Related Categories

Related Articles

Articles

What is the 'Sortino Ratio' ?

The Sortino ratio is a variation of the Sharpe ratio that differentiates harmful volatility from total overall volatility by using the asset's standard deviation of negative asset returns, called downside deviation. The Sortino ratio takes...

...the asset's return and subtracts the risk-free rate, and then divides that amount by the asset's downside deviation. The ratio was named after Frank A. Sortino.

BREAKING DOWN 'Sortino Ratio'

The Sortino ratio is a useful way for investors, analysts and portfolio managers to evaluate an investment's return for a given level of bad risk. Since this ratio uses the downside deviation as its risk measure, it addresses the problem of using total risk, or standard deviation, as upside volatility is beneficial to investors. A ratio such as the Sharpe ratio punishes the investment for good risk, which provides positive returns for investors. However, determining which ratio to use depends on whether the investor wants to focus on standard deviation or downside deviation.

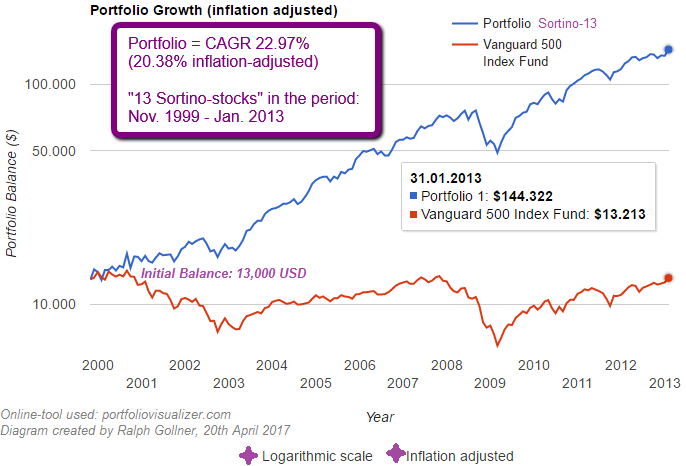

Building a resilient Sortino-Stocks Portfolio

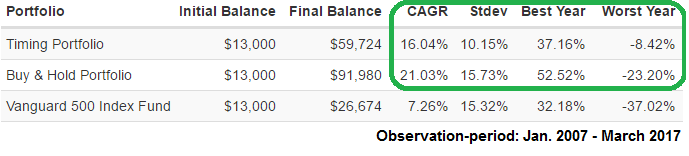

Selecting 13 stocks from different sectors and building a BUY&HOLD-Strategy in the year 2007 would have led to following outcome in the period: Jan. 2007 - March 2017. Adding a Timing-Strategy (Moving-Averages Signal "9" periods) would give the Investor the possibility to avoid such sharp corrections like the one happened in the year 2008!

How would the performance-curve look like? Well, take a look here:

To break this evolution into statistics, figures - one would get following table:

All the best!

Stay optimistic, but realistic (No risk, NO gain)

Ralph Gollner, 20th April 2017