Related Categories

Related Articles

Articles

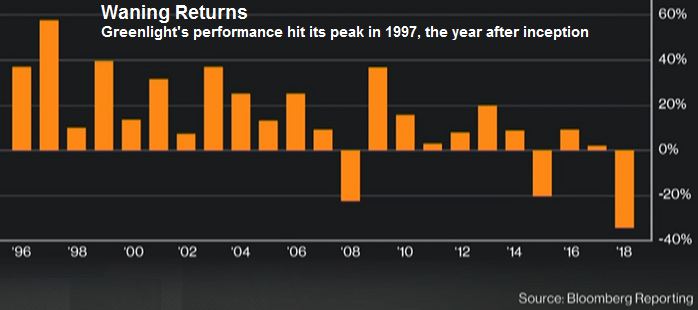

Billionaire hedge fund manager David Einhorn posted his worst year ever

since founding Greenlight Capital in 1996

After seeing returns sink 9% in December 2018, the New York-based firm’s main fund ended 2018 with a 34% loss, vastly underperforming the S&P 500's 7% loss. His strategies...

...did not pay off in 2018, however, as he posted 10 months of negative returns. In his third-quarter conference call, Einhorn cited short positions in an unnamed health care company and tech stock as main drivers of his poor returns. Electric vehicle maker Tesla, which he has compared to his call on Lehman Brothers, also did better than he expected. As for his major investments, Einhorn’s three largest positions, which are automaker General Motors Co., insurer Brighthouse Financial Inc. and homebuilder Green Brick Partners Inc., all struggled during the year.

As of 31st Dec. 2018, Detroit-based General Motors' shares had tumbled approximately 18% for the year to USD 33.43. Brighthouse Financial, which is headquartered in Charlotte, North Carolina, plummeted roughly 48% over the course of the year to close at USD 30.48 on New Year's Eve. Shares of Texas-based Green Brick Partners declined 36% to close at USD 7.24 on Monday, 31st Dec. 2018.

The performance of Einhorn's Greenlight has slowly deteriorated since 2015, when it lost more than 20%. According to GuruFocus data, the company then managed to scrape by with two positive years, returning 7% in 2016 and 1.5% in 2017.

The hedge fund manager recently became a critic and short seller of Tesla, even comparing the electric car maker to his call

on Lehman Brothers.

Status as per January 2019:

The firm's assets had shrunk to USD 2.5 billion, from over USD 10 billion four years ago.

Many investors were fed up with heavy losses and Einhorn said the firm has had "substantial redemptions."

links:

www.gurufocus.com/news/793454/david-einhorn