Related Categories

Related Articles

Articles

Sotheby's and the Dow Jones Ind. Average

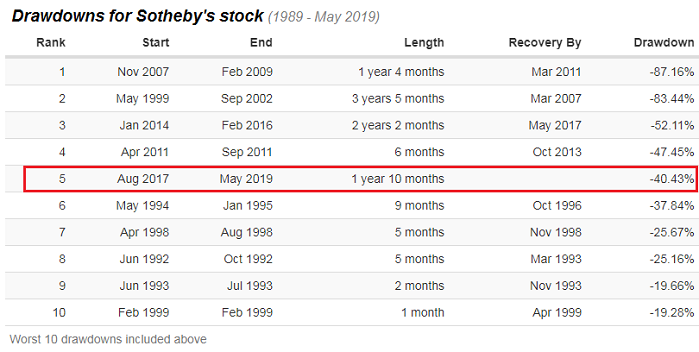

As per End-of-May 2019 Sotheby's (the company-stock) had a Drawdown (DD) of ca. 40% from its High. Often Sotheby's was a good indicator for the overall stock-market. Calculating away from the recent 40% DD-level I figured out...

...a further 7%-decline should be the maximum Risk for that stock (see the 2011-Drawdown period).

If that were to happen, I would have seen a correlated risk for the Dow Jones Ind. Average of ca. 5%. That would have meant following result, calculated away from a End-of-May 2019 level of 25,169 points: 23,910 points.

Since August 2017 Sotheby's stock was struggling with a Drawdown-period. So for a long period of ca. 22 months the struggle was going on. Normally there is always an end to such a DD-period.

Just as a reference; the level for the S&P 500 stood per May-Close: @ 2,788 points

As mentioned/ the Dow Jones Ind. Average May-Close was @ ca. 25k

For the Dow, I personally see a potential risk down to ca. 23,400 points,

OR to the max. near a lowest level of 23k!

-) "A total Panic Level" might be reached at the current EMA(50)-monthly: ca. 22k

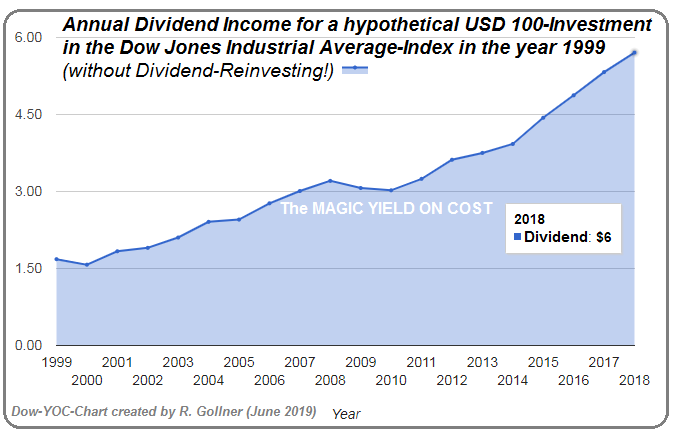

-) Currently the Dividend yield in the Dow Jones Ind. Average stands @ 2.27%

Dividend-yield source: www.wsj.com/market-data/stocks/peyields

A Reminder (Sotheby's):

All four of the last recessions and financial crises were reliably predicted by the share price of Sotheby's, the world-renowned auction house. When Sotheby's loses a lot of its value, difficult times are usually right ahead. Shareholders of Sotheby's seem to have a sixth sense for an impending crisis.

For economists and students, Sotheby's makes for a great case study on a company achieving a quasi-monopoly - shared with a second market participant of essentially equal stature, hence technically speaking a "duopoly" - without this market having any significant legal barriers to entry. There is not even the usual battle for market share through innovation, as is the case between Boeing and Airbus. It's a truly unique situation!

Until the end of May 2019 the company's share price has fallen from USD 60 to ca. USD 32. That was enough of a fall to make it appealing for a billionaire to buy into the company:

What happened?

Well, Telecom titan Patrick Drahi is buying Sotheby's for USD 2.7 billion, taking it private after more than three decades as a public company, and placing the world's two leading auction houses under the control of French billionaires.

Investors will receive USD 57 in cash per share of Sotheby's common stock under terms of the agreement, according to a statement on 17th June 2019 from the New York-based company. The offer represents a 61% premium to the closing price on 14th June. Sotheby's shares rose 57% to USD 55.58 as of 9:40 a.m. in New York. The enterprise value is USD 3.7 billion.

This is a company with a business model that has proven crisis-resistant, not for decades, but centuries!

links: