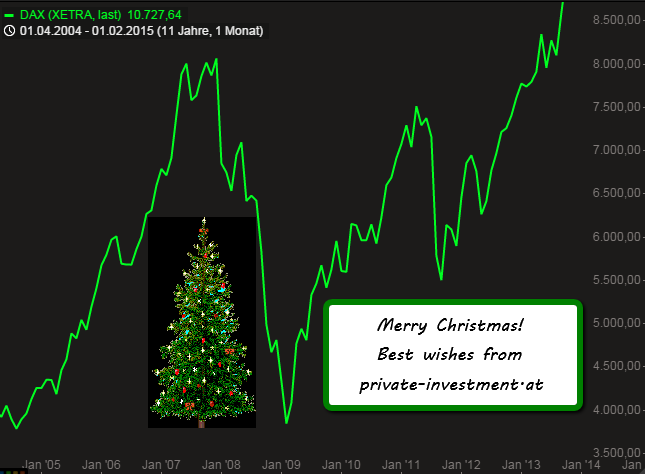

Merry Christmas

(Chart: Dow Jones vom Sommer 2016 bis Nov. 2017)

Faszinierend, mit welch konstantem "Karacho" der Dow Jones seit Sommer 2016 emport ansteigt. Ich wünsche Ihnen, Ihren Angehörigen und Freunden ein gesegnetes Weihnachtsfest!

Billdquelle: www.boerse.de

Zur Info: Der Letztstand des Dow Jones Ind. Average (per 22. Dez. 2017) beträgt 24.754 Punkte !

mfG

Mag. Ralph Gollner

Zitat

An der Börse sind 2 mal 2 niemals 4, sondern 5 minus 1.

Man muß nur die Nerven und ("etwas" Klein-) Geld haben, das minus 1 auszuhalten.

André Kostolany

ungarisch-amerikanischer Finanzexperte (1906 - 1999)

You really (!) have to learn the rules of the game

If you try hard you will thrive and understand. And once you understand the rules then you (just) have to play better than anyone else. To get better over time: You may need to have "Skin in the game". You will always be...

...learning. You will always be starting over! Take a look at the Big Picture, but don't ignore the "most relevant", but yet tiny little bits and pieces...

Ben Graham

wise words - time should take care of the rest...

...food, drinks, etc.

Invest in yourself (what else?)

I don't know what George Clooney would say, BUT:

nice input from:

Trust ist the "new" currency

Everybody is speaking nowadays about Fiat Money and/versus Virtual Currencies, etc....

BUT in the end it's all "just" about TRUST.

Mister Market

It's foolish to think that all stock price declines are merely the result of the market being fearful. Often, a decline in share price can be warranted. But remember, in the short-run the stock market is a a voting machine; in the long-run the stock market is a weighing...

...machine. Stock prices will fluctuate day-to-day. But over many years, stock prices will reflect the true intrinsic value of the underlying business. It's important to remember this fact - and to always think of Mr. Market.

Don't forget: Mr. Market has incurable emotional problems - Warren Buffett ...

Holiday until 15th November 2017

India (Mumbai & Co.)

No postings until then - enjoy your "free time" :-)

Take care !

Ralph Gollner

Peter Lynch

Walt Disney

(Stay Hungry !)

btw.:

Disclaimer/Disclosure: Ralph Gollner hereby discloses that he directly owns securities of Walt Disney Co (DIS), as per 11th October 2017.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Aktien von Walt Disney Co (DIS) befinden sich aktuell im "Echt-Depot" von Mag. Ralph Gollner - per 11. Oktober 2017.

George Lucas and Risk

In 2012, Lucas sold Lucasfilm to The Walt Disney Company for a reported sum of USD 4.05 billion. It was widely reported at the time that Lucas intends to give the majority of the proceeds from the sale to charity...

A spokesperson for Lucasfilm said, "George Lucas has expressed his intention, in the event the deal closes, to donate the majority of the proceeds to his philanthropic endeavors." Lucas also spoke on the matter: "For 41 years, the majority of my time and money has been put into the company. As I start a new chapter in my life, it is gratifying that I ...

Wall Street Journal on a Saturday...

TGIS = Thank got it's Saturday - so we can just relax and read our Wall Street Journal just for fun...and not for business reasons (only). Enjoy your Weekend :-)

You can read it - anytime/anywhere

FINANCIAL NEWS

(@ Karlie: Could you do such a video for my site ?? pleeeaase ; -)

here she goes: www.youtube.com/watch?v=CDllbGKVFcc

Holiday until 23rd August 2017

Last time in Italy (Cinque terre):

He could be right...

?!

Warren Buffet

(Zitat)

"Nimm eine Jahresbilanz nicht zu ernst. Schau lieber, was

über einen Zeitraum von vier bis fünf Jahren geschieht."

Viele an der Börse lassen sich quartalsweise von der "Earnings Season" in Aufregung versetzen, in der Unternehmen ihre Geschäftsergebnisse bekannt geben. Nicht so Warren Buffet. Der Altmeister denkt in größeren Zeiträumen. Aus gutem Grund: Wer den Ansatz verfolgt, Aktienüber Jahre oder (gar) Jahrzehnte (!) zu halten, muss sich über kurzfristige Schwankungen keine Gedanken machen. Es geht um die wahre Durchsetzungskraft der Konzerne - und diese ändert ...

Have a vision, have a goal!

I follow my passion!

Investing in yourself is one of the best return on investments you can have. Whether it's investing in learning a new skill, developing yourself personally or professionally or tapping into your creativity, you need to...

...give to yourself first before you can give to others. It is our responsibility to take the time to develop our gifts and talents, so we can best serve others. Investing in yourself is an example of self-love, you must love yourself before you can expect others to love you.

Why is investing in yourself so powerful?

...

2016 - ein hartes Börsenjahr (ex-post)

John Bennett, Leiter des europäischen Aktienteams von Henderson Global Investors antwortet auf die Frage: "Welche Erkenntnisse haben Sie aus den Entwicklungen im Jahr 2016 gewonnen?" Antwort: "Eine Erkenntnis ist, dass man als Anleger...

...an den Märkten nie auslernt. Der Markt lehrt uns, dass Demut eine Tugend ist. (Im Chart oben sieht man die Indexentwicklung vom US-amerikanischen Aktienmarkt, SPX = S&P 500, sowie vom österreichischen Markt, dem ATX - in den letzten Jahren; Inklusive dem Jahr 2016)

Das haben viele Fondsmanager 2016 ...

What is "INVESTING" ?

Morgan Housel is a partner at Collaborative Fund and a former columnist at The Motley Fool and The Wall Street Journal; He says: Investing is about probabilities, and almost all probabilities are less than 100%. So you're going to be wrong and lose...

...sometimes, even when the odds were in your favor. The late investor Peter Bernstein: "You just have to be prepared to be wrong and understand that your ego had better not depend on being proven right. Being wrong is part of the process. [...]"

♦

History is mostly the study of ...

Investing: Economics & Psychology...

Greenhorn-Advice (Warren Buffet)

TIME TO RELAX

> and ignore the stock market :-)

...wishing you a happy Weekend !

"All we need is just a little patience"

...

Davon kann jeder erfolgreicher Langfristanleger ein Lied singen!

Joel Greenblatt

Joel Greenblatt ist Gründer und Portfoliomanager von Gotham Capital sowie Dozent an der Columbia Business School.

André (Bartholomew) Kostolany

(* 9. Februar 1906 in Budapest als Endre Kosztolányi, Österreich-Ungarn)

...war ein Börsen- und Finanzexperte. Kostolanys Philosophie ist von einer profunden Abneigung gegen die klassische Volks- und Betriebswirtschaftslehre gekennzeichnet. Damit meinte André Kostolany nicht, dass man nur aufgrund von Intuition und Phantasie investieren soll, sondern dass man sich inhaltlich sehr intensiv mit dem jeweiligen Investment auseinandersetzen und dieses verstehen muss...

"Wenn man über die Einzelheiten zuviel weiß, hat man keinen Überblick mehr über das Ganze."

...

Holiday until 6th June 2017

...enjoy your BLOGGING-FREE Time - I will be on Holiday (New York, Florida). Financial Education is still ALWAYS possible. Please look up the archive here on this Website. I always recommend: BEHAVIORAL FINANCE. Financial Markets involve PSYCHOLOGY ;-)

cheers, Ralph

Ray Dalio

"It is far more common for people to allow ego to stand in the way of learning."

I am off (to Budapest) on Saturday

Enjoy your free day !

Walter Schloss (quote)

Walter Schloss is not nearly as well known as other investors such as Warren Buffett but Schloss has gained a reputation as one of the best value investors ever. Like Buffett, Schloss was a direct student of Benjamin Graham, and is one of the "Super Investors"...

...mentioned by Warren Buffett in his famous essay, The Super Investors of Graham-And-Doddsville.

Schloss was born in 1916 and passed away during 2012 at the age of 95. Schloss stopped actively managing other people’s money in 2003. He then became a treasurer for the Freedom House, a non-profit group ...

HAPPY EASTER

(RM-Reminder ;-)

Super Investor, Seth Klarman, on Lessons Learned from Buffett

Seth Klarman has a legendary hedge fund that you may know (?), the Baupost Group. His returns in that fund have been Buffett-like.

Seth Klarman is a value investor... His insights are treasured, and the only book he wrote sells on Amazon for USD 2,500 each. Following some interesting lessons, which were recently published in the Financial times; An extraxt of some great lessons that make you think.

Seth Klarman: "Warren Buffet has become wealthy and famous from his investing. He is of great interest, however, not because ...

Money (alone) can't buy you happiness!

Carl Barks' genius is not only about his wonderful art. Carl Barks was an excellent storyteller who used his stories to not only tell jokes and send these characters on great adventures. He also told us about how they were as people and...

...used them to examine real issues. Uncle Scrooge started out as a penniless prospector in the late 19th century, and by utilizing his smarts and work ethic he built a vast mining/shipping/media/oil/just-about-everything-else empire that resulted in his three cubic acres of swimmable cash money. He's the ...

6 Key Value Propositions A Good Financial "Partner" Can Provide For Clients

Seeking A Better "Return On Life"

in short:

♦ You need to bring order to your financial life!

♦ Prioritise your goals, regularly review your progress toward achievement.

♦ Try to avoid emotionally driven decisions in important money matters.

♦ Try to anticipate your life transitions and be financially prepared for them.

♦ Try to explore what specific knowledge will be needed to succeed in your situation by thoroughly understanding your situation. Then state your questions to get explanations on options and ...

Cinema tonight!

Enjoy your free friday-eve :-)

The Risk-Return tradeoff

...is the principle that potential return rises with an increase in risk. Low levels of uncertainty or risk are associated with low potential returns, whereas high levels of uncertainty or risk are associated with high potential returns.

According to the risk-return tradeoff, invested money can render higher profits only if the investor is willing to accept the possibility of losses.

Read more: Risk-Return Tradeoff Definition | Investopedia

www.investopedia.com/terms/r/riskreturntradeoff

Bad strategy...

a small "problem"...

Just the truth or a "bad" joke ?

"Overall in Europe, four out of five active equity funds failed to beat their benchmark over the past five years, rising to 86 per cent over the past decade, according to S&P’s analysis of the performance after fees of 25,000 active funds." (March 2016)

If this encourages some retail investors to question their financial advisers and fund groups, then that is a good thing. The passive voice is getting louder and louder!!

More specific: Almost every actively managed equity fund in Europe investing in global, emerging and US markets has failed to beat ...

! Merry Christmas !

Vacation (28/09/2016 - 13/10/2016)

I´m going on holiday! Will be back by Mid-October, cheers Ralph

Merksatz (J.W. Goethe)

Johann Wolfgang von Goethe war der berühmteste deutsche Dichter und einer der bekanntesten Dichter der Welt. Er wurde 1749 in Frankfurt am Main geboren und wuchs in wohlhabenden Verhältnissen auf. Weiters war er auch Naturwissenschaftler und Staatsmann.

Bildquelle: http://de.slideshare.net/netzvitamine

André Kostolany - Zitate

André Kostolany war ein "Börsenlehrer", der von der Praxis zur Theorie kam. In Wien begann Kostolany Philosophie und Kunstgeschichte zu studieren, sowie einige Semester Volkswirtschaft,...

...wurde aber Mitte der 1920er-Jahre von seinen Eltern zu einem Pariser Börsenmakler in die Lehre geschickt. Von da an nahm Alles seinen Lauf...

In Deutschland erlangte Kostolany Berühmtheit durch die Kolumne in der Finanzzeitschrift Capital". Von 1964 bis zu seinem Tode, gehörte ihm insgesamt 414-mal die letzte Seite. Bekannt sind auch die von ihm gehaltenen legendären ...

Vacation (30/06/2016 - 08/07/2016)

I´m going on holiday! Will be back in July, cheers Ralph

(Warren Buffet's financial partner)

Tips on the decision-making process; In 2015 T. Griffin homed in on the ideas of Charlie Munger, longtime investor and vice chairman of Berkshire Hathaway Inc.; a book by Mr. Griffin, “Charlie Munger: The Complete Investor”.

WSJ: ...

Enjoy your Saturday!

Prior to 1928, the stock market was open on Saturdays, but not Sundays. The Sunday closings were out of religious respect, and the fact that in those days most Americans lived on farms, and had to give their horses a day of rest or they would die...

During 1928 & 1929, as the stock market was in its "bubble phase", many Saturdays were taken off to allow exchange staff to catch up on their paperwork. For months after the stock market crash of late 1929, Saturdays were taken off to allow exchange staff to catch up on their paperwork...this time led by selling ...

During 1928 & 1929, as the stock market was in its "bubble phase", many Saturdays were taken off to allow exchange staff to catch up on their paperwork. For months after the stock market crash of late 1929, Saturdays were taken off to allow exchange staff to catch up on their paperwork...this time led by selling ...

Ken Fisher (quote)

Financial Education Offensive (Österreich)

Nationale Strategie zu finanzieller Bildung erforderlich; Aktienforum-Präsident Ottel: Potenzial und Brainpower in Österreich enorm - Finanzbildung samt notwendigen Vermittlungsmethoden findet aber nicht statt, wäre aber dringend notwendig.

Ein stärkeres Engagement der Politik im Bereich Finanzbildung forderte Robert Ottel, Präsident des Aktienforums, im Feb. 2016 bei der Veranstaltung „Pitch im Paternoster“ im Haus der Industrie in Wien ein. Das von der Jungen Industrie gehostete Event wurde neben dem Aktienforum auch vom AWS unterstützt. ...

The market lost 22.6% in a single day of trading

GOTCHA!

Happy April Fool's Day!

Happy Easter

Good Friday

The New York Stock Exchange, the biggest stock market in the world, is closed for business. Bond and other securities markets are somewhat more decentralized, but the Securities Industry and Financial Markets Association (SIFMA) also calls off today.

Finally, the Chicago Mercantile Exchange and US equity and other futures markets are also closed today!

source: http://www.businessinsider.de/2016-us-market-holiday

André Kostolany

Merry Xmas (Dec. 2015)

Lots of presents and fun with your family & friends!!

It's all about LEARNING BY DOING!

Live-Seminar am 27. Nov. 2015 in Wien

EINLADUNG/GRATIS-Anmeldung inkl.:

https://www.facebook.com/groups/1408093186152381/

Split Vormittagsteil & Nachmittagsteil:

1. Teil (Längere Einleitung/interessante Details)

2. Teil (Die wichtigsten Infos/AUCH für die dann später Hinzukommenden/Berufstätigen)

WLAN inkl. (kostenfrei => somit LIVE-Crosscheck des Vorgetragenden, bzw. interaktives "Mitmachen" möglich)

AGENDA

____________________________________________

-) Die Weltwirtschaft 2016 bis 2025 bzw. 1920 bis 2015

(Einführung für Newbies und Wirtschaftsakademiker)

-) Was nicht nur Banker wissen ...

Der Wanderprediger in Sachen Börse und sein langjähriger Partner Gottfried Heller

Gottfried Heller war jahrzehntelanger Partner und Freund von André Kostolany, mit dem er auch die Investmentfirma Fiduka gründete.

Gottfried Heller war jahrzehntelanger Partner und Freund von André Kostolany, mit dem er auch die Investmentfirma Fiduka gründete.

Viele Kommentare von A. Kostolany waren einfache Aussprüche, die das Wesentliche auf den Punkt brachten. "[Es] mag vielleicht etwas banal klingen, doch letztlich kommt es darauf an, ob und wie Aktionäre die Gewinne eines Unternehmens, die Wirtschaftslage und die politische Großwetterlage bewerten. Das müsse jeder Börsianer verinnerlichen", so Kostolany.

Die Psychologie war für ...

Aug. and Sep. are always good months to be on holiday...

not only because of the weather, but also because there are several factors, which suggest that the 3rd quarter of the year is the perfect time for European tourists to fly around the world and for investors to partly hedge ones portfolio (or just relax in the hot summer sun).

In 2015, staying away from the markets in Q3 of the year and enjoying the summer sun, would have been the best idea. At least, one should always think about taking some sort of headging measures, if you have a Long-Equities-portfolio.

BTW: I will be back ...

Related Articles

Pain is temporary

(2nd April 2020)

It may last for a minute, an hour or even a Year - but eventually: It will subside!

Zitat

(Warren Buffet)

Die meisten Leute interessieren sich für Aktien, wenn alle anderen es tun. Die beste Zeit ist aber,

wenn sich niemand für Aktien interessiert.

Warren Buffet (Quote)

KISS = Keep it short and simple (stupid), or "he would put it in other words":

Those who won't go with the time will go with the time

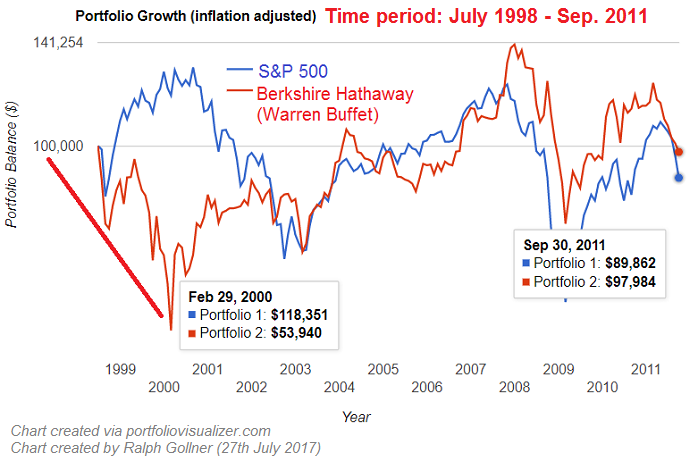

In July 1998 (one month before Warren Buffet turned 68 years; easy to calculate: He was born in 1930 :-) Warren could have gone into pension...I am not sure, if it was really senseful of him or helpful to stay in the investing field...

...

Warren Buffet on low-cost Index funds

Quotes from Berkshires shareholder letters

Quotes from Berkshires shareholder letters

Quotes from Berkshires shareholder letters

Quotes from Berkshires shareholder letters

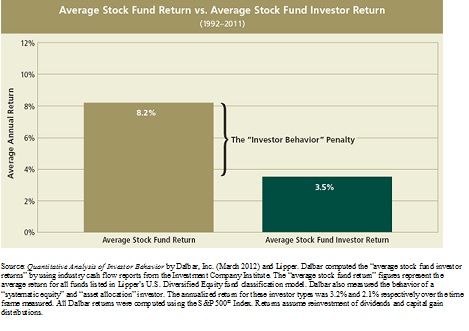

“Individuals who cannot master their emotions are ill-suited to profit

from the investment process.”

Quote by Benjamin Graham (Father of Value Investing and Warren Buffett's teacher at Columbia Business School)

A study by Dalbar underscores the importance of controlling emotions and avoiding ...

Quotes from Berkshires shareholder letters

Quotes from Berkshires shareholder letters

Art Cashin is a real veteran on Wall Street

Quotes from Berkshires shareholder letters

Liebe Interessierte!

Das nächste Live-Meeting in Wien wird wohl Mitte August stattfinden.

Infos zu genauem Datum / Uhrzeit / Location folgt noch

Freue mich über rege Teilnahme,

LG Ralph Gollner