Related Categories

Related Articles

Articles

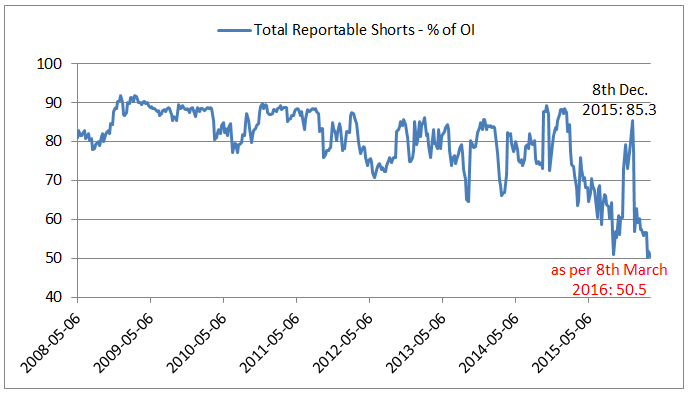

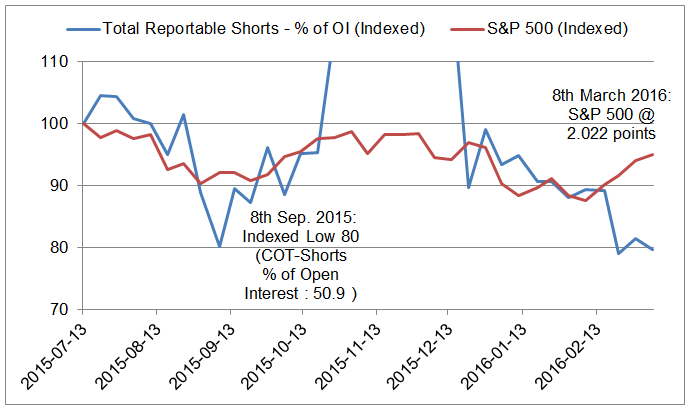

COT for S&P 500 % of Open Interest

Commitment of traders data for S&P 500 Stock Index on the Chicago Mercantile Exchange

Commitment of Traders - S&P 500 Stock Index - Futures and Options - Percent of Open Interest

Total Reportable Shorts - % of Open Interest (for S&P 500 as per 8th March 2016: 50.5)

data: https://www.quandl.com

"Short" shares are borrowed and then sold in the hope that the share price will fall before the borrowed shares have to be purchased and replaced. A high level of short interest could indicate that a share price is ready to fall, but can also be a hedge, or counterbet, for an investor who has gone "long," or bought a lot shares of a company thinking that the share price will rise (source: The Wall Street Journal).

data: https://www.quandl.com