Related Categories

Related Articles

Articles

Black Swans, Grey Swans, and White Swans

Brexit (Grey Swan)

Life is full of surprises. Good and bad. We all know that. What we learn over time is that a few of those surprises have sculptured the bodies of our lives. The whole world evolves through large incremental random changes!

Until 1697, the Western world believed that all Swans were White until a Dutch explorer, named Willem de Vlamingh, documented the first observation of a Black Swan in Australia. In his book "The Black Swan", Mr. Nassim Nicholas Taleb , an ex-Wall Street quant and now Professor, leverages the metaphor of a Black Swan to describe "The Impact of the Highly Improbable."

The Definition of a Black Swan:

Mr. Taleb defines a Black Swan as a random event with three attributes: "First, it is an outlier, as it lies outside the realm of regular expectations because nothing in the past can convincingly point to its possibility. Second, it carries an extreme impact. Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable."

A Black Swan is a change of low predictability but of a large impact. What makes the impact of a Black Swan extraordinary is that it built over time a cumulative effect.

The notion of Black Swans can be applied to many kinds of random changes that can occur in personal life, business, arts, cultures and civilizations.

White Swans, Gray Swans and Black Swans:

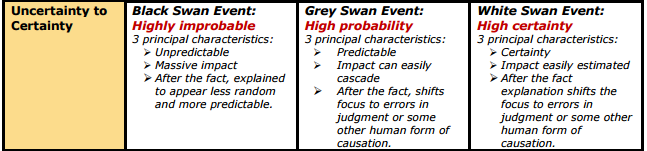

To "somewhat" expand Mr. Taleb’s thoughts, we can consider three species of Swans: White Swans, Grey Swans and Black Swans. And, any Swan can have a positive or negative consequence.

♦ White Swans are random events that we know, have high probability of occurring and create little implications in our lives. We learn how to deal with White Swans in our everyday life. A positive White Swan could be falling in love, finding a new job, while a negative White Swan could be getting the flu or having your vacation flight being cancelled.

♦ Grey Swans are random events that we know, have low probability of occurring but have significant impacts. A positive Gray Swan was Newton’s law of gravity, the first heart transplantation, or could be a start-up going for an IPO or a best seller from an unknown author such as Harry Potter, while a negative Gray Swan could be an earthquake in California or the next Katerina.

♦ As already mentioned, Black Swans are random events that we have never imagined before their occurrence, have extremely low probability of occurring but have dramatic consequences. A positive Black Swan was the first man walking on the moon, the long term economic expansion of the 20th century, the increase of human life expectancy, while a negative Black Swan was Global Warming, the continuation of new and old war conflicts, the atomic bomb, September 11 or the spread of the AIDS virus.

(!) Dealing with the Impacts of the Swans:

We do not know what could be a Black Swan until we see it. But we know about some Grey Swans that will come back again. We need to expose ourselves to positive Gray Swans while being prepared for the consequences of negative Grey Swans.

By increasing our exposition to positive Grey Swans, the likelihood of an occurrence grows significantly. If your goal is to study the secrets of the stars in the sky and meet a PhD in astrophysics, take as many lectures as you can at Berkeley or at Princeton University; or if your goal is to study the beauty of human nature and meet a top fashion model, save enough money to go partying in the Champs Elysees or in Fifth Avenue since the probability of those two Grey Swans decreases exponentially if you stay anywhere in the country or in the world. (think about Silicon Valley ;-)

Much less enjoyable, to reduce the negative impact of Gray Swans prevention shall be our best and only strategy. Nobody knows when the next earthquake will shake California or when Global Warming will produce another Katerina but everybody must be prepared when they will occur.

Unfortunately as Mr. Taleb noted in his book, the social reward for those who try to prevent is much lower than the social reward for those who try to cure. So, we always end up curing and never preventing...

Versus selective perception; In this case Europe versus Australia: In the picture above you see A RARE WHITE SWAN pictured near the Narrows Bridge, Perth with its black mate. Picture: Lynette Hewitt (direct link: http://www.perthnow.com.au )

Versus selective perception; In this case Europe versus Australia: In the picture above you see A RARE WHITE SWAN pictured near the Narrows Bridge, Perth with its black mate. Picture: Lynette Hewitt (direct link: http://www.perthnow.com.au )

The Brexit referendum on 23rd June can be labelled a "Grey Swan" event: very hard to identify upfront in which direction it will go. However, we all had the chance to anticipate its potential market impact and hedge our financial portfolios via hedging-instruments (PUT-Options) or by reducing our stocks-exposure in the weeks BEFORE (a possible/) the BREXIT-voting.

RECAP: About Black Swans and Grey Swans (other Defintions & examples)

Black Swan:

The real uncertainty, however, often hides in the shadows of observable data. It stems from events that unexpectedly jump to the forefront and impact the global outlook or investor risk appetite. They can be generated by, for example, exposed fragility in the financial system (e.g. a credit crisis) or (geo)political surprises (e.g. military conflicts).

Since these types of events are much harder to foresee, much more infrequent and often have a larger impact than any data release or policy move, they represent the biggest part of the investment uncertainty ahead of us. Some shocks will always come out of the blue and can only be absorbed first and responded to afterwards.

Grey Swan:

Some events, though, can probably be better described as "Grey Swans". These are vaguely visible on the horizon, but it is extremely hard to identify in which direction they will swim. Yet it is possible to qualitatively assess the probability of potential moves and to anticipate their market impact.

Brexit referendum can be labelled a Grey Swan

The most important Grey Swan to assess was the recent Brexit referendum (23rd June 2016), as timing, likelihood and potential impact made it urgent to form an opinion upfront. However, disentangling what markets are exactly pricing in terms of Brexit risk was not easy, because so many other factors are at play. Still: Hedging ones stock-market-portfolio had been possible ca. 2 weeks before (since the volatility premia were not yet skyrocketing that time).

But was it really that of a pure Grey Swan, the final decision on the BREXIT?

One should (have) not underestimate(d) how deep-seated this desire for more UK sovereignty is. It became very much apparent in the second half of the 1980’s when Margaret Thatcher firmly opposed further European integration, a stance that eventually led to her downfall. Ever since, it has been an issue which has caused a deep split within the ruling Conservative Party.

links

definition & video of a Black Swan http://www.investopedia.com/video/play/black-swan-events

2008 - really a Black Swan, or more of a Grey Swan, sorry: Grey Swan (?) http://www.cmegroup.com

to Brexit, or not to Brexit (May 2016-article), Grey Swan: https://www.nnip.com

Dealing with the impact of the Swans: http://www.asiliconvalleyinsider.com