Related Categories

Related Articles

Articles

Dividends & Share Buybacks

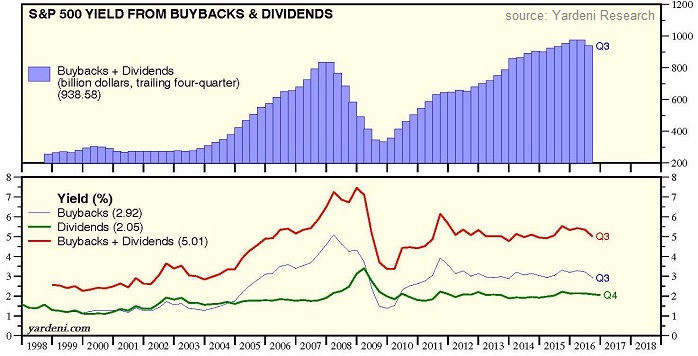

Equities continue to have a strong cash return story, even with interest rates having moved higher since bottoming last year. The S&P 500 Index sports a current Dividend yield of ca. 2.0%, a level that has been fairly consistent in recent years.

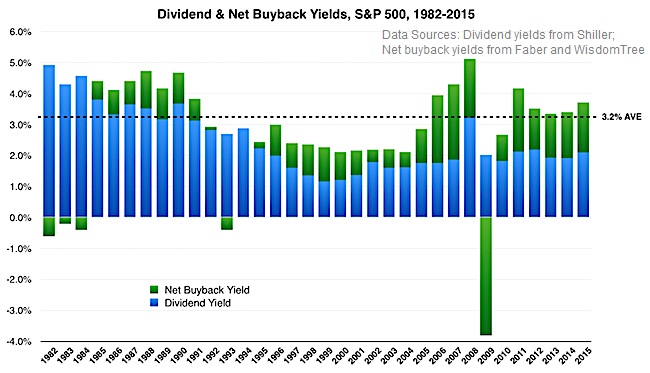

Dividend increases have been running strong since 2011, and one can expect mid- to high-single digit cash dividend growth this year and next as modest economic growth continues. Share repurchases remain an ongoing benefit to valuations as well. When combining net share repurchases with dividend yield, one can currently finds the effective yield of the S&P 500 to be around 4.0%, significantly higher than the current 2.3% yield on the 10-year Treasury !

While some may forecast a further pickup in share repurchases, one should consider a balanced approach by companies to corporate spending, including share repurchases, cash dividends, mergers and acquisitions and capital expenditure, implemented over time being the most likely scenario.

The following chart below illustrates just how significant share buybacks are. Since the Great Recession, they have been half again as large as dividend payouts:

Viewed another way, we can see that large US companies buy back shares equal to 2% - 3% of their market value every year. That's a significant fraction of overall trading volume.

links:

https://seekingalpha.com/article

www.advisorperspectives.com/articles/2017

Buybacks as per Dec. 2016 / Factset (.pdf) https://insight.factset.com/hubfs