Related Categories

Related Articles

Articles

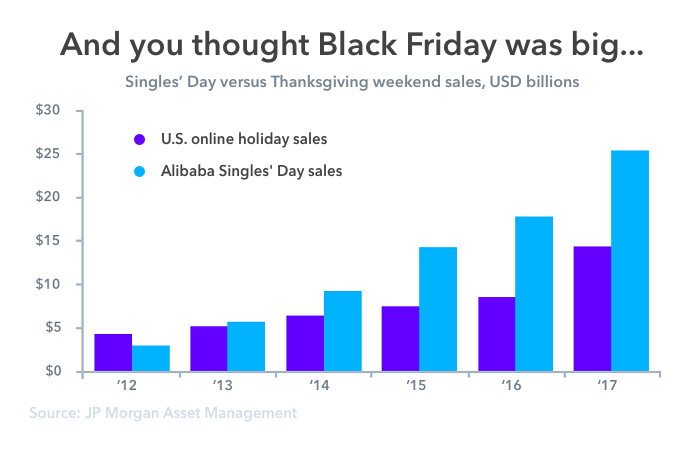

What's Behind Alibaba's USD 25 Billion in Sales on Singles' Day?

Since the early 2010s, China's e-commerce giant Alibaba Group has single-handedly turned Singles' Day into the biggest shopping event by launching large-scale shopping promotions centered around 11th November. Gradually,...

... other e-commerce companies also joined the event and Singles' Day no longer belonged to single people only, but to all e-consumers across the nation, just like Black Friday in the United States.

... other e-commerce companies also joined the event and Singles' Day no longer belonged to single people only, but to all e-consumers across the nation, just like Black Friday in the United States.

On 12th November 2017, Alibaba announced that it generated a record 168.2 billion yuan (USD 25.3 billion) in sales during 24 hours on Singles' Day, an increase of 39 % compared to 2016. More than 140,000 brands and merchants doing business on Alibaba's online platforms participated the promotion event.

In an attempt to display Chinese consumers' contribution to the global economy and China's robust consuming power, Alibaba particularly released the data involving international merchants. The company claimed that as many as 60,000 international brands and merchants had joined the promotion event.

The fast development of e-commerce, online payments, and express shipping services in China has made online purchasing extremely convenient: with a simple click on one's smartphone or computer, a customer can buy whatever he wants instantly. But the convenience has also spurred irrational purchasing decisions, particularly on Singles' Day. Some Chinese netizens even made jokes about "chopping one's hands off" as a cure for addiction to purchasing online.

Furthermore, apart from Alibaba JD.com plays also a huge role in the market. Remember the core difference between China's two leading e-commerce companies: Alibaba runs Tmall, the largest e-commerce platform in the world. For the most part, Alibaba does not purchase products. JD, on the other hand, runs its e-commerce operations more as a traditional online retailer (like Walmart) in which it purchases and resells. Again like Walmart, it has built its model on high-volume and low margins to deliver considerable value to Chinese consumers.

The result: JD reports Single's Day sales of USD 19 billion. This is less than Alibaba's USD 25 billion to be sure and also a little bit of apples-and-oranges here as the JD figure is for 11 days and the Alibaba figure is for (only!) one day. However the Alibaba numbers also include pre-orders that start in October.

But whether you prefer apple juice or orange juice, USD 19 billion is a huge figure and a reminder that international brands may also need to develop a JD strategy if they want to approach the China market.

Disclosure/Disclaimer: Ralph Gollner hereby discloses that he directly owns securities of the companies mentioned in the article: Alibaba and JD.com as per 7th December 2017.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Aktien von Alibaba und JD.com, welche im Artikel erwähnt wurden, befinden sich aktuell im "Echt-Depot" von Mag. Ralph Gollner - per 7. Dezember 2017.

links:

https://thediplomat.com/2017/11