Related Categories

Related Articles

Articles

Dividend growth investing

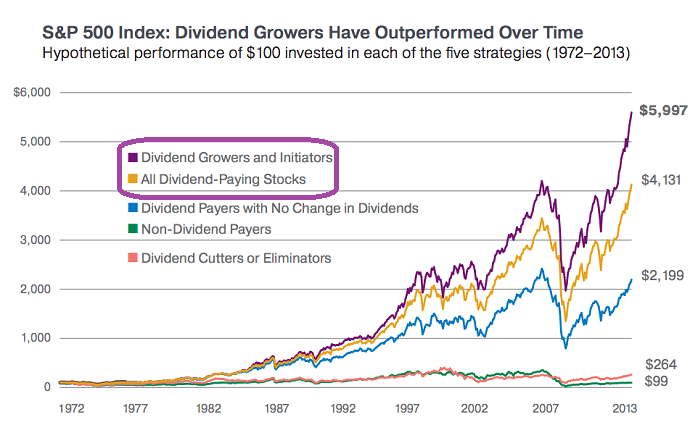

Dividend growth investing stands the test of time. There is plenty of academic evidence to show that stocks with consistently rising dividend payments tend to outperform the broader stock market. Identifying stocks with strong dividend growth...

...prospects, however, can be difficult. BUT: History is on our side here - dividend history matters. Stocks with long streaks of dividend increases are highly likely to continue increasing their dividends for years to come.

This investment strategy (Dividend growth investing) has been studied/written about since at least 1934, when Security Analysis (arguably the most famous book on investing) was published:

"The prime purpose of a business corporation is to pay dividends regularly and, presumably,

to increase the rate as time goes on."

– as quoted by Benjamin Graham in Security Analysis

Clearly, something is special about dividend growth investing. Dividend growth investing can seem very complicated to those just starting out. However, the blueprint for successful dividend growth investing is actually quite simple:

♦ Investing in consistent dividend growers

♦ Being mindful of the payout ratio

♦ Avoiding overvalued stocks

♦ Investing for the long term (Patience!) !