Related Categories

Related Articles

Articles

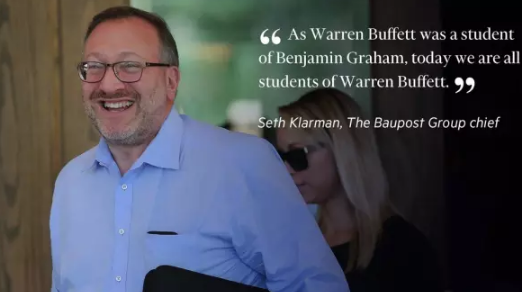

Super Investor, Seth Klarman, on Lessons Learned from Buffett

Seth Klarman has a legendary hedge fund that you may know (?), the Baupost Group. His returns in that fund have been Buffett-like.

Seth Klarman is a value investor... His insights are treasured, and the only book he wrote sells on Amazon for USD 2,500 each. Following some interesting lessons, which were recently published in the Financial times; An extraxt of some great lessons that make you think.

Seth Klarman: "Warren Buffet has become wealthy and famous from his investing. He is of great interest, however, not because of these things but in spite of them. He is, first and foremost, a teacher, a deep thinker who shares in his writings and speeches the depth, breadth, clarity, and evolution of his ideas.

He has provided generations of investors with a great gift. Many, including me, have had our horizons expanded, our assumptions challenged, and our decision-making improved through an understanding of the lessons of Warren Buffett."

♦ Quality matters, in businesses and in people. Better quality businesses are more likely to grow and compound cash flow; low quality businesses often erode and even superior managers, who are difficult to identify, attract, and retain, may not be enough to save them. Always partner with highly capable managers whose interests are aligned with yours.

♦ Consistency and patience are crucial. Most investors are their own worst enemies. Endurance enables compounding.

♦ Risk is not the same as volatility; risk results from overpaying or overestimating a company's prospects. Prices fluctuate more than value; price volatility can drive opportunity. Sacrifice some upside as necessary to protect on the downside.

♦ Unprecedented events occur with some regularity, so be prepared.

♦ You can make some investment mistakes and still thrive.

♦ Holding cash in the absence of opportunity makes sense.

♦ Candour is essential. It's important to acknowledge mistakes, act decisively, and learn from them. Good writing clarifies your own thinking and that of your fellow shareholders.

♦ To the extent possible, find and retain like-minded shareholders (and for investment managers, investors) to liberate yourself from short-term performance pressures.