Related Categories

Related Articles

Articles

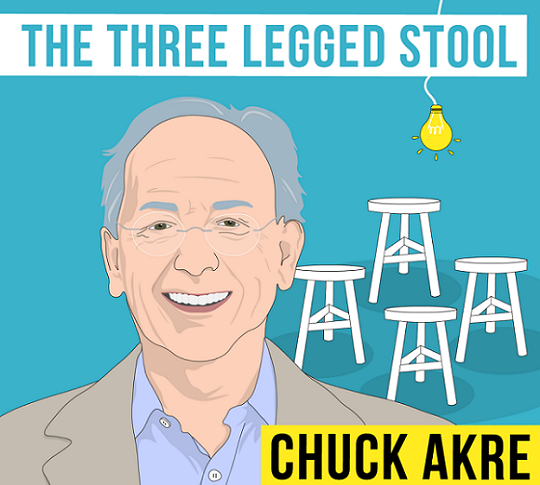

Chuck Akre

Just some snippets from one of the friends of Charlie Munger, the successful investor Chuck Akre. He follows a playbook called the "the three legged stool"; In a few words one could describe that story the following way:

http://investorfieldguide.com/akre

Chuck Akre uses the visual analogy of an early 20th century 'three legged milking stool' to describe his investment process; a metaphorical 'stool' provides a more stable and reliable footing than a standard four-legged stool amidst the topography of chaotic markets. It also leverages the Power of Compounding!

In his words: "The essence of our investment approach is perfectly captured by the visual of a "three-legged stool." This metaphoric three legged stool describes what we look for in an investment: (1) extraordinary business, (2) talented management and (3) great reinvestment opportunities and histories. I have an old three-legged milking stool in our conference room and it is clear by looking at it that it is sturdy and durable. We believe our stool is just as sturdy and durable based on our many years of experience!"

Chuck Akre

(I)

Leg One : Extraordinary Businesses

"Our favorite businesses will be those which exhibit real pricing power with their brands, which require modest amounts of capital to prosper, which are run by people with equal parts skill and integrity, and which have demonstrated an ability to reinvest virtually all the excess capital that the business generates."

Chuck Akre

Another attraction of owning high quality businesses is the resilience they tend to display in difficult markets. Consistent profitability through business cycles combined with solid balance sheets protects against the permanent loss of capital.

"The practice of not losing money is significantly advanced by the selection of superior businesses."

Chuck Akre

"Our primary frontier of risk management isn't wide diversification, but the quality of the individual businesses, their balance sheets and the people who run them."

Chuck Akre

(II)

Leg Two: Talented Management

"We look for managers who are owners, and who have always acted in the best interest of ALL shareholders. This leg is the trickiest: our experience shows us that we must follow what these managers have actually done, rather than what it is that they have said they have done. (You know, just the reverse of our parents' admonition: "do as I say, not as I do")."

Chuck Akre

(III)

Leg Three : Great Re-Investment Opportunities

"Does the company have the capital-allocation skills necessary and the market potential to invest all the excess cash generated by the business in projects that can earn above-average returns? In my experience this is perhaps the single most important issue facing any CEO, and is also the area in which management can create or destroy value most quickly and permanently.

Chuck Akre

link: