Related Categories

Related Articles

Articles

Definition of 'Yield On Cost - YOC' (example: Coca Cola/ticker: KO)

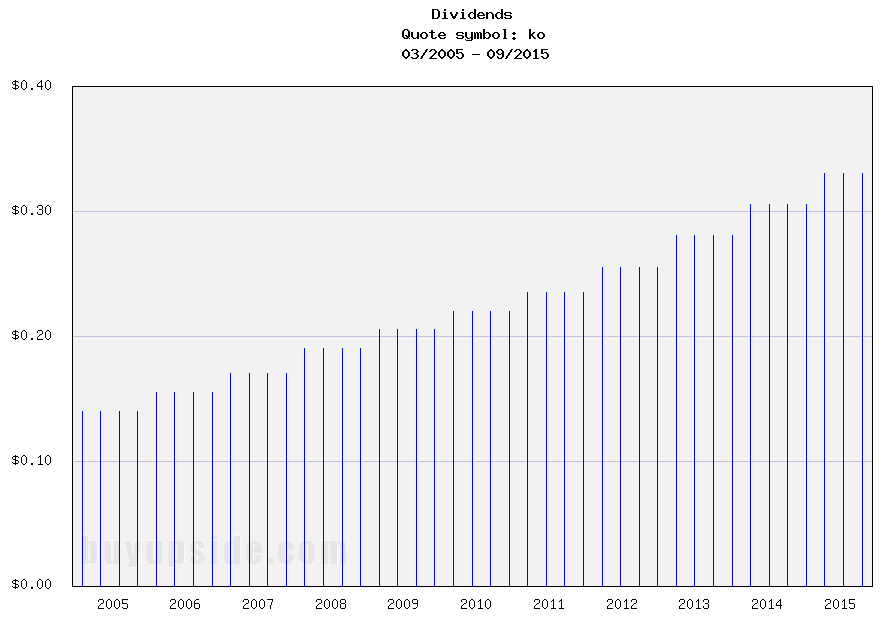

"YOC" ist the annual dividend rate of a security divided by the average cost basis of the investments. It shows the dividend yield of the original investment. Here a chart of the div. payments (cash-out) to Coke-Investors: source: www.buyupside.com

source: www.buyupside.com

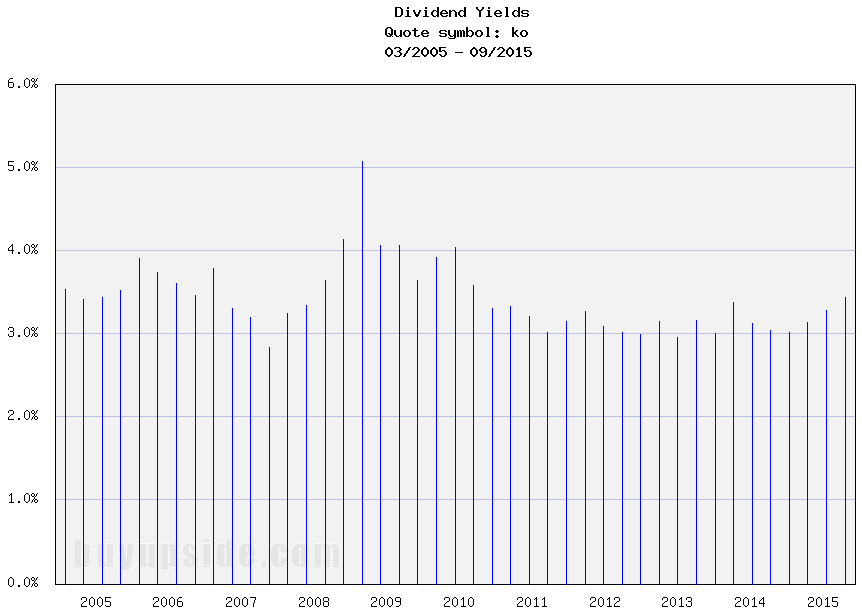

If the number of shares owned by the investor does not change, the yield on cost will increase if the company increases the dividend it pays to shareholders; otherwise it will remain the same. Following a chart of the dividend yields IN THE YEAR of a possible purchase in that year ONLY!

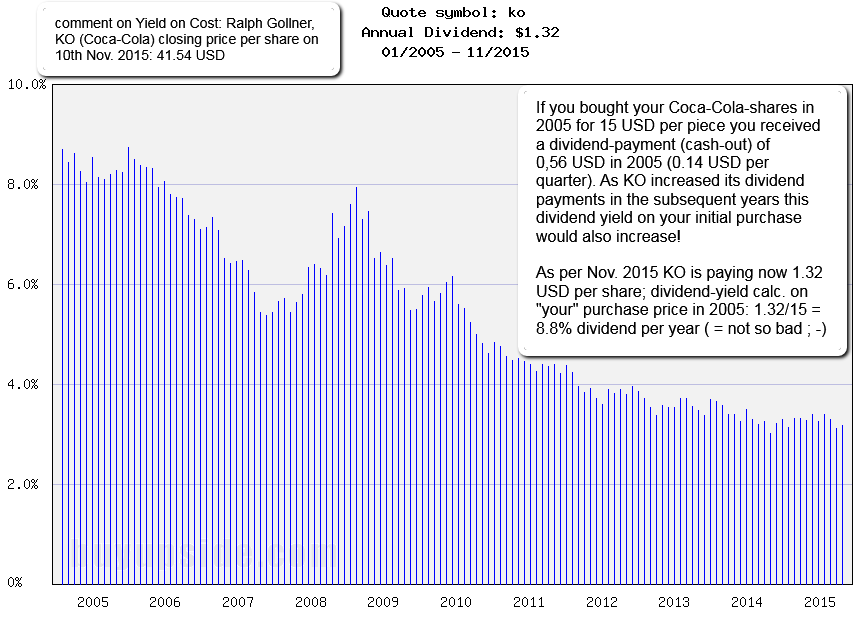

To calculate yield on cost for a stock, an investor must divide the stock's annual dividend by the average cost basis per share and multiple the resulting number by 100 (to get a percentage).

For example, an investor who purchased 10 shares of stock at $15 and 20 shares at $18 would have an average cost basis of $17/share ($15*10 + $18*20)/(10 + 20). If the annual dividend is $1.32 per share, the yield on cost would be 7.76% ($1.32/$17 * 100).

weekly updated Coca-Cola-Chart

(timeframe: last decade incl. quarterly dividend payments and calculated dividend yield as per current purchase price)

Read more: Yield On Cost (YOC) Definition | Investopedia: http://www.investopedia.com