Related Categories

Related Articles

Articles

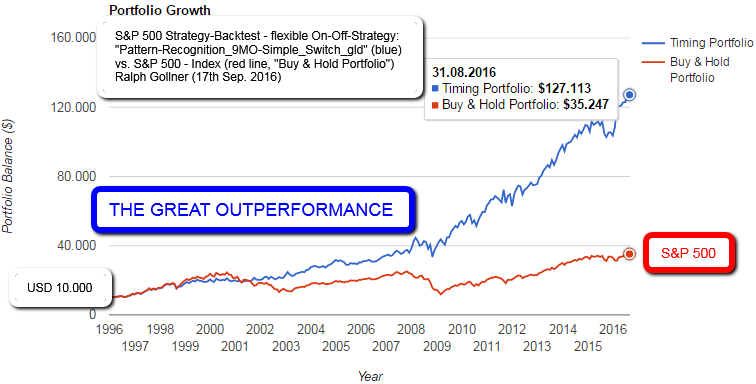

The Timing-Portfolio - Strategy

from Jan. 1996 - Aug. 2016

There is the story, that timing does not pay off for the average. Well, for the average - yes, maybe NOT...But: for people who know how to handle the Ups & Downs of the Market (Mr. Market) that story may just be a nice fairytale.

And I don't believe in fairytales anymore, since I passed elementary school. Being extremely interested in the mechanics of the financial-markets, the moods of Mr. Market and the strange moves the Stock-Indices and Commodity-Markets can make, I experimented quite some time on how to establish a sound Long-Term-strategy.

Eventually I came up with following the moves and streamline the length of the cycles. To avoid such fatal Drawdown-Periods like in the year 2008 one may adopt an adaptive rules-set to exit the Stock-Market, when there is weakness on the horizon or let's say: "When weakness is building up momentum".

From experience one can learn, that the Investors' Money is more or less ALWAYS seeking to find a way where their money can work - so to say: "finding the last resort of return".

Establishing an On-Off-Strategy therefore might involve handling ones Fear & Greed, AVOIDING LOSS-Aversion, embracing Risk-Taking (contrarian Buys) and reducing possible Overconfidence as much as possible.

With all these ingredients the following outcome might have been possible within the period of Jan. 1996 up to Aug. 2016:

In these (more or less) 20 years, only 4 years turned out to be negative wiht the worst year being last year, 2015, with a Minus of -5.23%. But in 2016, the strategy is up more than 22% so far (all in USD-terms).

♦ The best year for the "On-Off-Strategy" has been 2009 with > 36% Plus.

♦ The best long-run returns stem from avoiding the worst years in the benchmark/S&P 500. Therefore the nice outperformance in the years 2002 (> +13% versus < -23%) and the year 2008 have to be mentioned (> +3% vs. <-28%).

I also wish you good luck in finding your strategy how to handle the Ups & Downs of the Market. Buy & Hold may be a good choice for the Average, but there might also be an alternative route...

Good Luck, Ralph Gollner

Wanna do your own homework? then check this out: www.portfoliovisualizer.com