Related Categories

Related Articles

Articles

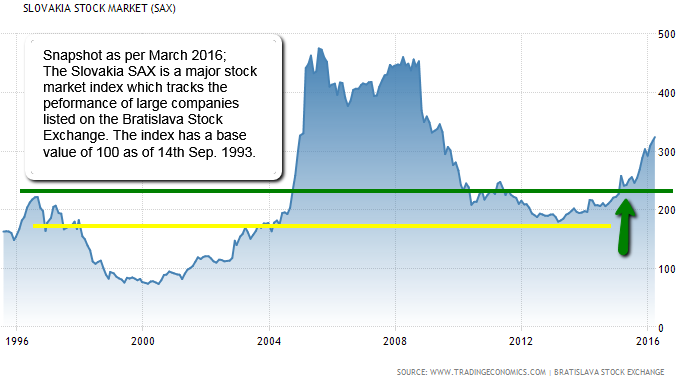

Slovak Stock Index (Q1-2016)

Slovakia’s tiny SAX index was up 6.4% in 2016 through 5th Feb. 2016, taking gains for the past 12 months to 36.6%.

source: http://www.bloomberg.com/quote/SKSM:IND

source: http://www.bloomberg.com/quote/SKSM:IND

The central European country has one of a handful of small stock markets that have notched up gains as markets tumble elsewhere in Jan. 2016 up to the 1st week of Feb. 2016. That select club also includes Thailand, Morocco, Mauritius and Colombia.

Slovakia’s outperformance comes despite its top three companies by market capitalization being two banks, Tatra Banka AS and Všeobecná Úverová Banka, and an oil refiner, Slovnaft AS. Banking and energy stocks have been at the forefront of the global selloff, with European banks, for instance, down 22% up till start Feb. 2016.

So what gives with the SAX? Analysts point to a number of potential reasons: the Slovakian economy’s relative outperformance and the very fact that the market is small. Slovakia itself could fit into Texas 14 times over and has a population of 5.4 million. The total market capitalization of all stocks listed on the Bratislava Stock Exchange was EUR 4.3 billion at the end of January. The SAX index has just seven shares with a total market cap of around EUR 2 billion. Despite its recent beating, the S&P 500 market cap is currently USD 16.5 trillion.

Trading volumes on the Bratislava Stock Exchange are pretty thin. Throughout 2015 just over EUR 16 million-worth of shares changed hands. “The liquidity of the market is really small,” said Marek Osvald of the Bratislava Stock Exchange. That lack of liquidity could be one reason why Slovakia’s stock market has held up, given it does not have the same flow of international investors leaping in and out of shares on global themes. The market’s rise could also reflect a robust domestic economy.

“The recovery in the Slovakian stock exchange comes after a relatively long period of stabilization in the country,” said Jaromir Sindel, an economist at Citigroup. The gains may be a case of catch-up. “GDP has increased significantly since the crisis in 2009, and that hadn’t been reflected in the market,” he added.

Slovakia’s relatively strong economic growth is expected to continue: The European Commission expects Slovakia’s gross domestic product to grow 3.2% in 2016, while its debt-to-GDP ratio is expected to fall slightly to around 52%. That compares with projected GDP growth of 1.7% for the whole of the euro area this year, and a debt-to-GDP ratio of 93%.

Still, the market is not likely to expand much to reflect its current popularity. There is little indication that Slovakia is set to become a hot new destination for initial public offerings. “The equity market is quite small so most companies wanting to do IPOs will probably think about listing in Poland instead,” Mr. Sindel said.

WSJ-link: http://blogs.wsj.com