Related Categories

Related Articles

Articles

Methods for Valuing a Stock Based on Profitability and Growth (by T. Howard)

Your goal is not to identify the profitability and growth stars of tomorrow. Your goal is to have a good handle on a company’s true profitability and growth potential so that you value it correctly.

You should even be willing to buy a low-profitability and low-growth company as long as the price is right.

Please check out the whole article on quick (& dirty) Valuation examples:

http://www.aaii.com/journal/article/methods-for-valuing-a-stock-based-on-profitability-and-growth

Remember the famous Ben Graham formula

Benjamin Graham and David Dodd, along with Sidney Cottle, are referred to as the fathers of securities analysis. While I am not as conservative as this threesome, I have the utmost respect for their unique investment strategy.

A number of years ago, Graham and Dodd conducted some empirical tests to determine the relationship between a company’s growth rate and its price-earnings ratio (P/E). They determined that this relationship is:

P/E = 8.5 + 2G

That is, if there is no growth, the price-earnings ratio should be 8.5 and increase at double the growth rate if there is actual growth. Remark: The problem with the given equation is that in the time period over which the tests were run, there were few changes in interest rates. Of course, recent years have witnessed dramatic interest rate changes, so the equation has to be modified to capture these changes (see link above for further details).

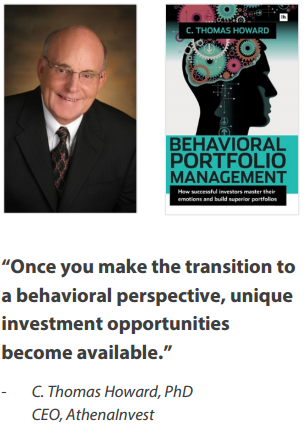

♦ Thomas Howard , Ph.D., is the CEO and director of research for AthenaInvest Inc. He is a professor emeritus at the Reiman School of Finance, Daniels College of Business, University of Denver.

another link/reading: http://www.athenainvest.com/get-the-book