Related Categories

Related Articles

Articles

"Return-figures and Standard Deviation"

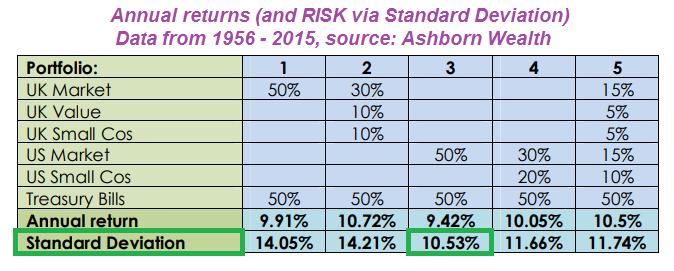

Let's illustrate how increasing diversification can help optimise returns within a given risk profile, let's revisit the scenario below based on Data from 1956 to 2015:

Looking at a rebalanced 50/50 Treasury Bill and UK Equity portfolio, one can find the following:

50/50 Shares / Bills

Return: +9.9% p.a.

Standard Deviation ("old" Risk-definition): 14.1%

But let's recheck what happens if one diversifies by building in overseas equities, and small companies. Here the data is based on UK and US equity markets, for which there are good long term data sets. In each case we will assume rebalancing is done each year. Purely looking at the relative values of annual return and volatility, in the table above you can see that a different mix will offer either better returns or lower risk.

Conclusion: Unless you know in advance which asset class is going to perform best - and you don't - diversify. It is your best chance of getting the highest return within any given risk profile.

If one now takes the Standard Deviation of ca. 10.5% as a "Risk-Benchmark" I could try to form a potential Portfolio which suits this "Risk-number", but WAS (is?) able to outperform benchmark-Return figures like + 9,4% p.a. >>

>>> Well >> That is what I tried in the following backtest (55/45):

It is very clear to see, that is possible to fight back any benchmark figures: Higher RETURN & (!) lower Standard deviation! This has been done in the portfolio above via a 55 (stocks) / 45 (Bonds) - Split. The Backtest-Portfolio consists of 14 Stocks and a Bond-ETF. I am currently holding all 14 stocks in my Real-Portfolio, whereas I am only diversifiying by holding CASH or/and an EmergingMarkets-Bonds-ETF.

In the following table one can see a Recap regarding the return figures and the Standard Deviation over the full period 2005 until June 2018 "55/45-split versus S&P500-ETF" (having started the backtest with 20k USD in January 2005, Performance Curve given above):

Reminder: Everything is possible...one just has to try, test, trial and error, try harder and...

...eventually: IT WILL WORK :-)

cheers

Ralph