Related Categories

Related Articles

Articles

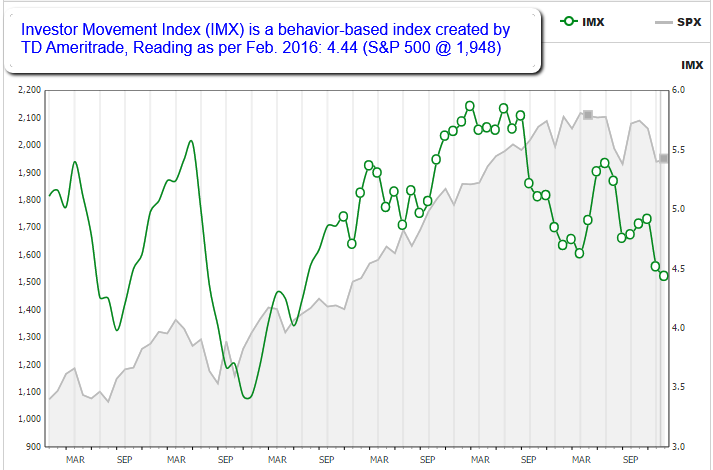

Investor Movement Index (IMX)

The Investor Movement Index, or the IMX, is a proprietary, behavior-based index created by TD Ameritrade designed to indicate the sentiment of retail investors.

source: https://www.tdameritrade.com/research/imx.page

source: https://www.tdameritrade.com/research/imx.page

Investor Movement Index Summary for Feb. 2016:

TD Ameritrade clients had slightly less exposure to the equity market in February, as the IMX decreased to 4.44.

For a second month, volatility in the overall market outpaced the volatility of many of the widely held positions in TD Ameritrade client accounts. The relative stability of these positions, coupled with net buying in some other names whose volatility was less than that of the overall market, helped to lower the IMX reading. The February IMX period saw the major equity market indices take a brief dip mid-month, with the Russell 2000, Nasdaq Composite, and S&P 500 closing at their lowest points in a year. However, markets rose in the second half of the month, and each of the indices ended the month slightly above or very near where they began.

The February IMX period saw the major equity market indices take a brief dip mid-month, with the Russell 2000, Nasdaq Composite, and S&P 500 closing at their lowest points in a year. However, markets rose in the second half of the month, and each of the indices ended the month slightly above or very near where they began.

The Dow Jones Industrial Average was the biggest winner, gaining around 1%, while the S&P 500 and the Russell 2000 were essentially flat at month end. The NASDAQ Composite had lost about half of a percentage point at the close of the February IMX period. The markets’ foray into negative territory raised volatility and the VIX, a measure of volatility in the S&P 500, closed above 28 in mid-February-something it hadn’t done since September.

As the markets rebounded, the VIX settled lower, closing near 19 which was the lowest close since the year began. The price of crude oil was also volatile in February, and eventually declined to around $26, its lowest point in more than a decade. Prices later rebounded to close the period around $34.

Final wrap-up/explanation on IMX:

If a score increases month over month, that likely means that investors are getting more bullish. If a score decreases month over month, investors are becoming bearish (or at least less bullish than before).