Related Categories

Related Articles

Articles

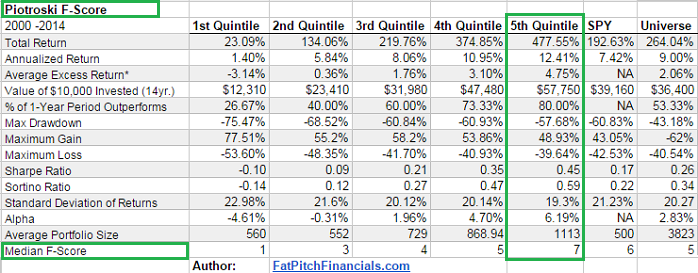

Piotroski F-Score

(Backtest 2000 - 2014)

The Piotroski F-Score is an advanced compound fundamental analysis strategy developed by Joseph D. Piotroski. Piotroski detailed this strategy in his 2002 academic paper, "Value Investing: The Use of Historical Financial Statement...

...Information to Separate Winners from Losers." The F-Score gives stocks one point for passing each of the following simple accounting-based fundamental tests:

♦ Positive net income

♦ Positive operating cash flows

♦ Higher return on assets than the previous year

♦ Operating cash flows greater than net income

♦ Lower debt than the previous year

♦ Higher current ratio than the previous year

♦ Less stock dilution than the previous year

♦ Higher gross margin than the previous year

♦ Higher asset turnover than the previous year

As you can see from this list, the highest F-Score a stock can receive is 9 if it passes all the above tests. The use of previous year data actual refers to comparing the current trailing twelve months versus the year ago trailing twelve months data from the income statement or statement of cash flows. If it was a balance sheet item, the F-Score compares the current quarter number to the previous year quarterly number.

The backtest for Piotroski F-Score reveals that the first quintile underperforms the S&P 500 Equal Weight Index benchmark. These companies typically weak balance sheets and weak earnings performance so it is not surprising that stock returns for these companies would underperform. The second through fifth quintiles have higher than average annual excess returns than each of the previous quintiles.There is a consistent linear trend upwards from the 1st to 5th quintiles. The Piotroski F-Score does appear to be a powerful fundamental predictor of 1-year stock performance.

So let's keep this in mind, when following the performance of following stocks, ranked by their current (25th Sep 2018) Piotroski F-Score according to the source of "gurufocus.com" (The stocks were individually selected by me, Ralph Gollner, for the purpose of a subsequent Performance test for the upcoming quarters and year):

US-Ticker & Piotroski F-Score

TJX 9

ROST 9

BLL 8

AZO 8

ISRG 8

ACN 8

GGG 8

GWW 8

DOV 8

FISV 8

NVDA 8

KLAC 8

TXN 8

I will check the performance of the (reshuffled-if needed?) Piotroski-Portfolio in the upcoming quarters (& years). As can be read from the text above, there can always be new stocks entering the group or dropping out of the portfolio. I will try to keep the group of selected stocks within the Piotroski F-Score Min. 8.