Related Categories

Related Articles

Articles

Price-Sales valuation versus Price-Book

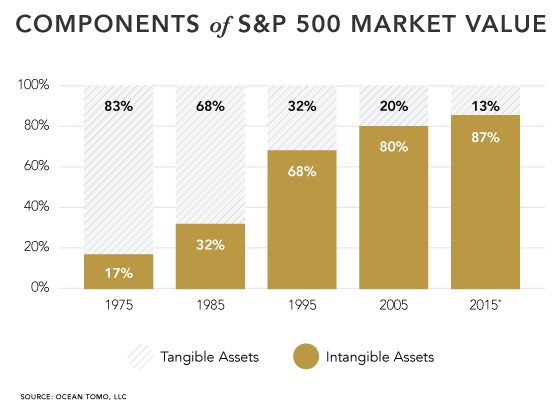

Companies and their investors have dramatically shifted their capital from tangible, asset-based businesses (aligned with the bottom two needs) to intangible, asset-light organizations. According to research by Ocean Tomo, in 1975, tangible assets...

...made up 83% of the market value of the S&P 500 companies. By 2015, the numbers had flipped completely, and intangible assets constituted 87% of market/corporate value.

This fundamental change signals something profound about the future of finance and financial markets.

Put simply, the finance function, and generally accepted accounting principles (GAAP), must adapt in order to help organizations measure and manage these new sources value (communities of common interest, self-esteem, self mastery and self-actualization). Accounting practices have not kept pace with the changing asset base of business as well as many key intangible assets. In fact, many higher-order needs of individuals are either mis-measured (lumped into the Goodwill grab bag), or ignored altogether. Human capital, such as employees, is classified as an expense. So are employee training, education and health care. Worse, customers and their relationships are not measured at all. This situation does not serve business leaders well, particularly leaders of large, established companies that are trying to find the right way to develop and use more scalable and capital-efficient intangible resources together with today’s technologies to drive performance and shareholder value.

Helping leaders understand and utilize intangible assets becomes even more urgent when you realize that the financial markets have already adjusted their thinking and capital allocations in favor of these newer, intangibles-based business models that use today’s technologies to scale at zero, or near zero, marginal cost.

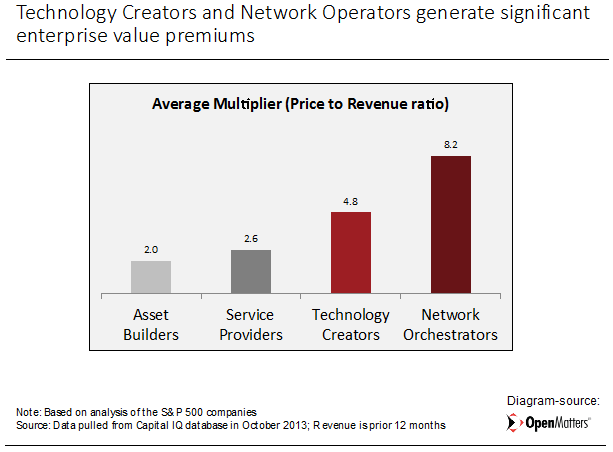

Research, conducted by OpenMatters in partnership with Deloitte, looked at 40 years of data from the S&P 500 companies and found that investors are rewarding organizations that satisfy these higher levels of customer needs, such as community, esteem and self-fulfillment, with valuations that are far greater than the organizations that satisfy the lower-order physiological and safety needs:

Wharton-research identified four primary ways that companies create value for their customers:

1) Asset Builders that make, market, distribute and sell physical products. Examples include manufacturers (all industries), distributors and retailers.

2) Service Providers that hire people who provide services for which customers are charged. Examples include consulting firms, health care providers and financial institutions.

3) Technology Creators that develop and sell intellectual property, such as software and biotech. Examples include software and pharmaceutical companies.

4) Network Orchestrators that create and manage networks of consumers, businesses or investors to help the participants market and sell their wares on a peer-to-peer basis. Examples include financial trading markets, on-line social networks and credit card processing companies. The later two business models, Technology Creators and Network Orchestrators, are rewarded by the financial markets (investors) with price to revenue ratios two to four times greater, on average, than Asset Builders and Service Providers due to their focus on highly scalable "intangible assets."

links: