Related Categories

Related Articles

Articles

Magic-Stock-Portfolio (2004 - Sep. 2016)

What does the Private Investor want? S/he wants the Professional to know/understand the risk-tolerance of the potential investor. The Professional should help the Private Investor to minimise the risk AND to MAXIMISE the return - as far as possible.

The portfolio ("Portfolio 1") displayed and backtested is made up of 15 USD-stocks (incl. one "China"-ADR-Stock), but excluding new highflyers like Facebook, Alibaba or Mastercard, etc. due to their relative young history on the stockmarket (IPO after the year 2004!). In order to have a buffer to minimise possible losses in tough years (so far this has ONLY happened in 2008) such a portfolio, besides of Technology, may also include Consumer stocks (favourably from the Food & Beverage Industry).

The magic behind this portfolio-BACKTEST (!) is that it is showing you the King-discipline of Buy & Hold - as it was propagated in - "good old times" - in the 20th century ;-)

Applying this theory I tried to build a portfolio of 15 stocks while diversifying across different sectors with an emphasis of having a diversified portolio which can also conquer the next 5 to 10 years (up to the year 2025 to be precise - even with no change of components, BUT rebalancing the weight of each compent at the end of each year).

FACTS

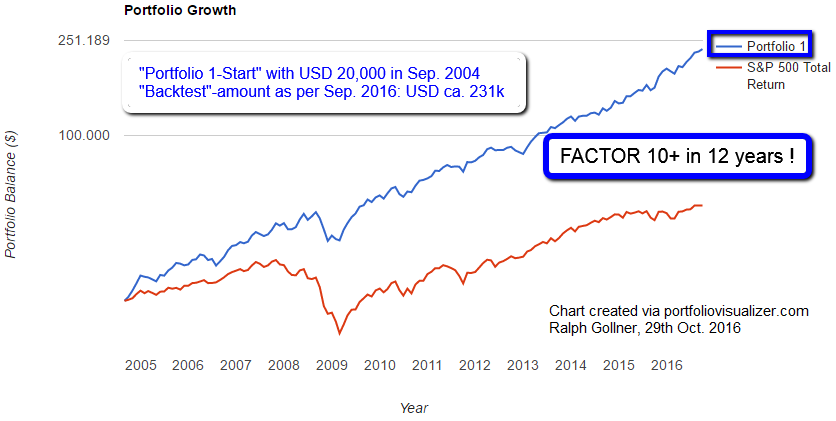

♦ Balance start in Sep 2004 with USD 20.000

♦ Final Balance per Sep. 2016: USD 231.082 (versus plain S&P 500 replication: USD 50.570)

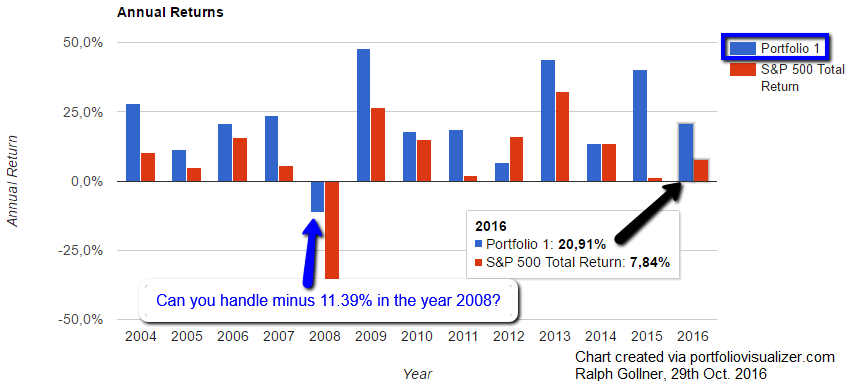

♦ Monitored period: ca. 12 years (only one year a loss)

♦ Losses: One year of losses(out of 12 years) / Loss happened in year 2008

♦ Loss in 2008 was minus 11.38% - the same year the broad Stock Market (S&P 500) made a minus of ca. 37% !!

RECAP OF GOALS

♦ The 1st goal of a Professional Investor might be be to minimise the risk AND to MAXIMISE the return to a MAXIMUM- as far as possible.

♦ The 2nd goal of a Professional should be to cover a long historical period (Track-Record), periods which cover good times and especially hard times, like they definitely occured in the year 2008 (post-Lehman & Financial Crisis).

♦ The 3rd goal of a Professional should be to explain what a reasonable minimum investment-period should be. In my personal case I am planning to invest for a minimum-period of 10 years up to 25 years...or even more!

More Portfolio-Details (Backtest only!):

♦ Start in Sep. 2004, when Google (Alphabet) made its IPO (first day of trading!)

♦ Compounded average growth: +22.45% [much higer than the Benchmark S&P 500 (+7.98%)]

♦ Standard Deviation +13.49% [lower than the Benchmark S&P 500 (+14.34%)]

♦ Sharpe Ratio 1.48 [versus the Benchmark S&P 500 (0.53)]

Discloser/Disclaimer: Ralph Gollner hereby discloses that he directly owns shares of some of the securities mentioned above (as per 28th October 2016): Facebook, MasterCard, Alibaba. Reminder: High Beta stocks are especially risky!

link:

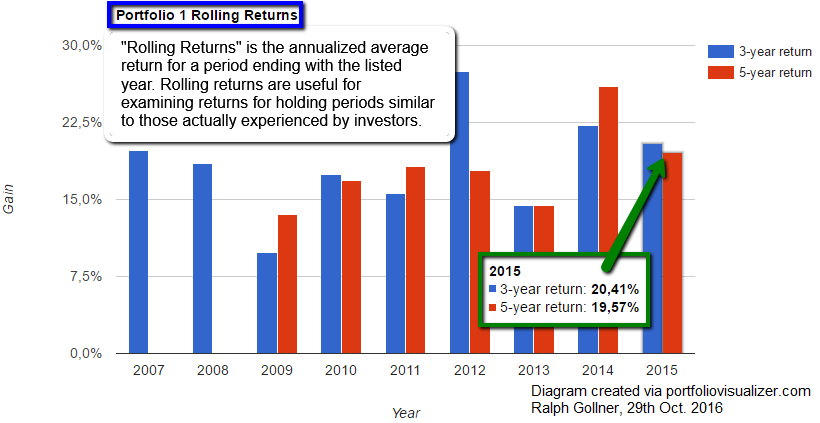

Rolling Returns (Definition) www.investopedia.com/terms/r/rollingreturns