Related Categories

Related Articles

Articles

Home Bias versus Cosmopolitan

Everyone is guilty of home country bias, let's be different:

Try to invest/be(come) COSMOPOLITAN !

For many people, there's no place like home. But if you're only investing at home, first: you are taking high(er) risks and 2nd sometime you're missing out...

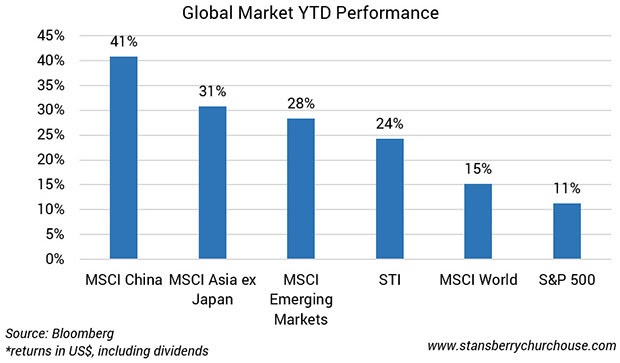

...on big gains (in markets abroad). As you can see in the next chart, so far this year, the S&P 500 is up 11 percent. The Singapore Straits Times Index has returned 24 percent. And the MSCI World is up 15 percent. Those are solid returns. But other markets have done a lot better...like the 41 percent return from the MSCI China Index or the 31 percent return from the MSCI Asia ex Japan Index (YTD Performance-data as per 11. Sep. 2017).

Many investors invest primarily "at home" – that is, their domestic stock market...and that often means that they’re missing out on big market gains elsewhere.

Again: Everyone is guilty of home country bias

It's natural to want to invest at home. If you live in Singapore, for example, you see the Straits Times Index quoted every night on the news. You drive by the DBS building (DBS = a bank) every day. If you're based in Hong Kong, you're used to watching the Hang Seng Index. And if you're American, U.S. markets are probably your first investment stop. Investing locally means investing in what you know - which, is generally smart - BUT...

So it's not surprising that most people invest mostly in their home market. This is called "home country bias" and it refers to the tendency of investors to have a portfolio weighting bias in favour of their local market.

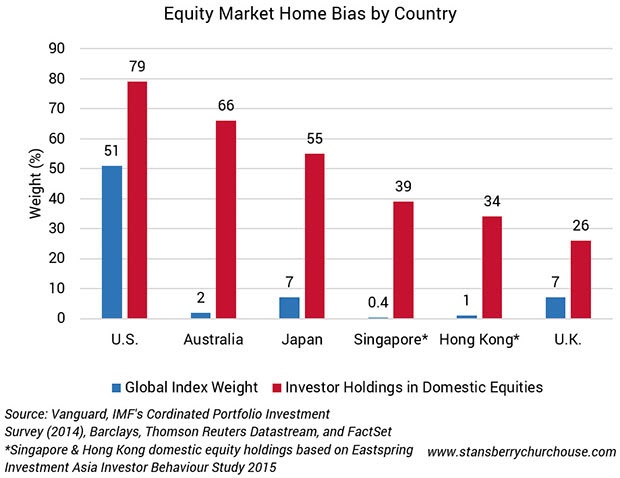

For example, as shown in the graph below, the average American with a stock portfolio has 79 percent of her money in U.S.-listed stocks. Investors in Japan put about 55 percent of their money in Japan-listed stocks. People in Australia have two-thirds of their portfolio in local shares:

That might be what they’re comfortable with. But from a portfolio diversification perspective, it's like juggling live dynamite.

As the graph above shows, American stocks account for only 51 percent of total global market capitalisation (that is, the value of all stock markets in the world). So American investors are a lot more exposed to U.S.-listed companies than – based on a breakdown of the world's markets - they should be. Japanese investors are even more lopsided in their home preference – Japan accounts for only 7 percent of the world’s stock market, yet they invest 55 percent of their money at "home".

...And Australians put 66 percent of their money into their own market – which is just two percent of the world’s markets. In this case, one may really compare Australians and Austrians...even if there are no kangaroos in both countries.

And Singapore's stock market is only 0.4 percent of the world total, but Singaporeans invest about 39 percent in domestic equities.

Why do investors do this? As I mentioned, they're investing in what they know, which (all else equal) makes sense. Also, studies have shown that domestic investors tend to be more optimistic about the local economy than foreign investors- so local investors think they're investing where the growth is.

And local investors face fewer tax hassles when buying domestic shares, and less foreign currency risk. Crucially, investors often trust companies and stocks outside their borders less than they do those in their own country (even if the "foreign" market is bigger and less volatile than the local market).

Looking at the components of the Austrian Stocks-Benchmark (ATX) one can cleary see, that the Austrian stock-index is made up of many cyclical stocks which tend to carry high risk (accompanied by high chances - see its great performance Year-to-date/Jan. 2017 - 13th Sep. 2017). Therefore focusing only on the Austrian Stock Market can lead to big gains or even bigger losses in years of "Distress".

How geographic diversification helps

A portfolio that isn't sufficiently diversified is riskier than one that is well diversified. And geographical diversification is important, as we showed here. Since different markets outperform at different times, even though they all tend to move in the same general direction, having money invested in a range of geographical markets can boost your returns.

Make sure to assess the home bias of your own portfolio. If you have a severe case of home country bias, it would be wise to consider moving some of your money elsewhere ("Diversification"). Your portfolio can only benefit from being a little more cosmopolitan.

(I'm) try(ing) this too...

Investing in high-potential stocks all around the world is exactly what I am doing . It’s the perfect antidote to home country bias. I've lived and travelled in/to many other countries, and I've spent my last years finding opportunities (also) off the radar...I'm going to keep doing that for the next decades to come!

links: