Related Categories

Related Articles

Articles

Pershing Square

The firm of Bill Ackman returned losses in each of the past three years - of Minus 4%, Minus 13.5% and more than Minus 20%; These losses come against gains in the S&P 500 (broad stock market index) in this 3year-period. The Pershing losses took...

...its net assets down to USD 9.3 billion from USD 18.3 billion.

In May 2017 the firm still managed about USD 11 billion but this number fell further down according to the website for Pershing Square Holdings, a publicly traded Pershing Hedge fund-vehicle (where Bill Ackman is the head of it all).

Hedge funds often have a two-tiered fee structure in which clients pay a percentage of assets under management - traditionally 2 percent - and a percentage of profits - typically 20 percent. Bt Bill Ackmn. is now reducing the fee-structure: clients will then immediately pay a lower management fee and prolong the time until they pay a performance fee further.

Because Pershing's returns have been negative over the past three years, the performance fee has been somewhat of "an irrelevant point" in the contract (nice joke)...

But remember better times:

It was January 2015 and the finance-info company Bloomberg had just named the then–49-year-old Bill Ackman the top hedge fund manager of the year after his Pershing Square Capital Management hedge funds turned in blockbuster returns of 37 to 40 percent. He alone had earned nearly USD 1 billion, making the Institutional Investor's Alpha list of the highest-paid hedge fund managers!

Pershing Square's assets were then over USD 18 billion, in part because Ackman had raised USD 3 billion the previous October by launching a permanent capital vehicle, Pershing Square Holdings, a publicly traded hedge fund listed on the Amsterdam Stock Exchange. At the time, his annualized return over 11 years was more than 20 percent, among the highest in the industry.

Back to the present: Today, after losing billions of dollars and with his hedge fund assets halved, Bill Ackman is in darker waters. And as questions swirl about his future, even he admits he's not having fun anymore.

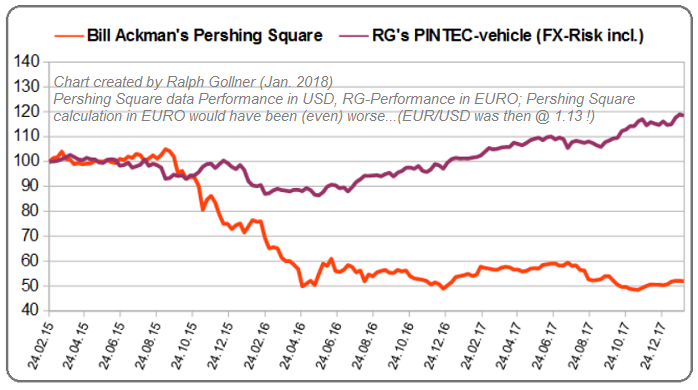

Personally (me, Ralph Gollner) I like to compare my personal Portfolio-Allocations to some of the Big (old) Boyz & Men...Warren Buffet, Billy Ackman and the like...

I am especially shocked, that outperforming Bill Ackman and his Pershing Square Portfolio-Holdings was that easy in the last years ! In the comparison-graph above between one of my PAPER-TRADEs-BACKTEST / TECH-loaded Portfolio (just a Backtest - NOT my real investments-portfolio stated above!) PINTEC, which i started around Feb. 2015 I can mention the main positions and their weightings as per 22nd Feb. 2018 (one can already grasp the diversification):

| Alphabet | 5.5% weight |

| Microsoft | 4.3% |

| Intel | 3.8% |

| Ebay | 3.1% |

| Nvidia | 3.0% |

| Amazon | 2.9% |

| Cisco Systems | 2.7% |

| Texas Insutruments | 2.7% |

| Fanuc | 2.5% |

| Bechtle | 2.2% |

| 2.1% |

Regarding the PINTEC-Portfolio (still on PAPER-TRADEs-MODE): Currently my Euro-denominated PINTEC portfolio also sits on 30.3% CASH (from which "16.3% is USD-hedged").

Status Quo in Bill Ackman's stock-portfolio:

Ackman's portfolio -on the other hand- is so highly concentrated - it has less than a dozen different positions - that a big loss in any one stock can swing the fund into the red.

Take Chipotle (a Snack/Restaurant-chain): Pershing Square took a USD 1 billion stake in the beleaguered Mexican-food chain in September 2016, when the stock had been cut in half after a series of health incidents in which customers became ill while eating at numerous locations across the U.S. In the recent quarters, Chipotle appeared to be coming back, BUT the stock fell precipitously after another incident in the summer.

Over the past few years, Pershing Square has been steadily selling out of some of its remaining hits, like Canadian Pacific (with a 327.1 % gain) and Air Products (up 105 %) to raise money for new investments and to meet redemptions. However, so far Ackman hasn't come up with any new bets that have matched the returns of his past winners. Maybe he really lost some of his Mojo? Investors who still believe in him were really tough the last years...

Disclaimer: Ralph Gollner hereby discloses that he directly owns securities of some of the stocks mentioned above, like Alphabet (formerly known as Google only), Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Cisco (CSCO), Texas Instruments (TXN), Facebook (FB) as per 22nd February 2018.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Aktien von Alphabet (GOOGL), Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Cisco (CSCO), Texas Instruments (TXN) und von Facebook (FB), Unternehmen die in diesem Blogeintrag/Artikel behandelt/genannt wurden, befinden sich aktuell im "Echt-Depot" von Mag. Ralph Gollner - per 22. Februar 2018.

links:

https://marketrealist.imgix.net/uploads/2018/01

https://nypost.com/2018/01/10/ackmans-pershing

www.institutionalinvestor.com/article

www.bloomberg.com/news/articles/2018-01-22

www.institutionalinvestor.com/article

http://fortune.com/2016/09/29/ackman