Related Categories

Related Articles

Articles

When will the earnings momentum rise on the European equity markets? (15th July 2015)

The most important fact (in the medium/long-run) for rising company valuations are rising company earnings / which are (unfortunatelly) currently hardly growing (so far my input).

comments taken from Harald Egger / http://blog.en.erste-am.com: The increase on stock exchanges is fundamentally justified if the valuation levels are rising across the board without earnings growth (e.g. price rises due to the low interest rates) or if company earnings themselves are rising (thus justifying the valuations). The interest rates can actually not fall any further, which means that the stock exchanges cannot get any impulse from that end.

How does the other factor, earnings growth, look? There is no clear answer to that question. Some market participants are rather sceptical. In the following Harald trys to shed some light on these factors, company earnings and earnings momentum.

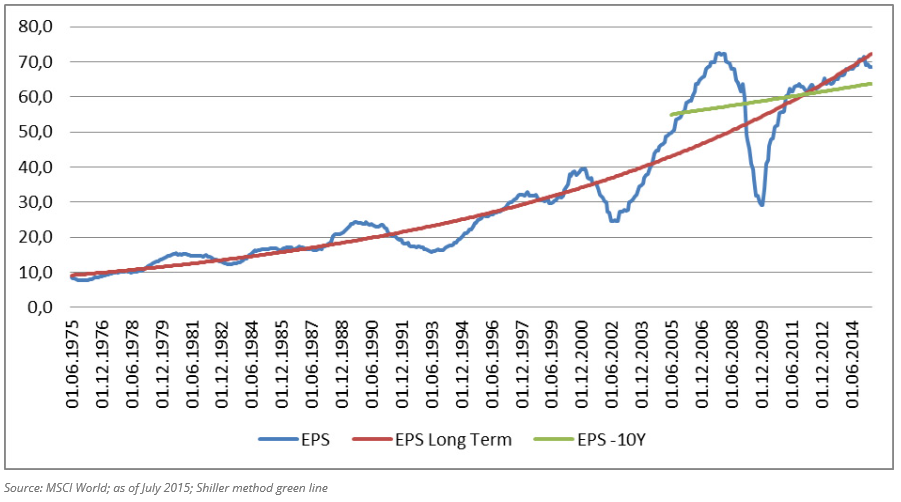

Worldwide quick recovery of company earnings after the financial crisis

The next chart highlights the fact that over the past 40 years (June 1975 – June 2015) company earnings have been rising at a relatively stable rate of 5.3% per year (long-term earnings trend – red line), taking into account cycles. After the financial crisis (2008) company earnings saw a relatively quick recovery, embarking on a trend that has been held for the past three years. However, over the past four months (Q2-2015), earnings have been sliding slightly but steadily. This is a warnings signal that we have to keep an eye on: without earnings growth, no further price increases can be justified, given the current valuation. Only once earnings start rising again can a price increase be fundamentally justified.

Published earnings (EPS), long-term earnings trend (EPS long term), and company earnings generated on average over the past 10 years (Shiller method) 1975 – 2015:

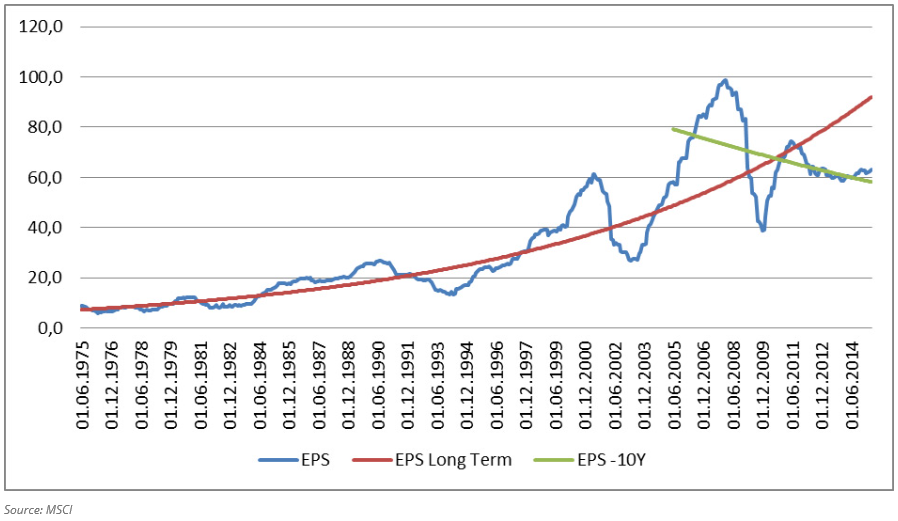

The European earnings lack momentum

Earnings (EPS) generated in Europe (ex UK), long-term earnings trend (EPS long term), and company earnings generated on average over the past 10 years (Shiller method) 1975 – 2015:

While Europe has rising earnings to show for in contrast to the global trend, said trend lags expectations. There is currently a significant gap between Europe and the long-term EPS trend (red line). In fact, earnings are back at the level of 2000, i.e. of 15 years ago!

Will earnings boost again?

The expansive monetary policy of the European Central Bank and the recently weak euro should facilitate a significant boost of earnings for companies. However, falling demand from the emerging markets, in particular from China, somewhat contradicts this scenario.

The general question is whether a return to the long-term earnings growth trend will be possible in the short run. The growth sectors of technology and biotech are underrepresented in Europe. In order for earnings to return to their long-term trend growth, they would currently have to rise by 47%. For the time being, this is unlikely to happen.

Text was only partly given/full blog entry: http://blog.en.erste-am.com