Related Categories

Related Articles

Articles

YOI or YOC

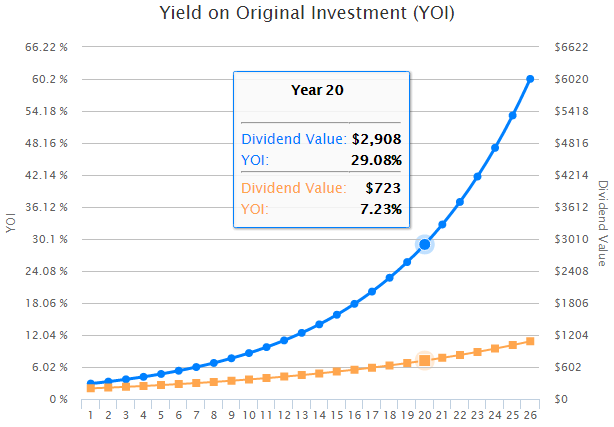

The Power of Compounded Growth and Reinvested Dividends! Buying a 2.9%-Dividend-Yield stock, which is raising its dividend payments 10% year-over-year leads to following YOI or YOC (yield on cost) after 20 years (check the blue line):

YOI stands for "yield on original investment (YOI)". YOI is simple; it’s the income yield you'd have today on an investment you made some time in the past. Harnessing this concept, an investor can achieve annual income returns of 10%, 20%, 30%, 50%, and more on original investment during an ordinary adult life. These are not "gains" in the usual sense. These are repeatable cash flows, each and every year. It’s not rocket science. Just two ingredients - sensible analysis and patience—are required. In other words, the best way to get a high yield on capital is to wait for it.

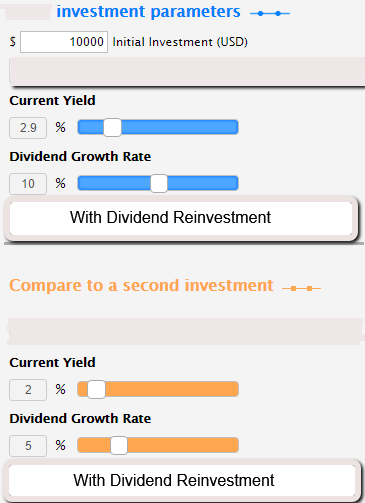

The parameters chosen for the calculation and the resulting curves in the graph above can be seen here:

Do your own calculations online /tool: http://mhinvest.com/yoi.html

Do your own calculations online /tool: http://mhinvest.com/yoi.html

Miller/Howard Investments, a boutique investment manager, developed this future income - yield calculating tool. You can try it out at the firm’s website at http://mhinvest.com/yoi.html.

For the question as to what to expect in 20 years, it's best to consider the yield on investment calculation in view of the uncertainties that the future always contains. (For example, in theory, highest growth of income will always eventually win the day. But for any given investment, how long can the assumed income growth rate last?).

The Miller/Howard YOI Calculator directly illustrates the results of dividend investing over time. It was designed to provide a basic roadmap to help investors who may have, for instance, a certain level of future dividend income from their investments in mind.

Using the calculator involves entering your beginning principal, beginning portfolio dividend yield, projected portfolio growth of dividends, and whether you plan to reinvest your income or not. The YOI Calculator then generates a timeline of expected future portfolio income based on these assumptions - an estimated future yield on original investment. Further, the income timeline can be compared to another investment with different yield and yield growth parameters.

Many would be right to question whether or not the rabbit can keep running at 10% for 20 years. Life is hard. Business is hard. Events intervene. The Law of Large Numbers casts a shadow, as the bigger a company gets, the more difficult it is to maintain a high growth rate that would fund a high rate of distribution increases. This is why "moderate sustainable growth" is appealing: In constructing a pro forma plan, you'd like to know that the result is reasonably possible - not just that it glows in a reality that is not especially probable. Seasoned quality companies with a great business model and durable markets can keep the compounding going. Frisky newcomers or over-leveraged companies, not so much.

Bear in mind that the YOI Calculator is only dedicated to discerning income yield on original investment. The slopes are smooth because the income portion of return is always (or almost always) positive. The calculator doesn't deal with total return, since Mr. Market is sometimes manic and sometimes depressive, and the overall pattern of ups and downs has significant impact on total return. The assumption is that with long - term income growth, the price of the instruments producing that income will respond in kind.

♦ Lowell G. Miller is the founder, chief investment officer, and director of research of Miller/Howard Investments Inc., an independent boutique investment manager located in Woodstock, New York, that specializes in high-quality dividend-growth companies.

This article originally appeared in the June 2015 issue of the AAII Journal, link: http://blog.aaii.com