Related Categories

Related Articles

Articles

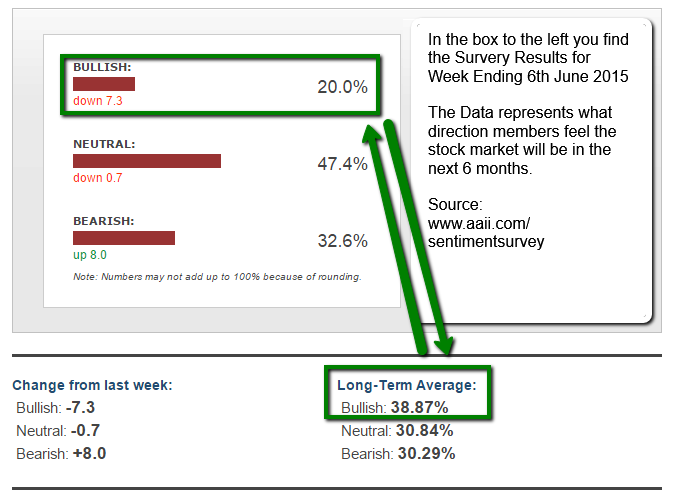

AAII Investor Sentiment (June 2015)

My Input with referring to articles of other authors (11th June 2015):

Contrarian investors should pay particular attention to the unusually low bullish reading in last week’s survey. There are about 160,000 AAII members. The typical member is a male, with a bachelor’s or graduate degree, and is in his mid-60s. The median portfolio size of members is just over $1 million.That makes the AAII Sentiment Survey a good proxy for the mood of the typical affluent retail investor.

Put simply, retail investors, as a group, tend to be very bad at timing the stock market. For instance, the highest level of bullish sentiment ever was 75%. This record was set on January 6, 2000 – just months before the dot-com crash.

Bullish sentiment has averaged 39% since 1987. A good measure for an “unusual” reading is one that is one or more “standard deviations” higher or lower than the average. (In statistics, a standard deviation measures a data point’s distance from the average.)

This means bullish readings between 28% and 49% are within the normal range of the historical results.

> Anything below 28% or above 49% is extreme.

Since 1987, there have been 212 weekly readings when bullish sentiment has fallen below 28%. (status as per June 2015)

Over the 12 months following these unusually low bullish readings, the S&P 500 rose:

+) 84% of the time,

+) producing average gains of 13%!

Conclusion:

Bullish sentiment remains at an unusually low level, while neutral sentiment continues to stay at an unusually high level. Historically, such readings—both unusually high low bullish sentiment and unusually high neutral sentiment—have been correlated with better-than-average market performance over the following six- and 12-month periods. (See Analyzing the AAII Sentiment Survey Without Hindsight in the June 2014 AAII Journal for more information.) There is no guarantee history will repeat itself in the future, however.

sources/articles (free data available):

http://www.aaii.com/sentimentsurvey/sent_results

http://blog.aaii.com/aaii-sentiment-survey-optimism-falls-to-a-new-two-year-low/

http://bonnerandpartners.com/this-contrarian-indicator-says-stocks-could-go-higher-still/