Related Categories

Related Articles

Articles

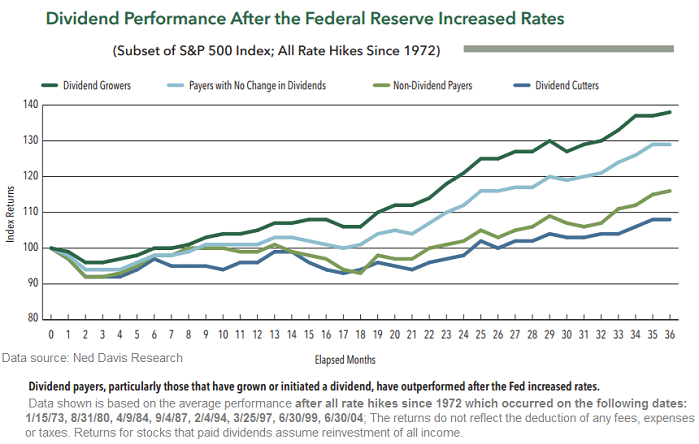

Why stock market investors should not fear

Fed rate hikes

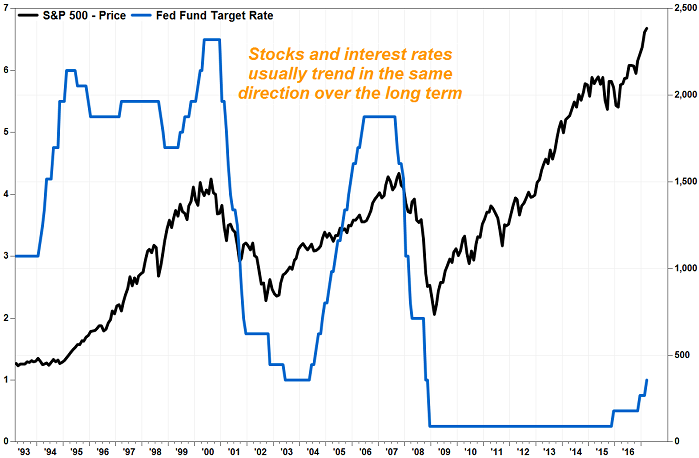

In theory, rising interest rates are supposed to hurt the stock market because it makes interest-rate instruments relatively more attractive and reduces liquidity in the marketplace. But in reality, interest rates and the stock...

...market usually trend in the same direction over the long term. That is because the conditions that lead to higher rates, such as an acceleration in economic growth, also fuel bull markets for stocks, while the drivers of rate cuts, like an impending economic recession, are often behind bear markets.

Since the current tightening cycle started on 16th Dec. 2015, the S&P 500 has climbed far over 10%.

"The popular narrative is that tighter [Fed] policy is a headwind to market success," Jonathan Golub, chief market strategist at RBC Capital Markets, wrote in a note to clients. "The data challenges this assertion, as the market advanced during each of the past five rate hike cycles."

Starting on 30th June 2004 the Fed raised its fed funds target at each of 17-consecutive meetings through 29th June 2006, with the rate rising to 5.25% from 1.00%. The S&P 500 rose 12% over that same time.

Golub said that from 1987 through 1989, the Fed hiked rates 27 times over 28 months, but stocks soared 26% during that time, even when including the 1987 crash.

And from 1994 to 1995, Golub pointed out that the Fed raised the fed-funds rate by 3 percentage points in 12 months, but stocks rocketed 20% over the next six months.

Eventually, rates will get high enough to choke off economic expansion and hurt stocks, but based on current market dynamics, the market appears to be safe for quite a while, maybe even years.

"Put differently, the Fed has a long way to go before damaging the market or economy," Golub wrote.

links: