Related Categories

Related Articles

Articles

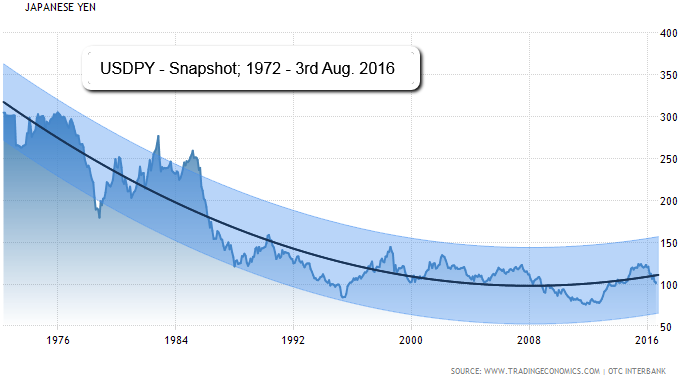

USDJPY (1972 - 3rd Aug. 2016)

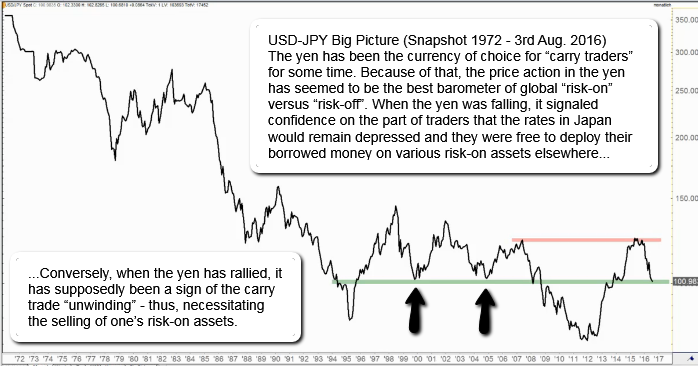

For the most part, as goes the Yen over the past several years, so goes the carry trade - and risk-on assets. For example, the relationship between the Yen and equities has been very tight (on an inverse basis) over the recent years.

The relationship between the Yn and equities has been very tight until Mid of the 1st HY-2016 (on an inverse basis) and over the past years. When the Yen has dropped, stocks have rallied – and vice versa – in a very consistent manner. As evidence, the Yen bottomed in May 2015 coincident with the top in stocks.

The Japanese Yen may be the asset that one suspects of getting the most votes in the category of being the "most important asset". The reason for that is because over the past several years, the currency has been the poster child of the so-called carry trade. What does that mean? Essentially it means borrowing money somewhere at a low (and likely to stay low) interest rate and investing the proceeds somewhere else that pays (and is likely to continue to pay) a higher return.

And nowhere has central bank policy seemed more determined to keep interest rates low – and, thus, the currency devalued – than in Japan. As such, the yen has been/remained the currency of choice for "carry traders" for some time.

Would a potential downdraft in the yen spur ANOTHER major risk-on rally around the globe? While one has to emphasize the fact that market dynamics are constantly in flux, there might still not be enough evidence to suggest that the carry trade relationship involving the Yen is dead. If one still belongs to the longer-term bulls, it is certainly possible that a Yen-decline could contribute to a solid intermediate-term rally in risk assets.

Conclusion: IF THE USDJPY stays ABOVE the magic 100-level (see chart above) - "Risk-on" could be the intermediate result!