Related Categories

Related Articles

Articles

Cost of Capital (WACC)

There is no number in finance that is used in more places or in more contexts than the cost of capital. In corporate finance, it is the hurdle rate on investments, an optimizing tool for capital structure and a divining rod for dividends. In valuation, it plays..

...the role of discount rate in discounted cash flow valuation and as a control variable, when pricing assets. Notwithstanding its wide use, or perhaps because of it, the cost of capital is also widely misunderstood, misestimated and misused. (Quoted by: Mr. A. Damodaran).

In a recent paper issued by the Flossbach von Storch RESEARCH INSTITUTE it is said that it is the weighted average costs of capital (WACC) rather than interest rates on debt capital that have a significant influence on investment. But WACC have not moved down in tandem with interest rates the last years, supporting the theorem of the constant cost of capital. >> Therefore, according to the authors of the paper (A. Gehringer, T. Mayer): "Hence, both theory and empirical analysis suggest that the low interest rate policy of central banks has been ineffective in raising investment."

Well, to get into deeper detail versus "Big Picture"; Let's look at the Weighted average cost of capital (WACC). WACC is the weighted average of the costs of all external funding sources for a company.

The primary drivers of WACC are the cost of equity and cost of debt. More details on how one can calculate each of these is below:

Cost of Equity

- Based on the capital asset pricing model (CAPM).

- One may use the market value of equity when calculating all total adjusted market capital ratios.

- The equity risk premium is the average of the current implied equity risk premium and the historical implied equity risk premium.

- For beta, one may use industry and sector averages, which we calculate based on daily prices over the past five years. One should careful to normalize beta to avoid it having undue influence on the cost of equity.

Cost of Debt

- Risk-free-rate is approximated by the 30-year Treasury bond. If the 30-year is not available the 20-year rate is used.

- One may add the debt spread associated with the debt rating on the company’s long-term debt to the risk-free-rate.

- The resulting pre-tax cost of debt is then multiplied by (1 - marginal tax rate).

- Using debt ratings from Moody's or S&P should be applied.

Generally speaking: If a company fails to generate a return on invested capital (ROIC) greater than its WACC, it is destroying shareholder value.

Recap on the Central-Banks Approach via lower interest-rate-policies

The simple Keynesian investment function, where lower interest rates lead to higher investment, is at odds with the investment theory of Modigliani and Miller (see footnote 1 at end of posting). These authors claim that it is the weighted average of the costs of debt and equity capital that influences an investment decisions.

If the theorem of constant costs of capital of Modigliani and Miller were true, a reduction in the cost of debt financing would have no significant impact on investment spending by companies. In the following, we investigate the relationship between the WACC and interest rates, and the influence of these variables on investment.

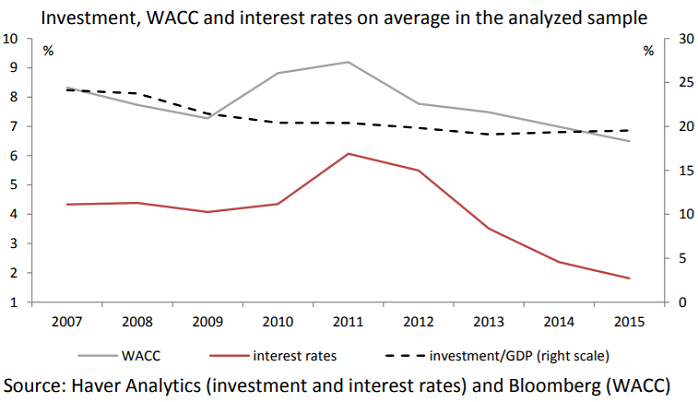

The estimates of the study show that in 2007-2015, when interest rates were pushed down by the extremely expansionary monetary of the ECB, the long-term interest rate did not exert a significant influence on real investment. Instead, the WACC was significantly driving investment spending by firms in the euro area. As the WACC came down only little over the investigation period, investment growth was relatively weak (see following chart).

Thus, the study-results reject the notion that lower interest rates can lift investment growth and, instead, support the investment theory of Modigliani-Miller.

Study-Conclusion (longer version):

Central banks have made strong efforts to lift investment growth of companies by depressing interest rates. Their policy may have been guided by the Keynesian investment function, where lower interest rates are seen to induce higher investment. However, according to the theorem of constant capital costs established by Modigliani and Miller, lower interest rates simply raise the equity costs of capital due to a higher risk premium as a result of more leverage.

This seems to have been the case in practice. The estimates in the study have shown that the weighted average costs of capital (WACC) were in general not driven down by declining interest rates. The only beneficiaries of falling costs of debt capital were firms with a credit rating below investment grade. The estimates have also shown that it is WACC and not interest rates that have a significant influence on investment. Hence, both theory and empirical analysis suggest that the low interest rate policy of central banks has been ineffective in boosting real investment.

(footnote 1) Modigliani F. and Miller M. (1958), "The cost of capital, corporation finance and the theory of investment", American Economic Review, 48(3): 261-297. debt financing raises the risk premium on equity financing due to the rise in leverage, the weighted average costs of financing an investment (WACC) does not decline when interest rates fall.

Recent data on some of the relevant parameters mentioned above can be found under this extensive list (Status as per Q1-2017): http://people.stern.nyu.edu/adamodar/New_Home_Page/datafile/wacc.htm

Links:

http://people.stern.nyu.edu/adamodar/pdfiles/papers/costofcapital.pdf

www.fvs-ri.com/files/its_the_wacc_stupid.pdf

WACC-Video to be found under this link: www.cleverism.com/calculate-cost-capital-business

example changing WACC over time 1998 - 2015: www.newconstructs.com