Related Categories

Related Articles

Articles

Walter Schloss

"Ben Graham - Student"

As he highlighted in Walter Schloss: Searching For Value, low Debt to Equity ratios were a cornerstone of his selection process. Another key consideration were dividends. It's common for management to think of their own bonuses before...

...the welfare of shareholders, especially as option grants have become more widespread. As a check on mindless self-interest, Walter Schloss also looked for dividends. [He said:] "I like the idea of company-paid dividends, because I think it makes management a little more aware of stockholders…"

In another article (The Right Stuff) he adds "[...] Managements, you know, often think of themselves. It depends on the board. One of the things about business is, you try to get in with good people. You don’t have to be smart. They don’t have to be the smartest guys in the world, but you want them to be honest."

Like Graham-Newman - where Schloss worked in the 1950s - Schloss Associates often held nearly 100 stocks at a time. Schloss said that it usually owned a stock for 4 years. He tended to be too early. Almost always losing some money - on paper - before he started making money. It's interesting to note that if Schloss owned as many positions as Graham – roughly 100 stocks at a time – and held them for four years, Schloss only needed to find two new buys a month. Considering that Schloss spent all his time holed up in his office reading financial reports – finding one new stock every 2 weeks seems like a perfectly leisurely pace compared to today's fund managers.

Psychology plays a huge role in Walter Schloss' investment success. In fact, if Big Walt didn’t have the degree of emotional intelligence that he has, he would have never have been able to wrack up the returns that he did. According to Big Walt, quoted in Walter Schloss: Searching For Value, it starts with perception, "What an investor does to some extent is based on his background. It's very difficult to tell somebody who is fearful of stocks, 'Yeah, you should put your money in the stock market.' If your father lost his money in the Depression, yo'll see things differently."

Weak emotional intelligence can be deadly to your investment career. If you have weak emotional intelligence, you'll find it very difficult to buy value stocks when a good opportunity presents itself, never mind hold on to your stocks when they dip.

This is what Warren Buffett said of Walter Schloss in his 2006 letter to shareholders: "Walter did not go to business school, or for that matter, college. His office contained one file cabinet in 1956; the number mushroomed to four by 2002. Walter worked without a secretary, clerk or bookkeeper, his only associate being his son, Edwin Walter and Edwin never came within a mile of inside information. Indeed, they used 'outside' information only sparingly, generally selecting securities by certain simple statistical methods Walter learned while working for Ben Graham."

In February of 2012, Walter Schloss passed away at the age of 95. Despite never having a college degree, Schloss was able to forge one of the best investment records of all time.

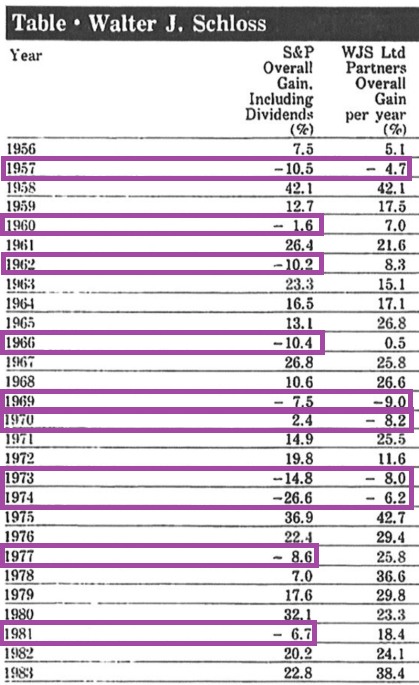

Some final metrics: For the 33 years ended 31st December 1988, Walter J. Schloss Associates earned a compound annual return of 21.6% per year on equity capital vs. 9.8% per year for the S&P 500 during the same period. Here some of the yearly records from 1956 onwards:

Schloss, being one of the greatest investors of the 20th century, beat the S&P 500 by 6 percentage points a year over 47 years. And was included as one of Warren Buffett's "Superinvestors of Graham and Doddsville" in Buffett's 1984 speech at Columbia.

links:

http://www.netnethunter.com/wp-content/uploads

www.netnethunter.com/your-essential-guide