Related Categories

Related Articles

Articles

My little nephew just celebrated his birthday yesterday!

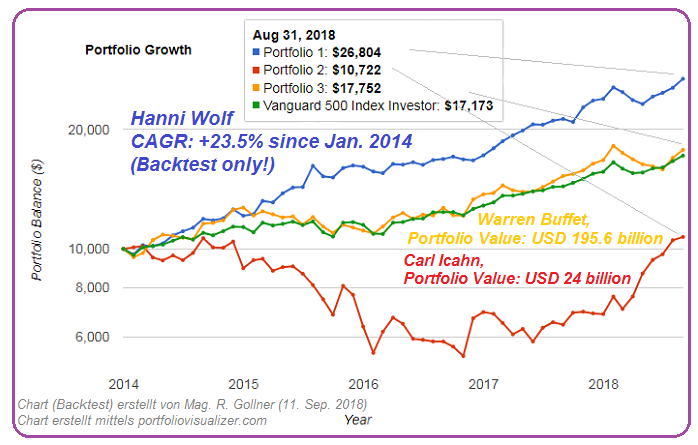

Here is his highly concentrated stocks-portfolio, which we built togther last year (2017). I backtested the portfolio selection and rebalanced the composition annually for the years before (Starting balance in Jan. 2014: USD 10k):

Long-Term investing requires LESS of YOUR TIME!

Long-Term investing is SIMPLE, but not easy (requires a certain temperament).

Less transactions, less fees; Reduce your propensity to sell (& buy new) stocks. Think about "Slow-Changing Industries for Long-Term Investors".

His (HANNI-) stocks in the backtest above: FAMG & SWAMMMMP

This is a concentrated portfolio holding only 10 stocks. These companies often established wide competitive moats! >> In the words of Warren Buffet:

"In business, I look for economic castles protected by unbreachable moats."- Warren Buffett

Just a short comment on the FAMG (mentioned briefly above):

According to Wall Street, Amazon's annual cash flow per share is expected to grow from USD 37.39 in 2017 to an estimated USD 132.90 by the year 2021. That represents a compound growth rate of 37.3%! As for Alphabet, its USD 53.52 in cash flow per share should practically double to USD 106.70 by 2021. Finally, while Wall Street doesn't offer estimates of cash flow per share for Facebook beyond 2019, the social media giant is nonetheless expected to see its CFPS grow from USD 8.19 in 2017 to USD 11.63 in 2019.

Over the last five years, Amazon, Alphabet, and Facebook have averaged a price-to-CFPS ratio of 29.5, 18.7, and 33.3, respectively, per Morningstar. But based on Wall Street's furthest available estimates of cash flow per share - i.e., 2019 for Facebook and 2021 for the other two companies - Amazon, Alphabet, and Facebook are looking at a price-to-CFPS ratio of 12.5, 10.7, and 16.9, respectively. These stocks (FB, AMZN, GOOGL) have never been this cheap on a forward basis with relation to their operating cash flow, albeit we are looking at good three years ahead for Amazon and Alphabet, and a lot could change in those three years...