Related Categories

Related Articles

Articles

Stock Newsletter Sentiment

(HSNSI, Mark Hulbert)

Stock-market timers grow cautious, and that's good for equities. Market tops are usually characterized by stubbornly held bullishness, but that’s not what we're seeing today. Stock-market timers have been turning remarkably cautious. It's...

...surprising and bullish from a contrarian perspective, because market timers typically become more bullish as stocks power higher. Not this time, however.

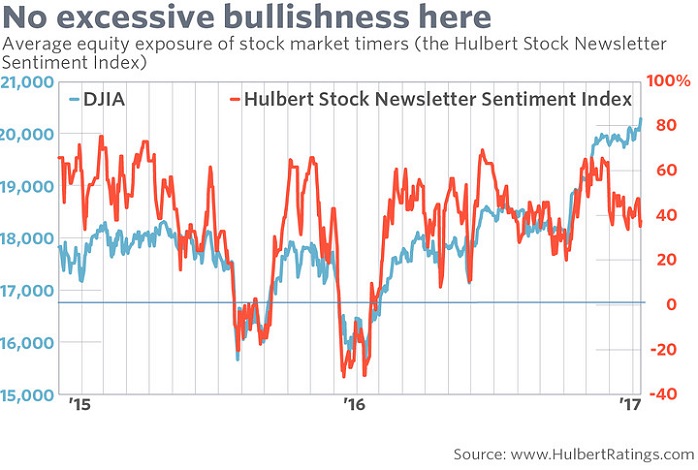

Consider the average recommended stock-market exposure among the market timers Mark Hulbert monitors who focus on forecasting the S&P 500's short-term gyrations (as measured by the Hulbert Stock Newsletter Sentiment Index, or HSNSI). This average currently stands at 37.5%.

That's below the HSNSI’s long-term average of 44%. In other words, despite a powerful bull-market rally that has thrust all the major averages to successive new all-time highs - including the Dow Jones Industrial Average DJIA, above 20,400 on Monday, 13th Feb. 2017 - the typical market timer is actually less exposed to stocks than he normally is!

These sentiment developments are bullish, according to contrarian analysis, because major market tops are usually characterized by stubbornly held bullishness. And by no means is that what we're seeing now.

The past six weeks are particularly instructive: In mid- and late December 2016, as you can see from the accompanying chart, the HSNSI rose to more or less the same high levels it did last summer and in late 2015. Both of those prior levels preceded several months of market weakness, of course — and contrarians expected the market to face the same fate this time around too.

They were wrong, needless to say.

If market timers today remained just as bullish as they were last December, contrarians would be inclined to say that the market had merely postponed the imminent weakness. But with the market timers actually so much more cautious today than they were six weeks ago, the best contrarian guess now is that the bull market still has more life in it.

To be sure, some sentiment indexes are reporting higher levels of bullishness than suggested by the HSNSI. Investors Intelligence, for example, is reporting that newsletter writers are more bullish than they've been since 2004. But note carefully that Investors Intelligence calculates its sentiment indicator by placing newsletter writers in just one of three categories - bullish, bullish but expecting a correction, and bearish - and each of those broad categories can encompass a wide range of market forecasts.

The HSNSI, in contrast, is constructed by averaging the precise equity exposure level of each market timer. One who is 40% invested in stocks could very well still be considered bullish, for example, even though he would be less bullish than when he was, say, 70% invested. The HSNSI is therefore particularly sensitive to changes in the degree to which timers are confident in their bullishness.

So it may be that many of the bulls are only weakly bullish.

Regardless, the HSNSI's relatively low current level suggests that the market's eventual top is still ahead of us.