Related Categories

Related Articles

Articles

Warren Buffet vs S&P 500-ETF vs Hedge Funds

Jan. 2008 - Dec. 2015

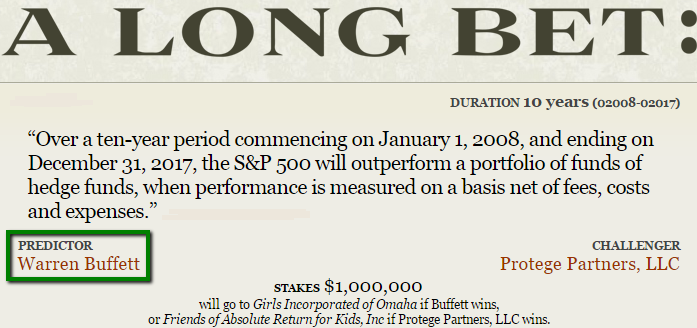

Buffett’s Big Bet ("The Bet") took the view that high fees would ultimately doom hedge funds to underperform the S&P 500 over long periods of time. As he described it at the Bet’s inception:

Costs skyrocket when large annual fees, large performance fees, and active trading costs are all added to the active investor’s equation. Funds of hedge funds accentuate this cost problem because their fees are superimposed on the large fees charged by the hedge funds in which the funds of funds are invested.

A number of smart people are involved in running hedge funds. But to a great extent their efforts are self-neutralizing, and their IQ will not overcome the costs they impose on investors. Investors, on average and over time, will do better with a low-cost index fund than with a group of funds of funds.

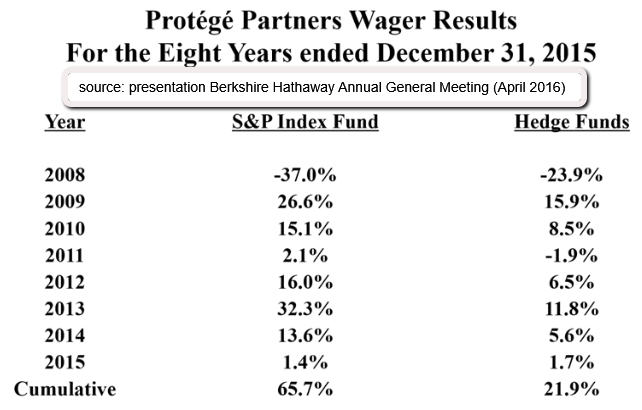

Buffett’s case implies that the market should win by approximately the amount of fees paid to the hedge fund and fund of funds managers. However, after seven years of live action, the lead taken by the S&P 500 is substantially more than the difference in fees would suggest.

further information on "Hedge Funds"/"Fund of Funds": is the composite return of the five hedge fund of funds selected by Protégé Partners, LLC (“Protégé”) for the Bet. Returns reflect actual results of the fund of funds in the Bet are from 2008–2013 and estimated results for 2014. Management fees are estimated as 1.5% of net assets per annum for hedge funds and 1.0% of net assets per annum for fund of funds. Incentive fees are estimated as 20% of gains per annum for hedge funds and 5% of gains per annum for fund of funds, both subject to a high-water mark.

further information on "Hedge Funds"/"Fund of Funds": is the composite return of the five hedge fund of funds selected by Protégé Partners, LLC (“Protégé”) for the Bet. Returns reflect actual results of the fund of funds in the Bet are from 2008–2013 and estimated results for 2014. Management fees are estimated as 1.5% of net assets per annum for hedge funds and 1.0% of net assets per annum for fund of funds. Incentive fees are estimated as 20% of gains per annum for hedge funds and 5% of gains per annum for fund of funds, both subject to a high-water mark.

Explanation by the Hedge Fund Expert (Ted Seides, CFA Institute) for the Hedge Fund underperformance:

Stated simply, the return earned by a hedge fund is a function of the beta embedded in the strategy, the return on cash balances, the alpha from security selection, and the fees and expenses incurred along the way.

Ted Seides, CFA Institute: We believe the headwinds faced by hedge funds have resulted from a combination of the substantial outperformance of the S&P 500 over global equity markets and the adverse impact of the Fed’s Zero Interest Rate Policy (ZIRP) on hedge funds relative to other investment vehicles. Together, these factors wreaked havoc on a bet, the prospects of which we initially felt quite confident about.

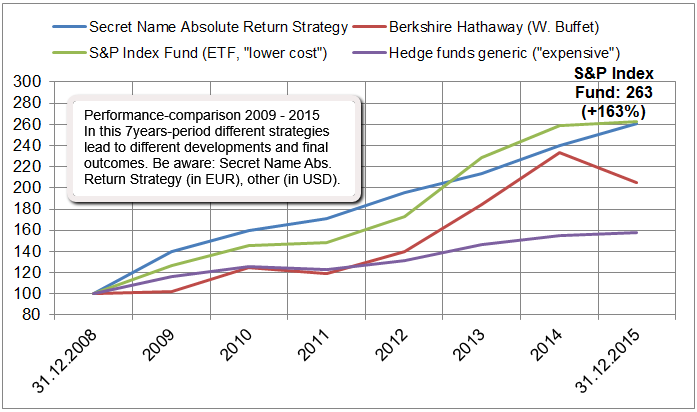

In the chart above I (Ralph Gollner) made a comparison (Year-End 2008 - YE 2015) between a great "Secret-Absolute-Return fund" (which managed to deliver a positive return in each of the 7 years given), Berkshire H., the cheap S&P 500-ETF (incl. dividends re-invested) versus the number 4 in this competition: the five selected hedge funds. The champion in the competition so far is the Index itself (S&P 500 incl. dividends). Still, most investors would have loved to invest in the least volatile investment-vehicle i guess, but still performing strongly: "the Secret Abs. Return Strategy".

"Excuse" by the Hedge Fund Expert/Ted Seides, CFA Institute (status year 2015):

Hedge funds generally, and the fund of funds chosen for the Bet specifically, diversify geographically, have a small-cap bias, and take on much less market risk than a fully invested long-only portfolio. As such, the Bet represents an apples-to-oranges comparison when pitting hedge funds against the S&P 500. The S&P 500 was one of the best performing indexes in the world over the last seven years, providing a boost from market exposure relative to more diversified hedge fund portfolios.

link (2015): http://www.businessinsider.com/fund-manager-explains-his-losing-bet

link (THE BET): http://longbets.org/362/#adjudication_terms