Related Categories

Related Articles

Articles

Venture Capital (VC)

and the magic 12%-Return (?)

The talk somehow pivoted from my seed-seeking startup into talking about the macro view of venture capital and how it doesn't actually make sense. "95 % of VCs aren't profitable," a well-known Israeli startup investor said. To...

...be clear: Ninety-five percent of VCs aren't actually returning enough money to justify the risk, fees and illiquidity their investors are taking on by investing in their funds. The other 95 percent are juggling somewhere between breaking even and downright losing money (remember to adjust for inflation).

A VC fund needs a 3x return to achieve a "venture rate of return" and be considered a good investment.

Success = 12 percent return per year

Venture capitals get their money from limited partners (LPs), who are usually traditional investors such as banks, institutions, pension funds, etc. In their eyes, throwing USD 50 million into a startup fund is "risky" business compared to their other options, such as the stock market/real estate, which are lower cost, liquid and could "more easily/safely" return 7-8 percent per year (so far/yet). For them, 12 percent return on their money per year is good. Anything below that? Not worth the high risk they're taking.

That brings us to...(Investment horizon)

A 10-year fund needs to return 3x the fund size

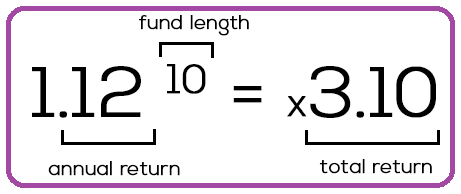

We agreed VCs need to earn 12 percent return a year, right? Most funds, while only actively investing 3-5 years, are bound to 10 years. Many newer studies are showing that 12-14 year funds are more accurate for today, but let's stick with 10 just to give the VCs a fighting chance. That annual 12 percent rapidly grows, showing the power of compounded interest. You can see the math in the box above!

Short Resumé

Venture capital is a tough business. LPs struggle to get paid in excess returns for the risk, fees and illiquidity they take on for investing in venture capital. Entrepreneurs struggle to scale and grow their companies and position for great exits. It's not natural for a founder at stage one to know how he'll grow from zero to billion. So many things will change along the journey. VCs struggle to generate the returns they promise, and only a very few manage to deliver.

But VCs enjoy the only downside protection in the business - they can rely on fees to pay themselves when their investments are mediocre. The long feedback cycle means that VCs can raise a few funds - and lock in a few fee streams - before their less than stellar returns catch up with them.

LPs, entrepreneurs, "small investors" don't have that safety net. We live and die on our investment returns.

Food for thought.