Related Categories

Related Articles

Articles

BOFA Fund Manager Survey (July 2016)

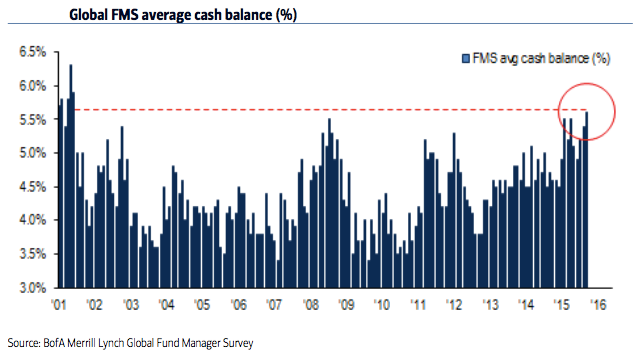

Cash levels at a 15-year high

Despite the post-Brexit market rally, fund managers have gotten even more wary of taking risks. Following Long-Term chart still shows the elder, lower reading of 5.6%, the most recent reading is now 5.8%.

The S&P 500 has jumped about 8.5 percent since the lows hit in the days after Britain's move to leave the European Union, but that hasn't assuaged professional investors. Cash levels are now at 5.8 percent of portfolios, up a notch from June and at the highest levels since November 2001, according to the latest Bank of America Merrill Lynch Fund Manager Survey.

The former Bank of America Merrill Lynch monthly fund manager survey showed that cash levels are averaging 5.7% of portfolios in the June reading, up from 5.5% in May 2016. Stock and bond prices keep on climbing, but the asset that global fund managers really want right now is cash, pushing Cash highest since 2001.

Reminder on the signal of the cash-piling: When fund managers put more than 4.5% of their holdings in cash, as has been the case for some time, it creates a contrarian buy signal, the Merrill Lynch researchers contend.

In addition to putting money under the mattress, investors also are looking for protection, with equity hedging at its highest level in the survey's history.

Another point in the survey: The one place where risk has risen is in emerging market equities, with allocations hitting 22-month highs. European stocks went to underweight for the first time in three years, while Japanese equities hit their lowest weighting in 3½ years.

links:

www.cnbc.com/2016/07/19/investor-cash-levels-highest-in-15-years

http://blogs.wsj.com/moneybeat/2016/06/14/fund-managers-are-stockpiling-cash