Related Categories

Related Articles

Articles

Advantages of Using Yield on Cost

Upfront info: In the long run (> 10 years) there are many forces driving a Portfolio-Performance.

Here just one of the most logic ones: The yield on cost can be useful in assessing how productive an existing investment has been at providing income...

...in the past. If you're looking to see how much income you're receiving based on your original investment, yield on cost is a way of determining that. Yield on cost is also an easy way to gauge the dividend growth of stock investments retroactively.

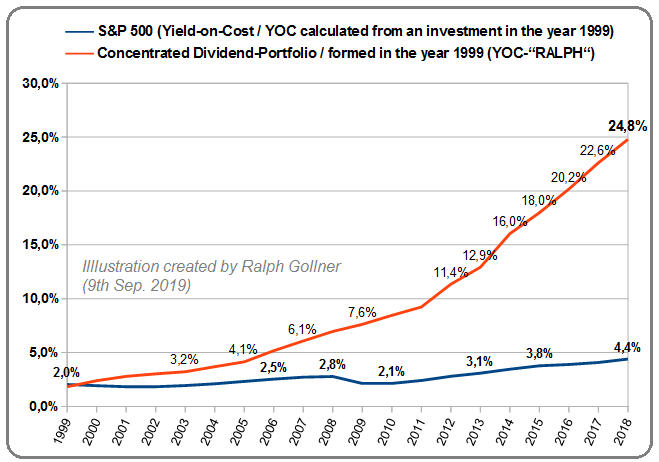

For example (see also my following illustration where I ran a concentrated Dividend-stocks-portfolio versus the S&P 500), consider an investor that purchased stock in XYZ Corporation at USD 100 per share. At the time of purchase, the stock was paying a USD 2-per-share annual dividend, translating to a 2% dividend yield. If the company increases its dividend by USD 0.10-per-share annually for the next 10 years, the stock's yield on cost has steadily increased to 3%. Since the original investment remains constant (assuming no additional purchases are made along the way), a consistently rising yield on cost indicates that the company has been successful in raising its dividend over time.

Along those same lines, the yield on cost, like the dividend yield, is not a total return measure. Depending on the study, analysts generally conclude that somewhere between one-third and one-half of a stock's total return comes from dividends.

A word of caution: That leaves a large chunk of return attributable to share price movement. Higher yields don't necessarily equate to better stocks. In fact, the opposite can often be true.

(!) In short, it's not wise to judge how attractive a stock is based solely on a (current) yield figure!

Final remarks (by Ralph):

It's important to review the Payout-Ratio of a Dividend-paying company.

It's relevant, that the company is generating Free-Cash-Flows (in order to maintain the Dividend-payouts).

It's relevant, that the earnings (and Cash-Flows) are growing over the time, so that some Dividend-Growth can be maintained over the years!

Many value-oriented traders look for stocks with a meaningful dividend yield and whenever possible, those with a strong history of steadily increasing dividend payouts.

It's (just) compounding, nothing else (the CFO of each company should be aware, that experienced investors expect that a proven track-record of rising dividends will be maintained).

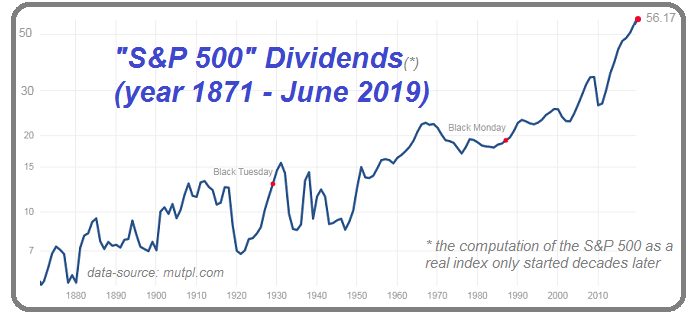

MAGIC NUMBER: Since 1946, S&P 500 dividend growth has been about 6% annually (up to nearly 7% yoy).

72/6 = 12 years (magic investment-period ;-)