Related Categories

Related Articles

Articles

David Blood, Al Gore

Generation Foundation

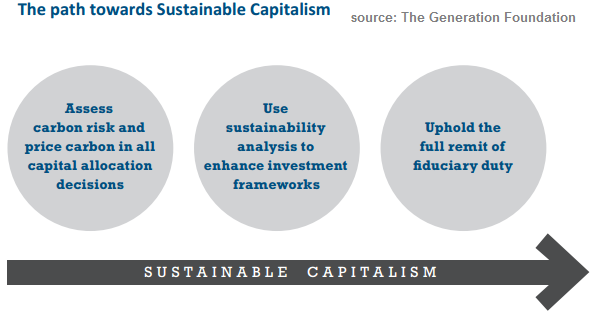

Definition of Sustainable Capitalism: Sustainable Capitalism is an economic system within which business and capital seek to maximise long-term value creation, accounting for all material ESG (environmental, social and governance) metrics.

Integral to this framework is the consideration of all costs and benefits, regardless of whether they are currently attributed with an economic "price tag" by society. While this framework is designed with a long-term horizon, it also has meaningful short-term implications, providing a process for identifying current risks and opportunities. Sustainable Capitalism aims to address real needs in all economic, business and policy decisions.

As Al Gore and David BLOOD (Fund Manager) explain further: Sustainable Capitalism transcends borders, industries, forms of ownership, asset classes and stakeholders. Indeed, it exists at the intersection of business, science, politics and market forces. Consequently, it is necessary to coordinate across disciplines and sectors in order to inspire and catalyse the innovation and lasting change that they believe is urgently needed.

One may propose the following definition as building block for the transition towards Sustainable Capitalism: A Sustainable Business does not borrow its current earnings from its future earnings and provides goods and services in a manner that is consistent with the transition to a low-carbon, prosperous, equitable, healthy and safe society.

Sustainable Investing is an investment philosophy and approach which allocates capital to companies aligned with these principles, using an analysis which integrates both financial and ESG metrics to rigorously evaluate the business quality and management quality of a company.

Sustainable Investing seeks competitive, market-rate returns. It does not compromise financial returns for sustainability outcomes, or the reverse. It applies to the entire investment value chain from entrepreneurial ventures to publicly traded large-cap companies, from institutional investors to high net worth individuals, from investors providing seed-capital to those focused on late-stage growth-oriented opportunities, from company employees to CEOs, from activists to policy-makers and standard-setters.

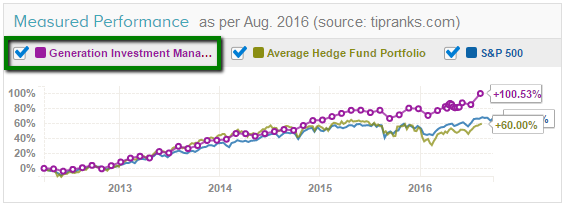

The (OUT-)performance of their most famous Fund:

Positive developments in the last years (ESG, integrated reporting)

An increasing number of companies are practising integrated reporting or are in the process of making a transition to integrated reporting, suggesting that the market acknowledges the value of integrated reporting. This change has occurred as the range of benefits from integrated reporting have been shown to include “a more holistic view of performance and better insight into risk, strategy, the business model, the operating context and governance." In particular, the focus on identifying and emphasising only the most material ESG issues, selected carefully on an industry-specific basis, is now changing companies’ and investors' attitudes towards the relevance of sustainability data. Indeed, studies now find that firms practising integrated reporting are able to attract more long-term investors to their ownership base !

Recap / Executive Summary

The importance of sustainability to business and investing is intensifying as financial markets are increasingly forced to address challenges posed by the realities of natural resource scarcity, the effects of unabated carbon-emissions, rapid urbanisation and widening wealth inequality, to name just a few. As the context of business and investing shifts, understanding the economic benefits of a sustainable form of capitalism and the best ways to navigate the transition have become even more critical. This has significant implications for asset owners, asset managers, corporate executives and other market participants seeking to develop successful businesses and deploy capital today and in the future.

The inertia that has kept capital allocation decisions anchored in traditional investment frameworks must give way to a new paradigm of capitalism - one which has evolved in parallel with the emerging opportunities and challenges driving the modern global economy. This new paradigm is Sustainable Capitalism.

The tailwinds behind the uptake of Sustainable Capitalism highlight the need for a new type of capitalism that is long-term and holistic in nature in order to take full advantage of the emerging needs associated with these realities, including:

♦The transition to a low carbon economy

♦More business models leveraging technology that improves asset utilisation, therefore conserving resources, in the "sharing economy"

♦Maturing field of sustainable finance: increasing demand, changing nature of consumption patterns, better tools for analysis in both accounting and reporting

♦Calls to update the measurement of growth beyond GDP

♦A shift in behaviours and attitude towards sustainability between generations with more enthusiasm and commitment from the Millennial generation and centennials

Conclusion / New Research

The business case for Sustainable Capitalism is being made more often and more rigorously by both academics and business leaders. And the sum total of both research and practical experience is proving that companies can improve their financial performance while improving performance on ESG dimensions.

New research continues to be published showing how sustainability can drive outperformance. These reports have come from academia, financial institutions, consultancies, think-tanks and non-profit organisations.

Many studies have now examined the relation between financial and ESG performance. Please check out the meta-study conducted by the University of Oxford and released in September 2014 in partnership with Arabesque Partners. Their report investigates and collates the findings from over 190 of the premier academic papers, industry reports, newspaper articles and books.

The report reviews the business case for corporate sustainability (across risk, process and product innovation, operations, reputation and cost of capital) and its link to stock price performance. The study concludes that "it is in the best economic interest for corporate managers and investors to incorporate sustainability considerations into decision-making processes." Specifically, their findings suggest:

1) companies that lead in sustainability have better operational performance and are less risky (supported by 88 percent of reviewed sources); and

2) investment strategies that incorporate ESG issues outperform comparable non-ESG strategies (supported by 80 percent of reviewed sources).

Theory "put into practice"

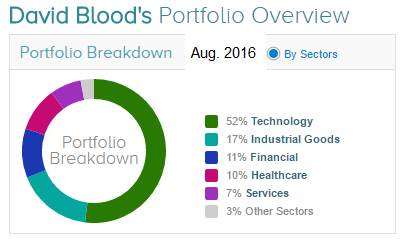

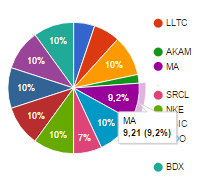

Studying the quarterly reports on the Fund-Holdings (see also Industry-Split/Fund-X-Ray in box above) I figured out possible core-holdings of the last quarters, years. In the following pie-chart you can see some of the stock-tickers I collected from these reports. The most relevant (to me, see also weightings in %) include e.g. Nike, Mastercard and others:

Disclaimer: Ralph Gollner hereby discloses that he directly ownes some of the securities mentioned above (as per 27th September 2016): MA (MasterCard), NKE (Nike)

Video - Al Gore & David Blood of Generation Foundation:

www.genfound.org/library

Portfolio-Insights-source: via tipranks.com & insidermonkey.com

White-paper on "Sustainable Capitalism" (incl. ESG-criteria):

www.genfound.org/media/pdf-genfound-wp2015-final.pdf

"About Generation Foundation/Goals"

www.genfound.org/about